How to get URL link on X (Twitter) App

@Vtrender Breaking it down for you:

@Vtrender Breaking it down for you:

📈 What is VWAP?

📈 What is VWAP?

I have marked 6 elements on this Option Table ( refer to pic above)

I have marked 6 elements on this Option Table ( refer to pic above)

Q) What is the Volume Profile?

Q) What is the Volume Profile?

1 a] You are born unique and are different.

1 a] You are born unique and are different.

Vix is at 25- 30 currently.

Vix is at 25- 30 currently.

Thanks to a spurt in online education, you learn quickly to sell options at 09.25 am and at 12.30 pm and every time of the year.

Thanks to a spurt in online education, you learn quickly to sell options at 09.25 am and at 12.30 pm and every time of the year.https://twitter.com/Am_Shai/status/1496775670860431372For the record, tweet was posted near 3.00 pm and a follow up was also done post close where I clearly mentioned there was no selling visible in the last 30 mins of the day

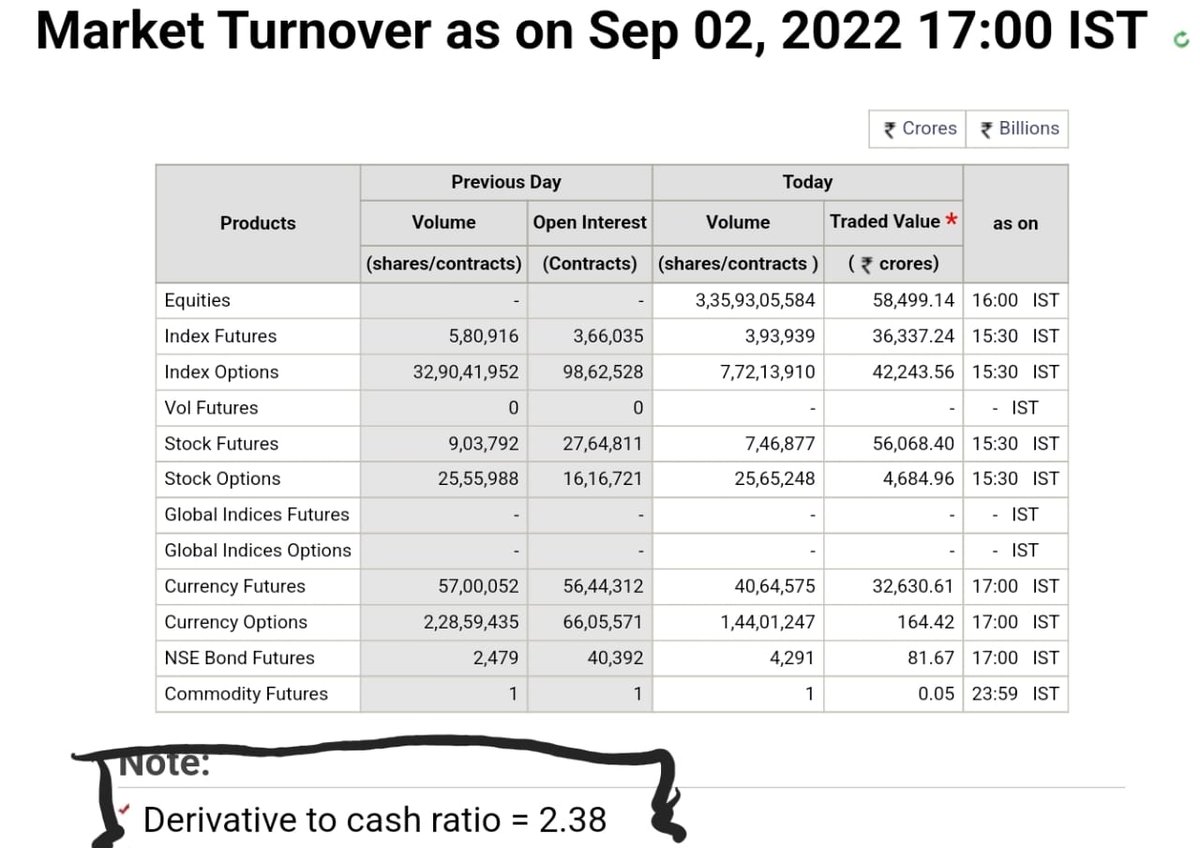

The futures market of today is just a fraction of the Options market.

The futures market of today is just a fraction of the Options market.

Most traders diss investors and most investors do not think kindly of traders.

Most traders diss investors and most investors do not think kindly of traders.