Been trying to take stock of the possibilities of where we are with the market:

1. We're in a bear market

2. Supercycle / S2FX

3. Cycles elongated, still on way to $1-200k peak

Here are my current thoughts (it's all WIP)...

1. We're in a bear market

2. Supercycle / S2FX

3. Cycles elongated, still on way to $1-200k peak

Here are my current thoughts (it's all WIP)...

1. We may be in a bear market. But if we are, $69k wasn't the peak... $64k in April 2021 was.

Basically, if leveraged derivatives trading wasn't a big part of this market (like in 2013 & 2017), maybe we would have gotten a blow-off top. Instead, funding rates were too HIGH

Basically, if leveraged derivatives trading wasn't a big part of this market (like in 2013 & 2017), maybe we would have gotten a blow-off top. Instead, funding rates were too HIGH

HODL waves and other on-chain activity also suggest that the market has been ~dormant since Q2.

This could be the final phase of a bear market, without us realizing we were in one!

This could be the final phase of a bear market, without us realizing we were in one!

https://twitter.com/LynAldenContact/status/1483970779268136962?s=20

This is Bitcoin divided by S&P500 (BTCUSD/SPX):

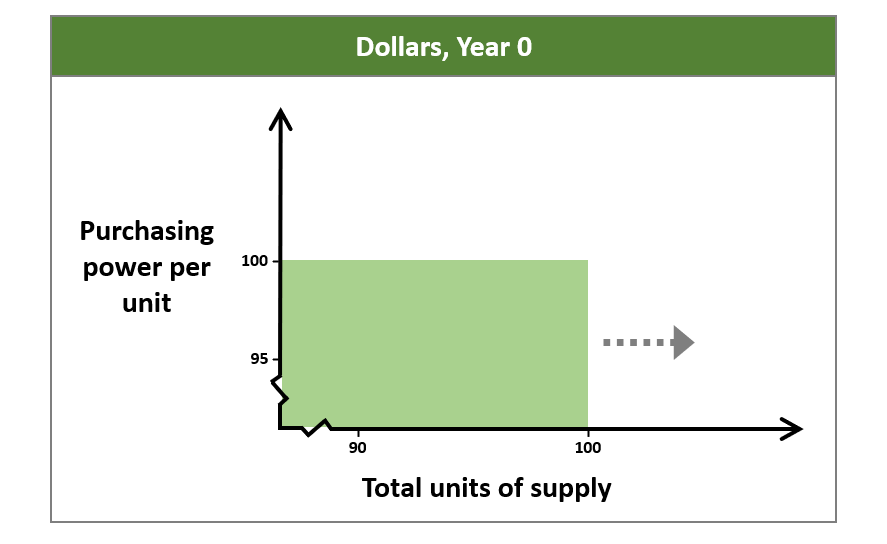

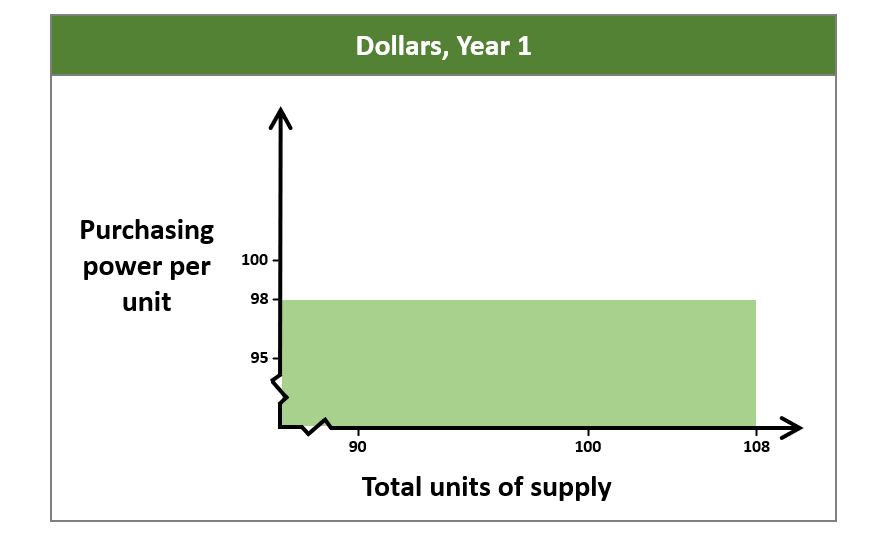

People shouting for $20k retest fail to account for how much nominal price of everything has increased since 2017.

Could absolutely still happen, but downside from here is picking up pennies in front of a steamroller, imo.

People shouting for $20k retest fail to account for how much nominal price of everything has increased since 2017.

Could absolutely still happen, but downside from here is picking up pennies in front of a steamroller, imo.

If we "peaked" in Spring 2021, we have been in a bear market for 11 months, after ~3x rally above prior cycle peak. $64.5->$28.8 = -55%. If from $130k, -78%.

2014 bear: -86%, 13 months to bottom, after a ~30x new high

2018 bear: -83%, 12 months to bottom, after a ~20x new high

2014 bear: -86%, 13 months to bottom, after a ~30x new high

2018 bear: -83%, 12 months to bottom, after a ~20x new high

Obviously a stretch but... but if Spring 2021 peak had the same market conditions (i.e., no leveraged deriv markets, spot only), I think we would have seen a blow-off top to something like $130k.

From there, a -78% drawdown would have gotten us to $28.8k (summer bottom). Enough?

From there, a -78% drawdown would have gotten us to $28.8k (summer bottom). Enough?

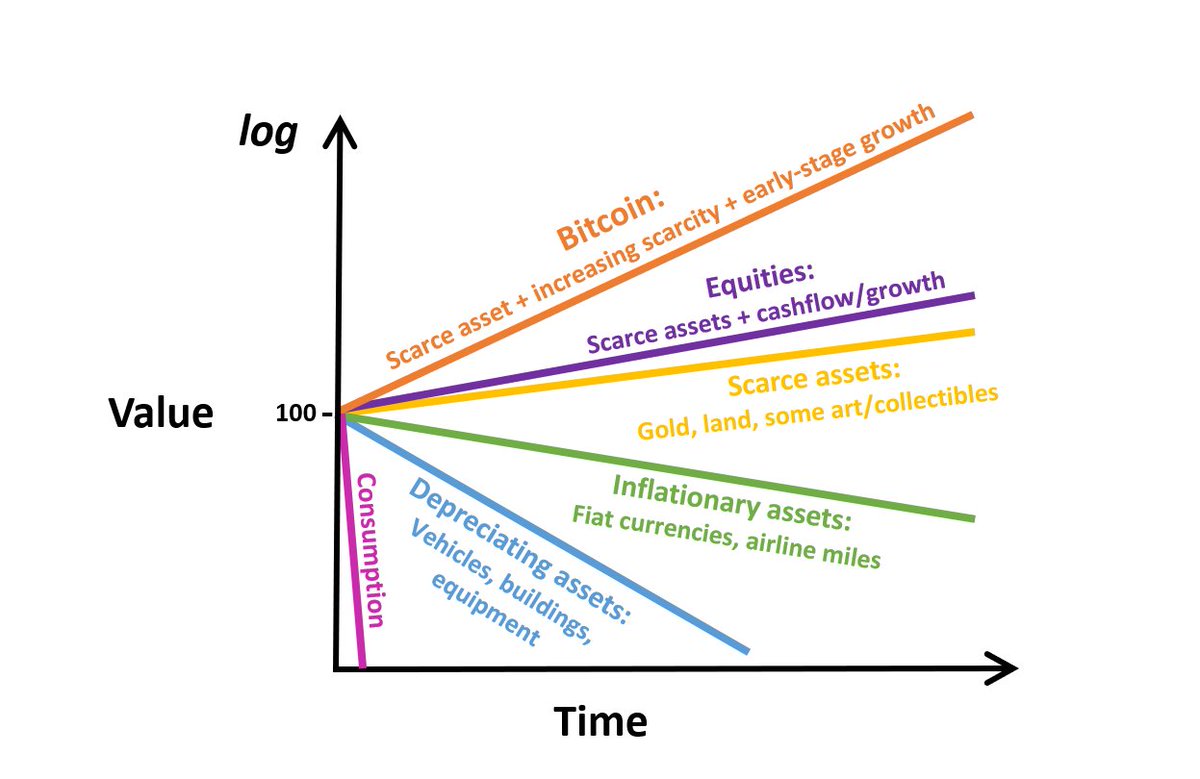

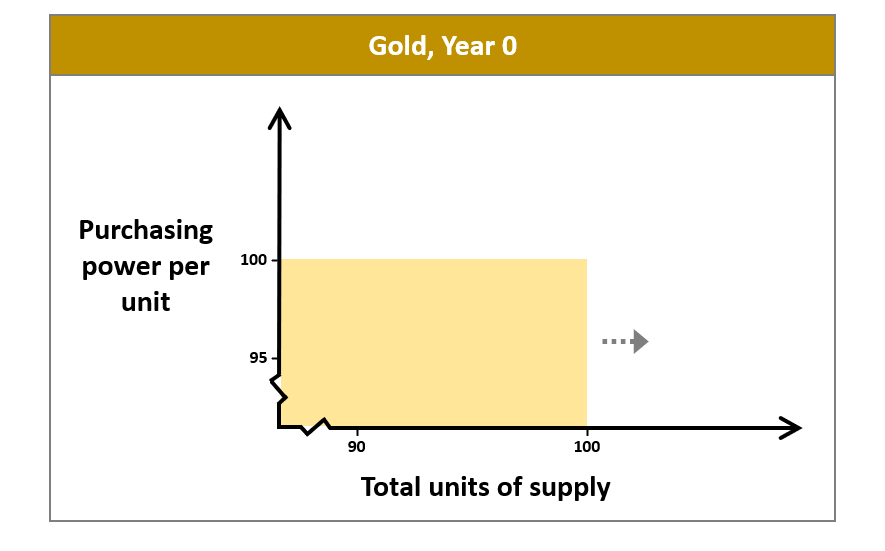

2. Supercycle imo shares characteristics with Plan B's S2FX model (which says BTC is now ~parity with gold, and should continue closing the gap as those mechanics manifest & are integrated into subjective valuations of BTC by market participants).

Supercycle boils down to "asset class has arrived on the global stage, merits ~$5T, will keep going until it gets there"

Stock-to-flow conceptualization is more about BTC being a ball underwater (i.e., undervalued) vs. other commodities / SoV assets.

More or less same result

Stock-to-flow conceptualization is more about BTC being a ball underwater (i.e., undervalued) vs. other commodities / SoV assets.

More or less same result

Either allows for what we've seen over the last year - rallies followed by mini-bear markets.

Summer 2021 = punishing overeager leveraged longs + China mining ban

Now = Asia sell-off in Nov, Dec 4 leverage liquidations, and now Jan equities markets sell-off contagion

Summer 2021 = punishing overeager leveraged longs + China mining ban

Now = Asia sell-off in Nov, Dec 4 leverage liquidations, and now Jan equities markets sell-off contagion

Either also allows for market mechanics to "put the brakes on" via violently shaking out low-conviction holders on the way up.

Doesn't need to be a spot-driven post-halving parabola. Can be a rally, year+ of violent consolidation in a channel (now), then more rally

Doesn't need to be a spot-driven post-halving parabola. Can be a rally, year+ of violent consolidation in a channel (now), then more rally

3. Thing is, if Supercycle & S2FX allow for the kind of violent interruptions in upward trajectory that are needed to reset leverage & ensure no free rides for low-conviction holders expecting 2017 parabola...

that also extends to $1-200k peak for this 2020-24 block reward era.

that also extends to $1-200k peak for this 2020-24 block reward era.

Traditional 4-year cycles with a clean 18-month parabola post halving are dead. Market maturation killed it (meaning, leverage products creating incentives to hunt for liquidations when strong consensus).

But if parabolas are out, question is just: is $36k overvalued?

But if parabolas are out, question is just: is $36k overvalued?

Overall, the maturation of crypto markets (specifically leveraged derivate products) is the root cause of our structural break from post-halving parabolas.

But that doesn't negate the fundamentals of increasing scarcity. Aka it still gets where it's going (just more violently)

But that doesn't negate the fundamentals of increasing scarcity. Aka it still gets where it's going (just more violently)

What is truly unknowable is how much equities contagion will drag BTC down. Do we get to $25k? $15k? Was $32k enough? No idea

But I am confident that Bitcoin is seriously undervalued at $36k (just $0.7T total)

But I am confident that Bitcoin is seriously undervalued at $36k (just $0.7T total)

• • •

Missing some Tweet in this thread? You can try to

force a refresh