🎯Investing with Gaps🎯

.

A Thread on Gaps and How they can be used for Investing.

.

Like & Retweet

.

#stockmarkets #trading #investing

.

A Thread on Gaps and How they can be used for Investing.

.

Like & Retweet

.

#stockmarkets #trading #investing

Gaps are basically blank spaces on Trading charts.

.

There are Two Primary Gaps

✅Gap Ups

✅Gap Downs

.

.

There are Two Primary Gaps

✅Gap Ups

✅Gap Downs

.

The first perception of a Gap on Charts is one that Light can pass through.

.

Something as shown below in the chart of SBI 5min

.

Technically, if it is a:

✅Gap Up: Open is above the previous High of the

day.

✅Gap Down: Open is below the Low of the Day.

.

Something as shown below in the chart of SBI 5min

.

Technically, if it is a:

✅Gap Up: Open is above the previous High of the

day.

✅Gap Down: Open is below the Low of the Day.

Gaps offer evidence that either:

✅The Stock goes through a reversal in the

market perception on two consecutive days and

is a rare occurrence.

OR

✅The fundamentals have drastically changed in the

three days.

.

✅The Stock goes through a reversal in the

market perception on two consecutive days and

is a rare occurrence.

OR

✅The fundamentals have drastically changed in the

three days.

.

The close circles to the Stock or prominent investors are rushing to exit the sinking ship in case of a Gap Down

And

The next day they chasing the Stock on Open after a Gap Up.

And

The next day they chasing the Stock on Open after a Gap Up.

For Investing purposes, we must look at:

✅ Runaway Gaps

✅ Breakaway Gaps

.

✅ Runaway Gaps

✅ Breakaway Gaps

.

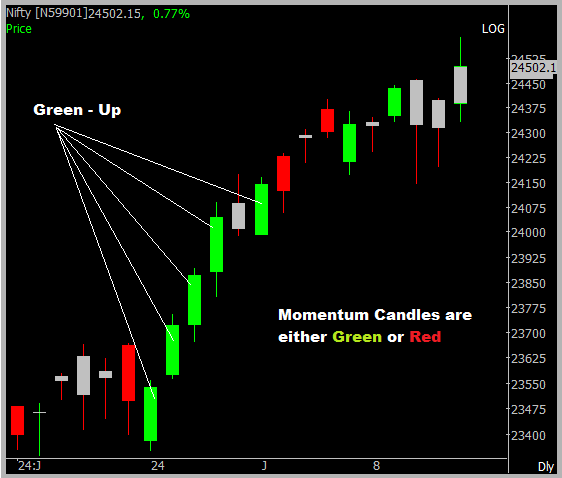

📌Runaway Gaps

Other than reversals, Gaps can be in the direction of the existing trend & such Gaps are referred to as Runaway Gaps

.

Runaway Gaps strengthen the market's existing perception as in the below example.

Other than reversals, Gaps can be in the direction of the existing trend & such Gaps are referred to as Runaway Gaps

.

Runaway Gaps strengthen the market's existing perception as in the below example.

The market Opens Gap-Up on consecutive days and is said to be in a Runaway mode.

Runaway Gaps get filled as is evident in the below chart.

Runaway Gaps get filled as is evident in the below chart.

📌Breakaway Gaps

The other Gap, other than Runaway Gap is a Gap that leads to a Breakout from Range known as Breakaway Gap

.

Below is a Gap when the market opens out of a previous range as it is more in the Breakout Mode

.

The other Gap, other than Runaway Gap is a Gap that leads to a Breakout from Range known as Breakaway Gap

.

Below is a Gap when the market opens out of a previous range as it is more in the Breakout Mode

.

If you happen to hold such stock and the Breakout in the next 2-3 days converts into a Runaway Gap.

.

Then probably you are sitting on a Goldmine that could soon turn in a Multi-Bagger

.

.

Then probably you are sitting on a Goldmine that could soon turn in a Multi-Bagger

.

As a Small Investor, you must focus on Gap ups every day for the first few minutes of the market.

.

With the help of any good screener, ensure before it hits the Upper Circuit you are in the stock.

.

With the help of any good screener, ensure before it hits the Upper Circuit you are in the stock.

Even if it does not do an Upper circuit,

Try to check up near close, if the stock is doing continuous highs at around 2:45pm and closes near the day’s High.

.

One can pitch such stocks for Investment.

.

This is the Best & Simplest way to ensure your money isn’t idle once parked

Try to check up near close, if the stock is doing continuous highs at around 2:45pm and closes near the day’s High.

.

One can pitch such stocks for Investment.

.

This is the Best & Simplest way to ensure your money isn’t idle once parked

Of course, needless to say, one may have to check

the Fundamentals of the Stock in a jiffy to execute the Investment Strategy.

the Fundamentals of the Stock in a jiffy to execute the Investment Strategy.

Gap Up open, may many times visit the previous day high as a gap-filling routine during the day. Later seen as Runaway Gap.

If they close the day, near the day’s high with a minor body near the High of the Day as seen below

If they close the day, near the day’s high with a minor body near the High of the Day as seen below

In a few cases, it may be even seen the Open and Close is the same forming a ‘T’ like Candle as in the below chart.

(The chart below is only for visual study and not an investment decision)

(The chart below is only for visual study and not an investment decision)

Thank you for Reading.

.

Do Like & Share to amplify the reach.

.

Happy Investing with Gap Ups.

.

📅(Next week will focus on Intraday Trading with Gap Ups)

.

Do Like & Share to amplify the reach.

.

Happy Investing with Gap Ups.

.

📅(Next week will focus on Intraday Trading with Gap Ups)

Nimblr's Trading Candlesticks Course

Date: 26 Feb - 17 March

.

Course + Educational Live Trading

.

Register:

forms.gle/NYyzspq9L5SSuA…

Date: 26 Feb - 17 March

.

Course + Educational Live Trading

.

Register:

forms.gle/NYyzspq9L5SSuA…

• • •

Missing some Tweet in this thread? You can try to

force a refresh