Seeing this a lot in my feed, but it's totally wrong, and is based on a mis-reading of BLS statistics. (There is a spike in the data but it's purely due to technical factors related to changing population controls.)

https://twitter.com/JimVandeHei/status/1491012401122234369

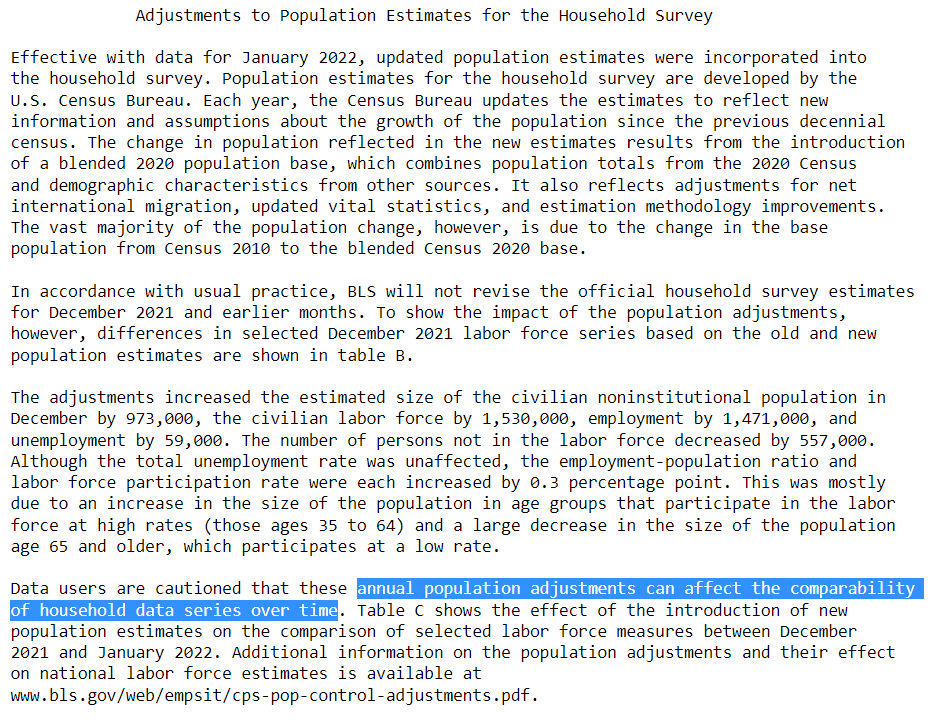

Longer version: Our employment numbers come from surveys. Those surveys must be weighted to reflect the population. January's numbers use different weights than December's, so they can't be directly compared. Here's the BLS: bls.gov/news.release/a…

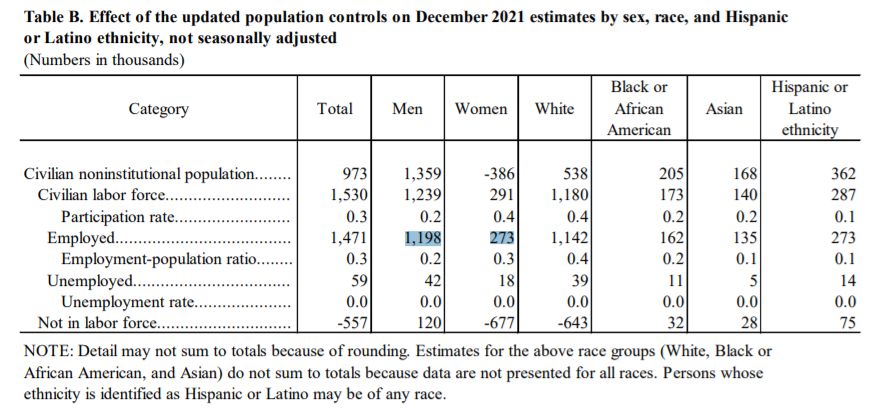

Nothing dramatic happened to female employment in Jan. Rather, the Census Bureau updated its population weights, which included more men than previously understood. Given survey estimates of the employment rate by gender, this mechanically raises the estimate of male employment.

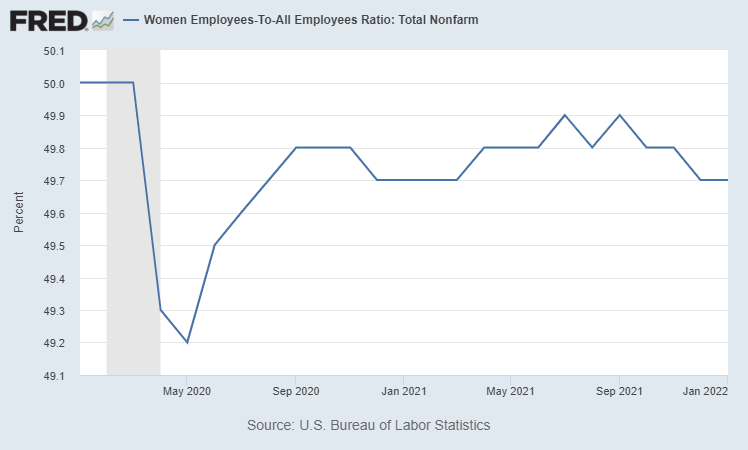

So the entire differential rise in employment by gender in January is a statistical artefact. You can also see this in a separate survey (the firm survey), which did not make the same adjustment, and which shows no change in January in the share of jobs held by women.

In all of this, I don't blame any journalist for taking the published statistics at face value (when the qualifications are buried in the end notes). The method the BLS uses to make these population adjustments is opaque, and apt to create confusion, and I know it can do better.

Also, there are a lot of interesting and important gender and employment stories coming out of the pandemic. This thread simply notes that handwringing about one monthly change (in January's jobs report) is misplaced. No-one should ever makes sweeping claims based on one report.

• • •

Missing some Tweet in this thread? You can try to

force a refresh