@PetraDiamondsIR #PDL is now at 96p / £186m and threatening to break out. It's in touching distance of the post-restructuring, intra-day high of 97.5p, with blue skies above.

Interim results are due out next Wednesday.

A basic summary of the investment case ⬇️

1/25

Interim results are due out next Wednesday.

A basic summary of the investment case ⬇️

1/25

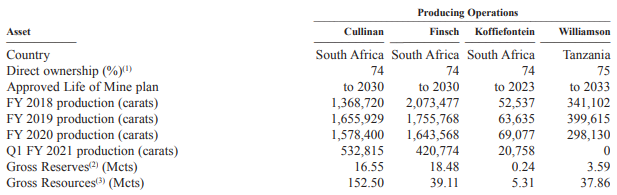

#PDL is a diamond miner, with interests in 4 mines:

3 underground mines in South Africa (all 74% owned), namely: Cullinan, Finsch, and Koffiefontein;

1 open pit mine (75% owned) in Tanzania, named Williamson.

The mines were all acquired from @DeBeers between 2007-11.

2/25

3 underground mines in South Africa (all 74% owned), namely: Cullinan, Finsch, and Koffiefontein;

1 open pit mine (75% owned) in Tanzania, named Williamson.

The mines were all acquired from @DeBeers between 2007-11.

2/25

The mines had all suffered from underinvestment when owned by @DeBeers. As such, between 2006 and 2019, #PDL invested approximately $1.6bn in improving the operational efficiencies of the mines and in extending their lives.

Much of this came in the form of debt...

3/25

Much of this came in the form of debt...

3/25

...culminating in $650m of senior loan notes issued in April 2017 (5-year term at 7.25%).

A new CEO joined in 2019. He quickly launched "Project 2022" in July of that year, to further drive efficiencies and improvements across #PDL.

Improvements in cash generation would..

4/25

A new CEO joined in 2019. He quickly launched "Project 2022" in July of that year, to further drive efficiencies and improvements across #PDL.

Improvements in cash generation would..

4/25

..become most evident in '21 / '22 - the initial target of Project 2022 was $150m to $200m in FCF in the three FYs from July '19 to June '22 (30 June YE).

Alas, just as #PDL was visibly improving, the pandemic struck. Demand for diamonds plummeted.

5/25

reuters.com/article/us-hea…

Alas, just as #PDL was visibly improving, the pandemic struck. Demand for diamonds plummeted.

5/25

reuters.com/article/us-hea…

#PDL itself realized diamond prices for FY 2020 of -18% YoY.

This was devastating for the biz: operational cash flow for the year was -$12.3m, whilst net debt position at end June '20 was $697m.

The company had to radically restructure its balance sheet, just to survive.

6/25

This was devastating for the biz: operational cash flow for the year was -$12.3m, whilst net debt position at end June '20 was $697m.

The company had to radically restructure its balance sheet, just to survive.

6/25

Debt holders would convert a substantial portion of their loans into equity.

They would become 91% shareholders; existing equity holders would be left with 9% of the enlarged share capital.

Proposed publicly in October '20, the restructuring completed in mid March '21.

7/25

They would become 91% shareholders; existing equity holders would be left with 9% of the enlarged share capital.

Proposed publicly in October '20, the restructuring completed in mid March '21.

7/25

From an eyewatering net debt position of $700m at 31 Dec '20, #PDL's net debt fell to $291m as at 31 March '21.

Q1 of CY 2021 also coincided with a recovery in diamond prices. Numerous factors drove this: on the supply side, @RioTinto closed its Argyle mine in Australia...

8/25

Q1 of CY 2021 also coincided with a recovery in diamond prices. Numerous factors drove this: on the supply side, @RioTinto closed its Argyle mine in Australia...

8/25

...which accounted for 10% of global production in 2020; the Ekati mine in Canada (~4% of global output) endured a 10-month-long suspension of operations; and Indian processing plants (90%+ of global cutting/polishing) ground to a halt during the pandemic.

9/25

9/25

Moreover, the demand side saw "renewed consumer interest in diamonds, driven by lack of competition from other luxuries such as experiences and travel." ⬇️

fortune.com/2021/06/09/dia…

"Consumers were ready to spend. They were flush with cash from buoyant capital markets...

10/25

fortune.com/2021/06/09/dia…

"Consumers were ready to spend. They were flush with cash from buoyant capital markets...

10/25

...and economic stimulus programs, and eager to spend it on meaningful gifts for their loved ones." ⬇️

bain.com/insights/a-bri…

The inelasticity of the supply side has resulted in prices continuing to rocket in '22, which show no signs of slowing.

11/25

bloomberg.com/news/articles/…

bain.com/insights/a-bri…

The inelasticity of the supply side has resulted in prices continuing to rocket in '22, which show no signs of slowing.

11/25

bloomberg.com/news/articles/…

What has this meant for @PetraDiamondsIR?

Higher $ per carat = revenues are increasing sharply.

In H2 CY 2020, #PDL recorded sales of $178.1m; in H2 CY 2021, sales were $264.7m - an increase of 49% YoY.

In those timeframes, production only increased 3.8%.

12/25

Higher $ per carat = revenues are increasing sharply.

In H2 CY 2020, #PDL recorded sales of $178.1m; in H2 CY 2021, sales were $264.7m - an increase of 49% YoY.

In those timeframes, production only increased 3.8%.

12/25

Combined with a dramatic reduction in interest payments following the balance sheet restructuring, #PDL has transformed from a cash guzzler into a cash cow.

From end March 2020 to end December 2020, PDL's net debt increased $33.1m per quarter, on average.

13/25

From end March 2020 to end December 2020, PDL's net debt increased $33.1m per quarter, on average.

13/25

From end March 2021 to end Dec 2021, #PDL's net debt DEcreased $45.7m per quarter, on average.

And diamond prices continue to surge ⬇️

At the current cash gen. rate, PDL could turn net cash positive in Q4 this year.

By end of next year, it could have generated close...

14/25

And diamond prices continue to surge ⬇️

At the current cash gen. rate, PDL could turn net cash positive in Q4 this year.

By end of next year, it could have generated close...

14/25

...to its current market cap in cash.

So what are the downsides?

Let's start with the very obvious: underground mining in South Africa, and open pit mining in Tanzania. What could possibly go wrong?!

Recent examples of the very real risks of such operations:

15/25

So what are the downsides?

Let's start with the very obvious: underground mining in South Africa, and open pit mining in Tanzania. What could possibly go wrong?!

Recent examples of the very real risks of such operations:

15/25

Cullinan: in Sept. last year, the mine experienced tunnel convergence. This could have affected as many as 10% of the draw points in the mine, which would have impacted on production (thankfully, rapid action was taken to mitigate).

Finsch: ingress of waste rock has...

16/25

Finsch: ingress of waste rock has...

16/25

...been unpredictable, leading to failures to hit prod. guidance.

Koffiefontein: perennially lossmaking!

Williamson: artisanal miners constantly encroaching. There's a violence history between them and security forces at the mine.

The largest notable threat to PDL's...

17/25

Koffiefontein: perennially lossmaking!

Williamson: artisanal miners constantly encroaching. There's a violence history between them and security forces at the mine.

The largest notable threat to PDL's...

17/25

...operations, however, is in whether it can extend the Life of Mine plans.

Its two flagship mines, Cullinan (62% contribution to FY 20/21 group revenue) and Finsch (31% contrib.), currently run for 9 more years, to 2030.

Williamson in Tanzania runs to end 2033.

18/25

Its two flagship mines, Cullinan (62% contribution to FY 20/21 group revenue) and Finsch (31% contrib.), currently run for 9 more years, to 2030.

Williamson in Tanzania runs to end 2033.

18/25

Koffiefontein's (7% contribution to group rev.) Mine Plan, however, comes to a close at the end of next year.

From the above table, it's evident there are ample resources at all of the mines to extend the Plans considerably: can #PDL convert those resources into reserves?

19/25

From the above table, it's evident there are ample resources at all of the mines to extend the Plans considerably: can #PDL convert those resources into reserves?

19/25

In July last year, #PDL launched another major initiative: Business Re-engineering Projects at both Finsch and Koffiefontein. The purpose?

"To comprehensively review and improve the mines’ cost bases and enhance operating margins at current throughput levels."

20/25

"To comprehensively review and improve the mines’ cost bases and enhance operating margins at current throughput levels."

20/25

The outcomes of these BREs will be detailed in #PDL's interim results next week.

N.B. Whilst mgmt has stated it is confident that these will be a success, it certainly should be considered an immediate term risk to the SP, in the (unlikely) event that the BREs aren't...

21/25

N.B. Whilst mgmt has stated it is confident that these will be a success, it certainly should be considered an immediate term risk to the SP, in the (unlikely) event that the BREs aren't...

21/25

...positive.

Koffiefontein hasn't generated more than $30m revs for the past 4 years (and has been a major cash drain throughout), and so isn't material.

Finsch, however, cold be restored to glory: in FY 2017/18 it generated an operating profit of $68m on revs of $232m.

22/25

Koffiefontein hasn't generated more than $30m revs for the past 4 years (and has been a major cash drain throughout), and so isn't material.

Finsch, however, cold be restored to glory: in FY 2017/18 it generated an operating profit of $68m on revs of $232m.

22/25

In Tanzania, #PDL is in the process of reducing its exposure to Williamson from 75% equity interest to 31.5% (with private contractor, Caspian, set to take a 31.5% stake, and the Tanz. Gov. to increase its stake to 37%).

Given that the last time it turned a profit was...

23/25

Given that the last time it turned a profit was...

23/25

...in 2017/18, and given the constant troubles caused by illegal miners, this seems prudent.

.........

To summarize the #PDL investment case:

A classic turnaround play, after a transformational restructuring, that will see @PetraDiamondsIR move from $700m net debt...

24/25

.........

To summarize the #PDL investment case:

A classic turnaround play, after a transformational restructuring, that will see @PetraDiamondsIR move from $700m net debt...

24/25

...at the beginning of 2021, to possibly being in a net cash position by the end of 2022.

The immediate priority: will the Business Re-Engineering Project at Finsch be a success? We shall find out next week.

In the meantime though, Cullinan will continue to print cash.

25/25

The immediate priority: will the Business Re-Engineering Project at Finsch be a success? We shall find out next week.

In the meantime though, Cullinan will continue to print cash.

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh