Rare earth elements continue to fly largely under the radar of the investment community.

The reason being that they're used in traction motors of EVs, and not the ever-discussed batteries.

The key REE, Neodymium, is now up 376% since 1 July '20.

Valuation check on #MKA ⬇️

1/8

The reason being that they're used in traction motors of EVs, and not the ever-discussed batteries.

The key REE, Neodymium, is now up 376% since 1 July '20.

Valuation check on #MKA ⬇️

1/8

@MkangoResources is due to complete its bankable feasibility studies for each of its rare earths mine in Malawi (Songwe Hill), and its separation plant in Poland, by the end of next month.

Details have been scarce, but #MKA has indicated the intended output of the...

2/8

Details have been scarce, but #MKA has indicated the intended output of the...

2/8

...mine and separation plant - which is more than double that of the output suggested in the 2015 pre-feasibility study.

Presumably with a little guidance from #MKA mgmt, @MkangoResources' broker provided some very basic headline numbers of how the integrated operations...

3/8

Presumably with a little guidance from #MKA mgmt, @MkangoResources' broker provided some very basic headline numbers of how the integrated operations...

3/8

...may turn out.

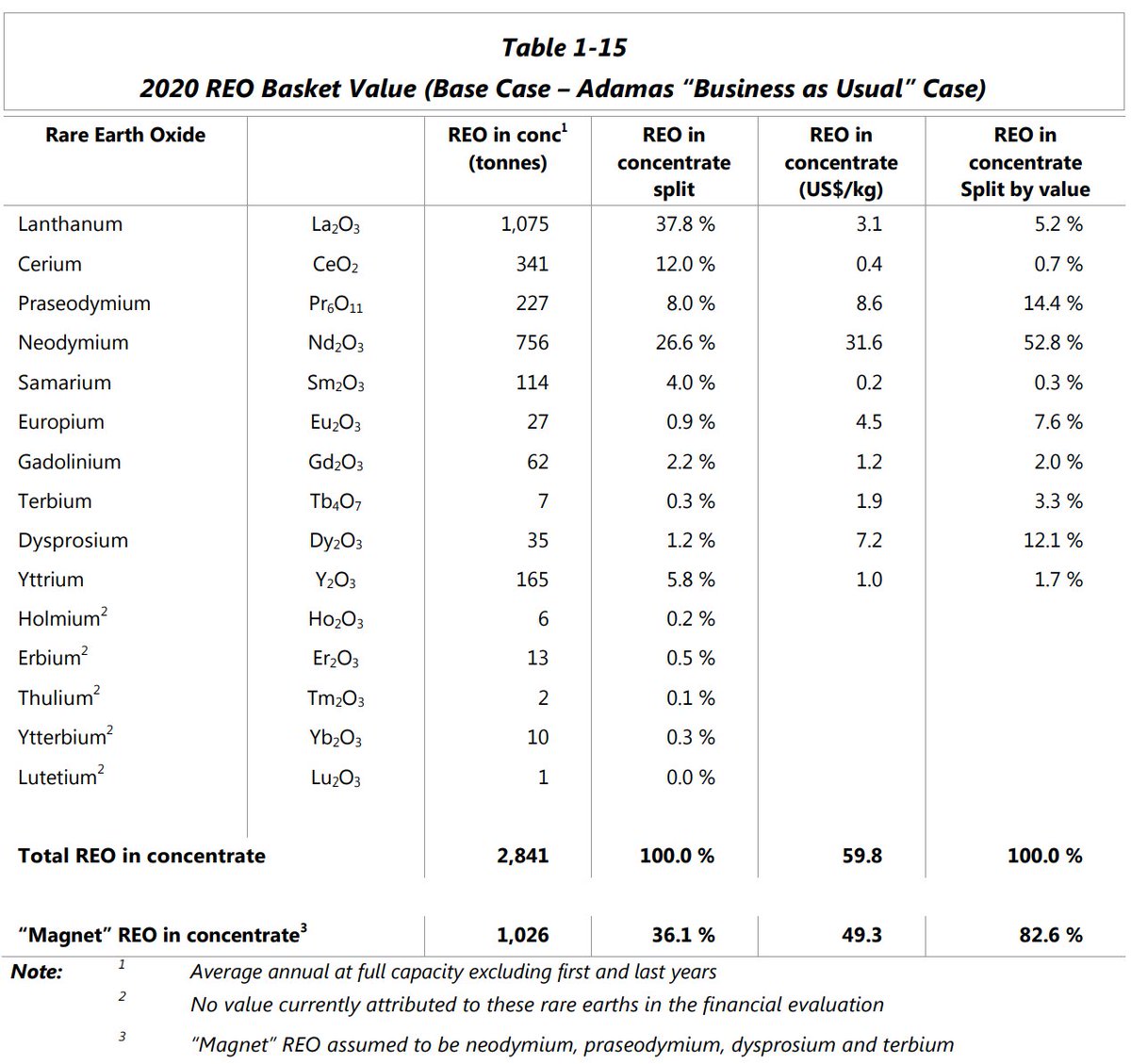

The ARC analyst has used a basket sales price of $42/kg. In the 2015 PFS, #MKA had used a basket price of $59.8/kg.

Given the very powerful moves over the past 20 months of the key 'magnet rare earths' (neodymium, praseodymium, terbium, dysprosium)...

4/8

The ARC analyst has used a basket sales price of $42/kg. In the 2015 PFS, #MKA had used a basket price of $59.8/kg.

Given the very powerful moves over the past 20 months of the key 'magnet rare earths' (neodymium, praseodymium, terbium, dysprosium)...

4/8

...which make up the large majority of the basket price at #MKA's Songwe Hill, I decided to run a quick exercise using current REE spot prices, provided by Kitco.

Needless to say, @MkangoResources will not be using these ridiculously elevated...

5/8

kitco.com/strategic-meta…

Needless to say, @MkangoResources will not be using these ridiculously elevated...

5/8

kitco.com/strategic-meta…

..prices in the feasibility studies. But equally, I think it highly unlikely that the BP will be as low as ARC's quoted $42/kg.

So here's current spot prices (at bid), dropped into ARC's model. Current Kitco pricings suggest a basket price for #MKA's Songwe Hill of ~$79/kg.

6/8

So here's current spot prices (at bid), dropped into ARC's model. Current Kitco pricings suggest a basket price for #MKA's Songwe Hill of ~$79/kg.

6/8

Even a 25% discount to current spots, suggests a BP of ~$60/kg.

At current spots, the integrated Songwe Hill / Separation Plant would be generating in the region of $400m EBITDA per annum, on revenue of $500m.

Total capex? ~$350m.

#MKA's current mkt cap? $76m.

7/8

At current spots, the integrated Songwe Hill / Separation Plant would be generating in the region of $400m EBITDA per annum, on revenue of $500m.

Total capex? ~$350m.

#MKA's current mkt cap? $76m.

7/8

Project life 15-20 years; but I believe that this could be extended significantly, using satellite deposits.

Geopolitics (esp. concerning US and China) only look to be going one way.

Deposits like Songwe Hill - of which there are very few worldwide - will be fought over.

8/8

Geopolitics (esp. concerning US and China) only look to be going one way.

Deposits like Songwe Hill - of which there are very few worldwide - will be fought over.

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh