Next week sees the release of February flash #PMI surveys, plus RBNZ and BoK meetings as well as #GDP for the US, Germany, Taiwan and Thailand.

Full preview at

bit.ly/3uX5ge0

Full preview at

bit.ly/3uX5ge0

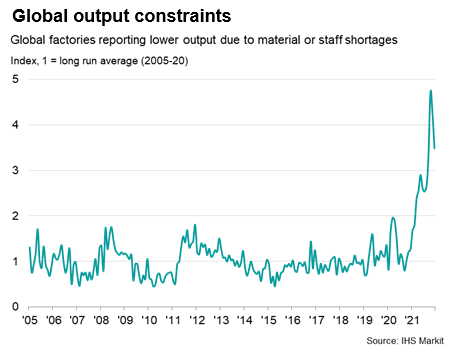

The PMI data in particular will help assess the economic impact of the Omicron variant. Global growth slowed to a 1½ year low in January with a sharp rise in the number of firms reporting output being constrained by staff shortages & illness linked to Omicron ...

More encouragingly, the incidence of output being constrained by materials shortages continued to fall from a pandemic-peak recorded last October.

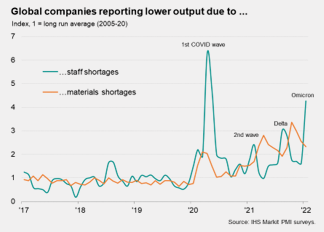

The concern – illustrated by chart below – is that output constraints due to staff shortages have been followed by periods of worsening materials shortages, reflecting the lagged impact from the lost production of inputs and other raw materials arising from the labour shortages

Which would mean that the global supply crisis could worsen again in coming months, which would in turn put further upward pressure on prices.

We will know more with next week's surveys.

We will know more with next week's surveys.

• • •

Missing some Tweet in this thread? You can try to

force a refresh