(1\26) A short historical & broad overview of the current Macro-Economic, Money & Political backdrop. The uncertainty of 2022.

The most uncertain times the🌎has ever faced may be upon us, despite many not aware. I discussed about the continual $eGLD $UTK $CEL $SAITO #Crypto

The most uncertain times the🌎has ever faced may be upon us, despite many not aware. I discussed about the continual $eGLD $UTK $CEL $SAITO #Crypto

(2\26) disruption the internet has created & how WEB3 is needed

The Executive order of 1933 was when the USA abolished the Gold Standard & entrusted the private entity of the Federal Reserve to maintain the global financial system via monetary policy.This

https://twitter.com/wesleybkress/status/1493822861001125889?s=21

The Executive order of 1933 was when the USA abolished the Gold Standard & entrusted the private entity of the Federal Reserve to maintain the global financial system via monetary policy.This

(3\26) entrusted the Federal Reserve, leveraging the US banking system & US Govt. (Fiscal Policy) to print US dollars out of thin air in just the right amount to keep financial stability.

All wars have always been predicated around resources, money, control & power. The US

All wars have always been predicated around resources, money, control & power. The US

(4\26) dollar has been the World Reserve Currency due to one single document signed into order in 1944 at the Bretton Woods Conference during World War II to make financial arrangements for after the War. This means the US Government & Federal Reserve sit at the center of the

(5\26) global financial landscape of the entire world. The medium of control is the US dollar.

In 1971, US president Nixon completely abolished the Bretton Woods Gold Exchange system. This has left the entire world printing FIAT out of thin air, backed by nothing. Setting the

In 1971, US president Nixon completely abolished the Bretton Woods Gold Exchange system. This has left the entire world printing FIAT out of thin air, backed by nothing. Setting the

(6\26) stage for the greatest levels of economic distortion fueled by Modern Monetary Theory (MMT). No Fiat currency has ever lasted the test of time, ever. The collapse of all of them has been underway & its accelerating.

A document that furthered this power was issued in

A document that furthered this power was issued in

(7\26) 2001 by president Bush of the USA, Executive order 13224 which gave the United States the power to exile anyone from the global financial system. This financial system is largely transacted on via SWIFT. This is the infrastructure.

The power that the USA holds with

The power that the USA holds with

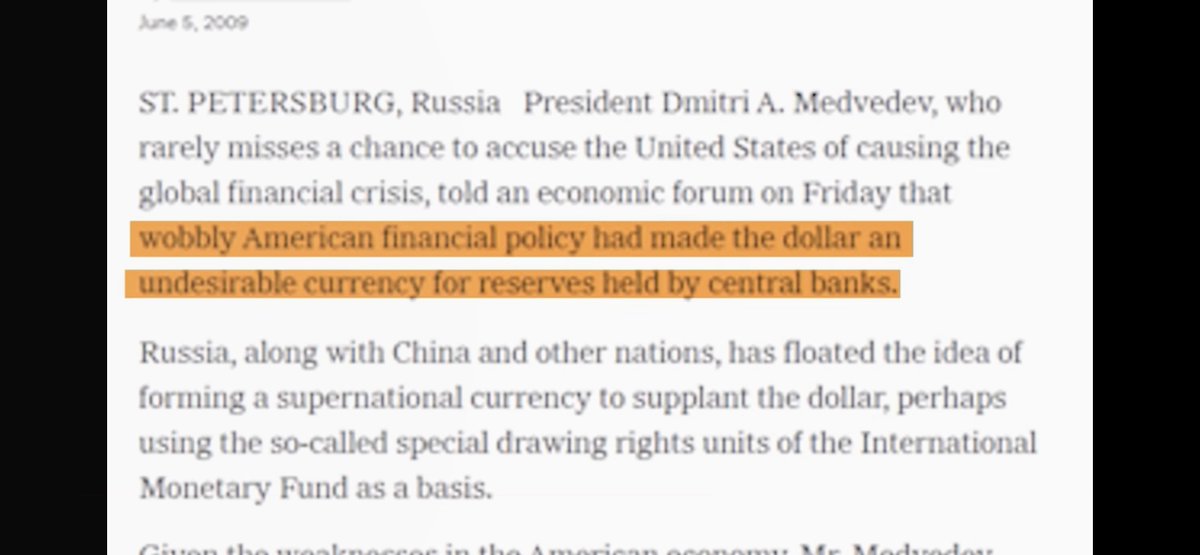

(8\26) this is why Russia & China have continually looked to undermine the US dollar. They have voiced that this level of power should not be allow both via their words and actions.

A few examples of Russia demonstrating this is some commentary dating back to 2009-2014

A few examples of Russia demonstrating this is some commentary dating back to 2009-2014

(9\26) coming from President Dmitri Medvedev. In an article by CNBC he voiced blame on the USA after the financial crisis. Also, in 2014 discussing it as unfair in a CNBC interview. Russia has been positioning its reserves into Gold with it now holding $583 Billion more than

(10\26) the US dollar as of January 2021.

China has made multiple attempts to free itself from the dollar over the last decade. Strategically they have used Blockchain to issue their own CBDC. Central Bank Digital Currency. A private Blockchain, not to be confused with a

China has made multiple attempts to free itself from the dollar over the last decade. Strategically they have used Blockchain to issue their own CBDC. Central Bank Digital Currency. A private Blockchain, not to be confused with a

(11\26) public blockchain. This has allowed China to side-step the current legal landscape due to this breakthrough in technology. Sidestepping the current legislation & rules of the game the world has agreed too. It has also allowed China to further the control of their

(12\26) citizens. They currency have active pilots in Guangdong & Shanghai.

Allows China to see all transactions & data. Also, introduce expiration for money & directly control economic spending behavior. Don't believe this can happen? *Canada not so Free

Allows China to see all transactions & data. Also, introduce expiration for money & directly control economic spending behavior. Don't believe this can happen? *Canada not so Free

(13\26) although many see this as justifiable.

China will be rolling out the Digital Yuan completely in 2022 at the Winter Olympics. Yes, this year.

After the Covid crisis of 2020 & the economic catastrophe that ensued from the lockdowns & policies we have seen unprecedented

China will be rolling out the Digital Yuan completely in 2022 at the Winter Olympics. Yes, this year.

After the Covid crisis of 2020 & the economic catastrophe that ensued from the lockdowns & policies we have seen unprecedented

(14\26) intervention to continue to keep a largely debt fueled world wide economy moving forward. The Federal Reserve & US Govt. printed more than 40% of the money in supply in 12 months.

This affected all countries who are required to hold US dollars in reserves due to them

This affected all countries who are required to hold US dollars in reserves due to them

(15\26) having this required reserve currency. This means that all those reserves are significantly less valuable. How do you think that makes these countries feel? The main beneficiary is the USA. The Ultra Wealthy all over the world have been the biggest beneficiaries of

(16\26) this due to the #CantillonEffect

https://twitter.com/wesleybkress/status/1439279625096491011?s=21I won’t discuss the obvious corruption that is happening in the same way it did during the collapse the Roman Empire by the incumbents. Corruption at banks continues per the usual & insiders theguardian.com/news/2022/feb/…

(17\26) Unprecedented inflation exacerbated due to backdrop of pent of demand from Covid lockdowns & supply chain bottlenecks worldwide. This is Y many forecasts by economists & The FED that this level of money printing would not lead to inflation in the same way it never did for

(18\26) Japan during their insane 💰 printing (MMT) was completely wrong. An oversimplification.

This has led to social unrest worldwide as the destruction of the middle class is accelerating at at an unprecedented rate. Wealth inequality is at a greater disparity than that of

This has led to social unrest worldwide as the destruction of the middle class is accelerating at at an unprecedented rate. Wealth inequality is at a greater disparity than that of

(19\26) the Roman Empire Collapse. Much of the Social Unrest has been fueled or accelerated via social engineering at the highest levels to keep the tension amongst the people & not point to the core sources of the problem. This is not difficult with financial literacy so low

(20\26) due to no education on these areas.

On top of that, all of the world countries are in an active soft default due to the record Debt to GDP levels that are mathematically inescapable. This means they are trying to print in order to

On top of that, all of the world countries are in an active soft default due to the record Debt to GDP levels that are mathematically inescapable. This means they are trying to print in order to

(21\26) make the debt easier to pay back as new dollars make old dollars less valuable, thus easier to pay off. They do want inflation for this reason but there is a looming threat that Russia see’s as prime territory to exploit with Oil sitting closer to $100.

The current

The current

(22\26) tensions between Russia & Ukraine happen to be prime opportunity to execute on the fragility of the US dollar, inflation & help to elevate Russia into power. Imagine going to war with Ukraine? This may allow for the ability to send inflation out of control & collapse

(23\26) the US dollar. Sending oil to $150 to $200 could also likely allow the current USA administration to point to variables outside of their direct control as to the US economy will once again enter into a collapse & justify even more money printing, soft default✅This will

(24\26) further the #CantillonEffect & #Inflation all which hurt the everyday person & working class. Not to mention it decimates the poor.

Typically, this could be controlled by increasing interest rates via monetary policy. Unfortunately, this is not that simple. Due to

Typically, this could be controlled by increasing interest rates via monetary policy. Unfortunately, this is not that simple. Due to

(25\26) insanity of money printing that has caused the massive increase in Financial Assets to levels never seen (6.3X to GDP) it threatens to collapse global markets if not controlled, yet if not done at all… threatens hyperinflation.

This isn’t going away, any of this.

This isn’t going away, any of this.

(26\26)Since 1978 almost all increases in wages have been completely offset by inflation.Cost of Thriving index states it would take 53 weeks to cover basic cost of living & 66 weeks on average for men & women. Millennials drowning in student debt. Remember #crypto is the problem

• • •

Missing some Tweet in this thread? You can try to

force a refresh