A Small Thread on Breakouts

What is Breakout ?

A breakout is a stock price moving outside a defined support or resistance level with increased volume.

Always trade breakouts in uptrend for high win ratios

Retweet and Share :)

1/n

Source : Google

What is Breakout ?

A breakout is a stock price moving outside a defined support or resistance level with increased volume.

Always trade breakouts in uptrend for high win ratios

Retweet and Share :)

1/n

Source : Google

What to Look before entering a breakout ?

Look for Volume Spikes on Up days and Down Volume on down days.

Simply Volume Should Dry during Pullbacks

This is a sign of Accumulation by Bigger Sharks.

As they buy in huge quantities they have to buy in parts to avoid price spikes

2/n

Look for Volume Spikes on Up days and Down Volume on down days.

Simply Volume Should Dry during Pullbacks

This is a sign of Accumulation by Bigger Sharks.

As they buy in huge quantities they have to buy in parts to avoid price spikes

2/n

They dont only buy on Uptrend but continue holding during pullbacks for bigger gains .

Important thing is pullbacks should always have less volumes .

3/n

Important thing is pullbacks should always have less volumes .

3/n

Rules For entering a Breakout .

1. Never enter more than 50 % of quantity on Breakout Region .

2. Most of the time the stock Pulls back to Breakout Region Giving a Good Reward opportunity.

3. Use Alerts to buy exactly at Pivot Points / breakout Regions to avoid extended stocks

4/

1. Never enter more than 50 % of quantity on Breakout Region .

2. Most of the time the stock Pulls back to Breakout Region Giving a Good Reward opportunity.

3. Use Alerts to buy exactly at Pivot Points / breakout Regions to avoid extended stocks

4/

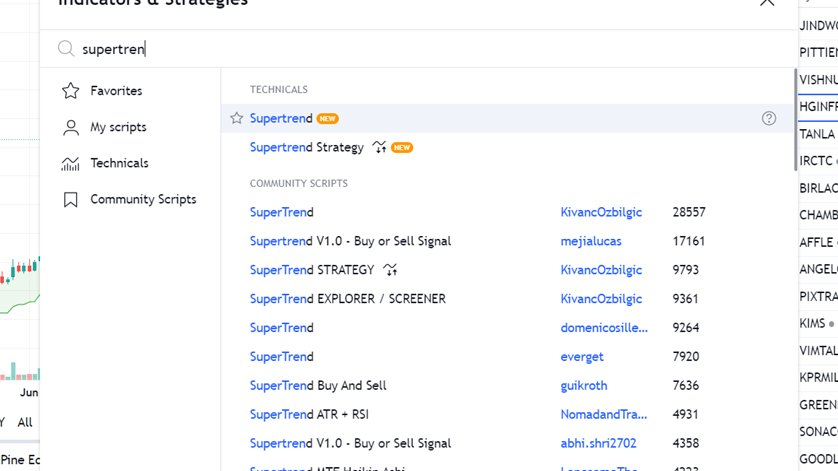

4. Keeping Alerts is important and once can use

tradingview or zerodhaonline or other Platforms to keep alerts .

5. Stock That is extended more th 4% above BO region shouldnt be bought as they dont provide Good RR .

5/n

tradingview or zerodhaonline or other Platforms to keep alerts .

5. Stock That is extended more th 4% above BO region shouldnt be bought as they dont provide Good RR .

5/n

Entry Rules :

1. Enter 50% Qty on Breakout os stock

If Stoploss Hits Your Loss is only on 50%

2. Wait for Retest and add the next 30%

3. Add Further Qty on way up

4. Always add on Winners Rather than Loosers

5. Protecting Capital Is utmost imporant in this case

6/n

1. Enter 50% Qty on Breakout os stock

If Stoploss Hits Your Loss is only on 50%

2. Wait for Retest and add the next 30%

3. Add Further Qty on way up

4. Always add on Winners Rather than Loosers

5. Protecting Capital Is utmost imporant in this case

6/n

Retests Also Fail and no one can Avoid this scenarios and Loss has to be booked Definatley

Example : Radico

Look for Volume Breakouts with Price Breakouts the probability of Winning Increases

Stocks Breaking out in Uptrend have High winning Chances then in DownTrend

7/n

Example : Radico

Look for Volume Breakouts with Price Breakouts the probability of Winning Increases

Stocks Breaking out in Uptrend have High winning Chances then in DownTrend

7/n

Range Breakouts VS Trendline Breakouts

Range Breakouts have Higher Winning % Compared to Traingle , Pennant Trend Breakouts due to over head Resistance .

As Buyers Are Trapped at Higher Prices they will Try to exit at every bounce at Min loss or Breakevens

Example :JindalSaw

8/n

Range Breakouts have Higher Winning % Compared to Traingle , Pennant Trend Breakouts due to over head Resistance .

As Buyers Are Trapped at Higher Prices they will Try to exit at every bounce at Min loss or Breakevens

Example :JindalSaw

8/n

Stoploss Rules :

Follow Maximum Stop of 8 to 10% in trades as Losses Work Against You .

If you are not getting Small Stop Trade move on to next trades as opportunities are endless .

Breakout Failures are common and hence Risk has to be managed

9/n

Follow Maximum Stop of 8 to 10% in trades as Losses Work Against You .

If you are not getting Small Stop Trade move on to next trades as opportunities are endless .

Breakout Failures are common and hence Risk has to be managed

9/n

Target Rules :

Target Should Be arounf 15 to 20% when your risk is 8 to 10 %

You can reduce this risk by entering at correct buy points and keeping stops at 5% .

Risk Reward of 1:2 is Great with 50% win Ratio

Book Partially at 1st targets and Keep Stop at cost.

10/n

Target Should Be arounf 15 to 20% when your risk is 8 to 10 %

You can reduce this risk by entering at correct buy points and keeping stops at 5% .

Risk Reward of 1:2 is Great with 50% win Ratio

Book Partially at 1st targets and Keep Stop at cost.

10/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh