1/x

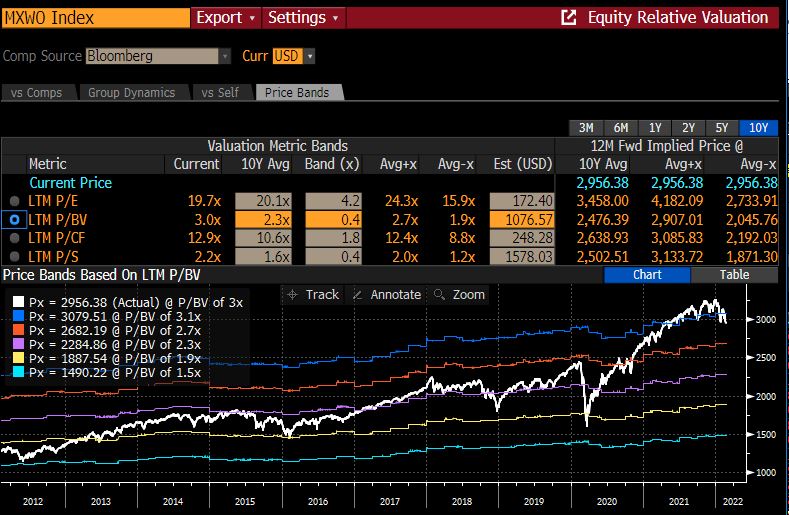

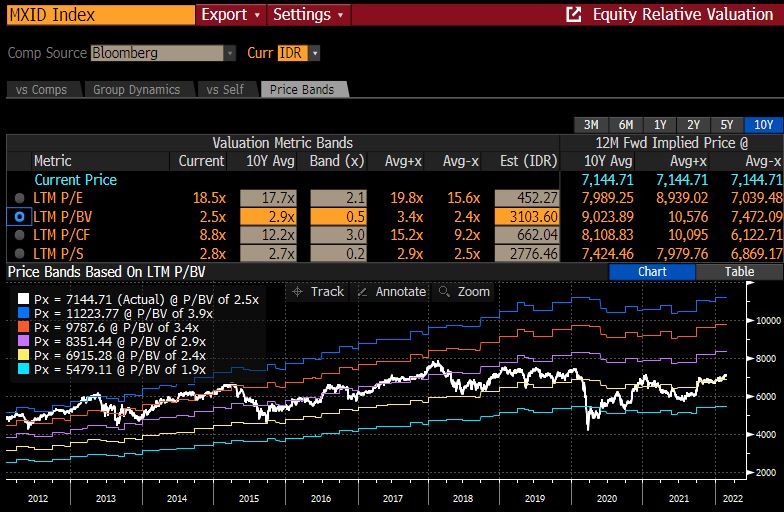

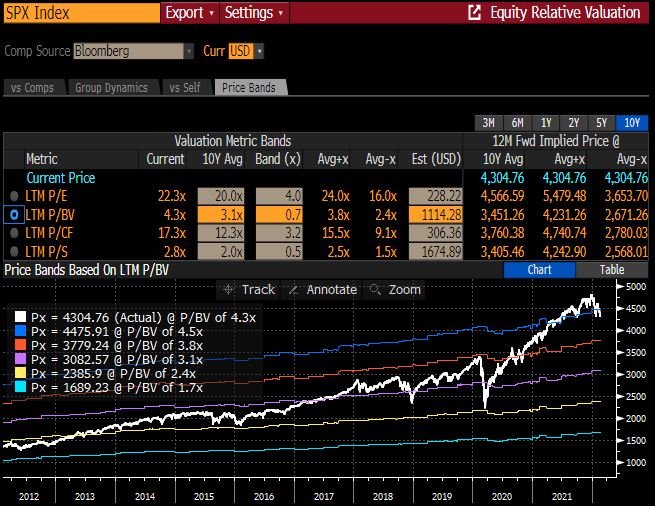

Sentiment check across markets. P/BV vs 10y averages. Assuming companies will perform neither better or worse fundamentally than they've shown historically, and shareholders will pay what they have on average have paid for those companies. Starting with #SPX500

Sentiment check across markets. P/BV vs 10y averages. Assuming companies will perform neither better or worse fundamentally than they've shown historically, and shareholders will pay what they have on average have paid for those companies. Starting with #SPX500

#SPX500 would need to come down to slightly above 3100 to reach its 10y average.

5/X

#Sweden, still my home, ca 5% down to average valuations. Note also the slope of the standard deviations, indicating good historical growth.

#Sweden, still my home, ca 5% down to average valuations. Note also the slope of the standard deviations, indicating good historical growth.

6/X

#Vietnam, ca 30% of #Frontiermarkets index (MSCI) ca 20% down to average valuations. One of few enthusiastic markets. Only due to locals. Massive foreign selling over the last year.

#Vietnam, ca 30% of #Frontiermarkets index (MSCI) ca 20% down to average valuations. One of few enthusiastic markets. Only due to locals. Massive foreign selling over the last year.

7/X

#Pakistan, sorry guys but you are completely and utterly abandoned. If history gets it right ca 50% upside just to reach average. Also note the good slope, indicating strong book value growth historically.

#Pakistan, sorry guys but you are completely and utterly abandoned. If history gets it right ca 50% upside just to reach average. Also note the good slope, indicating strong book value growth historically.

9/X

#SriLanka went from being the cheapest to reach average valuations in a massive run. Right now on average 10y valuations (and a lot of short-term headache).

#SriLanka went from being the cheapest to reach average valuations in a massive run. Right now on average 10y valuations (and a lot of short-term headache).

13/X

Would be the first to agree that an index valuation might not be representable to what you own as an investor. But it gauges the temperature of a market decently well. If valuations are low, you are more likely to find good companies at good valuations.

Would be the first to agree that an index valuation might not be representable to what you own as an investor. But it gauges the temperature of a market decently well. If valuations are low, you are more likely to find good companies at good valuations.

14/X

If the temperature is very high - What stocks do you own? Can you fundamentally vouch for good returns ahead, or are you (like the market) a bit tipsy right now?

If the temperature is very high - What stocks do you own? Can you fundamentally vouch for good returns ahead, or are you (like the market) a bit tipsy right now?

• • •

Missing some Tweet in this thread? You can try to

force a refresh