1/51 The crypto market has changed significantly over the past year

In this episode of @TheScoopPod, host @fintechfrank speaks to @joshua_j_lim of @GenesisTrading to gains insights to these changes

In this episode of @TheScoopPod, host @fintechfrank speaks to @joshua_j_lim of @GenesisTrading to gains insights to these changes

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 2/51 Key Takeaways

1. Complex products such as crypto derivatives are entering the market

2. The Basis Trade will converge with spot price over time

3. The crypto market is maturing and volatility is decreasing

4. Joshua aims to hire people who can tread between TradFi & Crypto

1. Complex products such as crypto derivatives are entering the market

2. The Basis Trade will converge with spot price over time

3. The crypto market is maturing and volatility is decreasing

4. Joshua aims to hire people who can tread between TradFi & Crypto

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 3/51 Background

• Head of derivatives at @GenesisTrading

• Head of derivatives at @GenesisTrading

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 4/51 Business In 2021

• Was a banner year for #crypto

• Their firm is positioned as a central dealing counterparty to other firms in the space

• Institutional investors shifted from market neutral strategies to risk-on strategies by allocating into earlier stage projects

• Was a banner year for #crypto

• Their firm is positioned as a central dealing counterparty to other firms in the space

• Institutional investors shifted from market neutral strategies to risk-on strategies by allocating into earlier stage projects

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 5/51

• #NFTs started to become a thing. Their customers were interested in NFT lending

• Another big theme is the use of crypto to expand business operations — corporates interacting with blockchains not as an investment product but to enhance their existing business ops

• #NFTs started to become a thing. Their customers were interested in NFT lending

• Another big theme is the use of crypto to expand business operations — corporates interacting with blockchains not as an investment product but to enhance their existing business ops

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 7/51 Growing Complexity Of Products

• More complex products are offered on the market to suit the needs of different counterparties

• Corporates are holding crypto on their balance sheet not just for investment purposes, but for operating purposes

• More complex products are offered on the market to suit the needs of different counterparties

• Corporates are holding crypto on their balance sheet not just for investment purposes, but for operating purposes

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 8/51

• These firms started engaging on derivative hedges to protect their downside

• #Derivatives are a useful tool for corporate treasuries and CFOs to smooth out their revenues and their cash flows throughout the year

• These firms started engaging on derivative hedges to protect their downside

• #Derivatives are a useful tool for corporate treasuries and CFOs to smooth out their revenues and their cash flows throughout the year

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 9/51

• Some staking assets have a bonding period where they are illiquid. Call/Put options enable these positions to be liquid and monetizable

• Users of these products tend to be mining firms, exchange firms, and asset management firms

• Some staking assets have a bonding period where they are illiquid. Call/Put options enable these positions to be liquid and monetizable

• Users of these products tend to be mining firms, exchange firms, and asset management firms

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 10/51

• It also includes long-term investors that want to participate in the network/protocol but reduce their exposure to the underlying asset

• It also includes long-term investors that want to participate in the network/protocol but reduce their exposure to the underlying asset

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 11/51 Firms Acquiring Metaverse Tokens

• More firms are trying to get involved with the #Metaverse

• They would need to acquire metaverse tokens and would need a counterparty who provides hedging capabilities to smooth out the price volatility of those tokens

• More firms are trying to get involved with the #Metaverse

• They would need to acquire metaverse tokens and would need a counterparty who provides hedging capabilities to smooth out the price volatility of those tokens

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 12/51

• In the real world, this is a critical function of corporate treasuries when they purchase assets that are not denominated in their domestic currency

• Hedging for firms with exposure to Metaverse tokens is at the early stage

• In the real world, this is a critical function of corporate treasuries when they purchase assets that are not denominated in their domestic currency

• Hedging for firms with exposure to Metaverse tokens is at the early stage

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 13/51 NFT Lending

• Starting to see their HNW clientele interested in NFT lending

• Genesis is already holding a basket of liquid assets to trade spot or to borrow and lend against those positions

• People are accumulating valuable NFTs as part of their broader portfolio

• Starting to see their HNW clientele interested in NFT lending

• Genesis is already holding a basket of liquid assets to trade spot or to borrow and lend against those positions

• People are accumulating valuable NFTs as part of their broader portfolio

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 14/51

• Doing due diligence on the types of collaterals that they would take

• Have a broad network of counterparties that are engaged in sourcing NFTs

• Over time, it would become normalized to consider NFTs as financial assets

• Doing due diligence on the types of collaterals that they would take

• Have a broad network of counterparties that are engaged in sourcing NFTs

• Over time, it would become normalized to consider NFTs as financial assets

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 16/51 What Does It Mean For Their Business When Crypto And NFT Prices Decouple?

• Thinks that NFTs can decouple from crypto

• The emergence of a new crypto category results in people allocating into it. This creates a mini-cycle where it separates from the broader industry

• Thinks that NFTs can decouple from crypto

• The emergence of a new crypto category results in people allocating into it. This creates a mini-cycle where it separates from the broader industry

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 17/51

• Plenty of celebrities and high profile individuals were publicly talking about NFTs and putting them as their profile pictures

• Plenty of celebrities and high profile individuals were publicly talking about NFTs and putting them as their profile pictures

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 18/51

• The decoupling could also be attributed to people rotating from $BTC and $ETH to other assets that might have convexity to the upside (e.g. NFTs, alt layer 1s, etc.)

• The decoupling could also be attributed to people rotating from $BTC and $ETH to other assets that might have convexity to the upside (e.g. NFTs, alt layer 1s, etc.)

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 19/51 Thoughts On The Basis Trade

• The basis trade involves buying spot crypto (taking a long position) and simultaneously establishing a short position through derivatives like options or futures contracts, or vice versa

• The basis trade involves buying spot crypto (taking a long position) and simultaneously establishing a short position through derivatives like options or futures contracts, or vice versa

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading 20/51

• The basis trade got as wide as 20% in Q4 due to the @CMEGroup ETF launch

• Subsequently, it compressed a lot due to the beta — correlation between the basis spread and spot price

• Thinks that they will sort of tie together over time

• The basis trade got as wide as 20% in Q4 due to the @CMEGroup ETF launch

• Subsequently, it compressed a lot due to the beta — correlation between the basis spread and spot price

• Thinks that they will sort of tie together over time

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup 21/51

• Market participants will shift focus to other market neutral strategies to hunt for yield

• As more people get comfortable with #DeFi, more capital will be deployed in DeFi

• Knows of other firms that are engaged in some capacity with DeFi

• Market participants will shift focus to other market neutral strategies to hunt for yield

• As more people get comfortable with #DeFi, more capital will be deployed in DeFi

• Knows of other firms that are engaged in some capacity with DeFi

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup 22/51

• @anchor_protocol has a 20% yield per annum on $UST

• Has seen a lot of interest in stablecoin yield and peg protection

• A few weeks ago, they received a lot of inquiries around hedging UST positions or trading the UST peg break

• @anchor_protocol has a 20% yield per annum on $UST

• Has seen a lot of interest in stablecoin yield and peg protection

• A few weeks ago, they received a lot of inquiries around hedging UST positions or trading the UST peg break

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 23/51

• Have also seen people being concerned about the $USDT peg earlier this year

• Thinks that stablecoin insurance would be a big trend this year

• Have also seen people being concerned about the $USDT peg earlier this year

• Thinks that stablecoin insurance would be a big trend this year

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 24/51

Differences Between Q4 2021 And Q1 2022

• Convergence of Crypto Native and TradFi

• Very broad compression of implied volatility

Differences Between Q4 2021 And Q1 2022

• Convergence of Crypto Native and TradFi

• Very broad compression of implied volatility

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 25/51

• Part of the reason is that there are a lot of new entrants coming into crypto and comparing BTC/ETH vols to FX and equities and end up finding high cross-asset correlation

• Part of the reason is that there are a lot of new entrants coming into crypto and comparing BTC/ETH vols to FX and equities and end up finding high cross-asset correlation

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 26/51

• Thinks that there will be good value there as there will be more demand than supply at some point

• Thinks that long-dated call options are a pretty interesting play here

• Thinks that there will be good value there as there will be more demand than supply at some point

• Thinks that long-dated call options are a pretty interesting play here

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 27/51 Will Less Volatility Be Bad For A Firm Like @GenesisTrading?

• It’s true, but it has to be balanced with the wider diversity of assets and products that are available for trading

• It’s true, but it has to be balanced with the wider diversity of assets and products that are available for trading

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 28/51

• In the last quarter, they have become more active in DeFi options. Have actively bidded in a lot of these options to source short-dated gamma-like options in the market

• In the last quarter, they have become more active in DeFi options. Have actively bidded in a lot of these options to source short-dated gamma-like options in the market

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 29/51

• Thinks that the trend where there’s a flavour of the day would continue persisting (e.g. governance tokens, #NFTs, etc.). They will think of them as different portions and rotate between them in their portfolios

• Thinks that the trend where there’s a flavour of the day would continue persisting (e.g. governance tokens, #NFTs, etc.). They will think of them as different portions and rotate between them in their portfolios

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 30/51

• The reduction in volatility for #Bitcoin is a sign of maturity for the asset class

• There’s lots of studies in traditional finance where derivatives bring about lower realized volatility as there’s more effective ways to transfer risk between market participants

• The reduction in volatility for #Bitcoin is a sign of maturity for the asset class

• There’s lots of studies in traditional finance where derivatives bring about lower realized volatility as there’s more effective ways to transfer risk between market participants

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 31/51 Will We See Fewer Cascading Liquidations Moving Forward?

• More capital is coming into the space and the markets are becoming a bit more regulated. This reduces the impact of cascading margin calls

• More capital is coming into the space and the markets are becoming a bit more regulated. This reduces the impact of cascading margin calls

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 32/51

• However, assets that are primarily traded on offshore exchanges or assets that are levered up in a certain way through DeFi lending protocols may be more affected

• However, assets that are primarily traded on offshore exchanges or assets that are levered up in a certain way through DeFi lending protocols may be more affected

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 33/51 Has Price Discovery Moved From Spot Offshore To Regulated US Futures?

• Doesn’t think it is fully there yet

• The biggest change he has seen is the maturity in the options market

• Doesn’t think it is fully there yet

• The biggest change he has seen is the maturity in the options market

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 34/51

• Spreads have compressed a lot on listed options. It has become easier to source block liquidity

• Will be seeing more people building structured products on top of the vanilla options market. In crypto, structured products generally refer to DeFi option vaults

• Spreads have compressed a lot on listed options. It has become easier to source block liquidity

• Will be seeing more people building structured products on top of the vanilla options market. In crypto, structured products generally refer to DeFi option vaults

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol 35/51

• Started to see the listing of equities in crypto products (e.g. $COIN for @coinbase stock, etc.)

• Dual currency notes/structures are a popular structured product

• Started to see the listing of equities in crypto products (e.g. $COIN for @coinbase stock, etc.)

• Dual currency notes/structures are a popular structured product

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 36/51

• In traditional markets, one could extract 5-10% yield on an equity product. In contrast. traders could extract 30-50% on Bitcoin

• In traditional markets, one could extract 5-10% yield on an equity product. In contrast. traders could extract 30-50% on Bitcoin

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 37/51 Change In Market Structure From The Day He Started Till Today

• The number of counterparties that they talk to on a daily basis has increased

• Quality of traders has improved, using more complicated strategies

• The number of counterparties that they talk to on a daily basis has increased

• Quality of traders has improved, using more complicated strategies

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 38/51 Are There Any Gaps In The Market That Vol Shops Have Yet To Enter?

• Likes to think back to new tokens launching and the cycle for new verticals emerging

• When exchange tokens first launched, people were assigning valuation metrics from the equities industry to them

• Likes to think back to new tokens launching and the cycle for new verticals emerging

• When exchange tokens first launched, people were assigning valuation metrics from the equities industry to them

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 39/51

• There’s a middle ground between venture and liquid market traders where there’s deal flow with vesting schedules

• Multiple ways to price assets:

- From a venture angle

- Valuation in the context of other deals

• There’s a middle ground between venture and liquid market traders where there’s deal flow with vesting schedules

• Multiple ways to price assets:

- From a venture angle

- Valuation in the context of other deals

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 40/51

- Valuation relative to what they think the exit opportunity

- As a financial problem — pricing of liquidity

- Valuation relative to what they think the exit opportunity

- As a financial problem — pricing of liquidity

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 42/51

Do VCs Need To Have Hedging Experts On Their Teams Now That They Have To Dabble In Liquid Markets?

• Yes. This ties in with continued upgrading of personnel in asset management firms

Do VCs Need To Have Hedging Experts On Their Teams Now That They Have To Dabble In Liquid Markets?

• Yes. This ties in with continued upgrading of personnel in asset management firms

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 43/51

• This is a big driver for their business. They can offer this sort of expertise to other firms

• This is a big driver for their business. They can offer this sort of expertise to other firms

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 44/51 Do They Have A Philosophy Of Who They Hire?

• There is a lot of talent coming out of traditional finance with product specific knowledge

• Similarly, there are crypto natives that grew up in crypto

• There is a lot of talent coming out of traditional finance with product specific knowledge

• Similarly, there are crypto natives that grew up in crypto

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 45/51

• However, there’s not many people who can do both and speak fluently to both. This is the type of people they are looking for

• Potential candidates need to have a good understanding of the crypto market structure

• However, there’s not many people who can do both and speak fluently to both. This is the type of people they are looking for

• Potential candidates need to have a good understanding of the crypto market structure

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 46/51

• Their specialties will be taken into consideration as well

• Their specialties will be taken into consideration as well

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 47/51

Any Prediction For The Rest Of The Year?

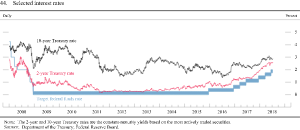

• A lot of people expect that prices will be driven by macro events and fed policy till the rate hike cycle in March

Any Prediction For The Rest Of The Year?

• A lot of people expect that prices will be driven by macro events and fed policy till the rate hike cycle in March

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase 48/51

• Once rate hikes start, it would be interesting to compare it to the 2015-2018 cycle where there was a couple of rate hikes. During that period, Bitcoin rallied a ton (H/T @federalreserve)

• Once rate hikes start, it would be interesting to compare it to the 2015-2018 cycle where there was a couple of rate hikes. During that period, Bitcoin rallied a ton (H/T @federalreserve)

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase @federalreserve 49/51

• People expected that the tightening of financial markets would be bad for risk assets like crypto, but it turned out otherwise in the past

• People expected that the tightening of financial markets would be bad for risk assets like crypto, but it turned out otherwise in the past

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase @federalreserve 50/51

Podcast: open.spotify.com/episode/6eE8Sw…

Thanks to @fintechfrank for this episode

Podcast: open.spotify.com/episode/6eE8Sw…

Thanks to @fintechfrank for this episode

@TheScoopPod @fintechfrank @joshua_j_lim @GenesisTrading @CMEGroup @anchor_protocol @coinbase @federalreserve 51/51 What are your thoughts on the episode?

1. Share your thoughts - comment below!

2. Follow me @ramahluwalia for more of my thoughts on crypto

1. Share your thoughts - comment below!

2. Follow me @ramahluwalia for more of my thoughts on crypto

• • •

Missing some Tweet in this thread? You can try to

force a refresh