So, what's up next in the 🇪🇺🇺🇸 sanctions against Putin's 🇷🇺?

In 1st stage, it was necessary to focus on finance (#SWIFT and all that) to quickly frontload the pain, as explained in this great🧵by @SonyKapoor

But that won't be the end. My thoughts (1/n)

In 1st stage, it was necessary to focus on finance (#SWIFT and all that) to quickly frontload the pain, as explained in this great🧵by @SonyKapoor

But that won't be the end. My thoughts (1/n)

https://twitter.com/SonyKapoor/status/1498373046058504196?s=20&t=Pc75cUPiG3YVIf4OQvpCpA

Like Sony & @adam_tooze, I also think that oil/gas/coal exports are in spotlight soon

- Either Putin stops their delivery; that's the only econ retaliation he's got

- Or 🇪🇺🇺🇸 impose embargoes to drain the daily FX flows which help funding his war /2

faz.net/aktuell/wirtsc…

- Either Putin stops their delivery; that's the only econ retaliation he's got

- Or 🇪🇺🇺🇸 impose embargoes to drain the daily FX flows which help funding his war /2

faz.net/aktuell/wirtsc…

We haven't seen action on this front yet. Transit volumes of Russian gas through Ukraine are even *up* ever since the attacs

Check this great source @Bruegel_org :

bruegel.org/publications/d…

So, are we stuck in an "equilibrium of scare" to sustain 🇷🇺 energy vs. 🇪🇺🇺🇸FX flows? /3

Check this great source @Bruegel_org :

bruegel.org/publications/d…

So, are we stuck in an "equilibrium of scare" to sustain 🇷🇺 energy vs. 🇪🇺🇺🇸FX flows? /3

Not sure. Many military experts expect the war to enter an uglier phase soon, in which case the pressures to end those trade flows (which effectively "finance the war") will inevitably built up.

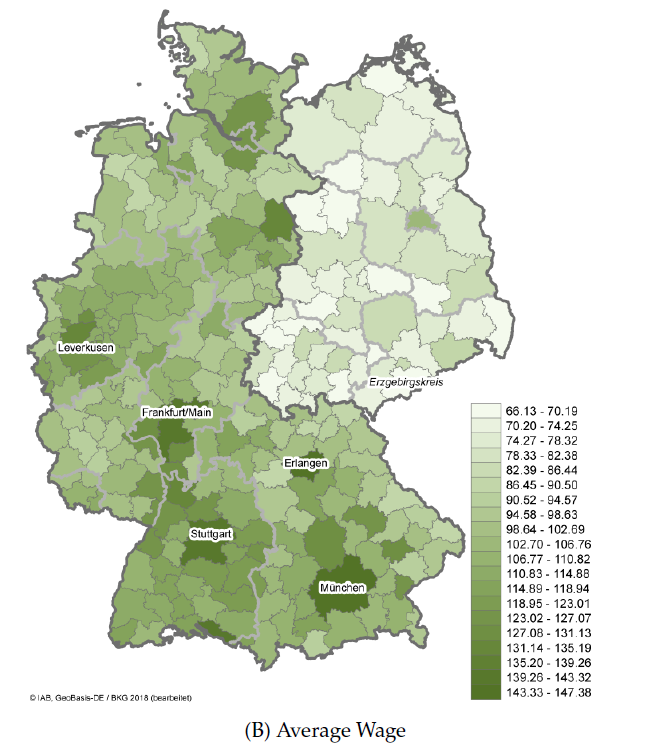

What would be the effect on 🇪🇺🇺🇸 economies? /4

axios.com/ukraine-russia…

What would be the effect on 🇪🇺🇺🇸 economies? /4

axios.com/ukraine-russia…

One thing's for sure: energy prices would skyrocket

It's reflected already in prices for gas futures (see theice.com/products/27996…) but need not stop there as the discussion on trade disruptions heats up

And remember: it would come on top of the high inflation we already have /5

It's reflected already in prices for gas futures (see theice.com/products/27996…) but need not stop there as the discussion on trade disruptions heats up

And remember: it would come on top of the high inflation we already have /5

What to do? Govs already enact emergency plans to substitute Russian energy. Speeding up rollout of renewables is a must, delaying nuclear exit maybe too, etc.

But in the short-run, all of that won't be enough. We need to get our hands on coal & gas. /6

But in the short-run, all of that won't be enough. We need to get our hands on coal & gas. /6

https://twitter.com/ARD_BaB/status/1497997825598177283?s=20&t=Q05DAzP7pgtxEywf8qOMWA

That's not an impossible task, as explained in this great @Bruegel_org piece. But it's daunting and could even involve demand curtailments by shutting down some industries for some time.

However, one thing might play out in our favor: trade diversion /7

bruegel.org/2022/01/can-eu…

However, one thing might play out in our favor: trade diversion /7

bruegel.org/2022/01/can-eu…

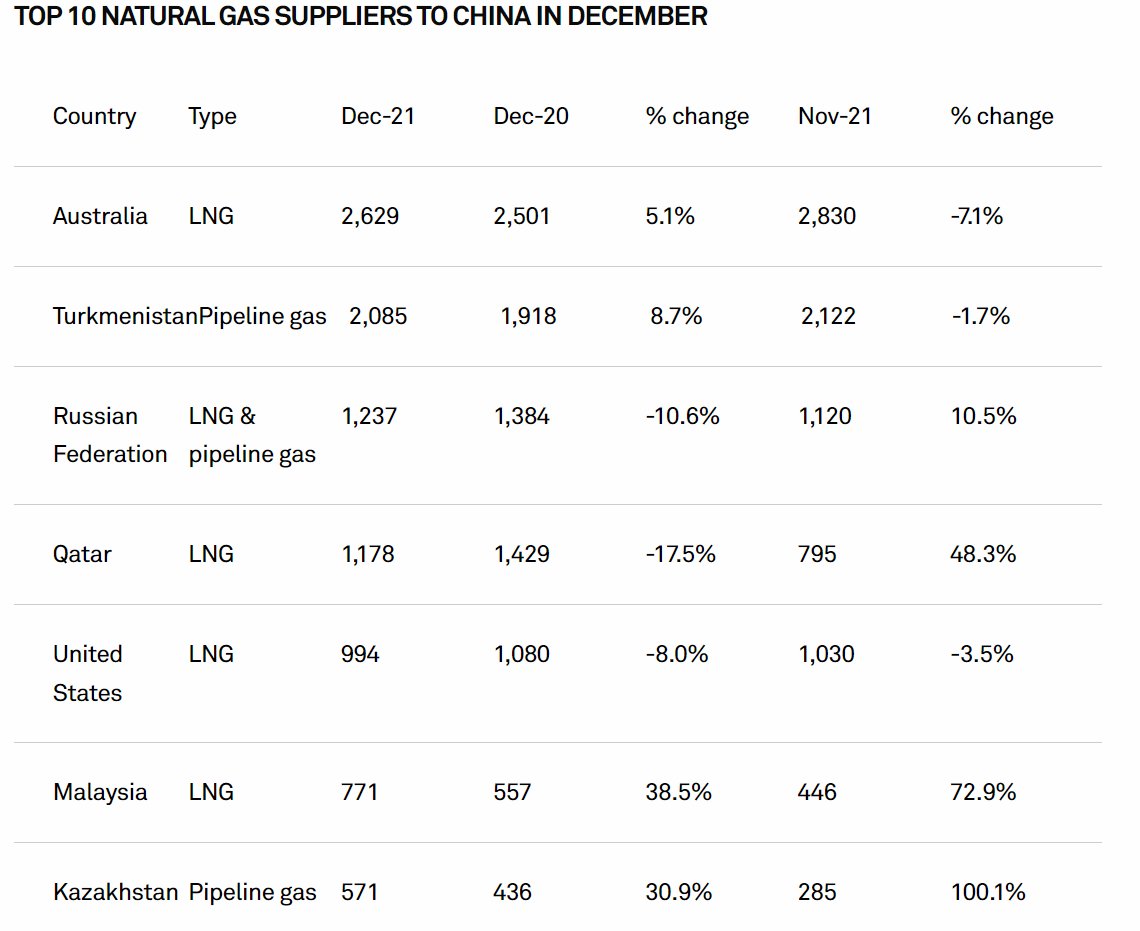

At the end of the day, when flows 🇷🇺->🇪🇺🇺🇸 stop, FX-desparate Russia will sit on a lot of supply that it'll need to sell somewhere

Obvious candidate is China 🇨🇳, which doesn't yet impose sanctions

How quickly that can happen is unclear, as redirecting energy flows isn't easy /8

Obvious candidate is China 🇨🇳, which doesn't yet impose sanctions

How quickly that can happen is unclear, as redirecting energy flows isn't easy /8

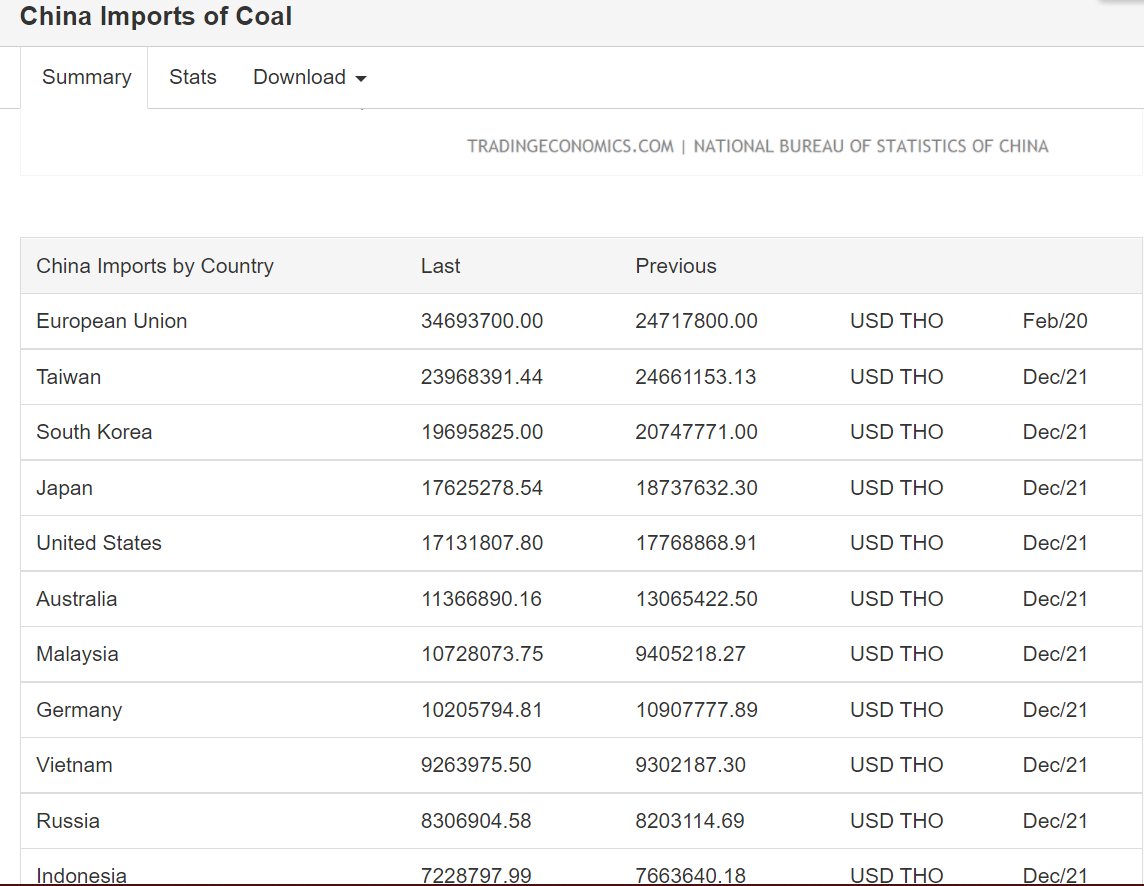

You need infrastructure, pipelines,... But key for us: as 🇨🇳 buys more oil&gas from 🇷🇺, it'll buy less from other origins like Australia, Indonesia etc.

After all, global energy demand hasn't really changed because of the war. /9

spglobal.com/commodity-insi…

tradingeconomics.com/china/imports-…

After all, global energy demand hasn't really changed because of the war. /9

spglobal.com/commodity-insi…

tradingeconomics.com/china/imports-…

We need to make sure to get our hands on those "freed up" capacities.

The better this works, through futures contracts and by securing shipment routes, the smaller will be the inflationary jump of energy prices in 🇪🇺🇺🇸 which harms all of us (and esp low-income families). /10

The better this works, through futures contracts and by securing shipment routes, the smaller will be the inflationary jump of energy prices in 🇪🇺🇺🇸 which harms all of us (and esp low-income families). /10

That should be one key priority right now, and @BMWK and others are already working on it.

The current setting, where we're in a severe conflict with Vladimir Putin but still do business with him, is pretty fragile - both from an economic and an ethical point of view. /END

The current setting, where we're in a severe conflict with Vladimir Putin but still do business with him, is pretty fragile - both from an economic and an ethical point of view. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh