Wolverhampton Wanderers 2020/21 financial results covered a season when they finished 13th in the Premier League. Although lower than previous two seasons, still third best since 1980. Head coach Nuno Espirito Santo replaced by Bruno Lage in June 2021. Some thoughts follow #WWFC

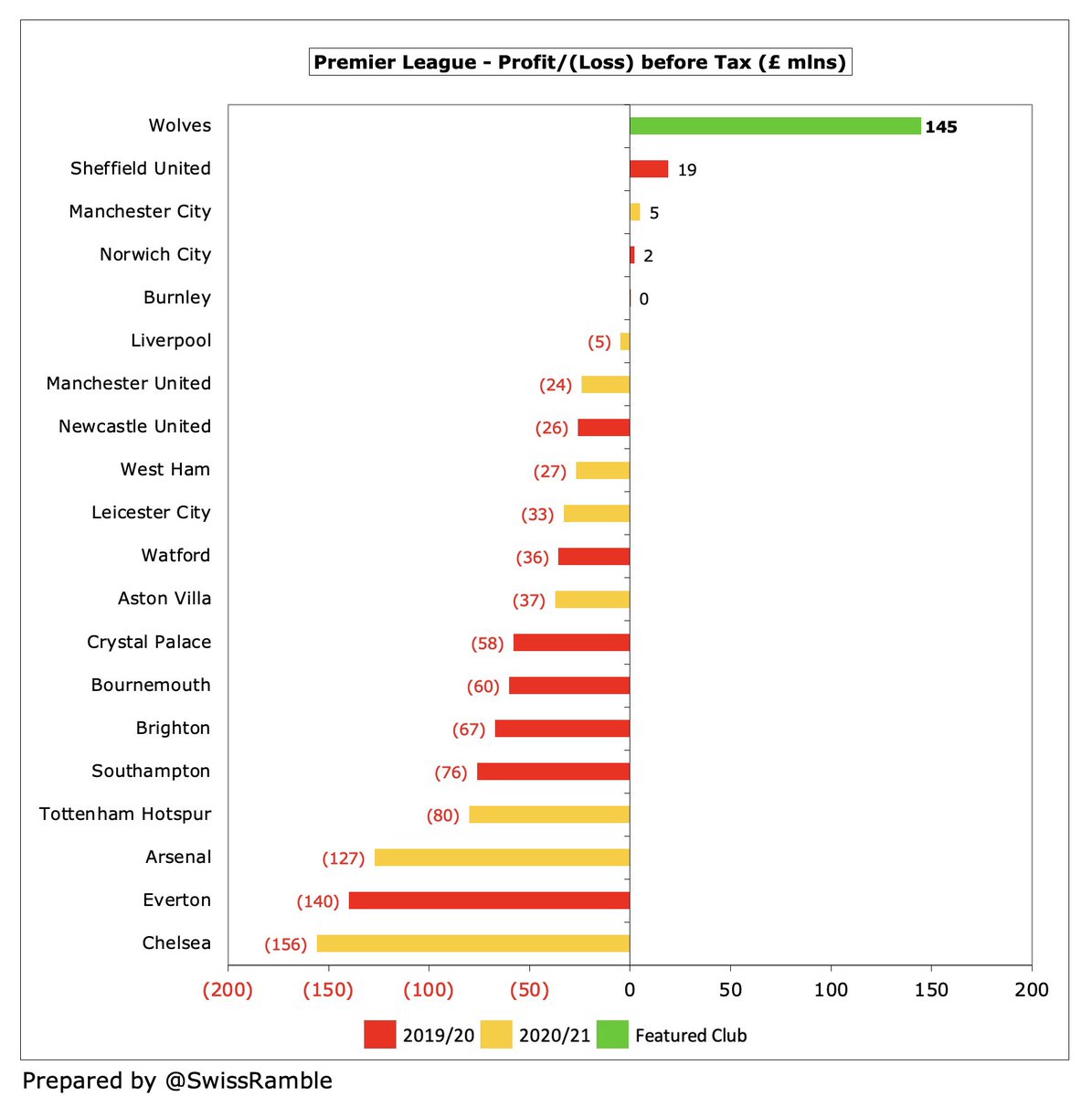

#WWFC swung from £40m pre-tax loss to £145m profit, £18m excluding £127m waiver of debt owed to owners Fosun. Revenue rose £61m (46%) from £133m to a club record £194m, while profit on player sales increased £51m to £61m, partly offset by operating expenses growing £54m (30%).

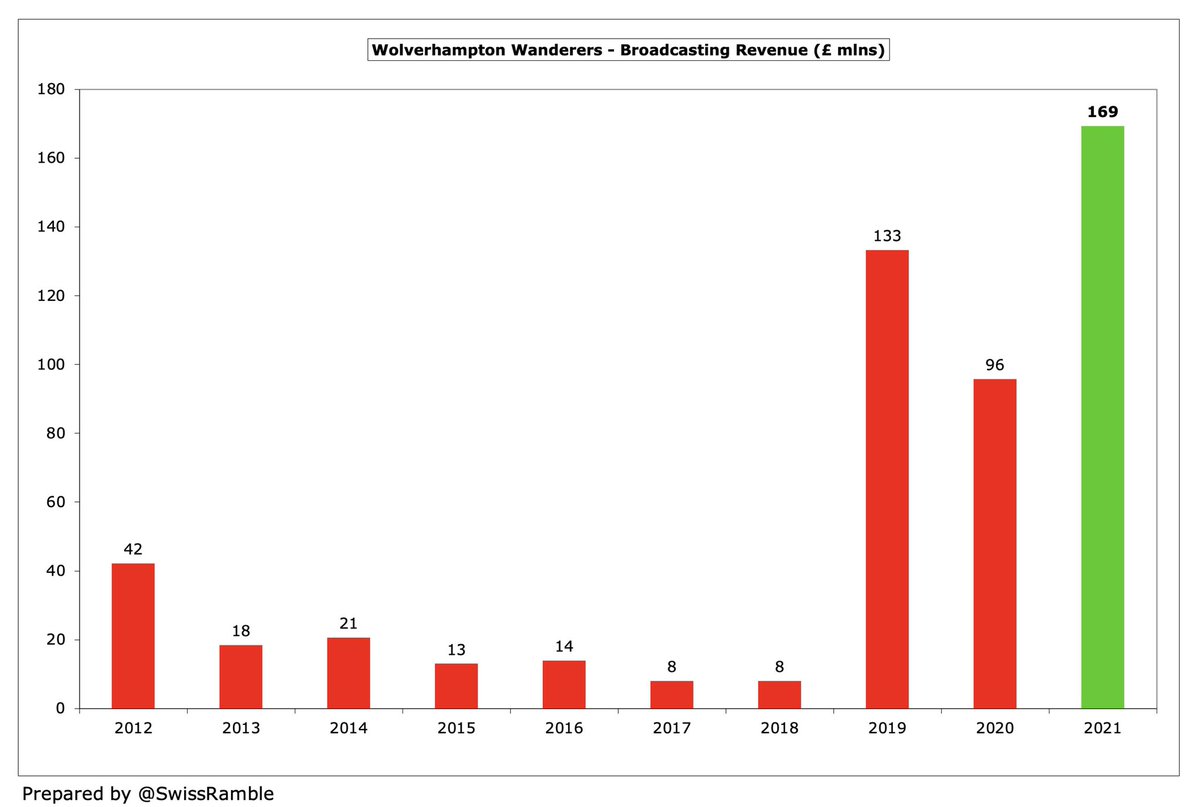

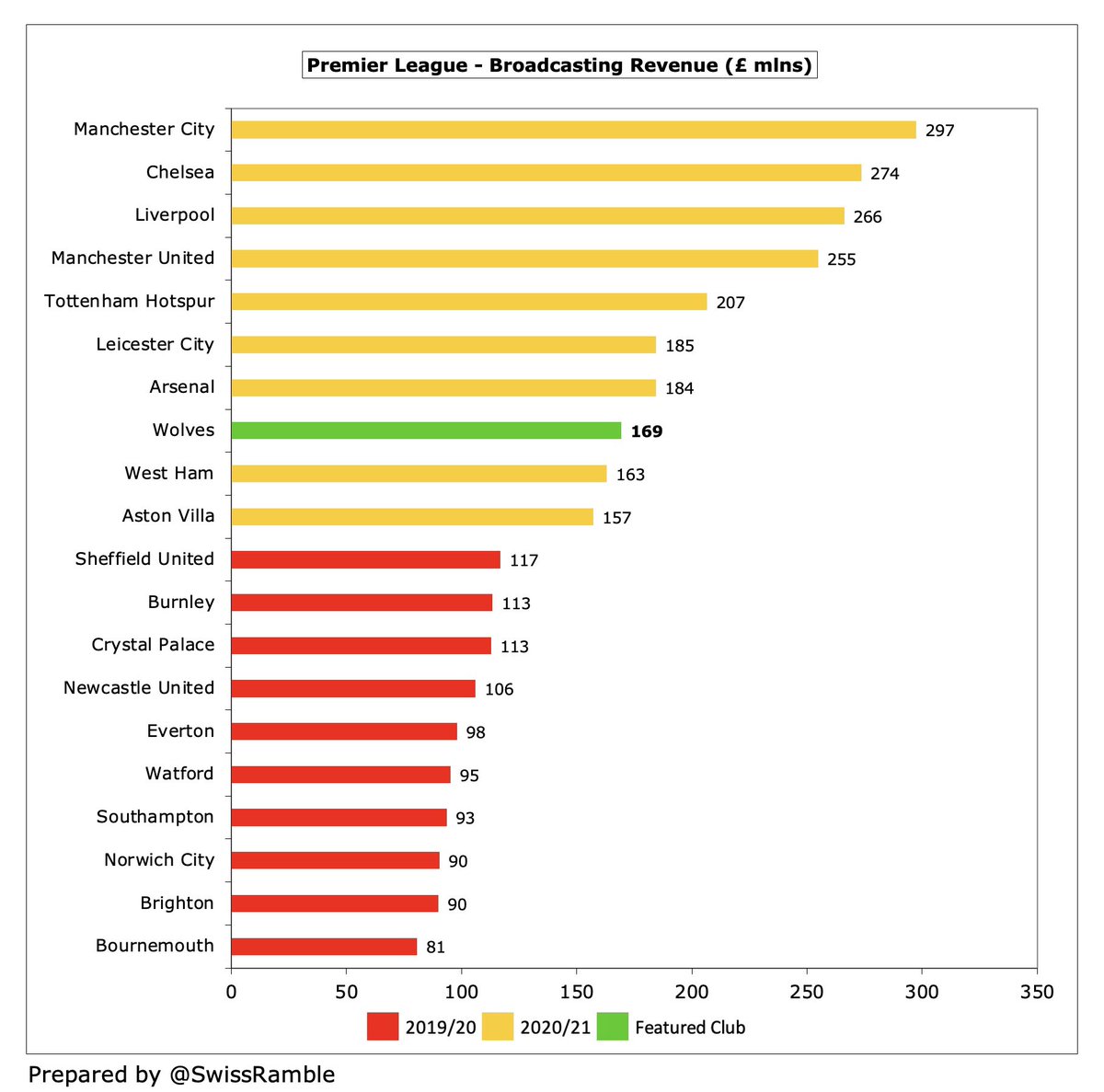

#WWFC broadcasting revenue increased £73m (77%) from £96m to £159m, mainly due to money deferred from 2019/20 for games played after the accounting close, which offset COVID driven reduction in match day, down £13m (99%) to just £144k. Commercial rose slightly (2%) to £25m.

Following further investment in the squad, #WWFC wages rose £45m (47%) from £95m to £139m and player amortisation increased by £10m (20%) from £52m to £62m (plus £9m impairment). Other expenses cut £11m (38%) to £17m, but interest payable up £0.7m to £5.4m.

#WWFC £145m profit is by far the highest in 2020/21 Premier League, largely thanks to £127m loan write-off. Even if excluded, £18m net profit is still comfortably the best result. A full year of the pandemic meant some very high losses, e.g. #CFC £156m, #AFC £127m and #THFC £80m.

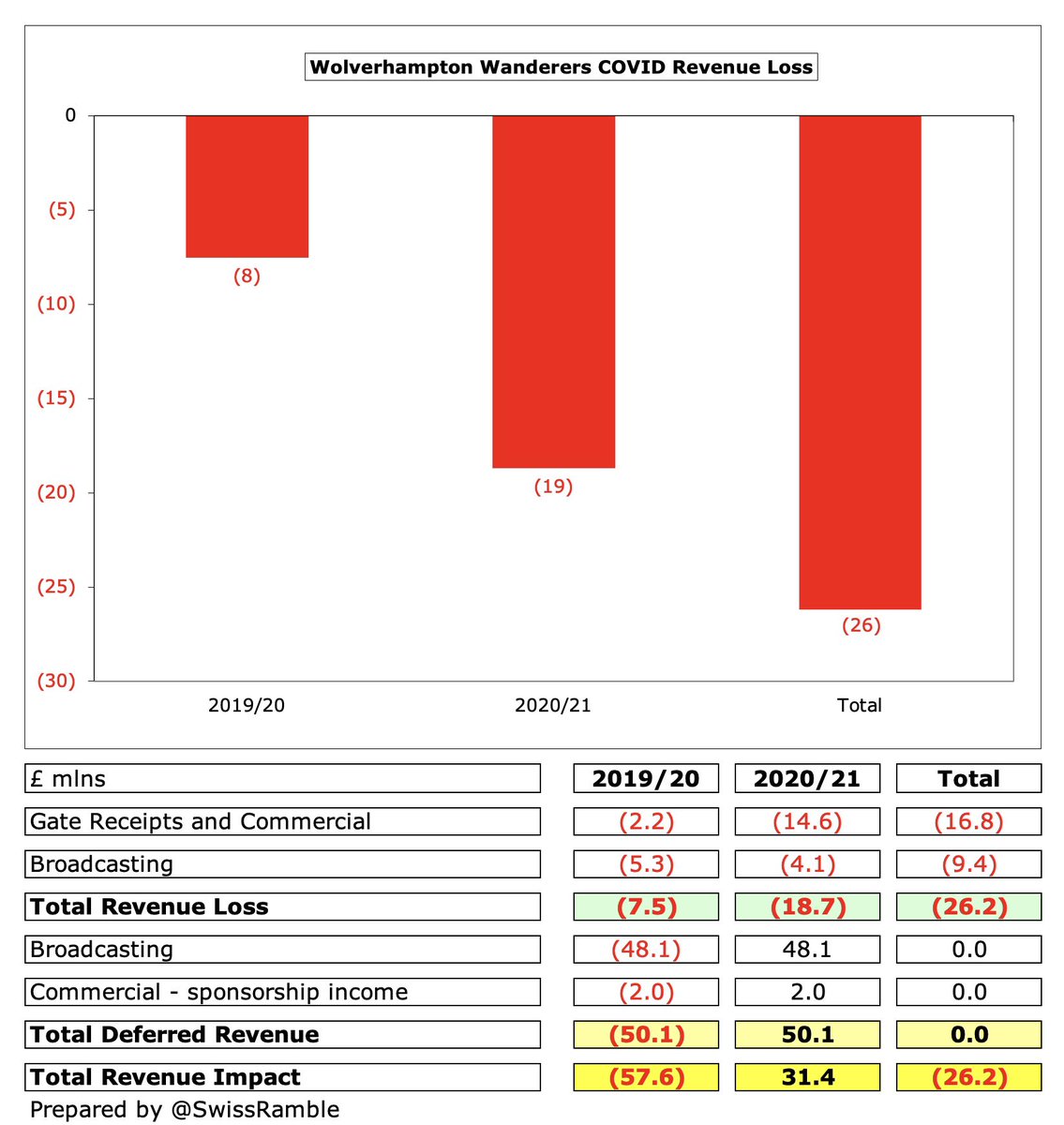

According to the club, COVID cost #WWFC £19m in 2020/21 (gate receipts and commercial £15m, broadcasting £4m), but this was more than offset by £50m deferred from prior year accounts to 2020/21, mainly TV. Revenue loss over last two years is £26m.

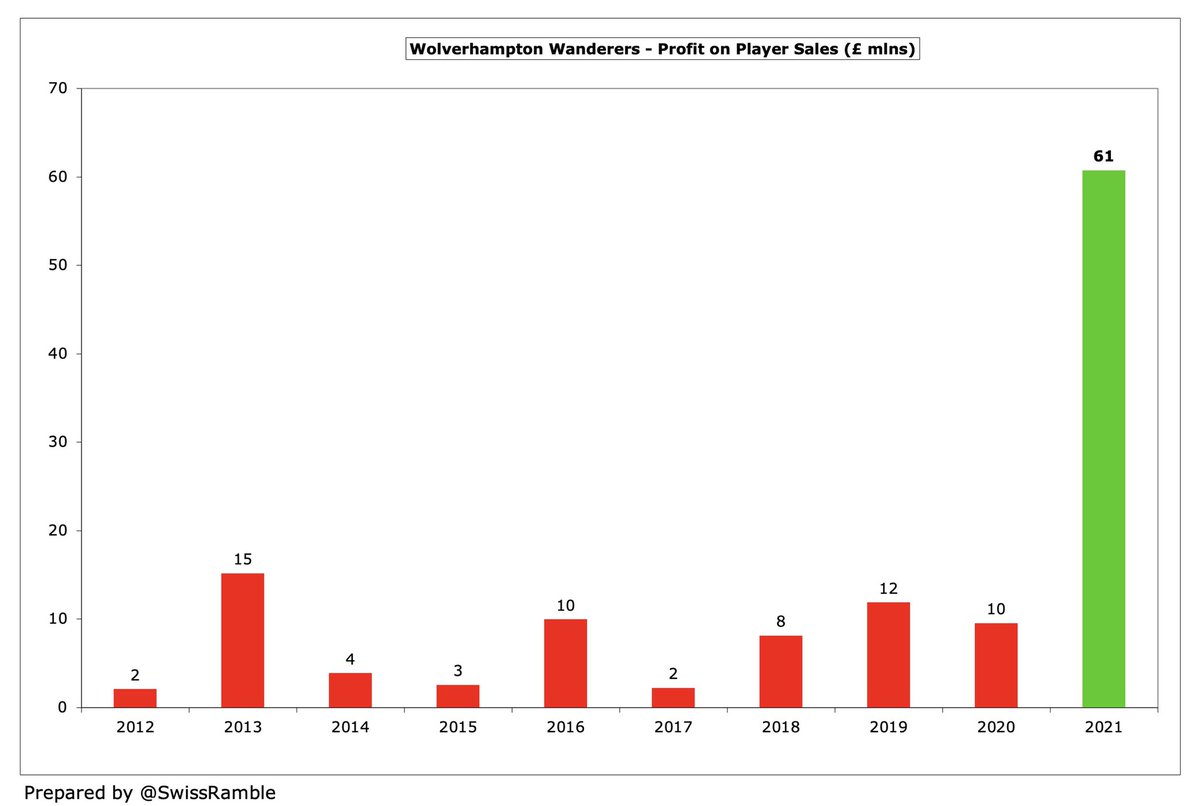

#WWFC profit on player sales shot up £51m from £10m to £61m, including Diogo Jota to #LFC, Matt Doherty to #THFC, Helder Costa to #LUFC plus contingent fees due for Cavaleiro and Goncalves. Only surpassed by #MCFC £69m in 2020/21 Premier League.

Up until the 2021 profit (highest ever in the Premier League), Fosun’s strategy of investment into the squad had led to £100m net losses between 2017 and 2020. In the case of #WWFC, this gamble paid-off, first with promotion from the Championship, then European qualification.

#WWFC results have often been impacted by exceptional items, especially the £127m loan write-off in 2021. In contrast, the hefty 2018 loss included (reported) £20m of promotion payments, while a £15m restructuring provision was booked in 2013 following two successive relegations

#WWFC rarely made big money from player sales before £61m profit in 2021, which was almost as much as £65m gain from previous 9 years combined. However, this season only includes £14m (Rafa Mir to Sevilla, Rui Patricio to Roma). Barcelona have option to buy Adama Traore for £29m.

#WWFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £10m to £38m, which is the sixth best in the Premier League, around the same level as #AFC £43m, though a fair way below #MCFC £116m.

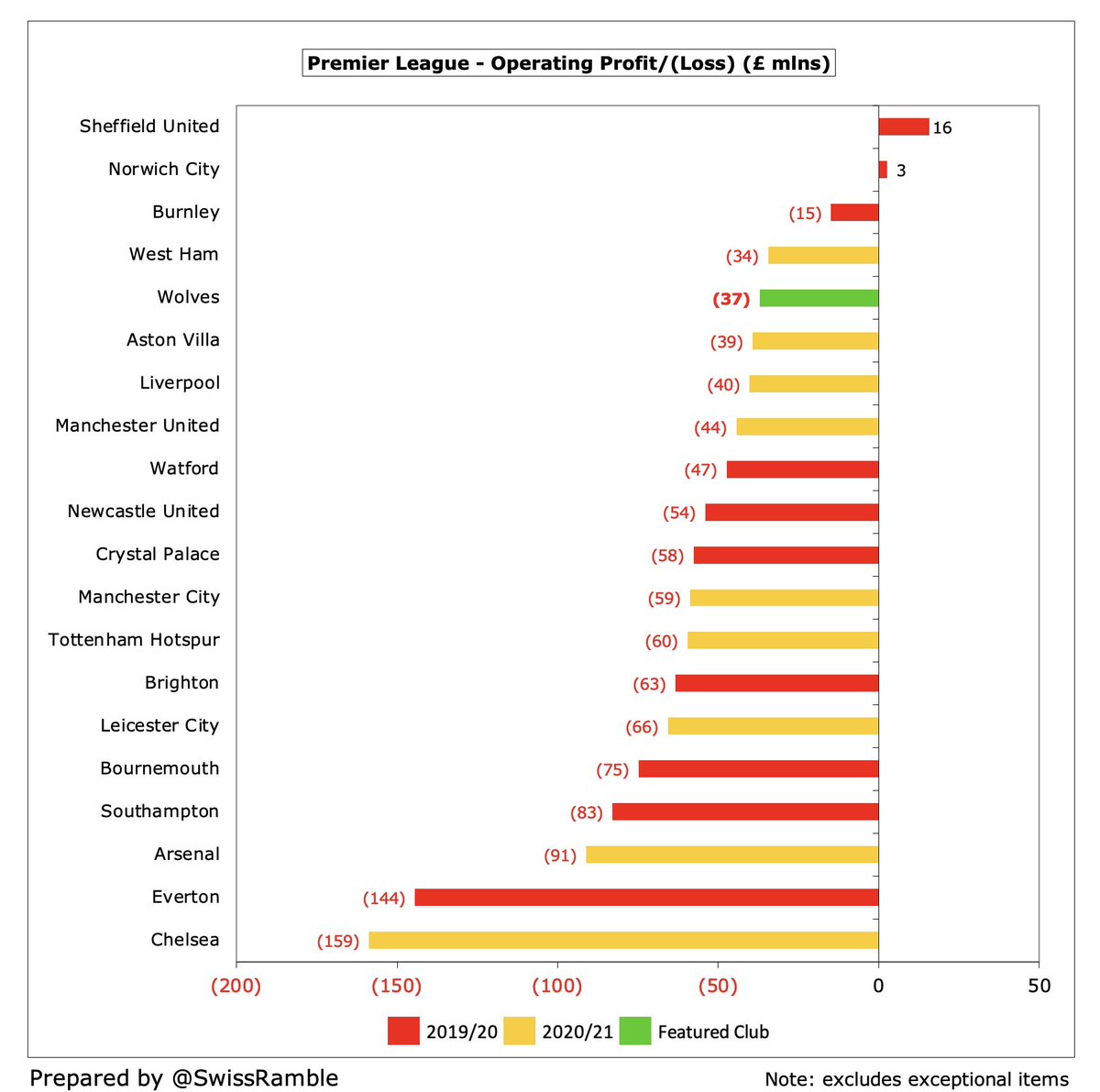

#WWFC operating loss (excluding player sales and interest) narrowed from £45m to £37m, the second best result reported to date in the 2020/21 Premier League. Very few clubs deliver operating profits, while some have huge losses, e.g. #CFC £159m, #AFC £91m & #LCFC £66m last year.

Despite the adverse impact of the pandemic, which has decimated gate receipts, #WWFC revenue has still increased by £22m (13%) from £172m to £194m since 2019, very largely due to higher broadcasting income, thanks to revenue deferred from 2019/20 season.

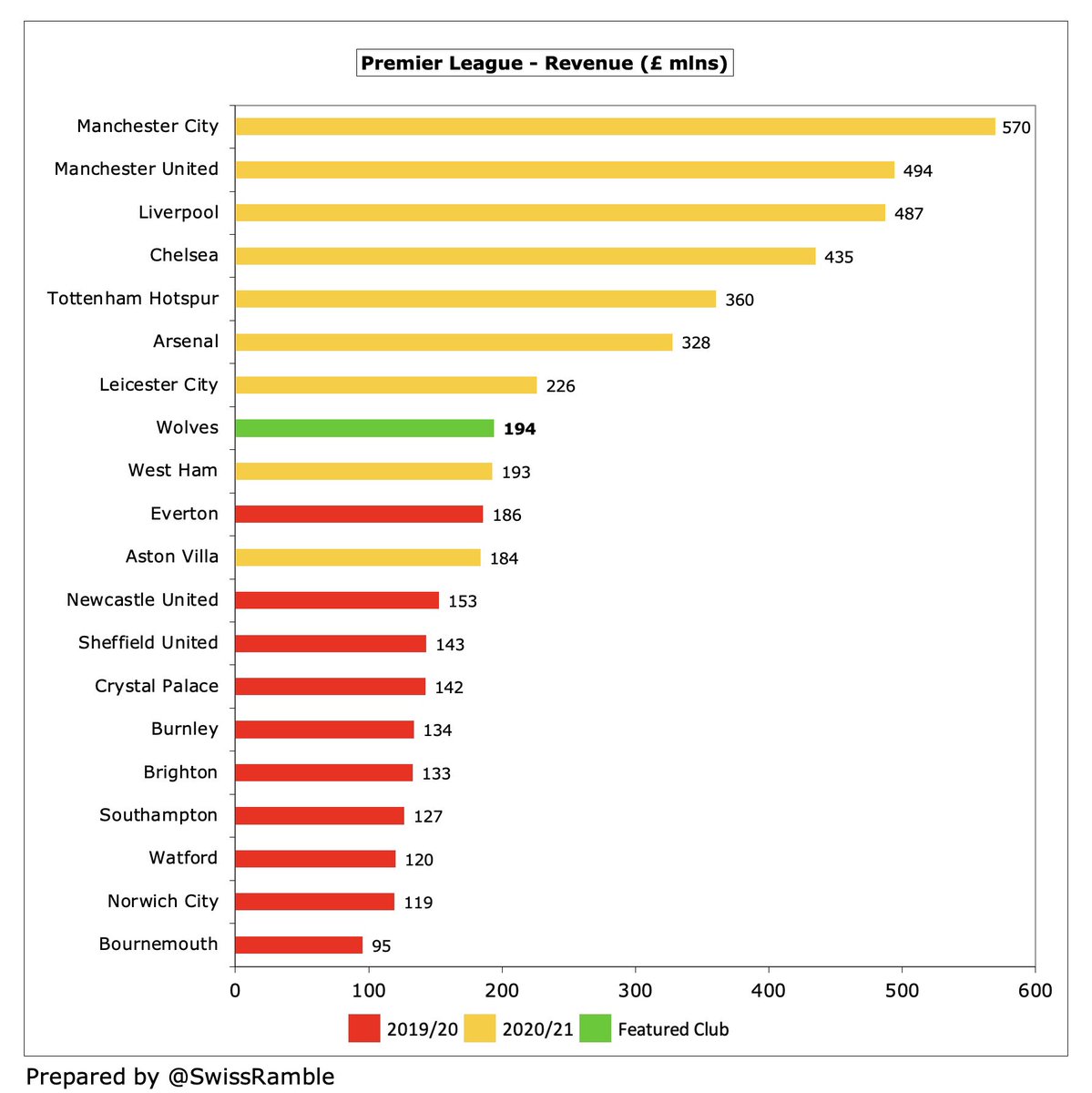

Following the increase, #WWFC £194m revenue is now 8th highest in the Premier League, only behind the Big Six and #LCFC, though #EFC and #NUFC have yet to publish 2020/21 accounts. However, for some perspective, only around a third of #MCFC £570m.

As a sign of how far #WWFC have come since playing in League One in 2014, their £133m revenue in 2019/20 placed them 29th in the Deloitte Money League, which ranks clubs worldwide. This was down from previous season’s 25th, but ahead of Milan £130m and just behind Ajax £136m.

#WWFC broadcasting income rose £73m (77%) from £96m to £169m, mainly due to revenue from games deferred from 2019/20, partly offset by Europa League money in prior year and lower merit payment (13th place vs 7th). Easily a club record for this revenue stream.

As 2019/20 season was extended, £48m revenue (PL £43m & EL £5m) was booked in 2020/21, driving £96m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs like #WWFC with May year-end had largest revenue deferrals, while nothing for those with a July close.

In 2019/20 #WWFC earned £20m (€22m) from Europe after reaching the Europa League quarter-final, where they were eliminated by eventual winners Sevilla. This is very good, but much lower than Champions League representatives (£60-80m). Some money deferred to 2020/21.

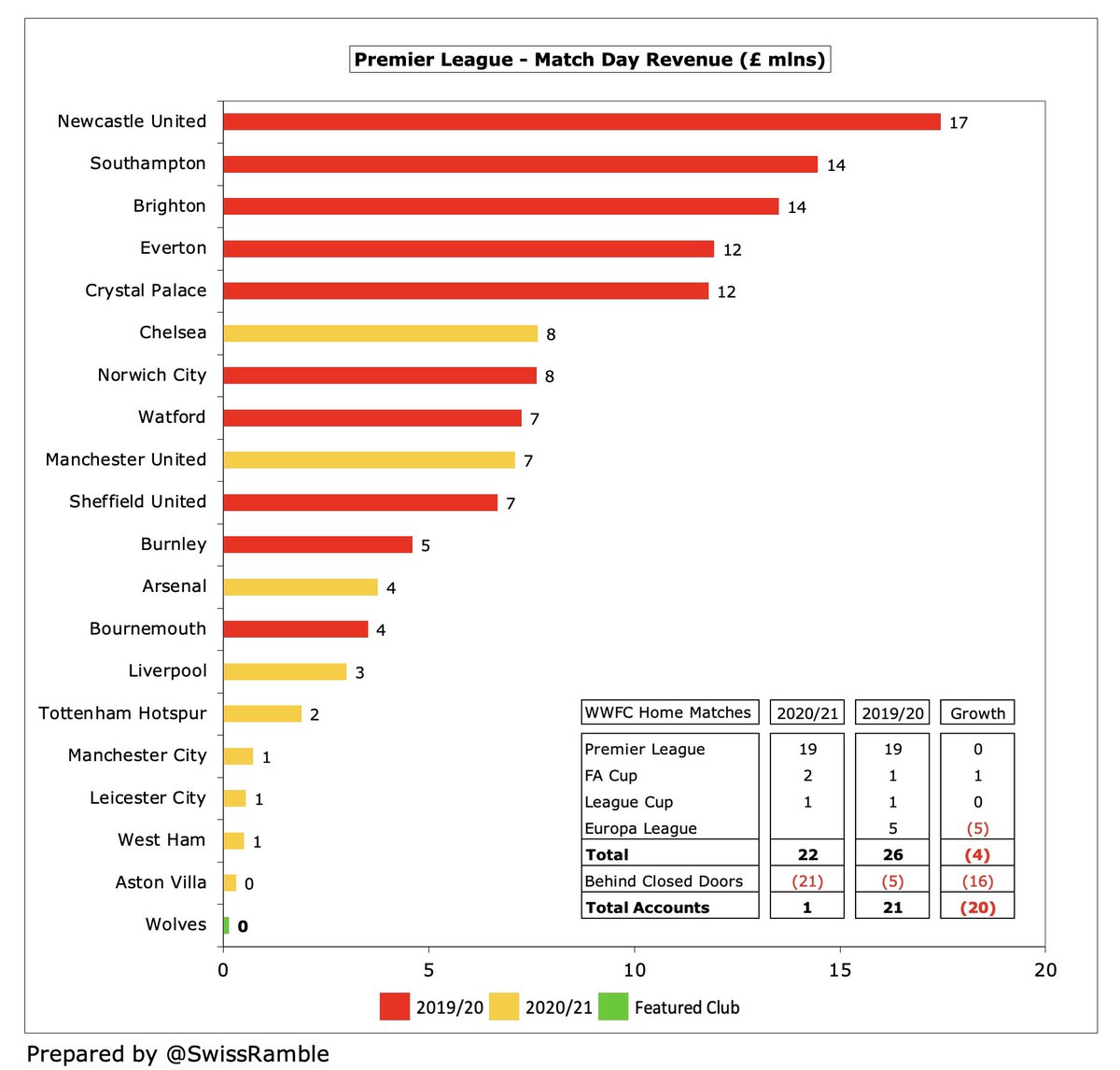

#WWFC gate receipts fell £13m (99%) to just £144k, as all home games were played behind closed doors (except one with 4,500 restricted capacity). In a normal season, income would be in bottom half of the PL, far below #THFC estimated £122m post-COVID, due to their new stadium.

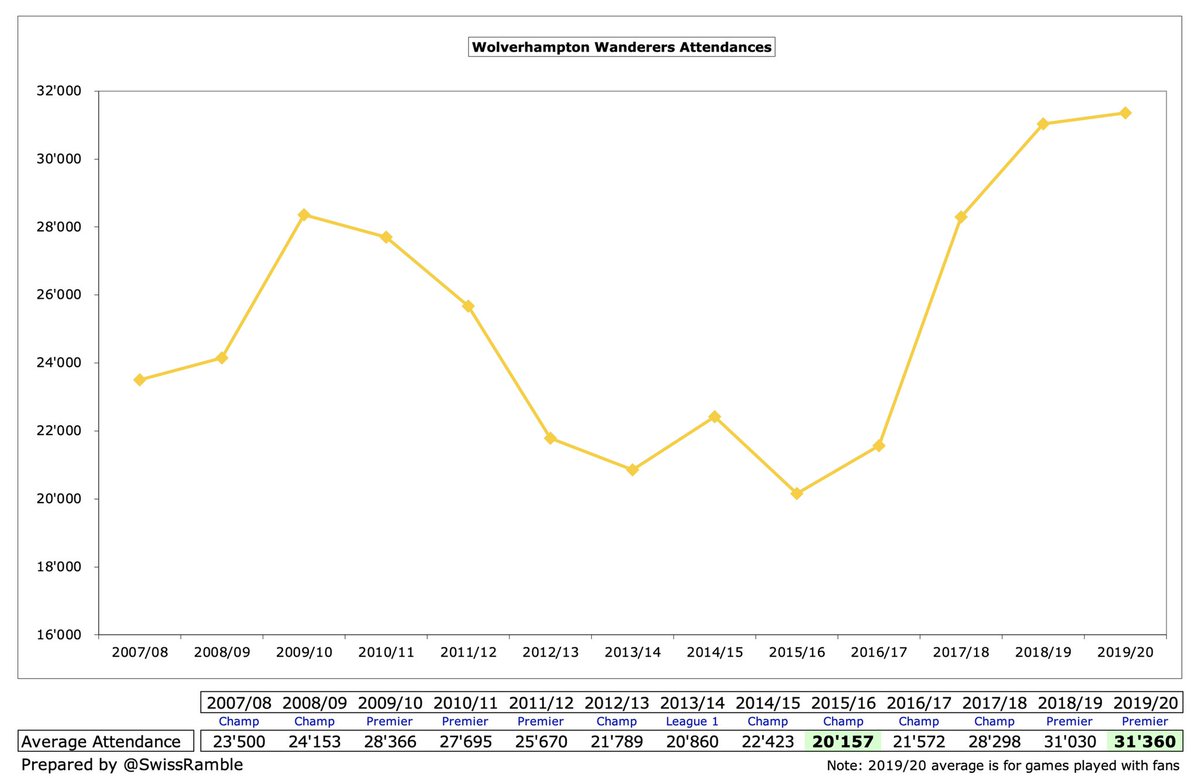

#WWFC 2019/20 average attendance of 31,360 (for games played with fans), up from a low of around 20,000 in the Championship, was the 12th highest in the Premier League, just below #LCFC 32,061.

#WWFC commercial income rose £0.5m (2%) from £24.1m to £24.6m, as higher sponsorship (including £1m from Fosun) offset fall due to reduced commercial operations. Up from £11m in Championship, but still only 13th best in Premier League, far below the Big Six, e.g. #AFC £136m.

#WWFC shirt sponsor is ManBetX in a deal reportedly worth £8m a year. In 2021/22 Castore replaced Adidas as kit supplier with “the largest technical partner sponsorship” in the club’s history, while Bitsi succeeded Aeroset as sleeve sponsor.

#WWFC wage bill rose £44m (47%) from £95m to £139m, which was attributed to the cost of competing in the Premier League. This means that wages have grown £88m in 3 years since promotion, while revenue is up £168m in the same period (including £50m deferred from 2019/20).

Following the growth, #WWFC £139m wage bill is now 9th highest in the Premier League, ahead of both #AVFC £138m and #WHUFC £129m. That said, it’s over £200m less than #MCFC £355m and around £100m below #AFC £238m.

#WWFC wages to turnover ratio slightly increased from 71% to 72%, though this is much better than the 192% last reported in the Championship (including promotion bonus). That’s not bad, but the ratio would have been much higher at 86% if COVID impact were excluded.

The remuneration of the #WWFC highest paid director decreased by 23% from £520k to £400k, which is on the low side in the Premier League, far below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

#WWFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £10m (20%) from £52m to £62m, up from only £13m before promotion. Mid-table in PL, just ahead of #WHUFC £58m and #AVFC £56m. Also booked £9m player impairment.

#WWFC spent £84m on player purchases, mainly Fabio Silva, Nelson Semedo and Ki-Jana Hoever. Wolves have averaged £104m gross transfer spend in the 3 years since promotion (£68m net spend), though much lower expenditure in 2021/22.

#WWFC gross debt reduced by £91m from £152m to £61m, as the £127m loan from Fosun was written-off. However, the Macquarie bank loan increased from £25m to £60m, repayable over 3 years at 7.185%. Up from just £4m only five years ago.

Following the waiver, #WWFC debt of £61m is one of the lowest in the Premier League, far below #THFC £854m (stadium), #MUFC £530m (Glazer’s leveraged buy-out), #EFC £409m and #BHAFC £306m (latter two’s debt is very largely in the form of “friendly” owner loans).

#WWFC interest payments rose from £4.8m to £5.4m, all on the bank debt, as Fosun’s loan was interest-free. That’s on the high side for the Premier League, but much less than AFC £34m (mainly a debt refinancing break fee), #MUFC £21m and #THFC £18m.

#WWFC transfer debt increased from £101m to £111m (only £5m in 2016), so the player purchases have been partly on credit. This is no different from other clubs, though Wolves have one of the highest payables in the PL. Net balance £47m after considering £64m receivables.

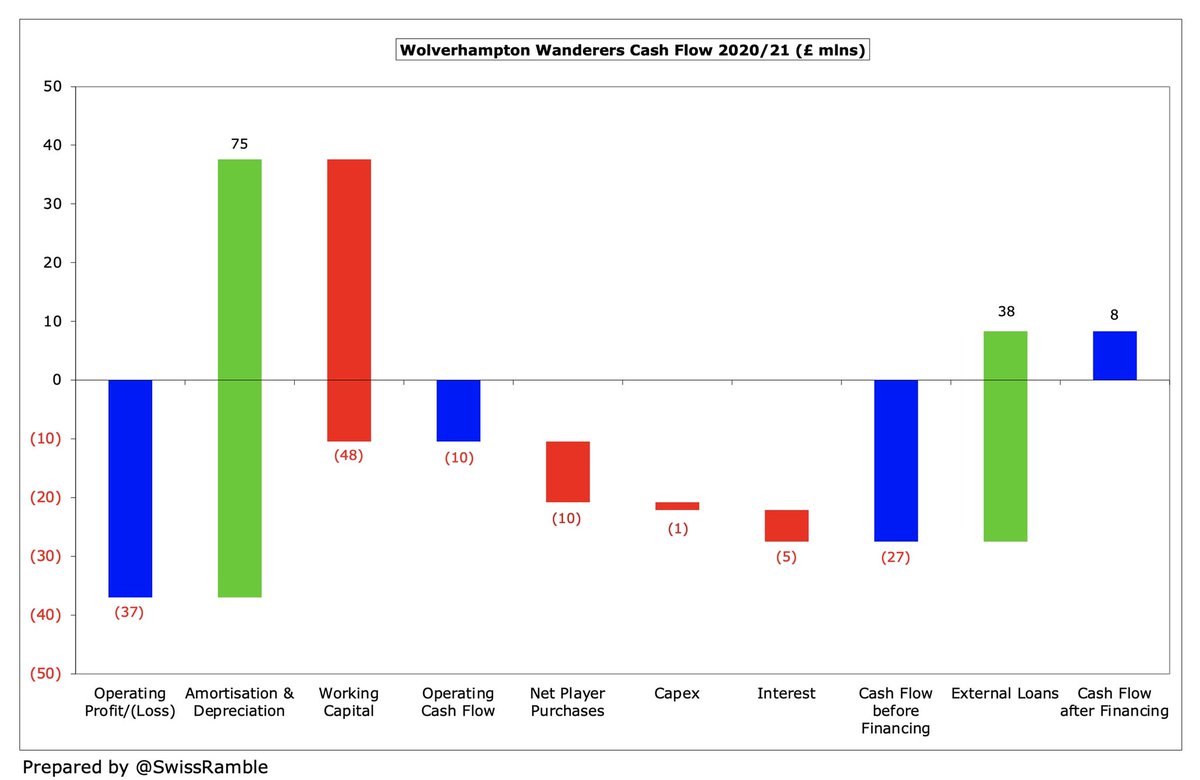

#WWFC £37m operating loss became £10m negative cash flow (after adding back £75m amortisation & depreciation, offset by £48m working capital movements), then spent net £10m on players (purchases £84m, sales £74m), £5m interest and £1m capex. Funded by £38m additional bank loans.

As a result, #WWFC cash balance increased £8m to £36m, which is mid-table in the Premier League. However, for some context this is a lot less than #THFC and #MUFC, who have £148m and £111m respectively,

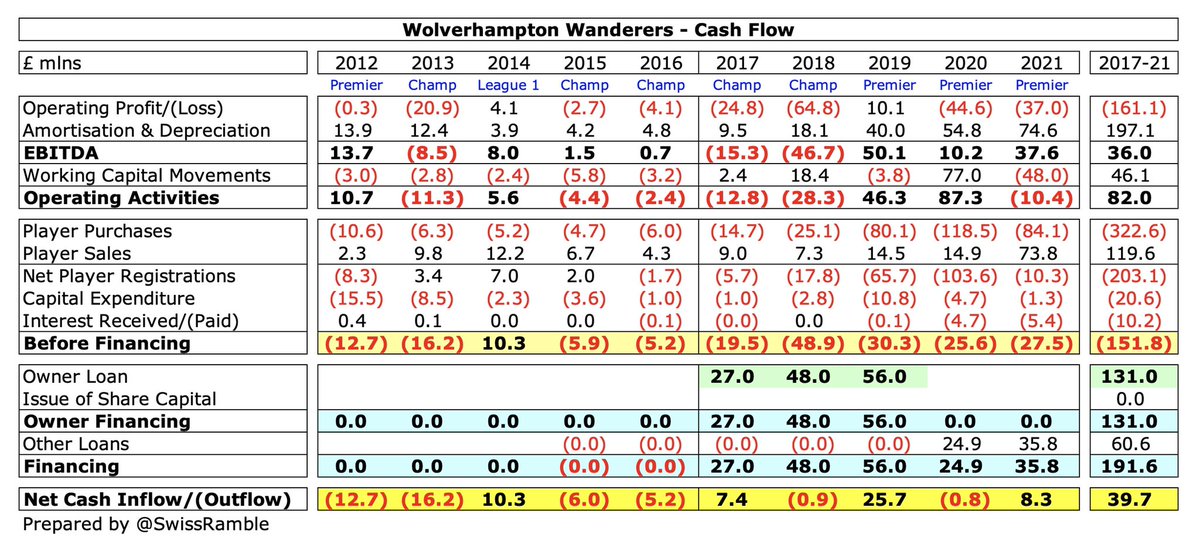

In the 5 years since Fosun bought the club, #WWFC made £82m from operations, but have largely benefited from higher loans (£131m from the owners and £61m from the bank). Most of this (£203m) has been spent on players (net) with £21m going on infrastructure plus £10m interest.

Fosun have not put any money in to #WWFC in the last 2 years (though they did waive debt repayment), but their £131m funding is still one of the highest in the Premier League in the 5 years up to 2020, only surpassed by #EFC, #AVFC, #CFC and #BHAFC.

After failing to meet UEFA’s FFP targets, #WWFC were given some sanctions as part of a settlement agreement for 2020/21 and 2021/22, including a small €600k fine and break-even targets: €30m for 2019/20; aggregate within acceptable deviation for 3 years up to 2021.

However, my calculations suggest that #WWFC should now be fine with Profitability & Sustainability rules, thanks to allowable deductions (notably the academy and promotion bonus), COVID impact and averaging 2019/20 and 2020/21 seasons. The loan write-off does not count for FFP.

#WWFC have come a long way under Fosun’s ownership, but the huge 2020/21 profit was largely due to the loan write-off. It also owed a lot to high player sales and revenue deferred from 2019/20, so this season is likely to see a return to the club posting a loss.

• • •

Missing some Tweet in this thread? You can try to

force a refresh