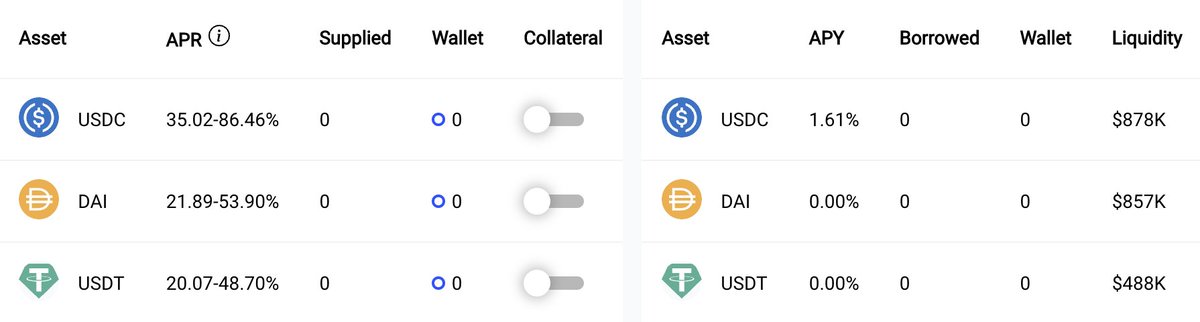

@HundredFinance on @optimismPBC paying 35%+ on $USDC 👀

Here's a couple of ways to take advantage of it 👇

Here's a couple of ways to take advantage of it 👇

Idea 1:

1. Bridge $USDC to @optimismPBC using @SynapseProtocol

2. Supply $USDC to @HundredFinance

3. Stake the hUSDC tokens that you received for 35% APR

Pretty straightforward.

Note that you get paid in $HND tokens.

1. Bridge $USDC to @optimismPBC using @SynapseProtocol

2. Supply $USDC to @HundredFinance

3. Stake the hUSDC tokens that you received for 35% APR

Pretty straightforward.

Note that you get paid in $HND tokens.

Idea 2: Have some spare $ETH or $BTC lying around?

1. Supply $ETH or $BTC as collateral

2. Borrow $USDC @ 1.61%

3. Supply & Stake $USDC @ 35% APY

If you borrow 50% of your collateral value, you are earning ~17% APY on $BTC or $ETH.

1. Supply $ETH or $BTC as collateral

2. Borrow $USDC @ 1.61%

3. Supply & Stake $USDC @ 35% APY

If you borrow 50% of your collateral value, you are earning ~17% APY on $BTC or $ETH.

Tip 1: Borrow $DAI or $USDT @ 0% instead of $USDC

Tip 2: If you own $HND, you can get boosted APR of up to 87% on $USDC

Tip 2: If you own $HND, you can get boosted APR of up to 87% on $USDC

As a sidenote, I'm very impressed with the experience on @optimismPBC.

Super fast transactions and the fees are pretty low.

$ETH is used for tx fees so no need to find faucets or ask around for gas money.

Super fast transactions and the fees are pretty low.

$ETH is used for tx fees so no need to find faucets or ask around for gas money.

• • •

Missing some Tweet in this thread? You can try to

force a refresh