2/

It's easy to pick winners in a bull market.

Really difficult to find winning altcoins in a bear market.

Your best bet is often to stick to $BTC, $ETH and some solid large cap coins.

But if you want to pick altcoins, make sure to understand the tokenomics.

It's easy to pick winners in a bull market.

Really difficult to find winning altcoins in a bear market.

Your best bet is often to stick to $BTC, $ETH and some solid large cap coins.

But if you want to pick altcoins, make sure to understand the tokenomics.

3/

Good tokenomics can make a shit project do well (for a while) 💩

Bad tokenomics can kill the best of projects. ☠️

When evaluating tokenomics, here's what I like to look at 👇

Good tokenomics can make a shit project do well (for a while) 💩

Bad tokenomics can kill the best of projects. ☠️

When evaluating tokenomics, here's what I like to look at 👇

4/

1. Utility

2. Supply (Distribution, unlock schedule, etc)

3. Demand Drivers (growth drivers, holder incentives, adoption)

4. Other token dynamics (staking, burns, lockups, taxes)

Let's try to understand using some examples.

1. Utility

2. Supply (Distribution, unlock schedule, etc)

3. Demand Drivers (growth drivers, holder incentives, adoption)

4. Other token dynamics (staking, burns, lockups, taxes)

Let's try to understand using some examples.

5/

1. Utility of the token:

• What is the token used for (other than speculation)?

• Will the utility grow with time / adoption?

• Is it a compelling enough use case to buy / hold the token?

1. Utility of the token:

• What is the token used for (other than speculation)?

• Will the utility grow with time / adoption?

• Is it a compelling enough use case to buy / hold the token?

6/

Examples of Utility:

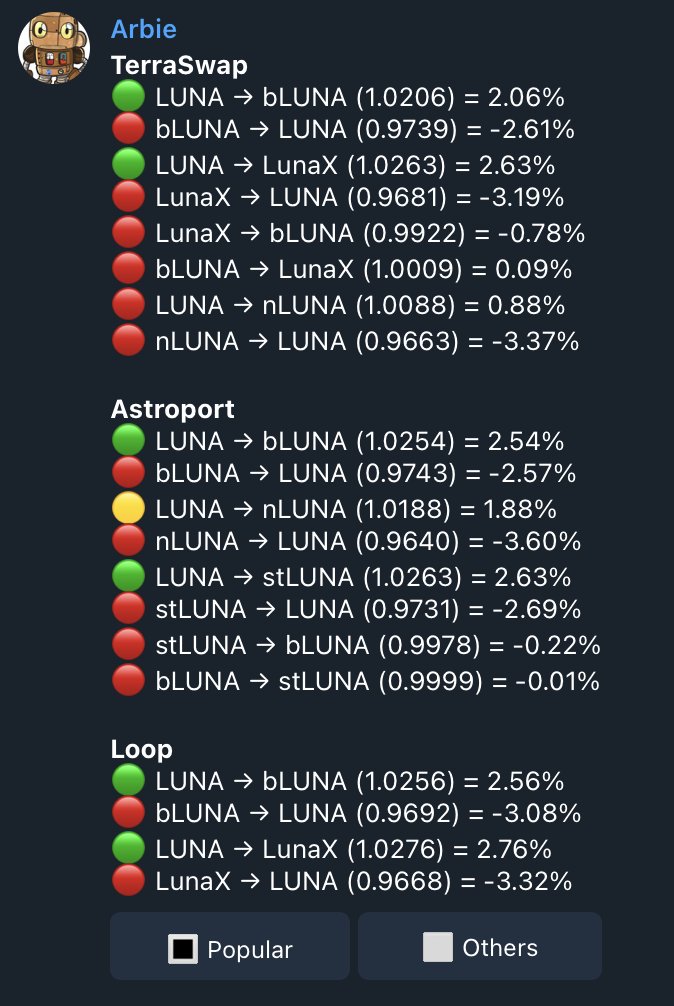

• $CRV is used for governance to direct emissions

• $LUNA is used to mint $UST

• $PTP is used for APR boosts

Example: Analysis of @CurveFinance's tokenomics below 👇

Examples of Utility:

• $CRV is used for governance to direct emissions

• $LUNA is used to mint $UST

• $PTP is used for APR boosts

Example: Analysis of @CurveFinance's tokenomics below 👇

https://twitter.com/shivsakhuja/status/1494159690946646022?s=21

7/

2. Supply

• How many tokens exist?

• How many in circulation?

• How are the tokens distributed?

• What is the unlock schedule of remaining supply?

• How much inflation / deflation annually?

+++

2. Supply

• How many tokens exist?

• How many in circulation?

• How are the tokens distributed?

• What is the unlock schedule of remaining supply?

• How much inflation / deflation annually?

+++

8/

Supply is a very important piece of the tokenomics puzzle.

A high allocation of tokens to internal team make the token vulnerable to a few actors.

An accelerated unlock schedule increases risk of whale dumps.

(Example: VCs may dump tokens as they unlock)

Supply is a very important piece of the tokenomics puzzle.

A high allocation of tokens to internal team make the token vulnerable to a few actors.

An accelerated unlock schedule increases risk of whale dumps.

(Example: VCs may dump tokens as they unlock)

9/

Some tokens like $ETH have both an inflation component (issuance) and a deflation component (burning) that determines total increase in supply of $ETH per day.

watchtheburn.com

Some tokens like $ETH have both an inflation component (issuance) and a deflation component (burning) that determines total increase in supply of $ETH per day.

watchtheburn.com

10/

Example: currently, ~13,000 new $ETH are minted & ~3,000 $ETH are burned per day.

i.e - Net $ETH issuance is ~10,000 per day.

Example: currently, ~13,000 new $ETH are minted & ~3,000 $ETH are burned per day.

i.e - Net $ETH issuance is ~10,000 per day.

11/

Deflationary tokens or tokens that have a burn mechanism that grows with usage (like $LUNA, $ETH) are a big plus.

As an example, $LUNA total supply has gone from 996M to 763M in the last 6 months.

Deflationary tokens or tokens that have a burn mechanism that grows with usage (like $LUNA, $ETH) are a big plus.

As an example, $LUNA total supply has gone from 996M to 763M in the last 6 months.

12/

Watch out for Inflationary tokens - they can find it hard to sustain pumps.

Farming tokens are a great example. Their charts are not pretty.

Watch out for Inflationary tokens - they can find it hard to sustain pumps.

Farming tokens are a great example. Their charts are not pretty.

https://twitter.com/shivsakhuja/status/1503662923876483074?s=20

13/

3. Demand Drivers

• What will cause an increase in token demand (other than speculation)?

• Do people have an incentive to buy / hold / stake / lock the token?

• Does the platform have a competitive edge to allow it to grow adoption fast?

3. Demand Drivers

• What will cause an increase in token demand (other than speculation)?

• Do people have an incentive to buy / hold / stake / lock the token?

• Does the platform have a competitive edge to allow it to grow adoption fast?

14/

Demand Driver Examples:

• A hyped project launch can be a (temporary) demand driver for launchpad tokens, which may reward users who held for longer.

• $CRV holders are battling for governance of an imp. piece of DeFi Infrastructure

• $HND is locked to boost reward APR

Demand Driver Examples:

• A hyped project launch can be a (temporary) demand driver for launchpad tokens, which may reward users who held for longer.

• $CRV holders are battling for governance of an imp. piece of DeFi Infrastructure

• $HND is locked to boost reward APR

15/

While I prefer fundamentals-based demand drivers, demand drivers based on marketing / hype / narratives can't be ignored either.

• $NEAR / $FTM / $AVAX saw a boost in ecosystem projects, TVL and price from incentive funds luring devs to their ecosystems.

• $DOGE / $SHIB

While I prefer fundamentals-based demand drivers, demand drivers based on marketing / hype / narratives can't be ignored either.

• $NEAR / $FTM / $AVAX saw a boost in ecosystem projects, TVL and price from incentive funds luring devs to their ecosystems.

• $DOGE / $SHIB

16/

Governance can sometimes be a demand driver but usually not.

Does the community have any real incentive to vote?

In the case of $CRV, the incentive is that voters receive bribes.

But in most cases, governance incentives are not much of a demand driver.

Governance can sometimes be a demand driver but usually not.

Does the community have any real incentive to vote?

In the case of $CRV, the incentive is that voters receive bribes.

But in most cases, governance incentives are not much of a demand driver.

17/

4. Token Dynamics (lockups, staking, taxes, burning, etc)

Examples:

• $SOLID and $CRV are locked for voting power / bribes.

• FaaS coins charge a tax on buys and / or sells that funds the treasury

• $LUNA is burned to mint $UST

4. Token Dynamics (lockups, staking, taxes, burning, etc)

Examples:

• $SOLID and $CRV are locked for voting power / bribes.

• FaaS coins charge a tax on buys and / or sells that funds the treasury

• $LUNA is burned to mint $UST

18/

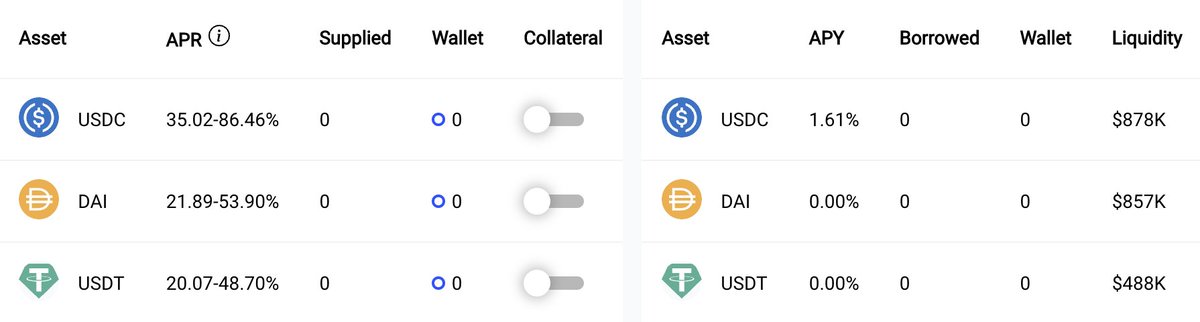

@Platypusdefi is an interesting case study in tokenomics. Let's take a look:

• Staked $PTP earns $vePTP every hour.

• $vePTP is used to boost reward APR.

• Unstaking ANY amount of $PTP means forfeiting accumulated $vePTP

@Platypusdefi is an interesting case study in tokenomics. Let's take a look:

• Staked $PTP earns $vePTP every hour.

• $vePTP is used to boost reward APR.

• Unstaking ANY amount of $PTP means forfeiting accumulated $vePTP

19/

This means there is a strong incentive for $PTP holders to keep all $PTP staked.

So if the boosting incentive of $vePTP is high, then it would be a good incentive to reduce sell pressure for $PTP.

This means there is a strong incentive for $PTP holders to keep all $PTP staked.

So if the boosting incentive of $vePTP is high, then it would be a good incentive to reduce sell pressure for $PTP.

20/

#crypto is an economic experiment happening in real time.

Ultimately, a big factor in the success (or failure) of a project comes down to the tokenomics, and the game theory.

#crypto is an economic experiment happening in real time.

Ultimately, a big factor in the success (or failure) of a project comes down to the tokenomics, and the game theory.

21/

But it's important to remember that it takes more than tokenomics to make a project successful and for price to go up.

Example: $SOLID had pretty good tokenomics, but when the devs quit abruptly with a poorly communicated departure, it destroyed trust (and then price).

But it's important to remember that it takes more than tokenomics to make a project successful and for price to go up.

Example: $SOLID had pretty good tokenomics, but when the devs quit abruptly with a poorly communicated departure, it destroyed trust (and then price).

22/

Another example: the game theory behind the $OHM (3,3) model was supposed to mean that a rational actor would stake their $OHM and not sell.

But there's a lot more to the price of a coin than the planned or expected game theory.

Another example: the game theory behind the $OHM (3,3) model was supposed to mean that a rational actor would stake their $OHM and not sell.

But there's a lot more to the price of a coin than the planned or expected game theory.

https://twitter.com/shivsakhuja/status/1466714481237524483?s=20

23/

Bear markets have different game theory.

Market participants are more irrational and need stronger, clearer incentives not to panic sell when there's blood in the streets.

If the model relies on participants understanding the game theory, it doesn't work nearly as well.

Bear markets have different game theory.

Market participants are more irrational and need stronger, clearer incentives not to panic sell when there's blood in the streets.

If the model relies on participants understanding the game theory, it doesn't work nearly as well.

24/

The behavior of market participants can't be accurately predicted.

But learning about tokenomics can help you stay away from bad projects.

And occasionally, catch the good ones early.

The behavior of market participants can't be accurately predicted.

But learning about tokenomics can help you stay away from bad projects.

And occasionally, catch the good ones early.

25/

If you're in the market for more DeFi content, here are my past threads

If you're in the market for more DeFi content, here are my past threads

https://twitter.com/shivsakhuja/status/1470898910218440708?s=20

26/

If you found this thread valuable, please consider liking ❤️ / retweeting ♻️ the first post - it really helps..

If you found this thread valuable, please consider liking ❤️ / retweeting ♻️ the first post - it really helps..

https://twitter.com/shivsakhuja/status/1505288833700487168?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh