Here's a 🧵 about why real estate will eventually get tokenized and what that model could look like 👇

A thought experiment...

A thought experiment...

2/

First, let's address what we mean by tokenized -- tokens will be created to represent ownership of real estate.

Since every piece of real estate is unique, NFTs would be a great way to represent them.

These can also be fractionalized to allow for multiple owners.

First, let's address what we mean by tokenized -- tokens will be created to represent ownership of real estate.

Since every piece of real estate is unique, NFTs would be a great way to represent them.

These can also be fractionalized to allow for multiple owners.

3/

If you have a token that represents a property, you have digital proof of ownership in your wallet.

That can be plugged into other smart contracts. What can you do with that?

If you have a token that represents a property, you have digital proof of ownership in your wallet.

That can be plugged into other smart contracts. What can you do with that?

4/

Mortgage / Refinance:

• It can take months to secure a typical mortgage.

• It requires all kinds of documentation.

• It requires a good credit score. Credit scores are an incredibly biased and unfair system.

Mortgage / Refinance:

• It can take months to secure a typical mortgage.

• It requires all kinds of documentation.

• It requires a good credit score. Credit scores are an incredibly biased and unfair system.

5/

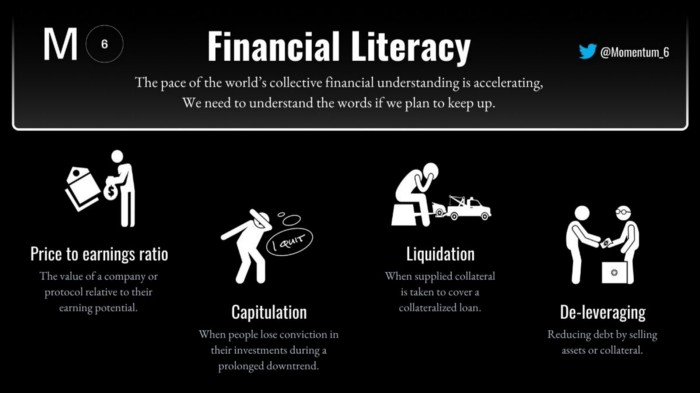

In #DeFi, you can get a loan in seconds, as long as you have collateral to back it.

When you get a mortgage, your house is the collateral.

So if you have a token representing a property, you should be able to use that as collateral to get a loan in seconds in #DeFi.

In #DeFi, you can get a loan in seconds, as long as you have collateral to back it.

When you get a mortgage, your house is the collateral.

So if you have a token representing a property, you should be able to use that as collateral to get a loan in seconds in #DeFi.

6/

Okay so you'll be able to get a mortgage / refinance in seconds, not months.

What else can we do with tokenized real estate? 👇

Okay so you'll be able to get a mortgage / refinance in seconds, not months.

What else can we do with tokenized real estate? 👇

7/

2. Real Estate Investments

In #TradFi, you have 2 options:

• Buy a property: Requires lots of capital required, physical access, management, offers no diversification.

• Real Estate Investment Trusts or REITs: limited options, requires trust in managers, no granularity.

2. Real Estate Investments

In #TradFi, you have 2 options:

• Buy a property: Requires lots of capital required, physical access, management, offers no diversification.

• Real Estate Investment Trusts or REITs: limited options, requires trust in managers, no granularity.

8/

With tokenized real estate in #DeFi, you'd be able to:

• Invest from anywhere in the world

• Invest with a small amount of capital

• Invest in a specific property, or

• (potentially) Invest in index tokens that represent a neighborhood, city, state, or country.

+++

With tokenized real estate in #DeFi, you'd be able to:

• Invest from anywhere in the world

• Invest with a small amount of capital

• Invest in a specific property, or

• (potentially) Invest in index tokens that represent a neighborhood, city, state, or country.

+++

9/

Here's an example: You have a $1M property, but you need $100k ASAP.

With #DeFi, you could do one of the following things: 👇

Here's an example: You have a $1M property, but you need $100k ASAP.

With #DeFi, you could do one of the following things: 👇

10/

1. Get a $100k line of credit against your property tokens in seconds.

2. Sell $100k worth of your property tokens. Liquidity will come from an open market with individuals, institutional investors, endowment funds, index token funds, etc

1. Get a $100k line of credit against your property tokens in seconds.

2. Sell $100k worth of your property tokens. Liquidity will come from an open market with individuals, institutional investors, endowment funds, index token funds, etc

11/

So if there are 1000 owners of a given property, who owns and lives in the house?

Here's one idea we have to solve this:

So if there are 1000 owners of a given property, who owns and lives in the house?

Here's one idea we have to solve this:

12/

Property token could be split into 2 tokens: one representing ownership, and one representing occupancy rights.

• Owners get the benefits of cash flow from rent and price appreciation.

• Occupancy token holder lives in the property and pays rent to a smart contract.

Property token could be split into 2 tokens: one representing ownership, and one representing occupancy rights.

• Owners get the benefits of cash flow from rent and price appreciation.

• Occupancy token holder lives in the property and pays rent to a smart contract.

13/

• If the Occupancy token holder defaults, the Occupancy token is seized, and the occupant can be evicted via court order.

• Taxes and maintenance are paid by owners (expenses can be automatically deducted from the Ownership token value)

• If the Occupancy token holder defaults, the Occupancy token is seized, and the occupant can be evicted via court order.

• Taxes and maintenance are paid by owners (expenses can be automatically deducted from the Ownership token value)

14/

This is just a thought experiment - we strongly believe that real-world assets will be tokenized through models like this.

There is so much more to muse about with this kind of model.

If anyone is working on this, we'd love to hear about it.

Only a matter of time.

This is just a thought experiment - we strongly believe that real-world assets will be tokenized through models like this.

There is so much more to muse about with this kind of model.

If anyone is working on this, we'd love to hear about it.

Only a matter of time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh