An educational #Thread on what type of trades 1 can take & what r the rules for it.

Majorly there r 3 types of trades a trader takes :-

* Breakout Trade

* Breakout Retest Trade

* High risk reward contra trades

Disc. - All the #Stocks discussed are for educational purpose!

1/n

Majorly there r 3 types of trades a trader takes :-

* Breakout Trade

* Breakout Retest Trade

* High risk reward contra trades

Disc. - All the #Stocks discussed are for educational purpose!

1/n

#Breakout Trade!

A Breakout trade is usually a trade where the price breaks a strong resistance/supply level after consolidation. These r considered strong stocks.

To add conviction to our trade we check volumes, RSI, RS etc. for confirmation.

Let's understand with e.g :-

2/n

A Breakout trade is usually a trade where the price breaks a strong resistance/supply level after consolidation. These r considered strong stocks.

To add conviction to our trade we check volumes, RSI, RS etc. for confirmation.

Let's understand with e.g :-

2/n

#ADANIPOWER

It has broken strong resistance level of 135 with strong volumes on daily chart with RSI crossing 70, Prev. swing high which adds more conviction in the trade & makes it a high probability trade.

Suggestion - Add 50% qty on breakout & rest 50% wait for retest.

3/n

It has broken strong resistance level of 135 with strong volumes on daily chart with RSI crossing 70, Prev. swing high which adds more conviction in the trade & makes it a high probability trade.

Suggestion - Add 50% qty on breakout & rest 50% wait for retest.

3/n

Breakout Retest #Trade

A Breakout retest trade is usually a trade where the price breaks a strong resistance with volumes, strong RSI & then retest the same price level with low volumes & RSI not breaking 55 on D which signifies a true retest.

Let's understand with e.g:-

4/n

A Breakout retest trade is usually a trade where the price breaks a strong resistance with volumes, strong RSI & then retest the same price level with low volumes & RSI not breaking 55 on D which signifies a true retest.

Let's understand with e.g:-

4/n

#timken INDIA

It broke the strong resistance level of 2130 with strong volumes, RSI after long consolidation. After breakout it has retested it with low volumes & RSI abv 55.

Suggestion - Good risk reward here but 1 should keep S.L at breakout candle low i.e 2084 on clbs.

5/n

It broke the strong resistance level of 2130 with strong volumes, RSI after long consolidation. After breakout it has retested it with low volumes & RSI abv 55.

Suggestion - Good risk reward here but 1 should keep S.L at breakout candle low i.e 2084 on clbs.

5/n

High risk reward #Contra trades!

These are trades which may seem against the trend, traditional rules of trading but where r:r is good & der is a strong reversal 1 can take the risk.

Provided the reversal should have a strong bullish candle with volumes & r:r atleast 1:3.

6/n

These are trades which may seem against the trend, traditional rules of trading but where r:r is good & der is a strong reversal 1 can take the risk.

Provided the reversal should have a strong bullish candle with volumes & r:r atleast 1:3.

6/n

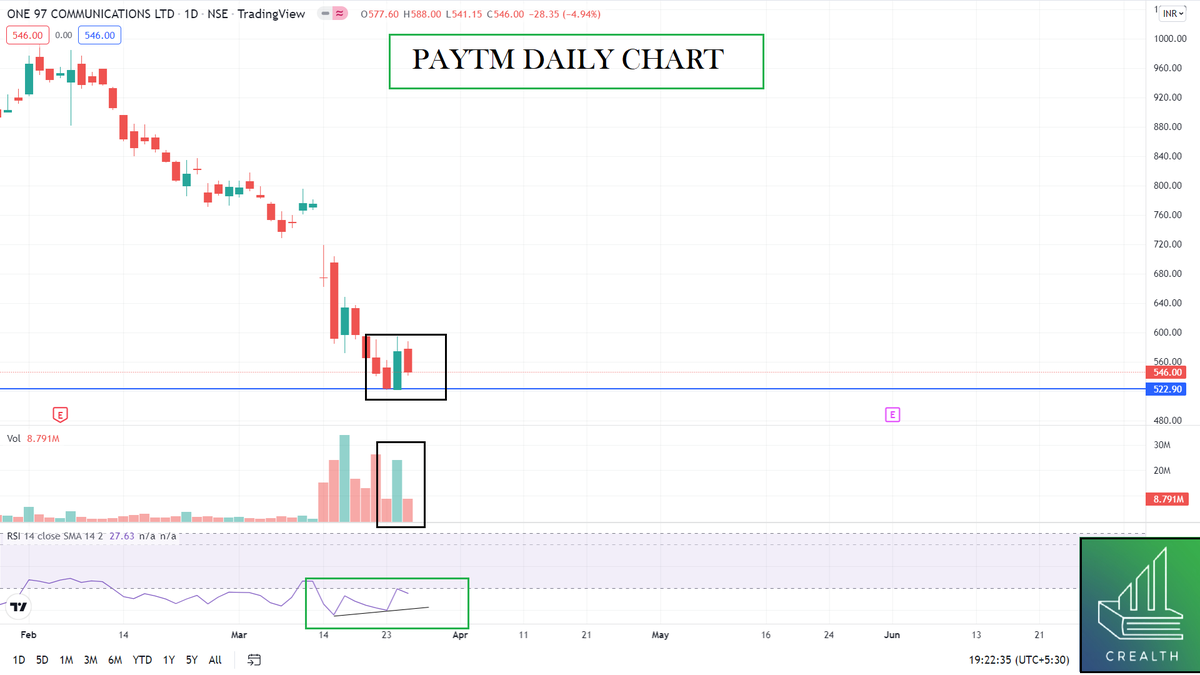

#Paytm

Most people will avoid a trade on this currently but why to miss a good r:r opportunity which has high reversal probability as bullish engulfing with strong volumes & a +ve RSI divergence after steep downtrend.

Also r:r is 1:5 is we take gap as trgt & 520 as S.L.

7/n

Most people will avoid a trade on this currently but why to miss a good r:r opportunity which has high reversal probability as bullish engulfing with strong volumes & a +ve RSI divergence after steep downtrend.

Also r:r is 1:5 is we take gap as trgt & 520 as S.L.

7/n

A lot of people are confused on when to take a #Trade hence explained with practical e.g's in which scenario's to take a trade with rules.

This is not a holy grail #strategy but 1 can use it to enter trades timely with conviction.

THE END.

Feedbacks, views are appreciated.

This is not a holy grail #strategy but 1 can use it to enter trades timely with conviction.

THE END.

Feedbacks, views are appreciated.

#Adanipower

Gave a good buying opportunity Intraday when it filled the Gapup & from der 🚀🚀

Hope you all learned as well as earned 🤠

Btw last 2 day big volumes so now ATH candidate 👍

Gave a good buying opportunity Intraday when it filled the Gapup & from der 🚀🚀

Hope you all learned as well as earned 🤠

Btw last 2 day big volumes so now ATH candidate 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh