🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review - 04/03/2022

1/13

Why is #Quad4 consensus for Q2?

Because everyone KNOWS that both growth and inflation are “un-comp-able” vs Q2 2021

And right on cue, #Quad4 deflationary signals appeared this week ⚠️

Global Macro Review - 04/03/2022

1/13

Why is #Quad4 consensus for Q2?

Because everyone KNOWS that both growth and inflation are “un-comp-able” vs Q2 2021

And right on cue, #Quad4 deflationary signals appeared this week ⚠️

2/13

Important note on trade (t) and Trend (T) this week

t = trade = 1-mo price change is comping against the March 7 commodity peak

T = Trend = 3-mo price change in comping against the #SPX ATH

Important note on trade (t) and Trend (T) this week

t = trade = 1-mo price change is comping against the March 7 commodity peak

T = Trend = 3-mo price change in comping against the #SPX ATH

3/13

The UST curve went from 🥞 to 🙃 as the 2Y ↗️ +18 BPS and the 10Y ↘️ -10 BPS to #inversion -7.2 BPS

Chart: 10/2s curve

The UST curve went from 🥞 to 🙃 as the 2Y ↗️ +18 BPS and the 10Y ↘️ -10 BPS to #inversion -7.2 BPS

Chart: 10/2s curve

4/13

With the #inversion, the long end of the bond market caught a bid ↗️

$BNDD +4.15% (w) +0.08% (T)

$TLT +3.05% (w) -10.65% (T)

$LQD +1.55% (w) -8.65% (T)

$HYG +0.75% (w) -5.8% (T)

Chart: 🏀 off support, $TLT - one week’s price action is not a 📈 🐻

With the #inversion, the long end of the bond market caught a bid ↗️

$BNDD +4.15% (w) +0.08% (T)

$TLT +3.05% (w) -10.65% (T)

$LQD +1.55% (w) -8.65% (T)

$HYG +0.75% (w) -5.8% (T)

Chart: 🏀 off support, $TLT - one week’s price action is not a 📈 🐻

5/13

To reinforce the point of #inflation assets ↘️, the $CRB -4.6% on the week, and for now 307.33 is the 🔝

To reinforce the point of #inflation assets ↘️, the $CRB -4.6% on the week, and for now 307.33 is the 🔝

6/13

Ex-Natty, hydrocarbons 🛢 & ⛽️ 📉 hard

$WTIC -12.85% (w) +32.0% (T)

$BRENT -1.075% (w) +34.65% (T)

$GASO -8.45% (w) +41.9% (T)

Chart: $WTIC has struggled over the past 4 weeks -14.2% with 130.50 🔝

Ex-Natty, hydrocarbons 🛢 & ⛽️ 📉 hard

$WTIC -12.85% (w) +32.0% (T)

$BRENT -1.075% (w) +34.65% (T)

$GASO -8.45% (w) +41.9% (T)

Chart: $WTIC has struggled over the past 4 weeks -14.2% with 130.50 🔝

7/13

Metals also struggled on the week as the 3/07/22 blow-off 🔝 remains a formidable barrier (machines are selling)

$COPPER -0.2% (w) +5.15% (T)

$GOLD -1.55% (w) +5.2% (T)

$PLAT -1.95% (w) +2.3% (T)

$SILVER -3.75% (w) +5.55% (T)

Chart: $COPPER -5.05% over (t) duration

Metals also struggled on the week as the 3/07/22 blow-off 🔝 remains a formidable barrier (machines are selling)

$COPPER -0.2% (w) +5.15% (T)

$GOLD -1.55% (w) +5.2% (T)

$PLAT -1.95% (w) +2.3% (T)

$SILVER -3.75% (w) +5.55% (T)

Chart: $COPPER -5.05% over (t) duration

8/13

Grains were also gobsmacked ↘️ this week

$WHEAT -9.9% (w) +27.7% (T)

$SOYB -7.45% (w) +18.2% (T)

$CORN -2.5% (w) +23.9% (T)

$SUGAR -1.2% (w) +2.5% (T)

Chart: $WHEAT -16.25% over (t) duration #correction

Grains were also gobsmacked ↘️ this week

$WHEAT -9.9% (w) +27.7% (T)

$SOYB -7.45% (w) +18.2% (T)

$CORN -2.5% (w) +23.9% (T)

$SUGAR -1.2% (w) +2.5% (T)

Chart: $WHEAT -16.25% over (t) duration #correction

9/13

Not a lot of change in #fx

$USD -0.2% (w) +3.18% (T)

$AUD -0.4% (w) +3.03% (T)

$FXC -0.37% (w) +0.92% (T)

$FXF +0.53% (w) -1.7% (T)

$EUR +0.5% (w) -2.9% (T)

$GBP -0.6% (w) -3.05% (T)

$FXY -0.5% (w) -6.2% (T)

Chart: $EURUSD +0.97% over (t) duration but 👋 at the 📉 line

Not a lot of change in #fx

$USD -0.2% (w) +3.18% (T)

$AUD -0.4% (w) +3.03% (T)

$FXC -0.37% (w) +0.92% (T)

$FXF +0.53% (w) -1.7% (T)

$EUR +0.5% (w) -2.9% (T)

$GBP -0.6% (w) -3.05% (T)

$FXY -0.5% (w) -6.2% (T)

Chart: $EURUSD +0.97% over (t) duration but 👋 at the 📉 line

10/13

The 15-day ♉️ impulse in 🇺🇸 equities abated somewhat as vol continued to ↘️

$SPX +0.05% (w) -4.6% (T)

$COMPQ +0.65% (w) -8.84% (T)

$IWM +0.7% (w) -6.7% (T)

$VIX 19.63 🔻

Chart: $IWM +4.5% (t) struggling at the break down line

The 15-day ♉️ impulse in 🇺🇸 equities abated somewhat as vol continued to ↘️

$SPX +0.05% (w) -4.6% (T)

$COMPQ +0.65% (w) -8.84% (T)

$IWM +0.7% (w) -6.7% (T)

$VIX 19.63 🔻

Chart: $IWM +4.5% (t) struggling at the break down line

10a/13

Low beta winning ♣️ over high beta stocks

$SPLV +2.25% (w) -0.8% (T)

$SPHB -0.5% (w) -3.8% (T)

Chart: $SPLV +3.7% over (t) duration

Low beta winning ♣️ over high beta stocks

$SPLV +2.25% (w) -0.8% (T)

$SPHB -0.5% (w) -3.8% (T)

Chart: $SPLV +3.7% over (t) duration

10b/13

Value over growth

$SPYV -0.5% (w) +0.3% (T)

$SPYG +0.25% (w) -8.6% (T)

Chart: $SPYV +6.8% over (t) duration

Value over growth

$SPYV -0.5% (w) +0.3% (T)

$SPYG +0.25% (w) -8.6% (T)

Chart: $SPYV +6.8% over (t) duration

11/13

Strongest US Sectors all #quad4 longs

$XLRE +4.55% (w) -4.9% (T)

$XLU +3.75% (w) +5.5% (T)

$XLP +2.15% (w) -0.6% (T)

$XLV +1.3% (w) -2.0% (T)

Chart: $XLRE +5.6% over (t) duration + divvy

Strongest US Sectors all #quad4 longs

$XLRE +4.55% (w) -4.9% (T)

$XLU +3.75% (w) +5.5% (T)

$XLP +2.15% (w) -0.6% (T)

$XLV +1.3% (w) -2.0% (T)

Chart: $XLRE +5.6% over (t) duration + divvy

12/13

Internat’l indices 💪 over past 3-4 weeks, but still 🐻📉

$HSI +2.95% (w) -5.80% (T)

$SSEC +2.2% (w) -9.8% (T)

$CAC +2.0% (w) -6.55% (T)

$DAX +1.0% (w) -9.05% (T)

$KOSPI +0.35% (w) -8.0% (T)

$NIKK -1.7% (w) -3.9% (T)

Chart: $DAX +10.3% over (t) duration but #fugly

Internat’l indices 💪 over past 3-4 weeks, but still 🐻📉

$HSI +2.95% (w) -5.80% (T)

$SSEC +2.2% (w) -9.8% (T)

$CAC +2.0% (w) -6.55% (T)

$DAX +1.0% (w) -9.05% (T)

$KOSPI +0.35% (w) -8.0% (T)

$NIKK -1.7% (w) -3.9% (T)

Chart: $DAX +10.3% over (t) duration but #fugly

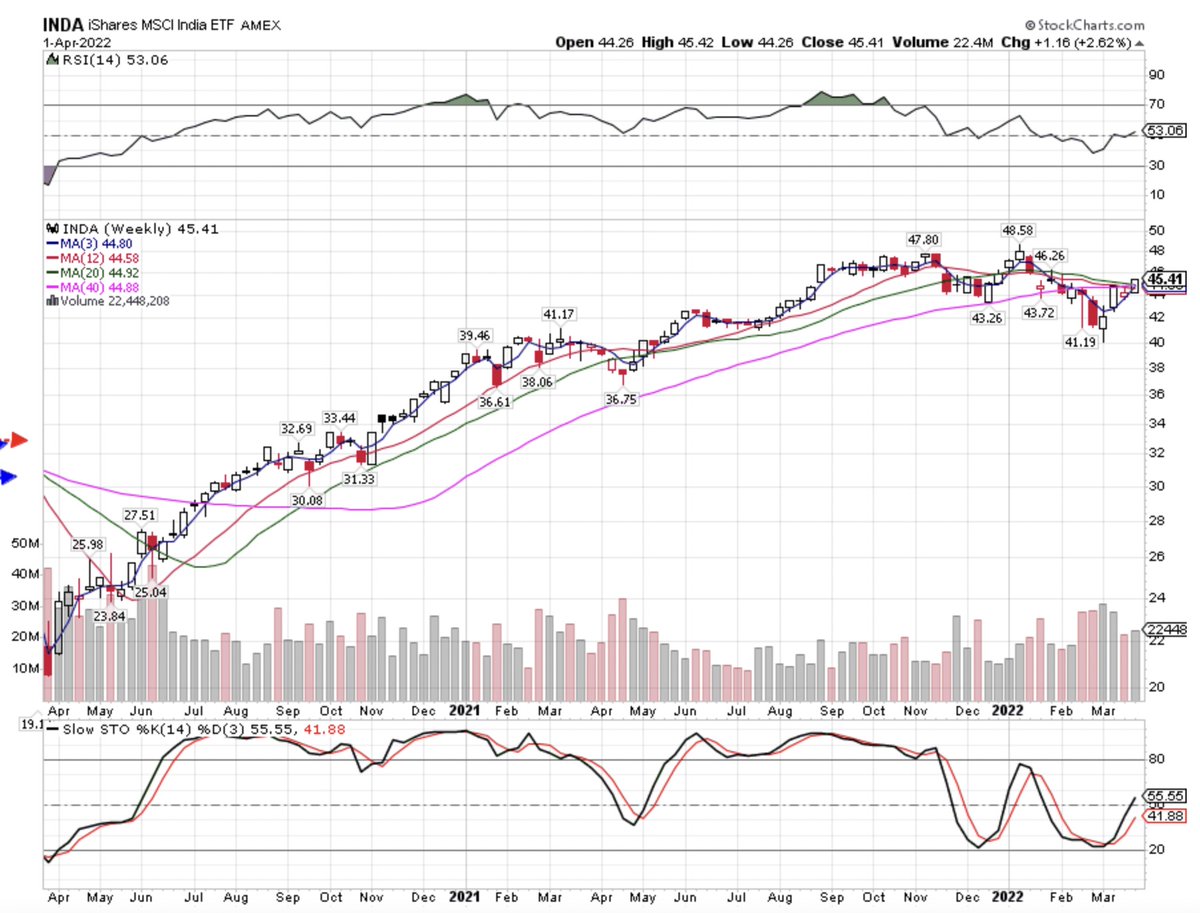

12a/13

Strongest Country ETFs

$EDEN +4.35% (w) -8.05% (T)

$EWZ +3.85% (w) +39.45% (T)

$EWW +3.3% (w) +9.4% (T)

$EWI +3.25% (w) -8.65% (T)

Chart: $INDA +2.6% is back to neutral Trend -0.95%

Strongest Country ETFs

$EDEN +4.35% (w) -8.05% (T)

$EWZ +3.85% (w) +39.45% (T)

$EWW +3.3% (w) +9.4% (T)

$EWI +3.25% (w) -8.65% (T)

Chart: $INDA +2.6% is back to neutral Trend -0.95%

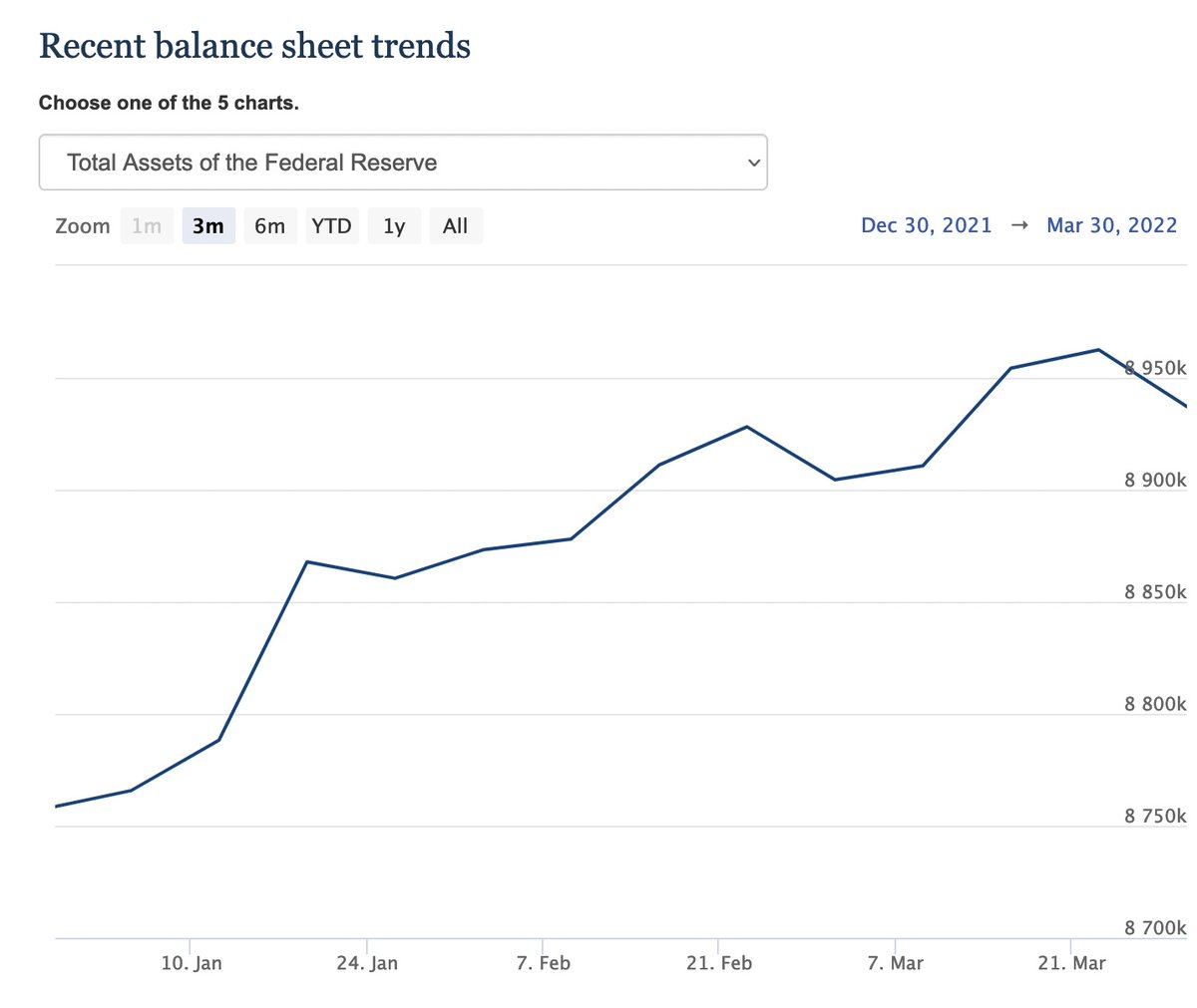

13/13

The market took a bite out of #inflation this week as the bond market flashed 📸 #recession 10-18 months ahead

Interestingly, the Fed’s balance sheet ↘️

One-week does not a 📉 make

Remain 💦 and have a super profitable 💰 week!

Chart: Federal Reserve BS 🌊

The market took a bite out of #inflation this week as the bond market flashed 📸 #recession 10-18 months ahead

Interestingly, the Fed’s balance sheet ↘️

One-week does not a 📉 make

Remain 💦 and have a super profitable 💰 week!

Chart: Federal Reserve BS 🌊

• • •

Missing some Tweet in this thread? You can try to

force a refresh