I got digging into the rather curious #WAVES address #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr, which is the center of some controversy since some analysis was performed on its recent activity in lending USDN to borrow USDC/T presumably to manipulate the market

https://twitter.com/0xHamz/status/1509581295621451779

On November 22, 2020 #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr withdrew 1,325,034.714 $WAVES from @binance. This address's first transaction was only a few days earlier, and this was only the beginning.. In the course of just over a month, it withdrew 5.64M Waves from #Binance...

4.95M of these were used for #USDN issuance, for a total of 41.28M $USDN. 30.88M USDN was transferred to what appear to be Liquidity / Lending platforms, but I haven't fully confirmed this as of yet..

0.68M Waves were transferred to other addresses which largely seem to be related to lending or liquidity. 20 WAVES were directly exchanged for USDT, and

1001 Waves purchased using USDN. All of this happened between 11.20.2020 and 12.25.2020.

1001 Waves purchased using USDN. All of this happened between 11.20.2020 and 12.25.2020.

Some have speculated that this address is owned by the core team, but I do wonder why the core team would be pulling 5.64M WAVES from Binance?

There was a substantial price increase preceding all this. Waves was under $2 in July, passed $4 in August then settled between $2-3 until October. On November 1st WAVES was $3.12, but by Nov 22nd it hit $7.88. It peaked at ~$9 early December then fell to ~6 by Dec 25th.

If the avg. price of these 5.64M Waves was $6, it would cost a total of $33.8M USD. At the recent ATH that amount would be worth ~$338.4M USD. Could it be that a big roller has been actively gaming the market for the past year and a half?

Consider that Alameda Research was allegedly caught doing an $80M USD short on #WAVES using the defi lending platform vires.finance - this is more than half the capital we see initially going into #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr

@0xHamz @Darrenlautf @sasha35625 #wavesarmy @NataleFerrara @thisiswenzel @0xGrecko

@0xSEM @0xtroll @Mister_Ch0c @sebastienbosca

@ogonshort @1ren @LissStern @Rap_Flag

@0xSEM @0xtroll @Mister_Ch0c @sebastienbosca

@ogonshort @1ren @LissStern @Rap_Flag

For a tad more context, here's the latest lending data on the wallet in question vires.finance/as/3PEEsRmcWsp… - 545M USDN put up as collateral to borrow 404M USDT/USDC -- anyone who put USDC/T into the lending platform cannot get it out because this address borrowed everything.

*Correction - the recent $80M shorting 'scandal' is more than TWICE the capital that initially went into #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr (previously stated "more than half").

Ok, so looking this over - another interesting address that has 28 interactions with 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr is wavesexplorer.com/address/3P87zr… -- interestingly enough it ALSO withdrew a massive amount of WAVES from Binance starting 29.12.2020 &swapped a TON of USDN->USDT/C.

This one withdrew 2,577,987.803 WAVES from Binance between 12/29/2020 and 1/13/2021 - a little over a month after the main whale acct, and has very similar activity.. This plus the transactions between these 2 addresses - pretty certain it's the same person.

And yet another account mass-cycling USDN for other stablecoins and tokens:

w8.io/3PNWjCoZuFyKDz… - also borrowed 20M USDT/USDT against USDN

vires.finance/as/3PNWjCoZuFy… - initial funding from 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB 05/25/2021.. Busy except a weird break June-Dec 2021?

w8.io/3PNWjCoZuFyKDz… - also borrowed 20M USDT/USDT against USDN

vires.finance/as/3PNWjCoZuFy… - initial funding from 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB 05/25/2021.. Busy except a weird break June-Dec 2021?

… And then there's w8.io/3P5TkQBU68n6YM… - got 25.7M USDN + 2 WAVES from _zr whale 12/13/2021, exchanges for USDT.. Then got 100+ BTC from _zr wallet on 28/03/2022 to borrow USDT&C. Also got 2M VIRES_USDC_LP and 10 USDN from 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB - all connected.

And another - 3PK47aHi2BzZGZDnxgWQVF54jDvfMBcggQE - received USDN and BondAppetit, then proceeds to buy and sell on pair BondAppetit/USDN like a bot

3PMJuZycSwKKg6QpXAbtMtP8beU2au9reVS initially funded 50k USDN, and 3 Waves by 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB on 03/09/2021 - also got 21k Curve DAO tokens (gateway?). Trades Curve DAO and USDN like a bot - similar to 3PK47aHi2BzZGZDnxgWQVF54jDvfMBcggQE

w8.io/3PMw8Sqeaz9H1Q… AND w8.io/3PD3oCH6jRsvXY… initially funded by _zr whale with 5M USDC out of the waves.exchange gateway 23/20/2020 - mostly putting it into liquidity pools. Both also receive transfers 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB

More and more started by _zr and/or _PB inflows - w8.io/3PMx76unTp5g2B… w8.io/3PJMyu8DvMzqrH… w8.io/3PMUTKMtJxfG5p…

w8.io/3PQFNSthBgj8A2…

w8.io/3PDiDfxMWVpBst…

w8.io/3PQFNSthBgj8A2…

w8.io/3PDiDfxMWVpBst…

Look Ma- another one! Loads of WAVES from Binance and purchased using USDN. Inbound USDN from _zr and _PB. This one didn't start until April 19 2021, but boy has it been busy pumping WAVES! First funded by 3P7NotqPNSFv1JYBp934yo1qPu8PzBVhAqN - another address in the mix!

3PHV72dTneSgXWoXEcbidV5hGUgywoEFtXL and 3PGPUHgT3Kp64cjy1eTzJCDs5HhtRHHompW also appear to be connected, but haven't dug deep enough to confirm.. What a rabbit hole.

Wait.. coingecko.com/en/coins/neutr… shows USDN has a circulating supply of 1.08B & market cap of 1.00B. USDN is backed by #WAVES, for which CG has a market cap of 2,86B. The backing ratio is 175% per app.neutrino.at/buy-nsbt, meaning $1.75B in WAVES. 60%+ of all WAVES is backing USDN?

Then we have to consider vires.finance/as/3PEEsRmcWsp… - a single wallet using 545M USDN backing loans.. 545M USDN IS MORE THAN 50% OF ALL USDN OUT THERE - meaning more than 30% of all WAVES tied up backing it.

Combine all the other address I've pointed out that are clearly linked to this address and you're likely to find more a fair bit more than this linked to 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr.

Then I have to wonder -- half the total supply of USDN when USDN is being burned like there's no tomorrow.. This is the wallet preventing people from withdrawing their USDT/USDC, but could it end up unable to withdraw it's USDN as people forfeit collateral to burn borrowed USDN?

I'm not one to point fingers without clear evidence, but I can see why @0xHamz came to the conclusion he did. You've got to at least acknowledge the on-chain data for what it is.. The team seems to be intent on diverting attention and limiting dialogue here, which is too bad.

Honestly, as much as Alameda Research is accused of pushing WAVES downward (a connection only made by @sasha35625 doxxing them), it's hard to refute that the owner of 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr has been pushing the market up - whomever that is.

... And it could be anyone really. Given the size of whales these days and the relatively low cost of waves in 2020, it's not a given that any of this is related to the team - that's pure conjecture... I don't get why the team wouldn't at least deny it? If they did - I missed it.

Maybe it's an oligarch playing with petty cash.. The crypto market is easily manipulated both ways. All manipulation serves to undermine the broader environment. If we're to grow gracefully, we can't ignore

'good' manipulation and attack 'bad' manipulation.

'good' manipulation and attack 'bad' manipulation.

MUTED FOR A WEEK on both the Neutrino and Waves Community telegrams for talking about on-chain data. No attempt to refute, despite my pleas for someone to show me where I went wrong. No interest in truth. This is #wavesarmy, this is #waves. What a shame.

vires.finance/as/3PEEsRmcWsp… whale down to 500M USDN collateral. Withdrew 48.5M and sent to wavesexplorer.com/address/3PHFKt… for staking. Account health below 5%. Will they allow default, or repay the loan?

If they default, they walk with 400M+ of other user's USDC and USDT, and their 500M USDN is liquidated. This may well be the best case scenario other than settling the loan and exchanging the USDN to WAVES - but that would require a LOT of gNSBT, which they don't seem to have...

gNSBT is extremely expensive right now, and without it they'd have to dump on the market or hold.. Dumping would be worse than allowing liquidation. I'm also wondering if they can AFFORD to settle their loan.. If they bought WAVES at ATH they've lost 1/2 their capital- ~200M USD.

This is also a good point re: the alleged @AlamedaResearch position

https://twitter.com/AliceSpade_Q/status/1512058632414048266.. Can anyone chime in on what exactly happens to USDN price and people's USDT/C balances if our whale defaults? I haven't gotten that far, and have to step away for awhile.

Sorry, deleted last tweet because I realize it's a frustrating one to leave dangling and definitely looks like FUD, which is not my intent. I'll reiterate that I like the waves platform, and think they've built a compelling ecosystem. None of this is about the technology.

Someone was ahead of the curve on this one -- threadreaderapp.com/thread/1508066… @ericonomic.. I'm planning on compiling all addresses mentioned in the above posts then digging deeper today in an effort to connect some more dots.

Anyone know why #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr provided initial funding to what wscan.io lists as Waves.Exchange gateway addresses: 3PMw8Sqeaz9H1QYwWjRYgG6YZGsrKPyru7z & 3PD3oCH6jRsvXYZz9mdX8rShqWKn6DC65zf? They don't look like gateways..?

OMG - @AlamedaResearch @SBF_FTX PAID THEIR WAVES BALANCE vires.finance/as/3PHkZUJpS3A…!! By now they've likely discovered that this is not enough to withdraw their collateral, because it's likely being borrowed by #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr ...More on this..

This would also mean the #wavesarmy @viresfinance proposal to force them to close their short position or get liquidated (along with everyone else) has ALREADY had the desired effect of propping up the price by forcing shorts to buy back millions worth of #WAVES....

And vires.finance/as/3PEEsRmcWsp… withdrew a bunch of their available collateral, pushing them closer to liquidation -- looks to me like they've decided to bail on their loan and letting it liquidate, meaning @AlamedaResearch won't be getting their USDT/C any time soon to say the least

OMG - it was an epic game of chicken! Now the #vires proposal is projected to be REJECTED now that @AlamedaResearch is out. #WavesArmy may yet avoid making @viresfinance lose all credibility.

Transactions between 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr

and 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB, as well as accounts that I'm looking into which are linked to one or both of these....

and 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB, as well as accounts that I'm looking into which are linked to one or both of these....

3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr provided initial funding to 3P5TkQBU68n6YMiiA8zEVSVqwhLcqNYVBFW and

3PD3oCH6jRsvXYZz9mdX8rShqWKn6DC65zf

- TXIDs: BSie5VLoXa4zkFzTykrSCf6t1ggh9imN8hLi3ioqNDb5

Cqh87k8Fdf9m2jBYxAzac7REN1tDcwpk3FUyDSAJGZpw

3PD3oCH6jRsvXYZz9mdX8rShqWKn6DC65zf

- TXIDs: BSie5VLoXa4zkFzTykrSCf6t1ggh9imN8hLi3ioqNDb5

Cqh87k8Fdf9m2jBYxAzac7REN1tDcwpk3FUyDSAJGZpw

3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB funded 3PNWjCoZuFyKDz5tvb2YcU5LtcDyyUAxaSh

- txid FtguXNdkjrPEWNKTg5xPzbk4iHJANUTP2oo4BMSpKuES

- txid FtguXNdkjrPEWNKTg5xPzbk4iHJANUTP2oo4BMSpKuES

To me, the origins and flow of assets paints a pretty clear picture that these accounts either belong to the same person/entity, or are collaboratively used by a small group.

Oh man!! This is big.

https://twitter.com/AliceSpade_Q/status/1512525223815381000w8.io/txs/g/55905 - 3PMw8Sqeaz9H1QYwWjRYgG6YZGsrKPyru7z is marked as a Waves.Exchange gateway wallet on wscan.io, @AliceSpade_Q seems to have found why it's shown as such...

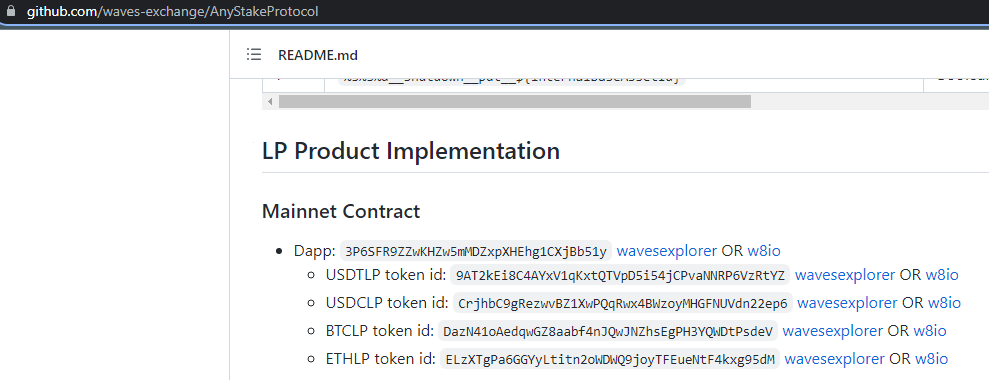

This address (3PM...7z) was INITIALLY FUNDED BY OUR WHALE (3PEE...zr) - it funds USDT to AnyStakeProtocol contract on 3P6SFR9ZZwKHZw5mMDZxpXHEhg1CXjBb51y github.com/waves-exchange… -- 3PM...7z is the only address to top up USDT on the contract: w8.io/txs/g/55905 !!!!!

Here we go. It's getting more interesting..

Our Whale's connection to the #AnyStakeProtocol DApp 3P6SFR9ZZwKHZw5mMDZxpXHEhg1CXjBb51y github.com/waves-exchange… and the genesis of the #USDT & #USDC tokens on #WAVES.

(1)

Our Whale's connection to the #AnyStakeProtocol DApp 3P6SFR9ZZwKHZw5mMDZxpXHEhg1CXjBb51y github.com/waves-exchange… and the genesis of the #USDT & #USDC tokens on #WAVES.

(1)

2) 3PD3oCH6jRsvXYZz9mdX8rShqWKn6DC65zf was initially funded by our whale #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr and 3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR -- it programmatically invokes topUpBalance ("6XtHjpXbs9RRJP2Sr9GUyVqzACcby9TkThHXnjVC5CDJ") -- that's the code USDC.

3) 3PMw8Sqeaz9H1QYwWjRYgG6YZGsrKPyru7z also initially funded by our whale 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr and 3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR -- programmatically invokes topUpBalance ("34N9YcEETLWn93qYQ64EsP1x89tSruJU44RrEMSXXEPJ") -- that code is for USDT ...

4) Both of these addresses were initially funded by our whale #3PEE...zr and 3PM...zGR. They keep the AnyStakeProtocol DApp on 3P6SFR9ZZwKHZw5mMDZxpXHEhg1CXjBb51y funded by all appearances. Now we dig into 3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR...

3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR is the address BEHIND THE REGISTRATION of both the USDT and USDC tokens on Waves; their creator. Just lookup the code after those 'topUpBalance' calls - i.e. wavesexplorer.com/tx/6XtHjpXbs9R… and asset ID link: wavesexplorer.com/assets/6XtHjpX… - sender: 3PM...zGR

Now I'll go out on a limb for a moment and speculate: MAYBE #3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr is part of the DApp infrastructure? It would make sense given how involved it seems to be here.. Maybe all those USDC/T loans are part of Lambo investments or something?

Back to w8.io/txs/g/55905 - 2 more addresses consistently sending synchronously transactions like the above two, both with connection to our "whale": w8.io/3PMJYSuMa6BJot… w8.io/3PGUWV66aEfTm7… - odd that the latter wasn't initially funded by our whale like the other 3

I can't find much on Waves #Anystake - is it related to #defiat Anystake? Looks like the dev behind the Waves Repo has prior experience working with Binance APIs, which may close the loop on the amount of WAVES coming in from Binance at the start of all this?

... And I'm now realizing 3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR is probably a gateway that was used to fund our whale's project wallets.. A mechanism to move funds across protocols or something?

Ok - confirming that 3P6SFR9ZZwKHZw5mMDZxpXHEhg1CXjBb51y is the official #AnyStake instance and not a copycat (img). Also noticed that 3PMRCnpRfpQzoRgEKX6ZuY2eynBkNoUxzGR was originally funded by...Binance?: wavesexplorer.com/tx/Hd42MS9bECF… - can't close the door on it's whale link now..

Interesting - github.com/waves-exchange… - first commit was Dec 21, 2020. That's a month after 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr's first transaction and days before 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB's.

More evidence of a team connection: Sasha tweeting about buying 5M USDN

- the only transaction in the 5M range that day.

https://twitter.com/sasha35625/status/1511650307910115334- only places with enough volume for that are WAVES DEX and CURVE. Matching swap on Curve USDN pool: etherscan.io/tx/0x553ef0f36…

- the only transaction in the 5M range that day.

The wallet used to swap is 0x9c02ac8a9e766a6e4f6987f5ea6aa91d70e932b9. This wallet has been interacting a number of times over the past months with the Waves Gateway bridge, and also that it received another ~5.5M USDN within a day of this; 'off to buy more cheap $USDN'

Let’s focus on the following tx: etherscan.io/tx/0x4adb8d62f…

transferring 2,994,903.202276 USDC to Waves Gateway deposit address. On Waves side we can see 2,994,903.202276 USDC sent by the Gateway to wallet 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB

transfer tx : wscan.io/71BxtKp4FEbhTq…

transferring 2,994,903.202276 USDC to Waves Gateway deposit address. On Waves side we can see 2,994,903.202276 USDC sent by the Gateway to wallet 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB

transfer tx : wscan.io/71BxtKp4FEbhTq…

There's plenty connecting 3P87zrU6UmJq7wEZz84Fm9PJXr9tLGfEwPB to 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr

- I've covered a handful of things, but you can find more if you dig.

- I've covered a handful of things, but you can find more if you dig.

Now again - in theory, perhaps @sasha35625 actually purchased 5M $USDN on the Waves.Exchange and this just a random coincidence - that could be demonstrated via sharing the transactions. Given the team's response to all this though, I suspect they won't try to disprove.

Some more addresses I wanted to get to are 3P7NotqPNSFv1JYBp934yo1qPu8PzBVhAqN,

3PQFNSthBgj8A2zRSrJXKviuwtqxhWUp2WR, and

3PGPUHgT3Kp64cjy1eTzJCDs5HhtRHHompW - I suspect they're connected, but I'm running out of steam and feel I've covered a lot today.

3PQFNSthBgj8A2zRSrJXKviuwtqxhWUp2WR, and

3PGPUHgT3Kp64cjy1eTzJCDs5HhtRHHompW - I suspect they're connected, but I'm running out of steam and feel I've covered a lot today.

One more potential Sasha connection to the ETH wallet I pointed to above - 0x9c02ac8a9e766a6e4f6987f5ea6aa91d70e932b9:

https://twitter.com/sasha35625/status/1453704967424991234and a 190K incentive to votium: etherscan.io/tx/0x98bd9859f… - I'll bet these timestamps are skewed 3 hrs due to different app time zones.

If you're unfamiliar with recent events with #NEM and #Symbol - a community fork and some internal drama resulted in a transition of treasury funds and more broadly control over the chain's future from a largely ineffective organization (to say the least)...

Conclude what you will from all this, but know that difficult times and painful revelations can bring new life to a chain by allowing it to redefine itself. It's a long road, but I believe #WAVES is a mature ecosystem enough to weather the storm.

Important: I didn't do much investigation into 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr's activities - I was focused on finding it's connections. Perhaps others characterizations of market manipulation are misguided. I would love an authoritative response from the team.

Oh man.. Another interesting find:

https://twitter.com/xGeee/status/1471575396214882307- @xGeee pointed it out as far back as Dec 16 2021. Who would put up 500M USDN to borrow 460M USDN.. Just to to pay interest? Funded by our whale 3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr!

@threadreaderapp unroll

Easier reading: threadreaderapp.com/thread/1510980… sorry it's such a long thread - stream of consciousness because I wanted to get things out there as I discovered them for a couple reasons (show the journey and allow others to contribute/do their own digging).

Easier reading of the thread at threadreaderapp.com/thread/1510980…

Oh man! Already rolled this thread up, but found another crazy thing.. The address that minted USDT on the WAVES Chain was funded by.... BINANCE!!?? Just like the whale and its associated wallets. Why would the team fund from Binance and not, say, a treasury wallet for this?

I mean initially funded from @binance -- not just coincidentally received funds from there.. This is the wallet's first transaction, and these #WAVES were used to create the official $WAVES #USDT token.

• • •

Missing some Tweet in this thread? You can try to

force a refresh