Brighton and Hove Albion’s 2020/21 accounts cover an “incredibly challenging” season, when they finished 16th in the Premier League under head coach Graham Potter, but their finances were significantly impacted by the COVID-19 pandemic #BHAFC

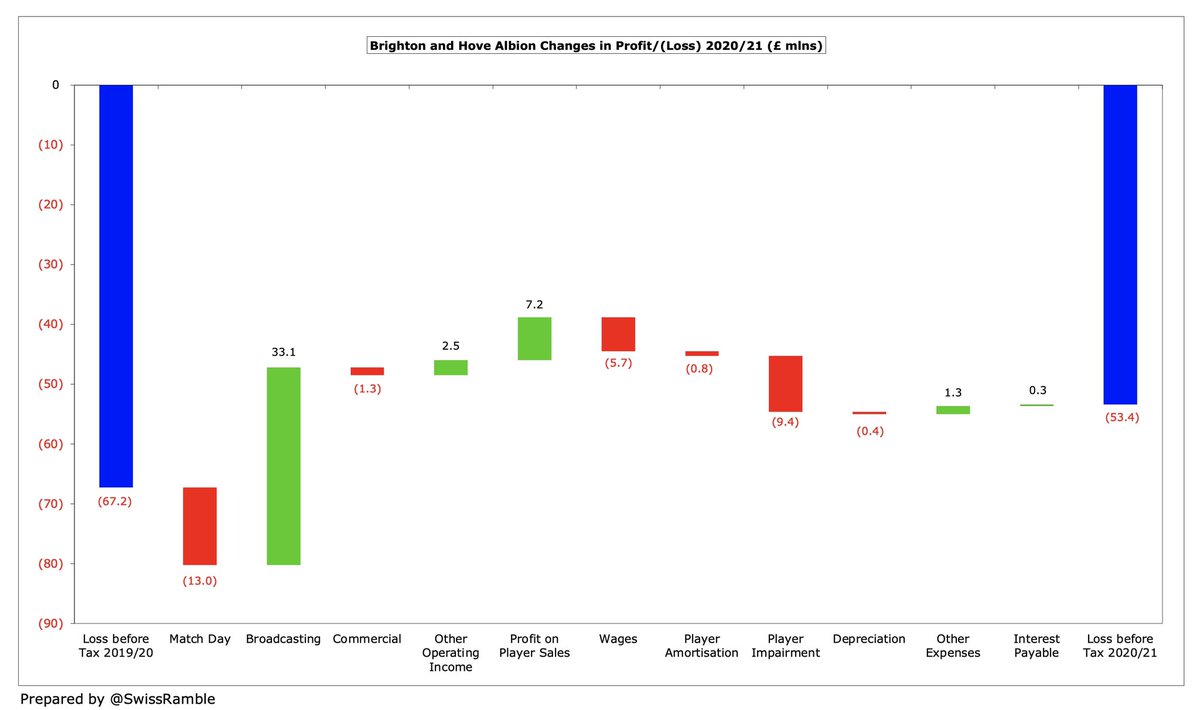

#BHAFC reported “another substantial loss” of £53m, though this was better than prior year’s £67m. Revenue rose £19m (14%) from £133m to a club record £152m and profit on player sales increased £7m (£1m loss in previous season), but expenses were £15m (7%) higher.

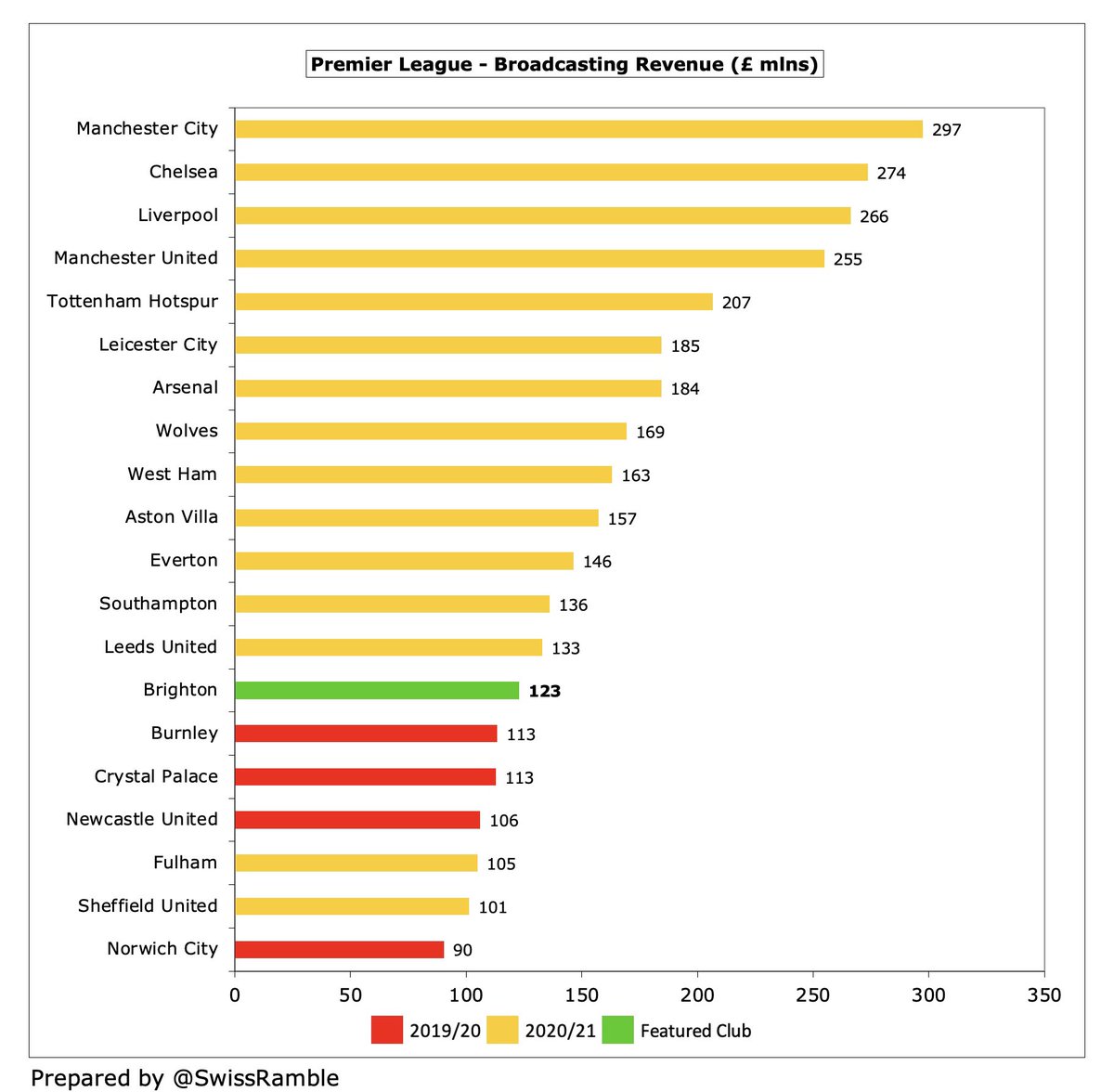

#BHAFC broadcasting revenue increased £33m (37%) from £90m to £123m, mainly due to money deferred from 2019/20 for games played after the accounting close, which offset COVID driven reduction in match day, down £13m (96%) to just £494k, and commercial, down £1m (4%) to £28m.

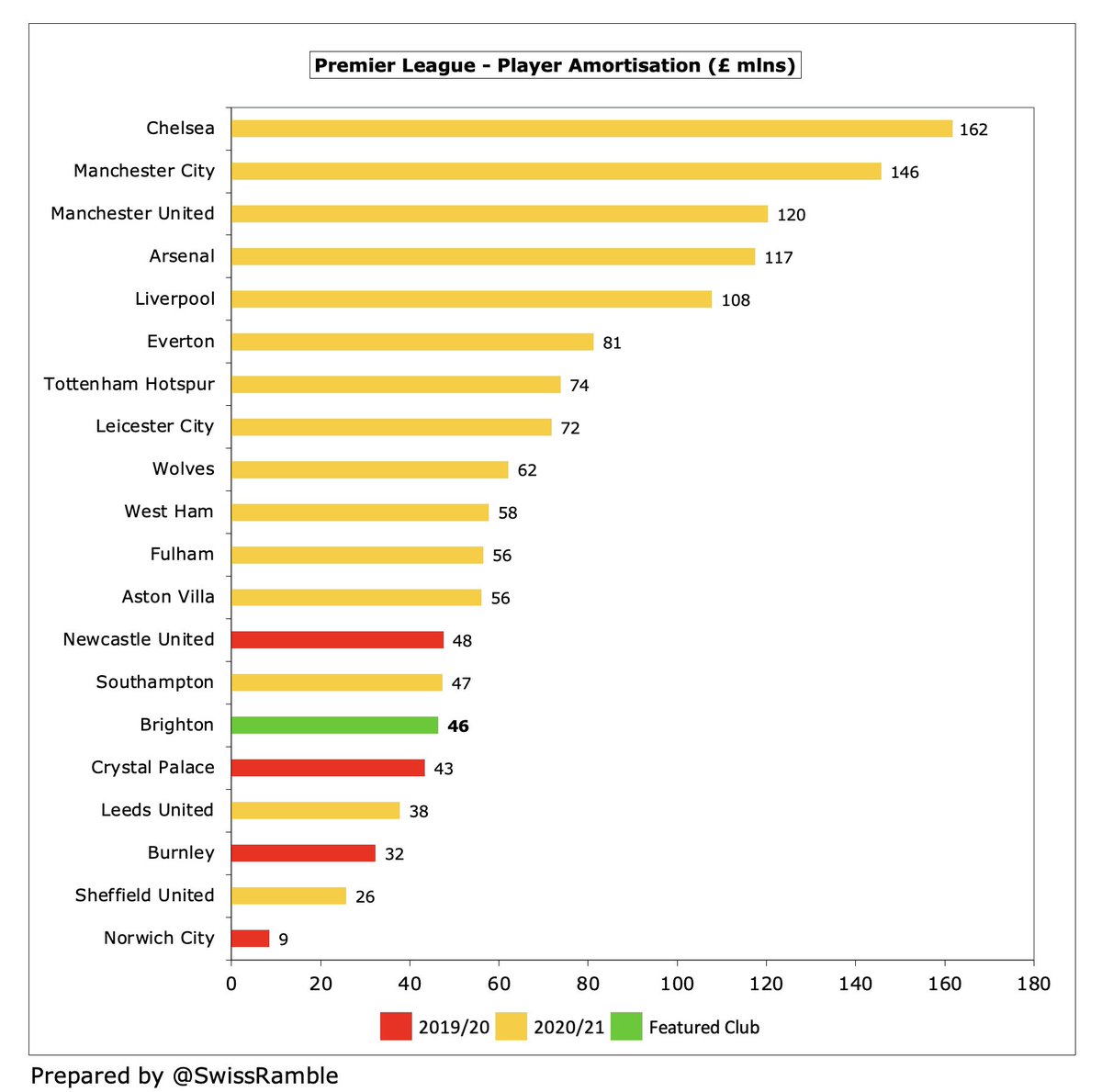

#BHAFC wage bill rose £6m (6%) from £103m to £109m, while player amortisation slightly increased to £46m and the club booked £9m player impairment. Other expenses were cut £1m (3%) to £40m and net interest payable was trimmed to £3m. Received £2.5m from insurance claim.

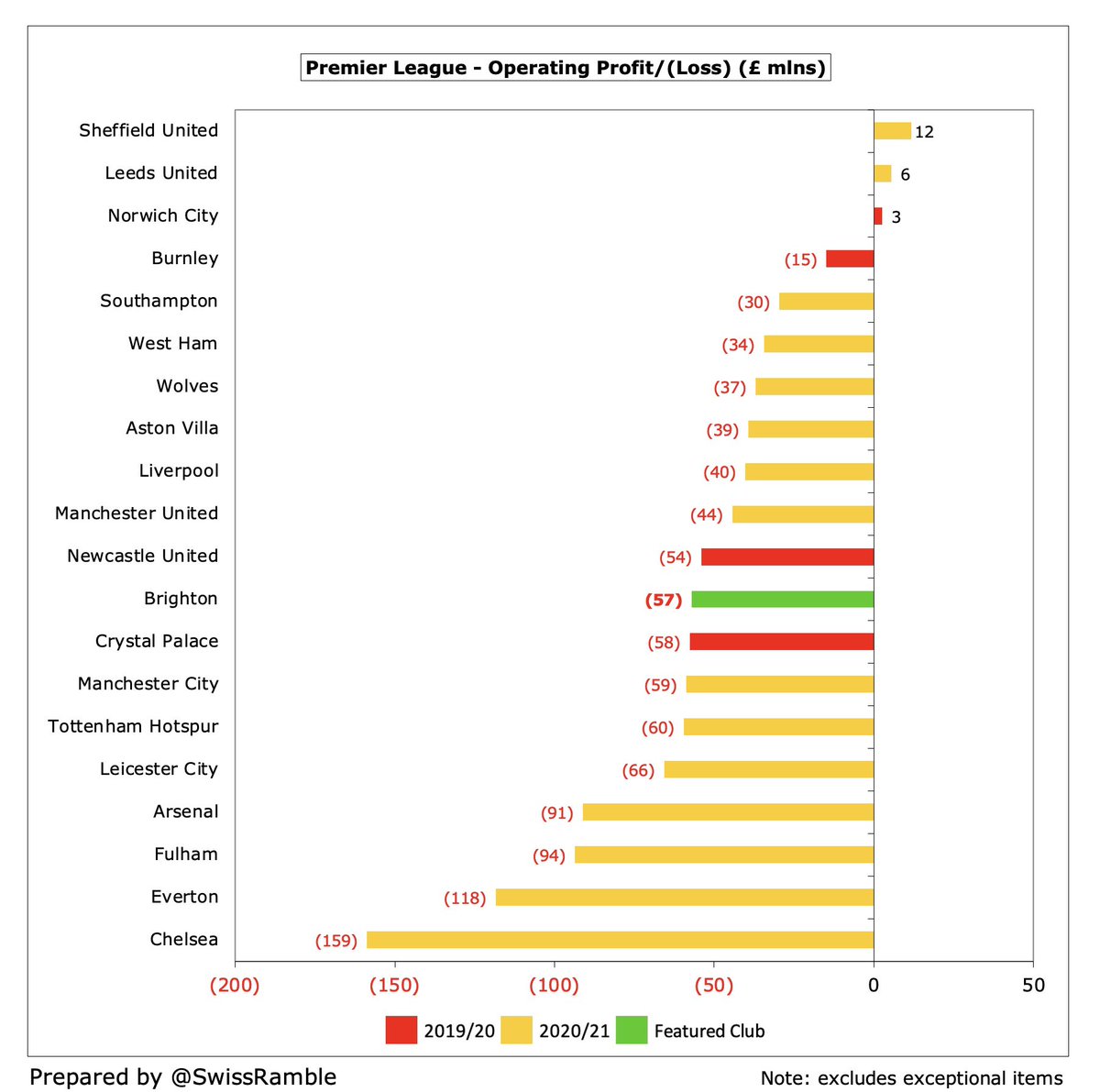

As chief executive Paul Barber said, “a loss is never ideal”, especially a substantial £53m deficit. That said, a full year of the pandemic has resulted in some very high losses, e.g. #CFC £156m, #AFC £127m and #EFC £121m. Note: #WWFC £145m profit is due to £127m loan write-off.

#BHAFC said that around half of the 2020/21 loss can be attributed to COVID, which implies an adverse impact of £27m, as the “match day, commercial and event turnover was all but wiped out”. If this is excluded, the club would still have lost £27m.

#BHAFC only made £6.6m profit from player sales, albeit better than prior year £0.6m loss, mainly Anthony Knockaert to #FFC. Unsurprisingly, this was one of the worst player trading results in the Premier League, miles below #MCFC £69m, #WWFC £61m and #LCFC £44m.

In the last decade #BHAFC have only posted a profit once (in season following promotion to the top flight), losing nearly quarter of a billion (£241m) in that period. Their £143m loss in the last 3 years is at the upper end in the Premier League, though much less than #EFC £373m.

#BHAFC have made very little money from player sales. In fact, their £15m profit in the last 5 years is by far the lowest in the Premier League. However, that will change this season with around £60m from the “significant sales” of Ben White to #AFC and Dan Burn to #NUFC.

#BHAFC operating loss (i.e. excluding player sales and interest) narrowed from £63m to £57m, though still the club’s second worst ever. That said, very few clubs post operating profits, while some had very high losses: #CFC £159m, #EFC £118m, #FFC 94m and #AFC £91m.

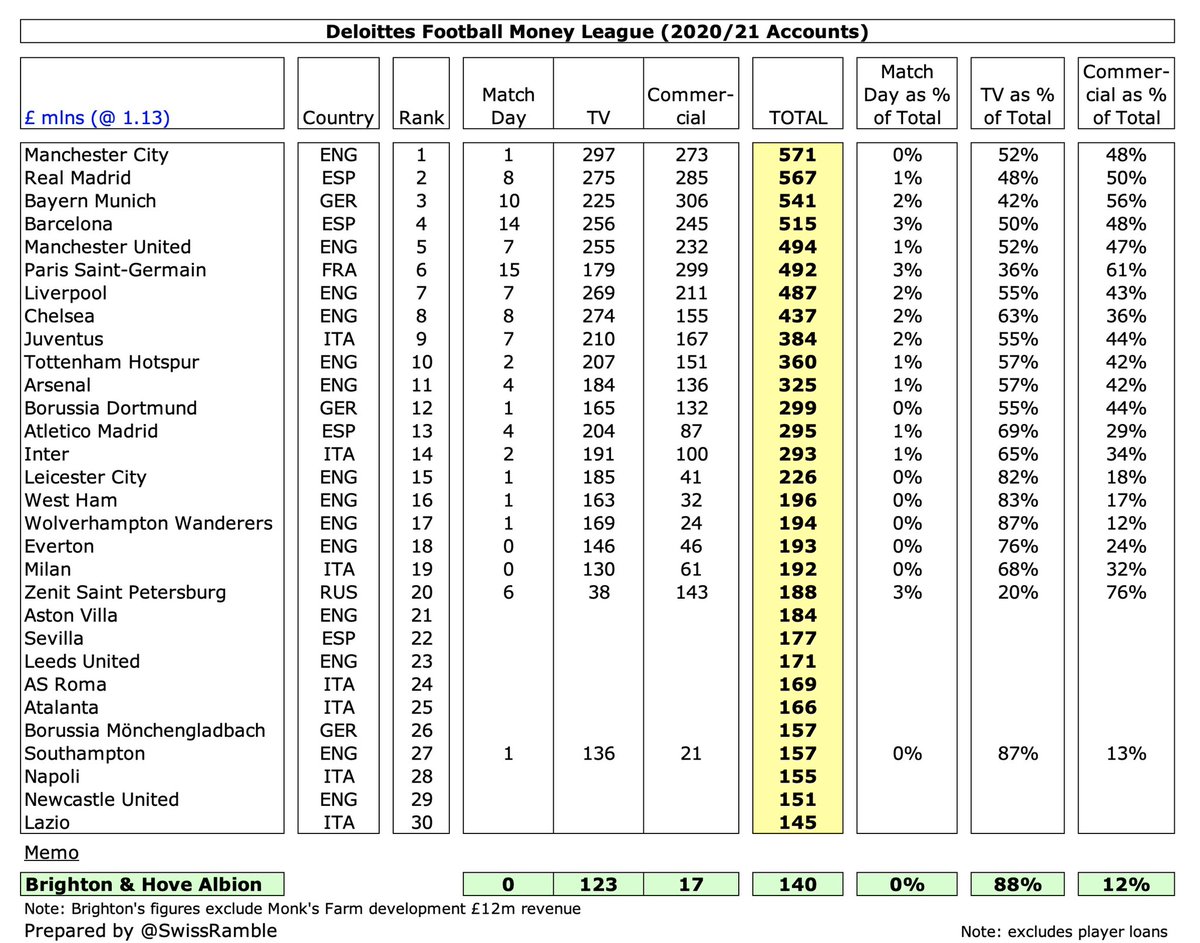

#BHAFC £152m revenue is actually £8m (6%) higher than 2019 pre-pandemic level, despite significant £18m fall in match day, as broadcasting rose £10m, due to deferred revenue from 2019/20. Excluding £12m from Monks Farm residential and commercial development, revenue fell £3m.

#BHAFC £152m revenue is 14th highest in the Premier League, sandwiched between #SaintsFC £157m and #NUFC £151m, but over £400m below #MCFC £570m. This season’s rankings are distorted by the different amounts of revenue deferred from 2019/20 accounts.

#BHAFC were not included in the Deloitte Money League, which ranks clubs globally by revenue, presumably because £12m for the Monks Farm project was excluded. On that basis, Albion’s adjusted revenue of £140m is just below 30th placed Lazio £145m.

#BHAFC broadcasting income rose £33m (37%) from £90m to £123m, mainly due to revenue from 6 games deferred to 2020/21 (played after June 2019/20 accounting close), partly offset by lower merit payment (16th place vs 15th) and broadcasters’ rebates.

As the 2019/20 season was extended, £16m revenue was booked in 2020/21 accounts. driving £32m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs with May year-end had largest revenue deferrals, while those with a July close deferred nothing.

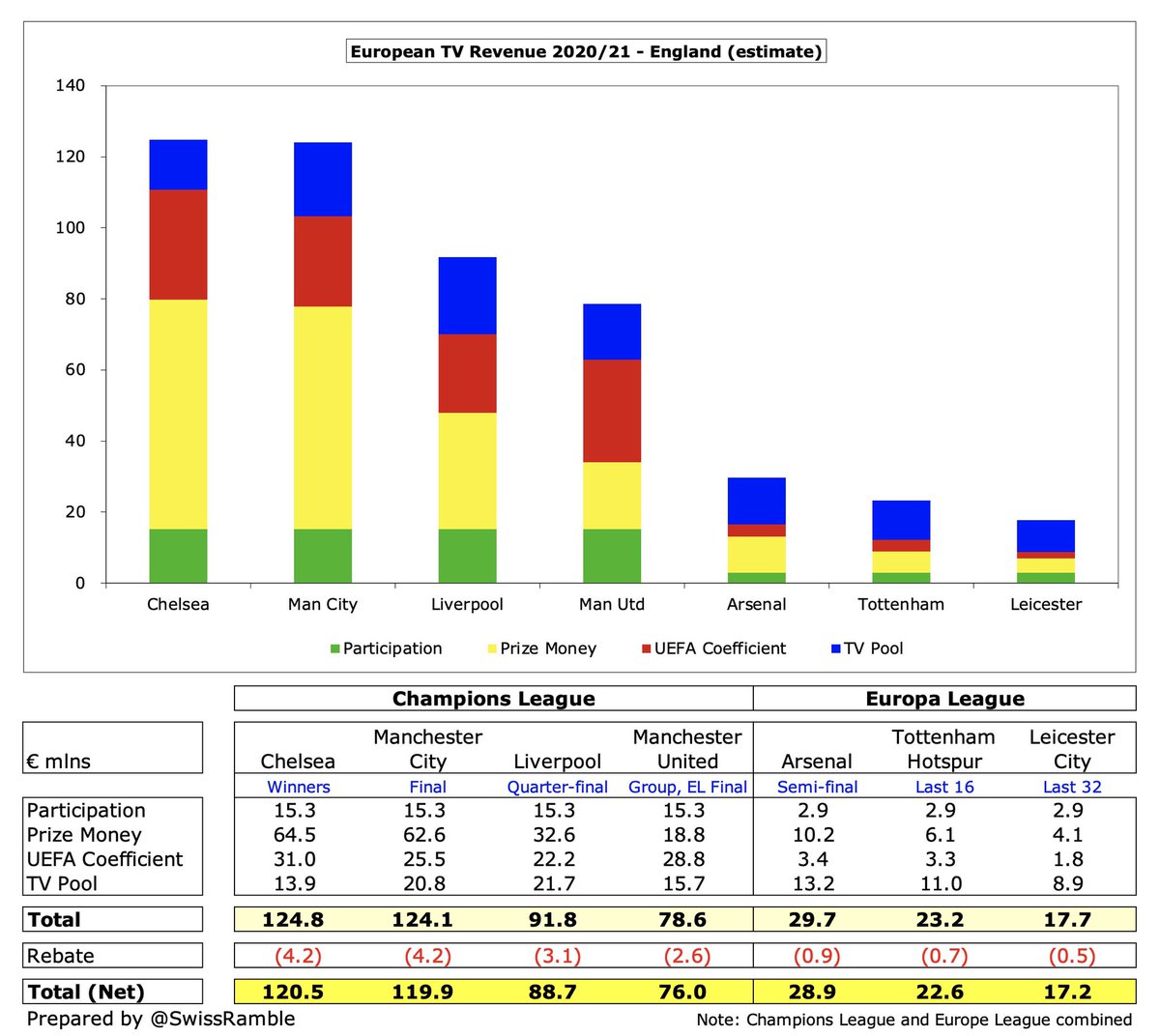

It is worth noting the impact of European qualification on a club’s broadcasting income, especially the Champions League, which was worth around €120m for finalists #CFC and #MCFC in 2021. Europa League participants earn less, but still ranged from €17m to €29m.

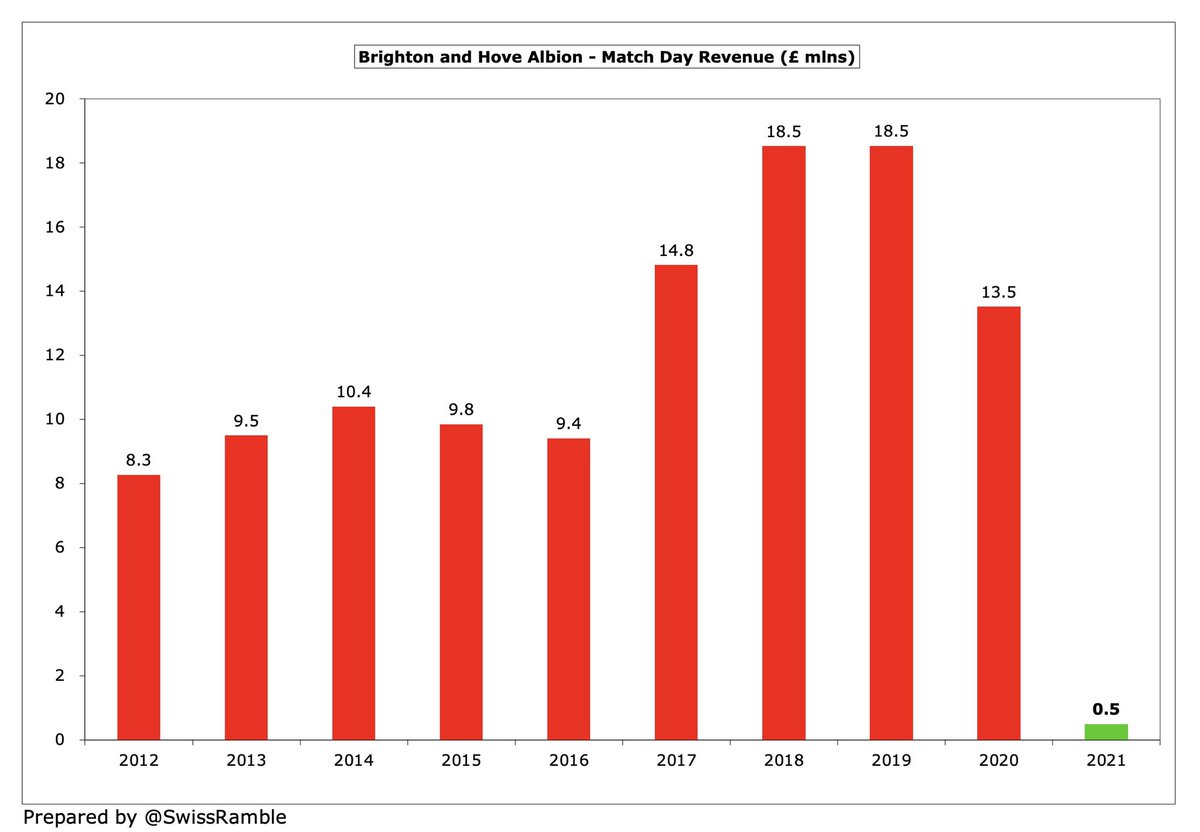

#BHAFC match day revenue fell £13m (96%) to just £494k, as all home games were played behind closed doors (except 3 with very restricted capacity: 2 with only 2,000 fans). Revenue down from £19m peak before the pandemic, though very low compared to elite clubs, e.g. #THFC £95m.

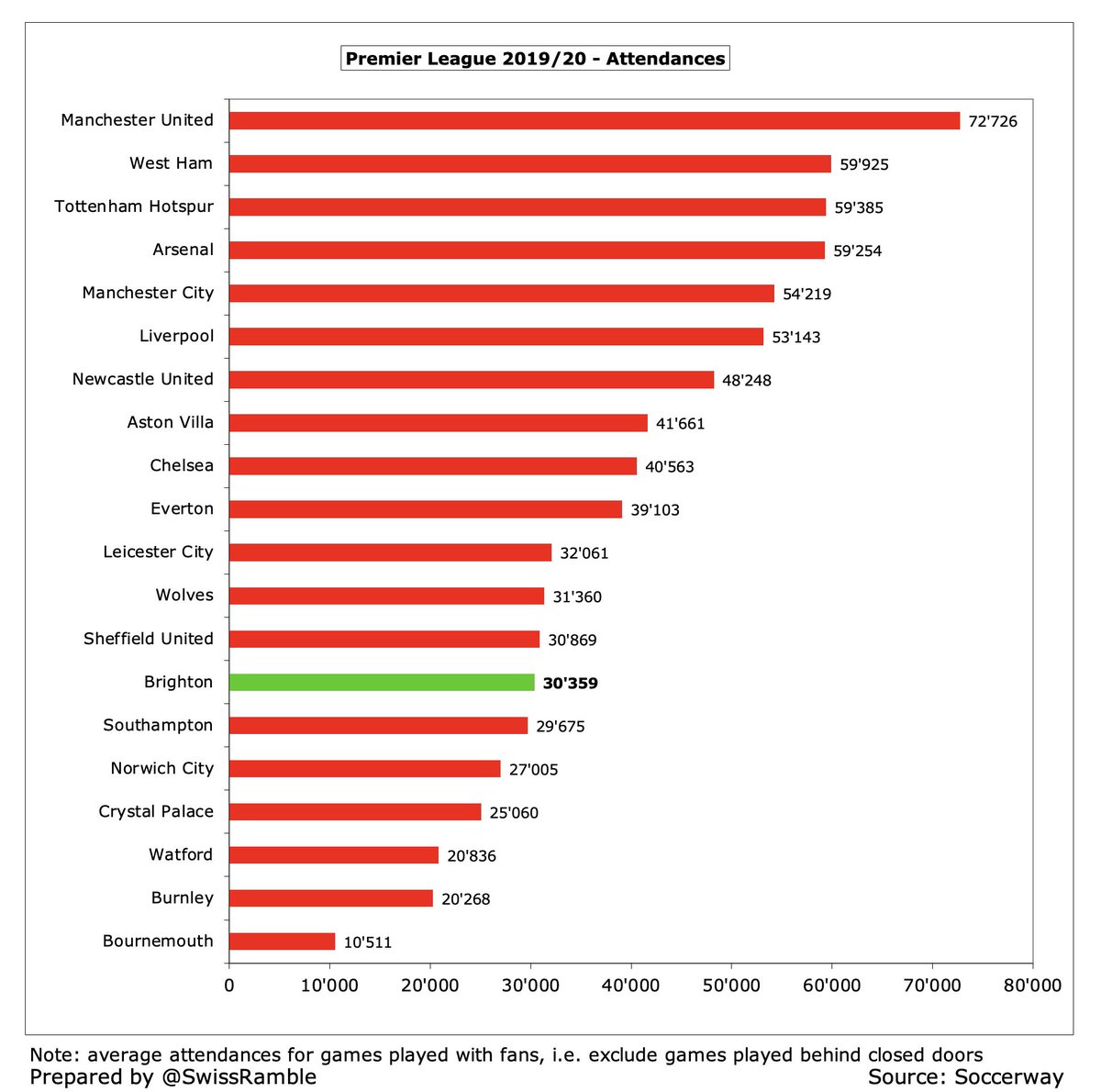

#BHAFC 2019/20 average attendance of 30,359 (for games played with fans) was the 14th highest in the Premier League, around 5,000 more than rivals Crystal Palace. Season ticket prices frozen for the second year in a row for the 2022/23 campaign.

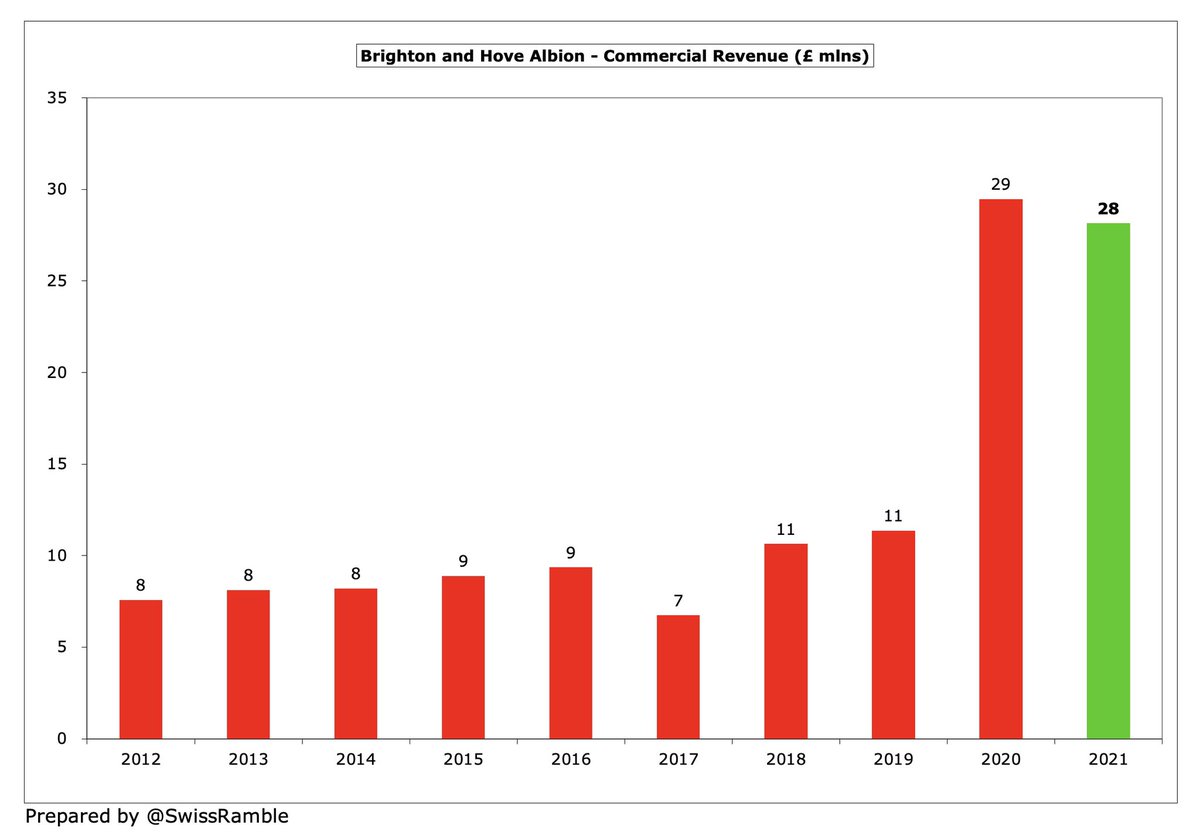

#BHAFC commercial income fell £1m (4%) to £28m, impacted by the loss of events, catering and merchandising. Monks Farm development income up from £9.4m to £11.6m. Club’s second highest ever and mid-table in the PL, but for some perspective only around a tenth of #MCFC £272m.

#BHAFC American Express new £100m 12-year deal for shirt sponsorship £6m and stadium naming rights £2.3m started in 2020/21. Kit supplier Nike has been extended to 2022, while the sleeve sponsor is SnickersUK.

#BHAFC also had £2.5m other operating income for a business interruption insurance claim for COVID losses. Highest amount reported here was #CFC £12.6m, mainly due to unexplained recharges.

#BHAFC wage bill increased by £6m (6%) from £103m to £109m, which is a club record. Wages have grown by £31m from the first season in the Premier League three years ago, while they have more than tripled from the £31m in the last season in the Championship.

Despite the growth, #BHAFC wage bill of £109m is one of the lowest in the Premier League, only above two clubs in the 2020/21 Premier League to date: #LUFC £108m (where the accounting year only covered 11 months) and #SUFC £57m.

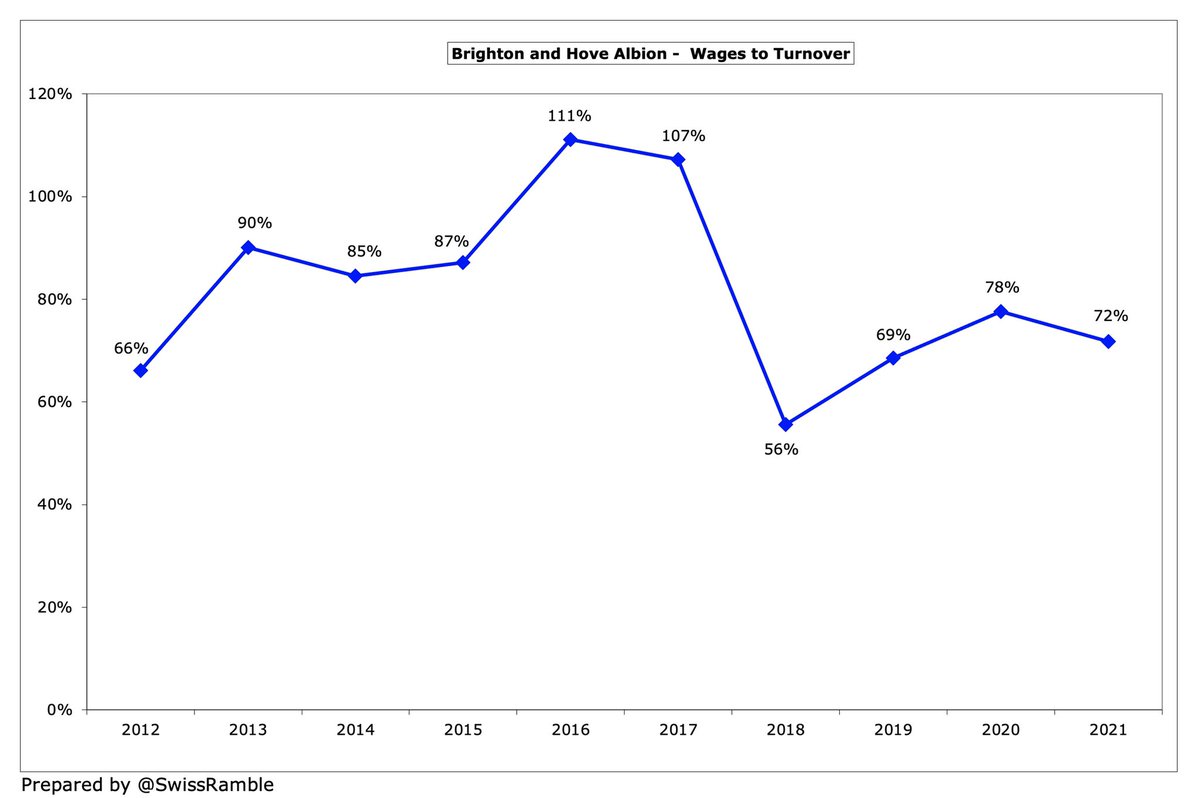

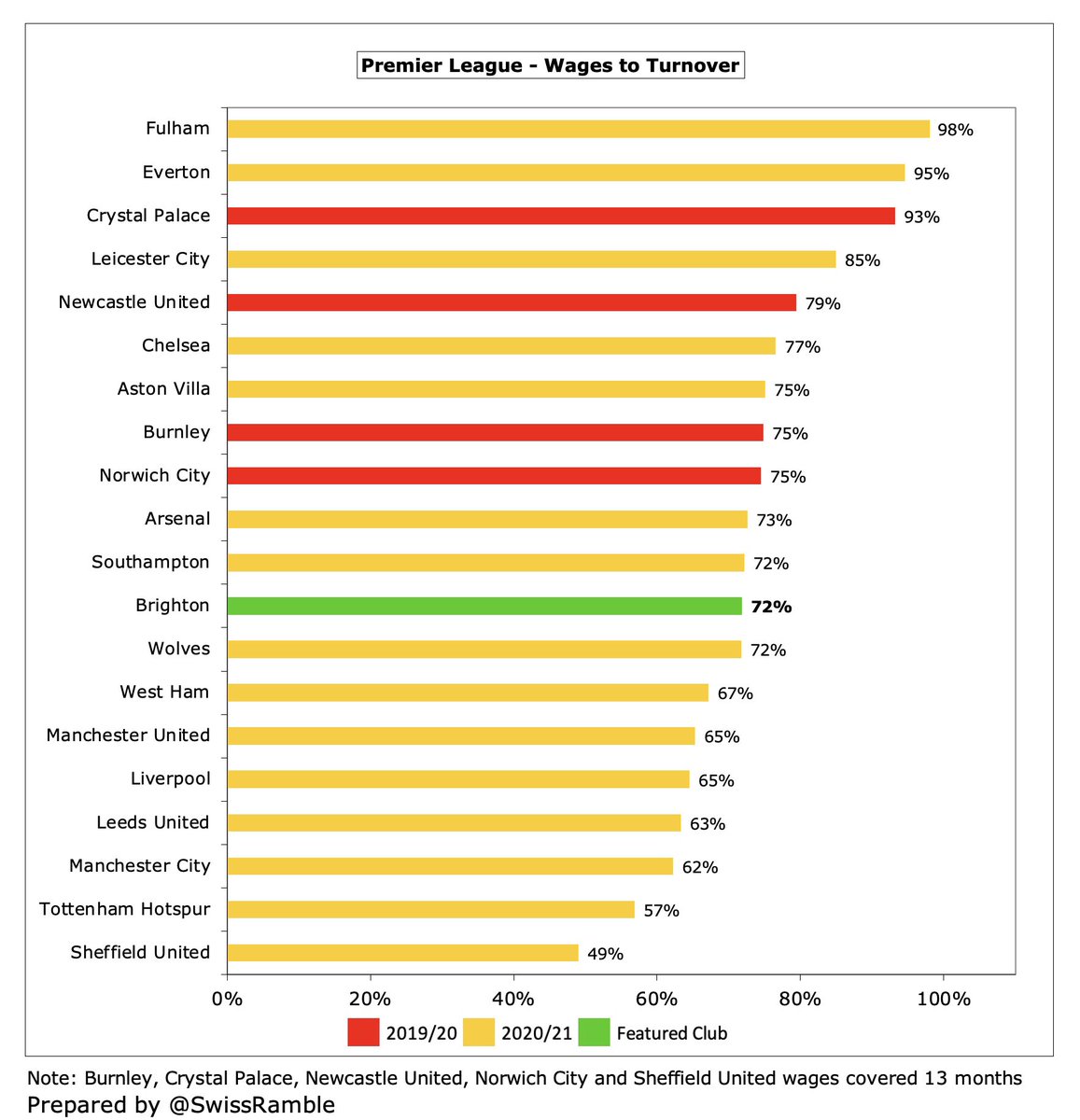

#BHAFC wages to turnover ratio decreased (improved) from 78% to 72%, around mid-table in the Premier League. The ratio would obviously have been lower if the impact of the pandemic were excluded.

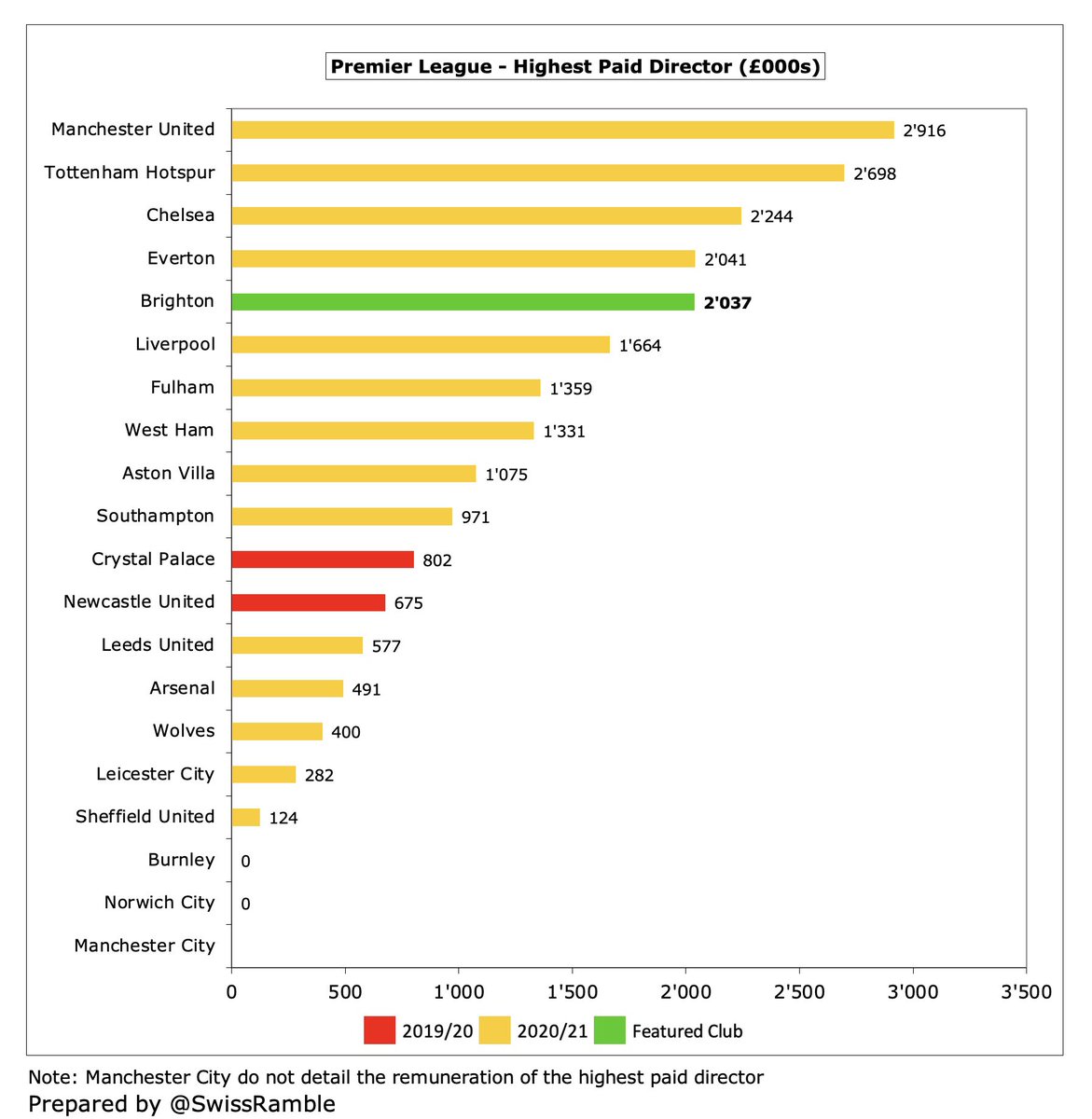

#BHAFC highest paid director, chief executive Paul Barber, saw his remuneration increase slightly to £2.037m. This is the fifth highest in the Premier League, though a fair way below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

#BHAFC player amortisation, the annual charge to write-down transfer fees over the life of a player’s contract, was largely unchanged at £46m, which is on the low side in the Premier League. Also booked £9m impairment charge to reduce some player values (Locardia?).

#BHAFC depreciation has also increased from just £100k in 2011 to £6m, reflecting the club’s investment in infrastructure (stadium and training ground). This is actually the 8th highest in the Premier League, only behind the “Big Six” and #EFC.

#BHAFC other expenses fell £2m to £40m, due to lower costs of staging games. Included £10m cost of sales for the Monks Farm project. Also includes travel subsidy for rail and bus transport to the stadium, stadium maintenance and security, plus investment in women’s football.

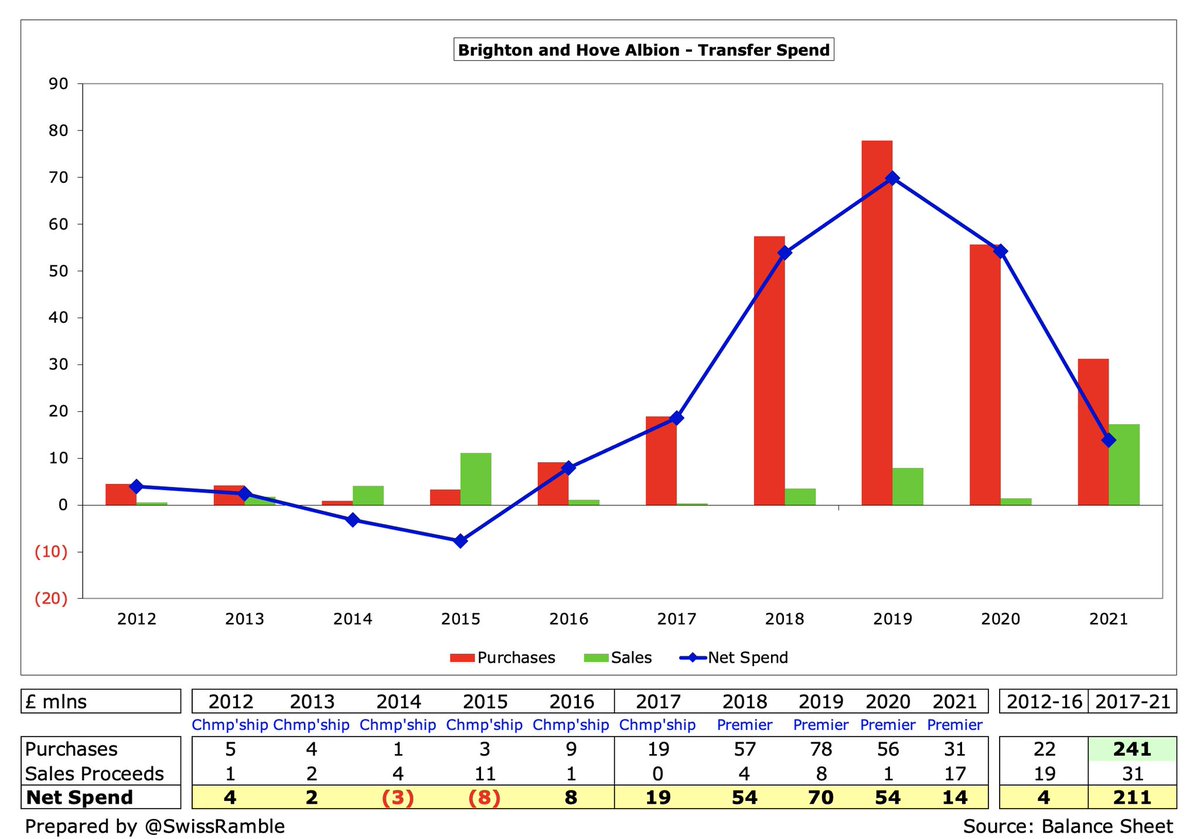

#BHAFC only spent £31m on player purchases in 2020/21, including Moder, Karbownik, Caicedo and Zeqiri. This is the club’s smallest outlay since promotion and also the lowest in the 2020/21 Premier League to date.

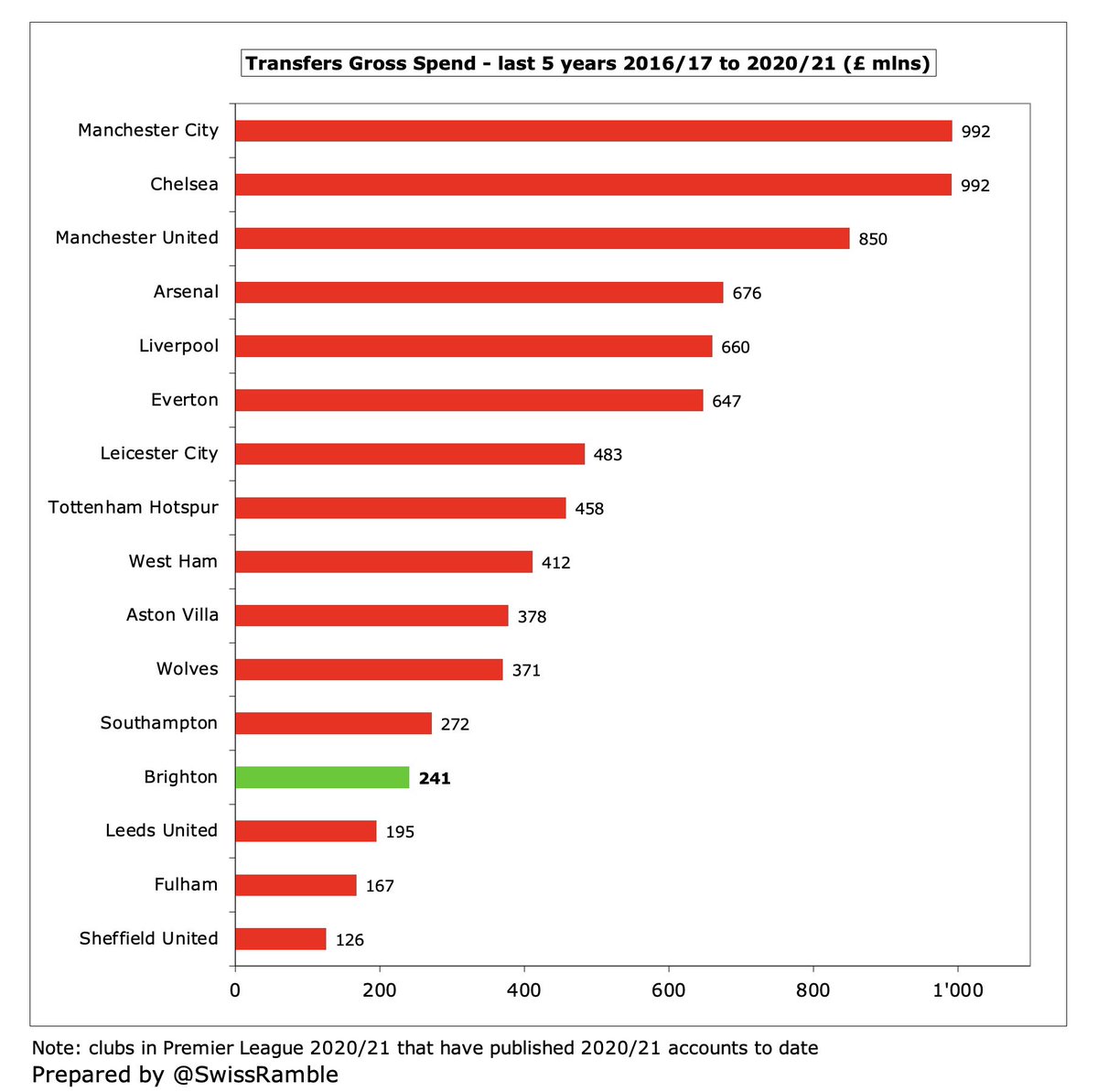

#BHAFC transfer exepnditure has significantly increased since promotion to the Premier League, so they have spent £241m in the last 5 years, compared to only £22m in the preceding 5-year period. However, this is still one of the lowest in the top flight.

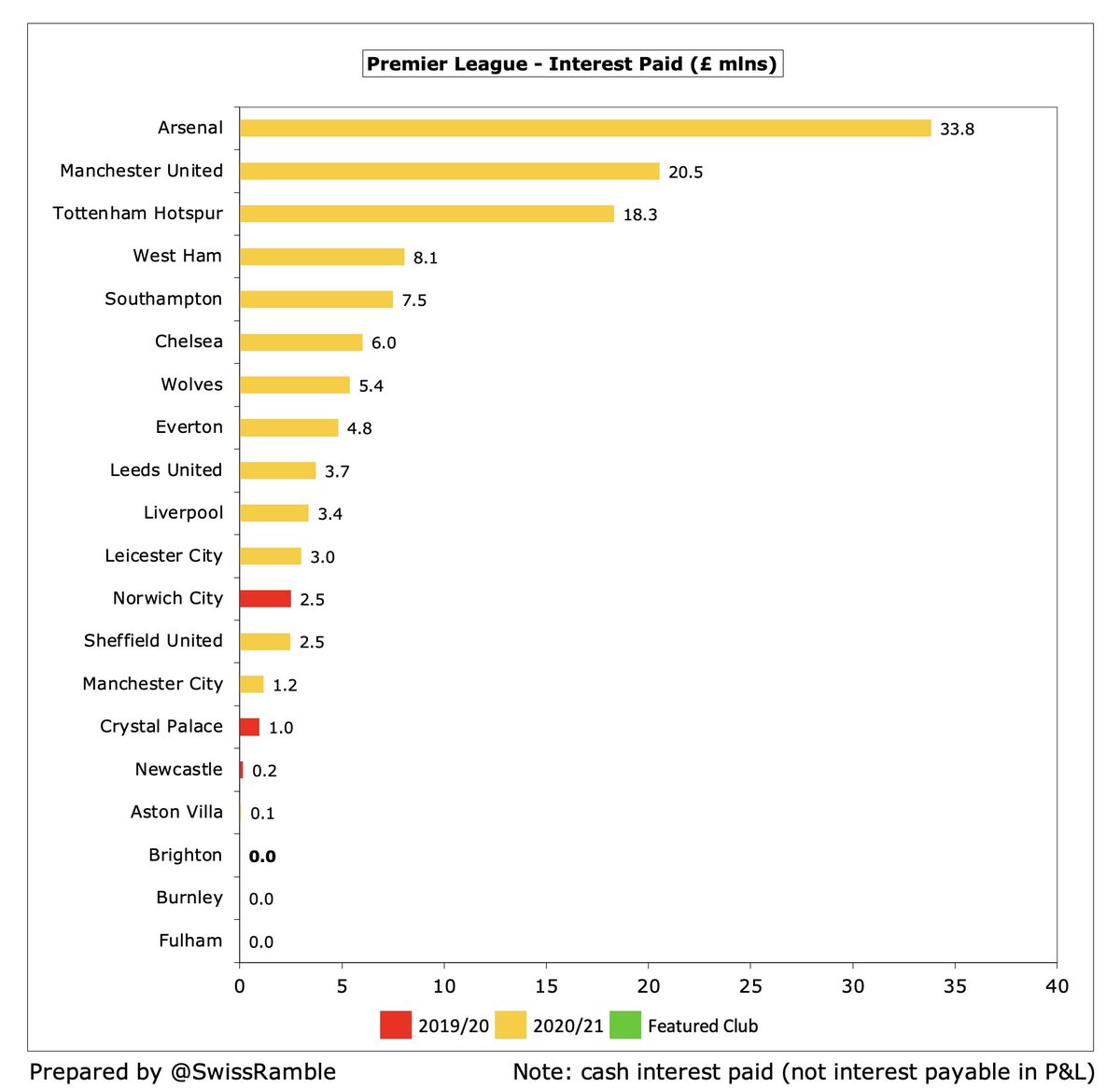

#BHAFC gross debt increased by £68m from £306m to £374m, mainly from owner Tony Bloom in the shape of an interest-free, unsecured loan of £337m (up £33m in 2021). It also includes a £37m bank loan against future TV money (up £35m).

#BHAFC £374m gross debt is 4th highest in the Premier League, only behind #THFC £854m (new stadium), #MUFC £530m and #EFC £379m. However, the loans from Bloom can be considered as the friendliest of debt (he has converted £30m of debt to equity in the past).

#BHAFC debt is undoubtedly very high for a club of their size, though it is not an issue, so long as Bloom continues to provide support. The fact that his loan is interest-free gives Brighton a competitive advantage against those rivals that have to pay interest on their loans.

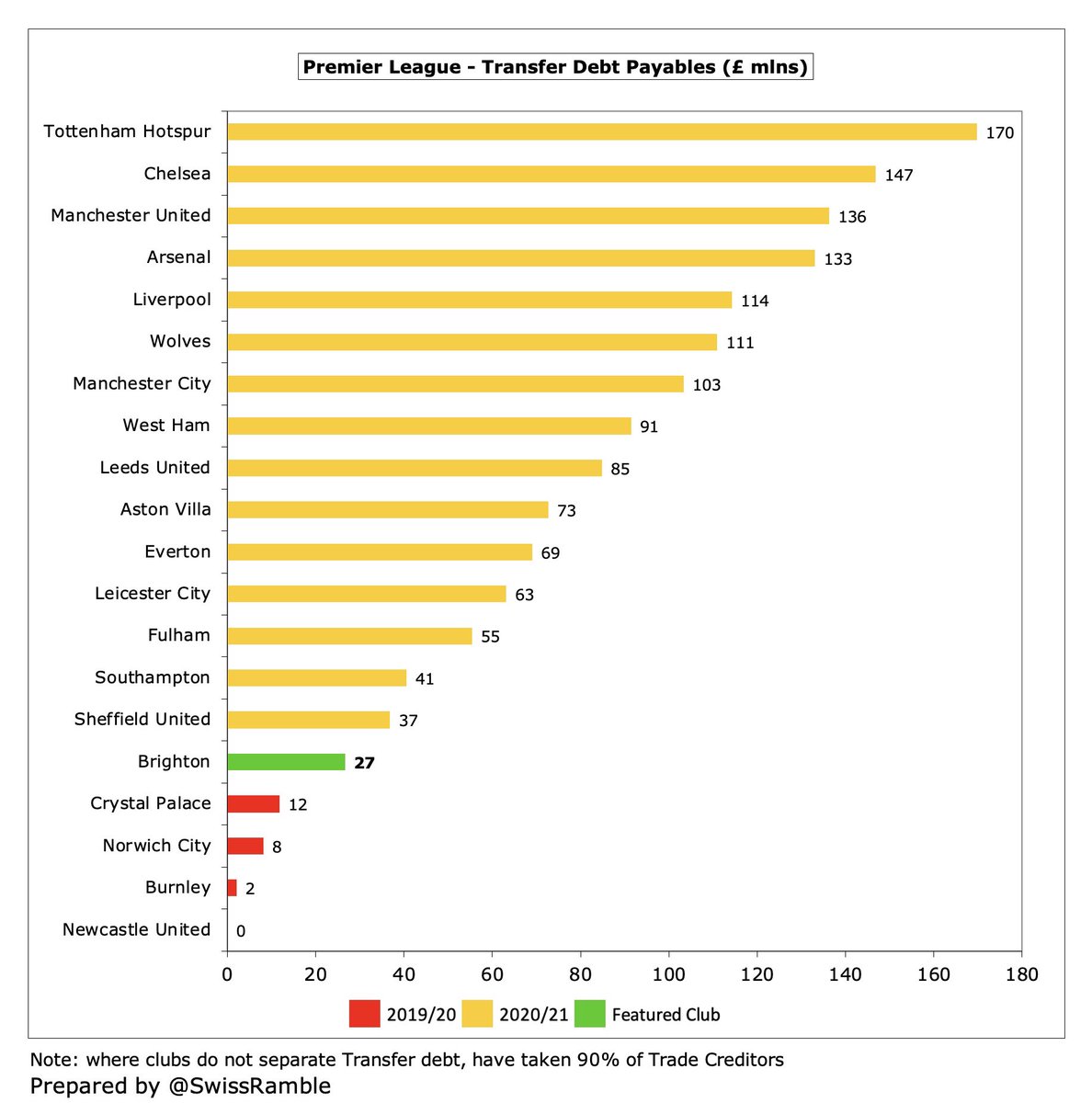

#BHAFC have cut transfer fees debt from £37m to £27m, one of the lowest in the Premier League. There is £3m owed by other clubs, so net payable is £24m. In addition, £20m contingent liabilities potentially payable, mainly dependent on player appearances.

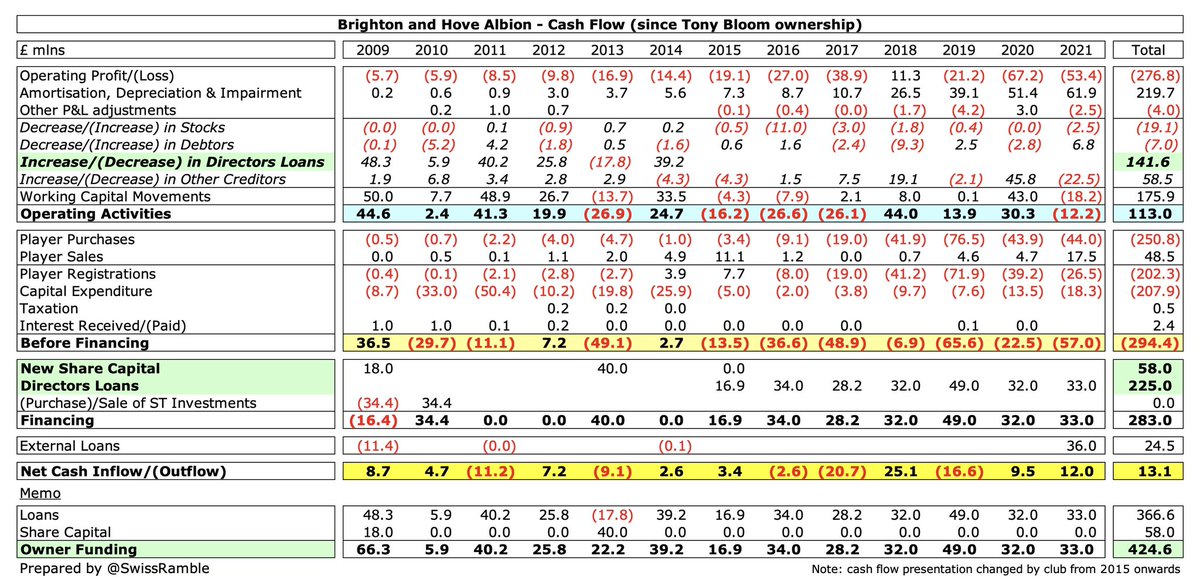

#BHAFC £57m operating loss became £12m negative cash flow (after adding back £62m amortisation & depreciation, offset by £17m working capital moves), then spent £26m on players (purchases £44m, sales £18m) and £18m on training ground. Funded by £33m from Bloom and £36m bank loan.

As a result, #BHAFC cash balance increased by £12m to £14m, though this was still one of the lowest in the Premier League, e.g. #THFC and #MUFC have £148m and £111m respectively, but Bloom has confirmed his support.

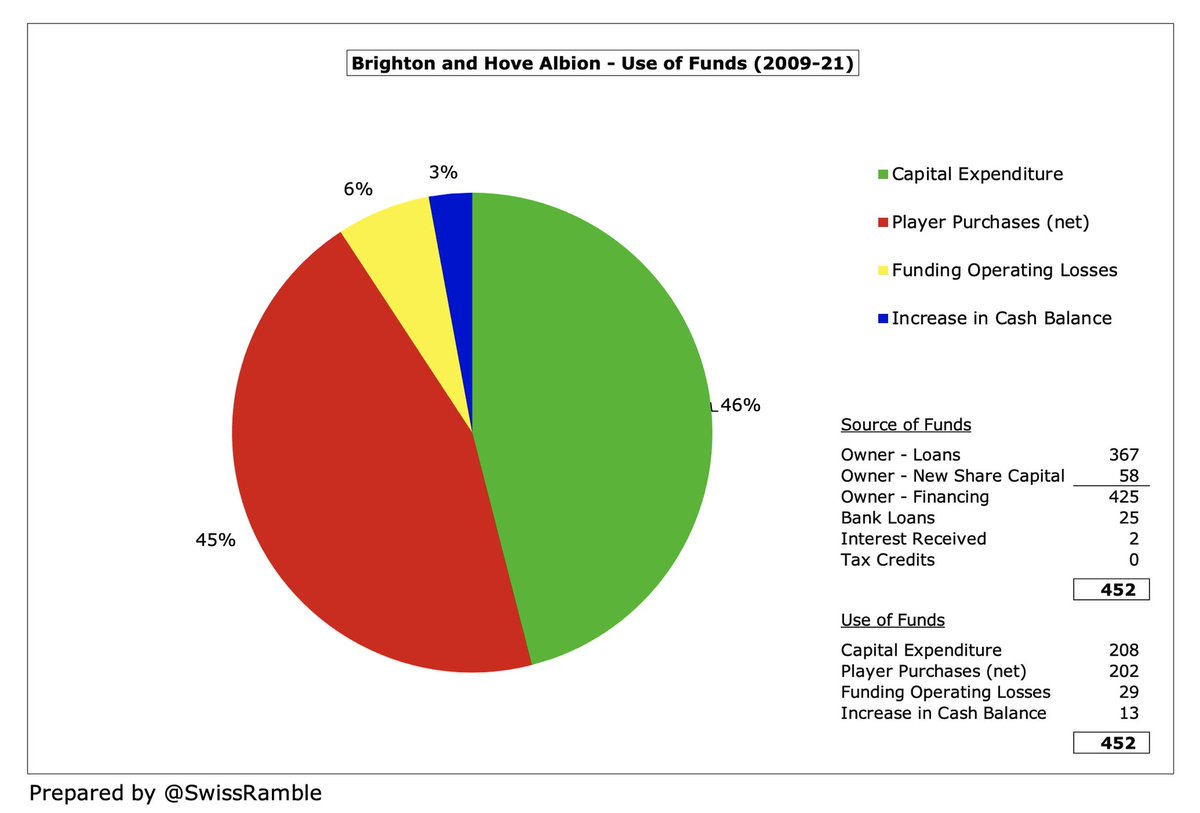

Bloom has now provided an incredible £425m of funding to #BHAFC via £333m of loans and £88m of share capital (including £30m loans converted into equity). In the 5 years up to 2021, his £174m funding was 6th highest among Premier League owners.

Bloom’s funding of #BHAFC has largely been used for investment into the stadium and the training ground (£208m) with another £202m spent (net) on new players, while £29m was used to cover operating losses.

#BHAFC have confirmed compliance with the Premier League’s Profitability and Sustainability (FFP) rules. The £70m loss over the 3-year monitoring period (2019/20 and 2020/21 averaged) is within the £105m limit even before making allowable deductions (including COVID impact).

Bloom said, “Our vision is to be a top ten Premier League club.” If #BHAFC are to achieve this objective, much of the credit should go to their owner and his “very significant” investment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh