Fulham’s financial results for 2020/21 cover a season when they were relegated to the Championship after just a single season in the Premier League, after they finished 18th. Head coach Scott Parker replaced by Marco Silva in July 2021. Some thoughts in the following thread #FFC

#FFC pre-tax loss widened from £48m to £93m, despite revenue doubling from £58m to £116m following promotion to the Premier League, as profit on player sales fell £25m to zero, while expenses increased by £78m (60%) in the top flight (including £21m player impairment).

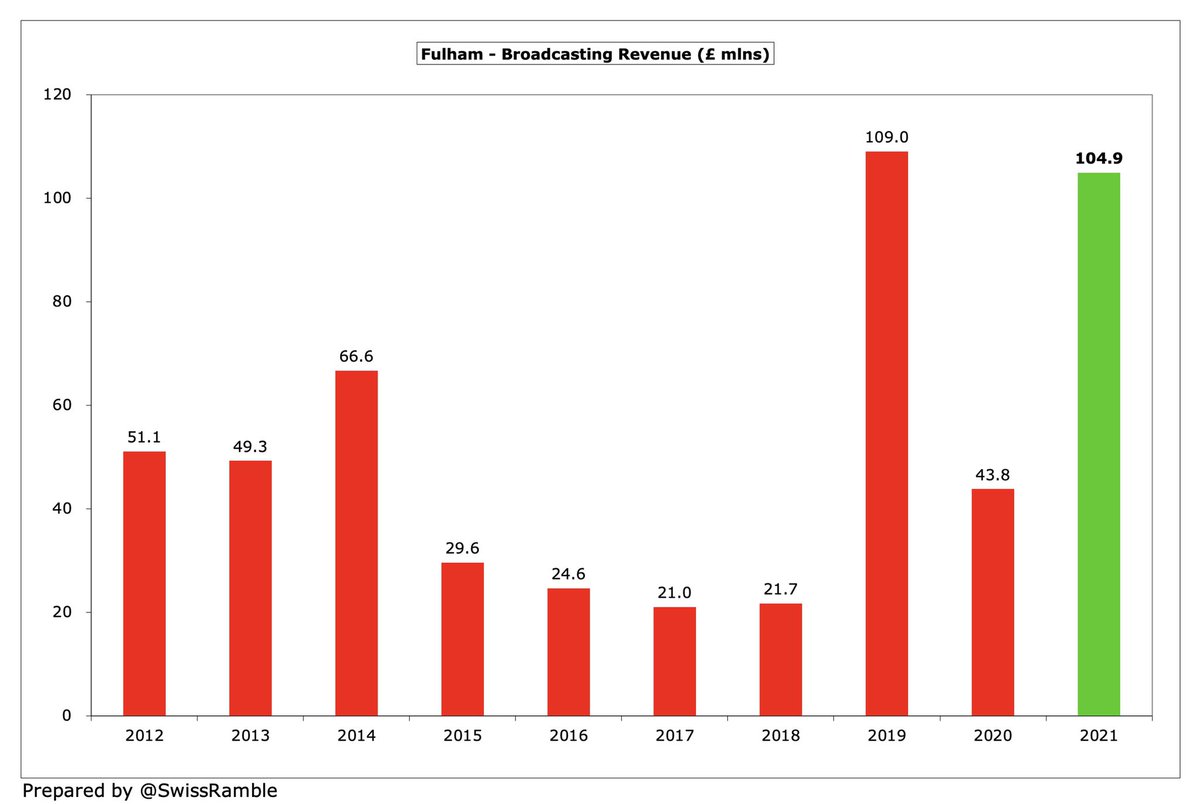

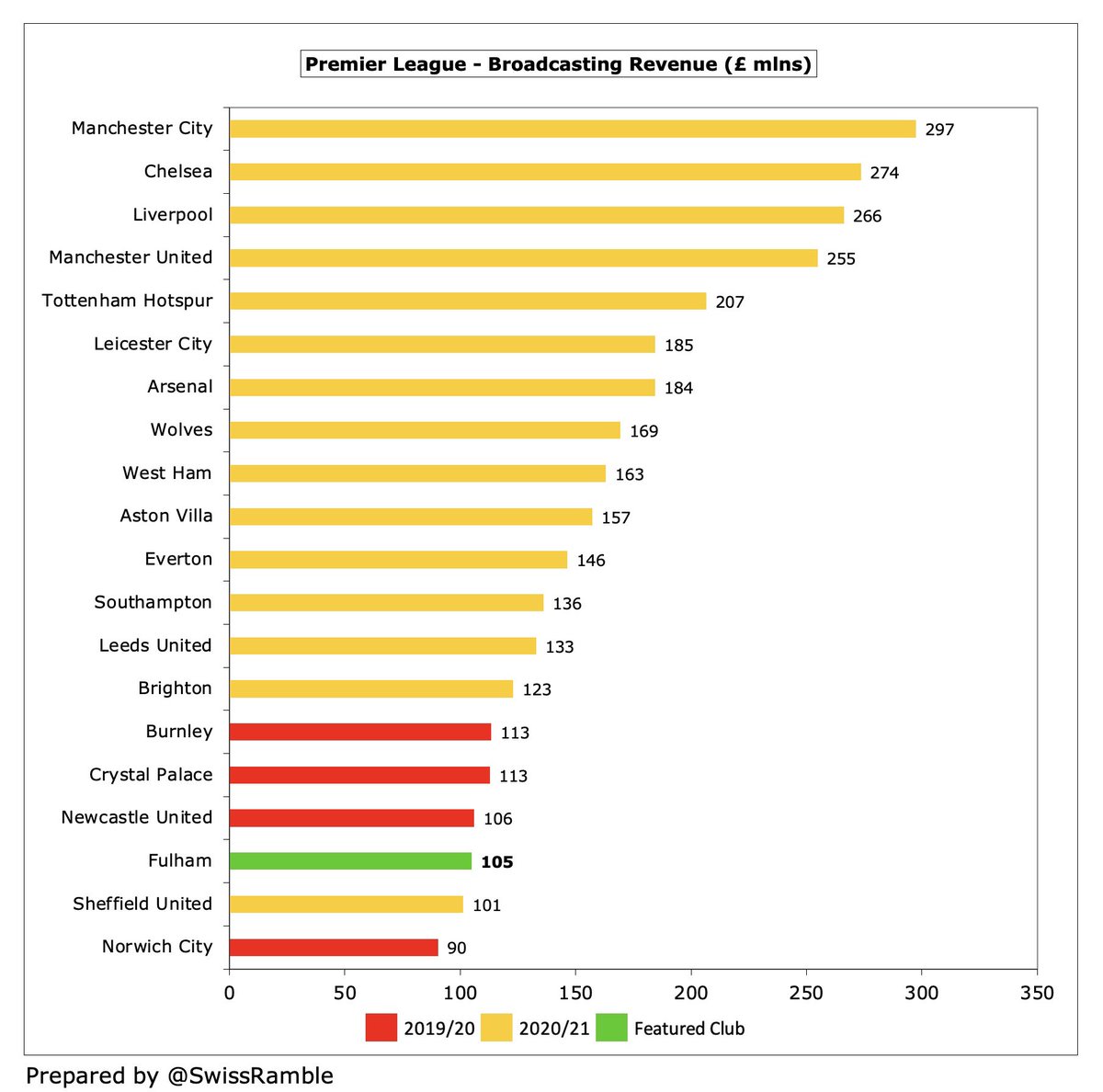

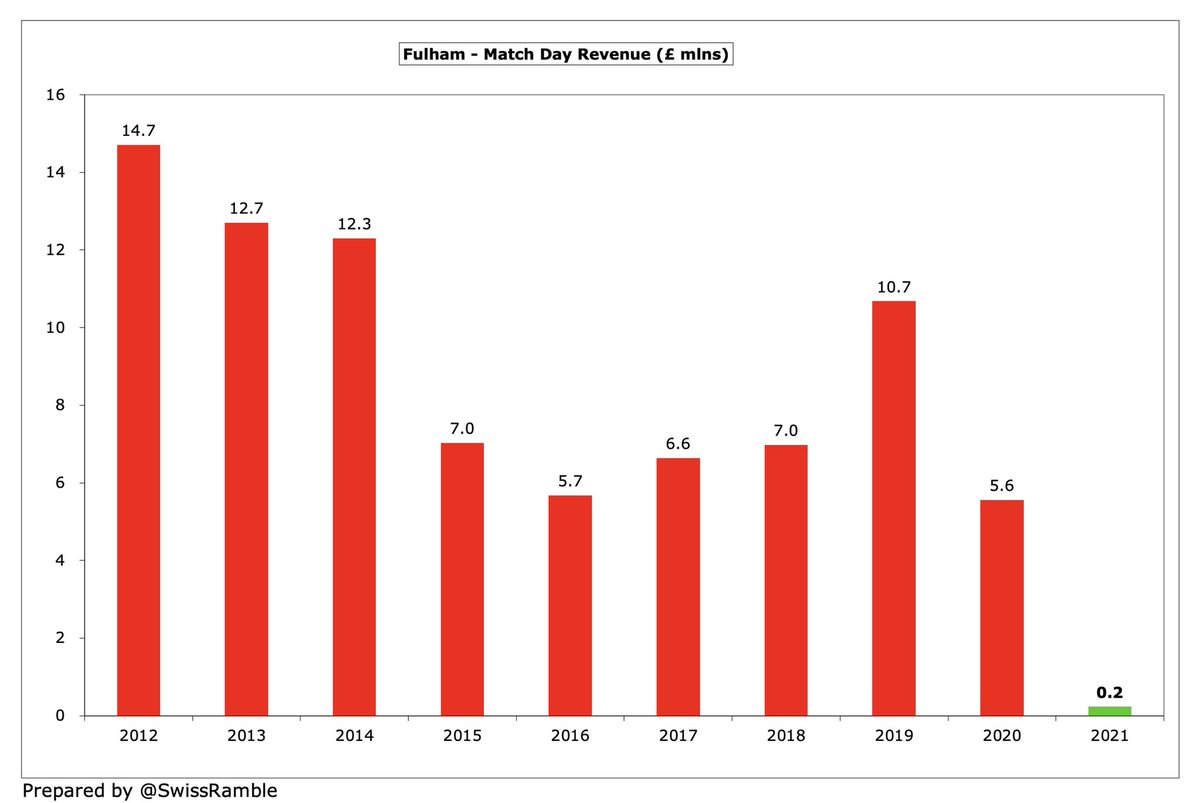

Main driver of #FFC £58m revenue increase was broadcasting, up £61m from £44m to £105m, due to the more lucrative Premier League TV deal, though commercial also grew £2m (26%) to £11m. This offset the COVID driven reduction in gate receipts, down £5.3m (96%) to just £231k.

However, #FFC had significant cost growth, as wages rose £41m (57%) from £73m (including a hefty promotion bonus) to £114m, while player amortisation rose £16m (41%) from £40m to £56m. The club also booked £21m impairment to reduce player values.

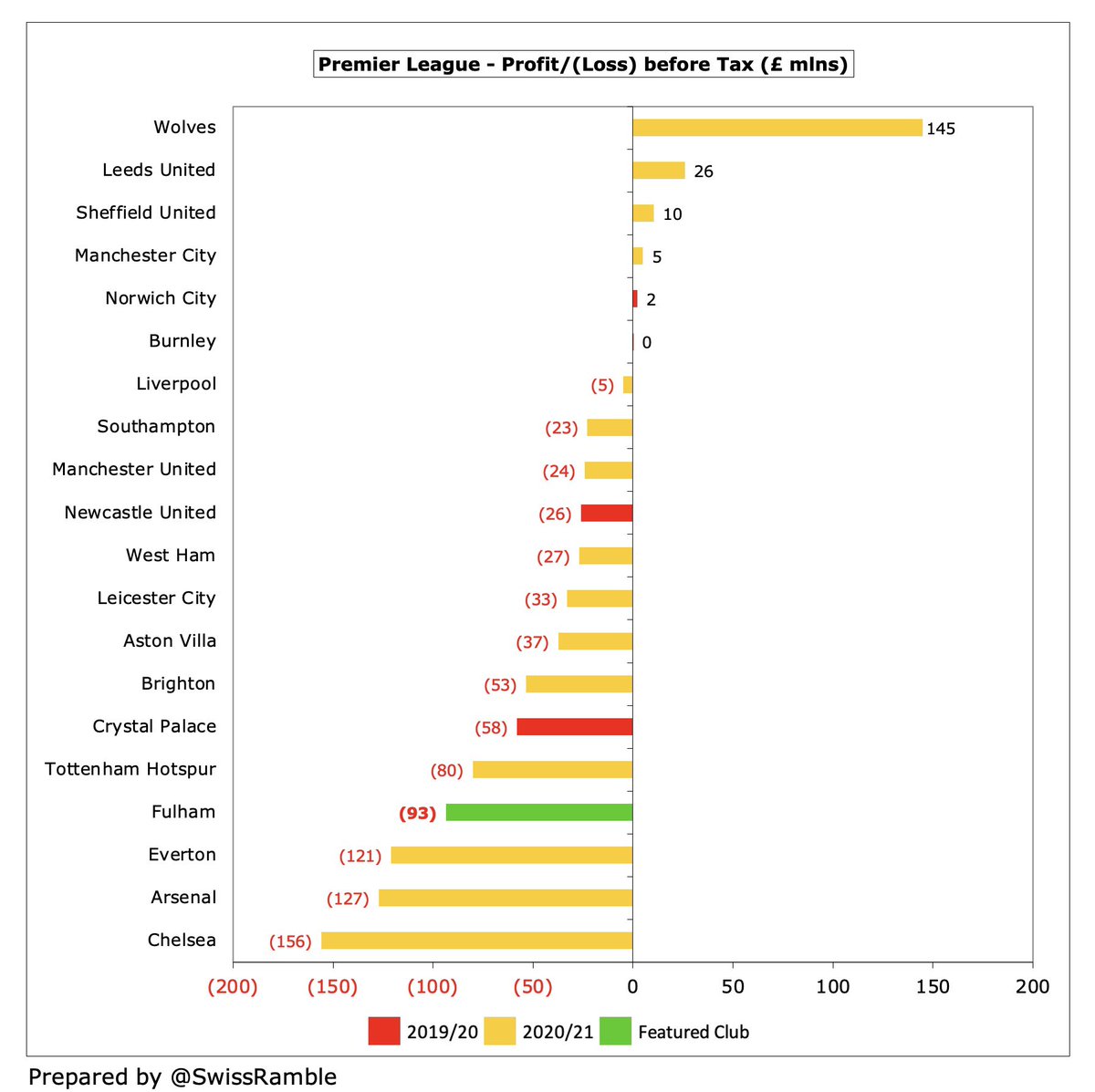

A full year of the pandemic meant some very large losses in the Premier League, though #FFC £93m was one of the highest, only surpassed by #CFC £156m, #AFC £127m and #EFC £121m. In contrast, #LUFC posted a £26m profit after promotion. #WWFC profit included £127m loan write-off.

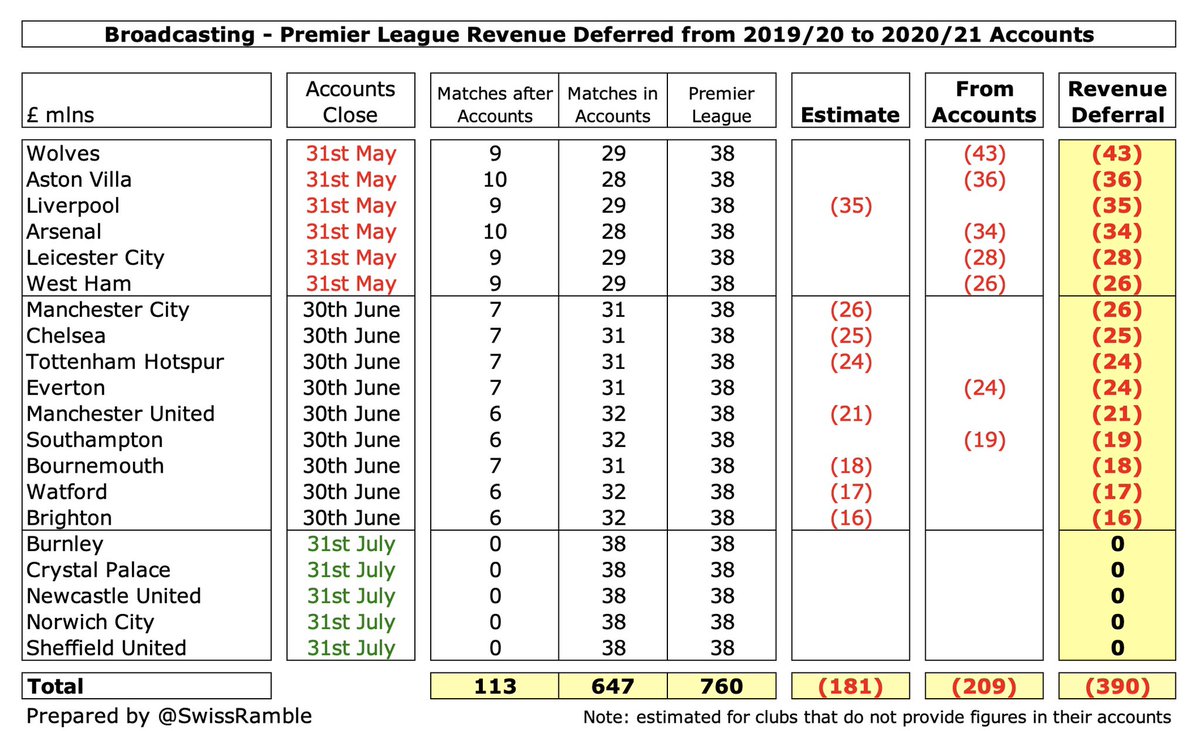

I estimate #FFC 2020/21 revenue loss due to COVID as £23m (match day £10m, commercial £7m & broadcasting £5m), partly offset by £6m TV money deferred from 2019/20 for games played after the 30th June accounting close. That gives £26m total revenue impact in last 2 years.

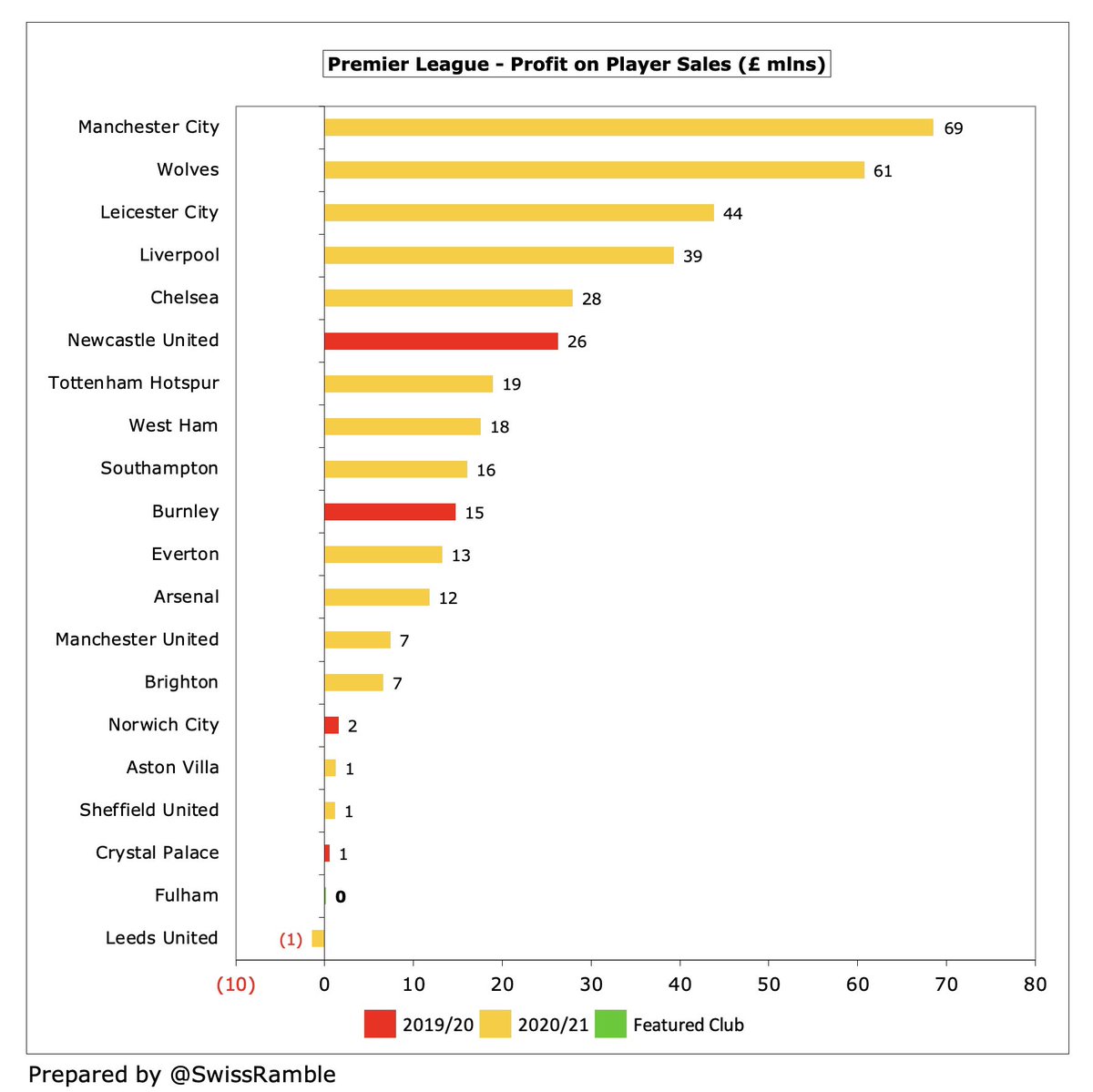

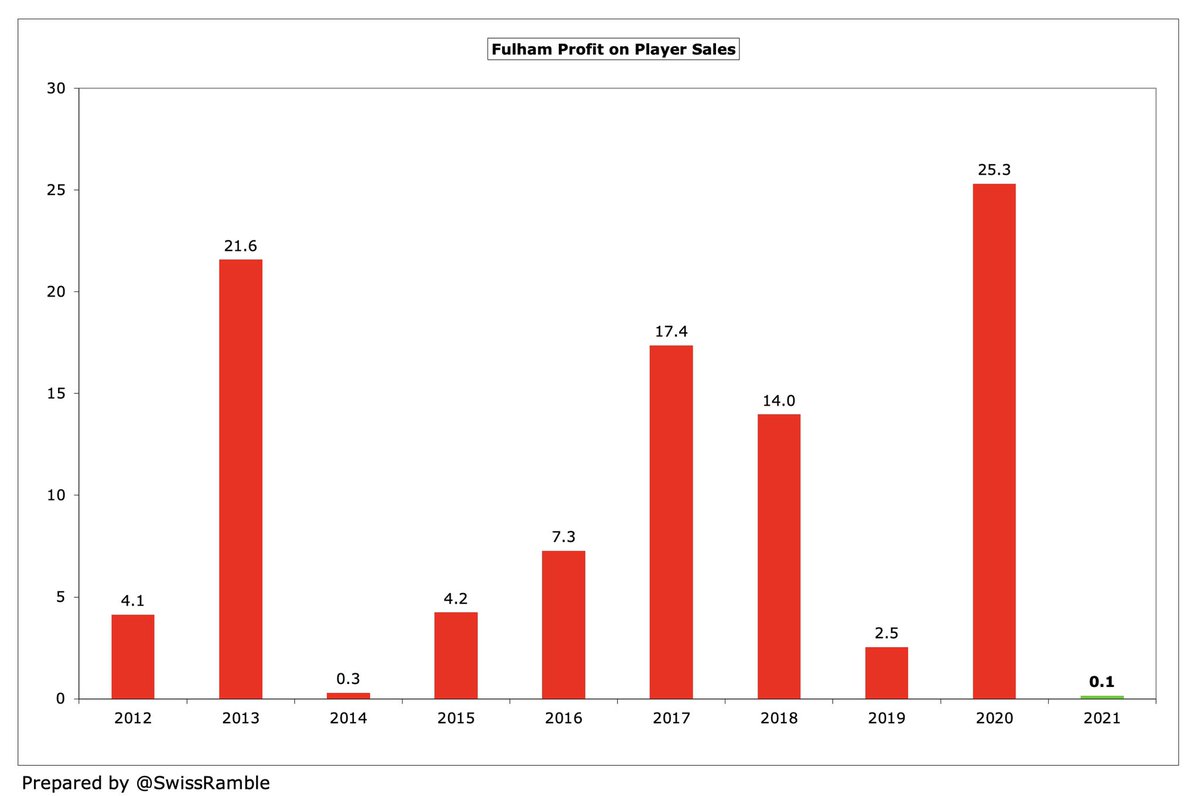

#FFC loss was not helped by the absence of profit from player sales, which dropped from £25m (Ryan Sessegnon to #THFC) to just £146k. This was one of the worst player trading results in the Premier League, miles below the likes of #MCFC £69m, #WWFC £61m and #LCFC £44m.

Losses are nothing new for #FFC, as the last time they made a profit was in 2011. Since Shahid Khan bought the club in July 2013, they have posted £301m losses, averaging £38m a year. In fact, the losses have been accelerating with £207m in the last 4 years (£52m average).

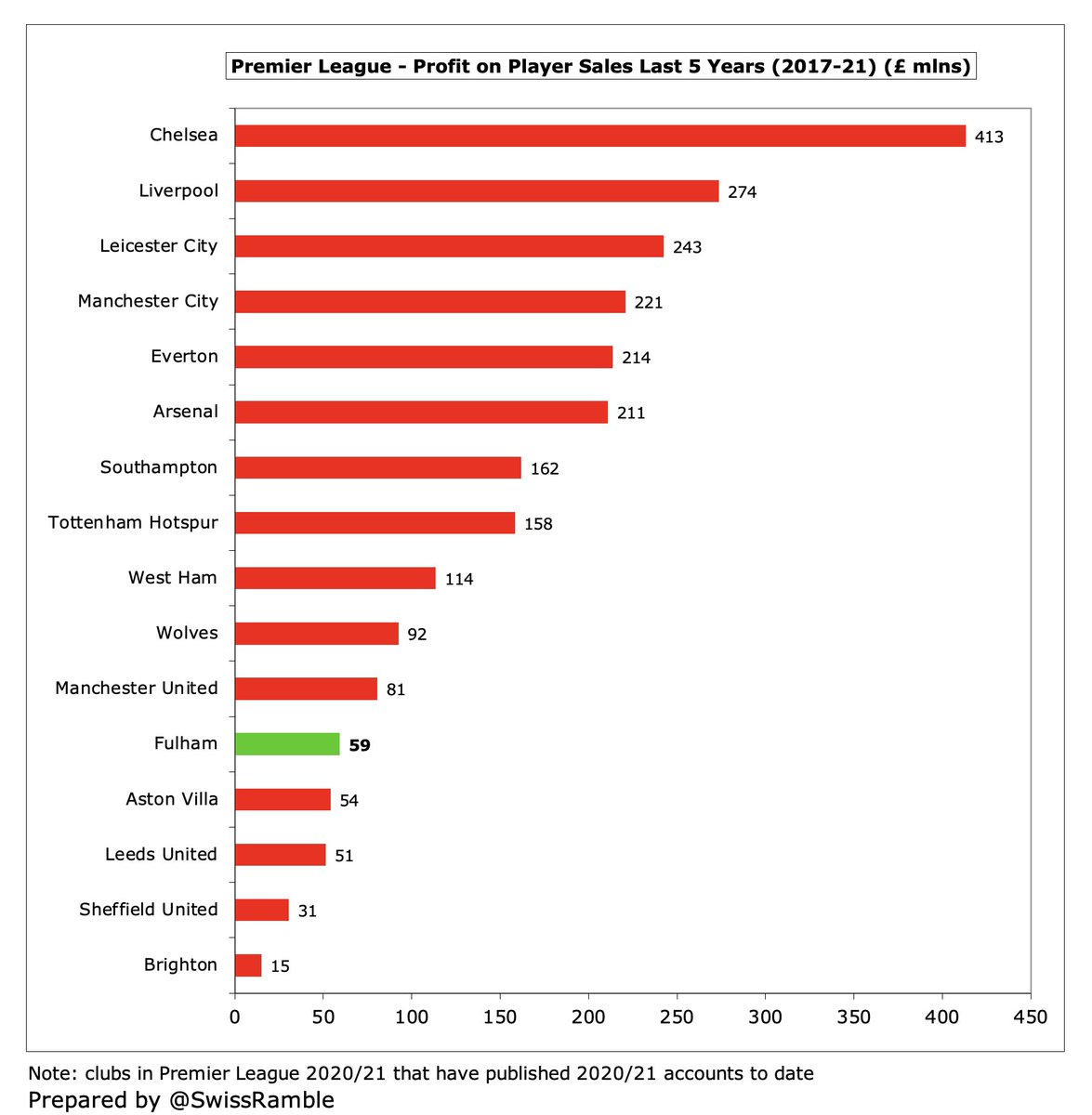

#FFC have not made much money from player sales with only £59m in total in the last 5 years, which is much lower than others, e.g. their West London neighbours #CFC made £413m in that period. It will be much the same this season with only £5m profit (per the accounts).

#FFC operating loss (i.e. excluding player sales and interest) increased from £73m to £94m, which was one of the worst in the Premier League, only better than #CFC £159m and #EFC £118m. This was significantly higher than the £23m loss the last time they were in the top flight.

#FFC £116m revenue is £22m (16%) lower than the pre-pandemic peak of £138m in 2019 with all streams lower. The largest reduction is match day, down £10m, as games were played behind closed doors, followed by commercial £7m and broadcasting £4m.

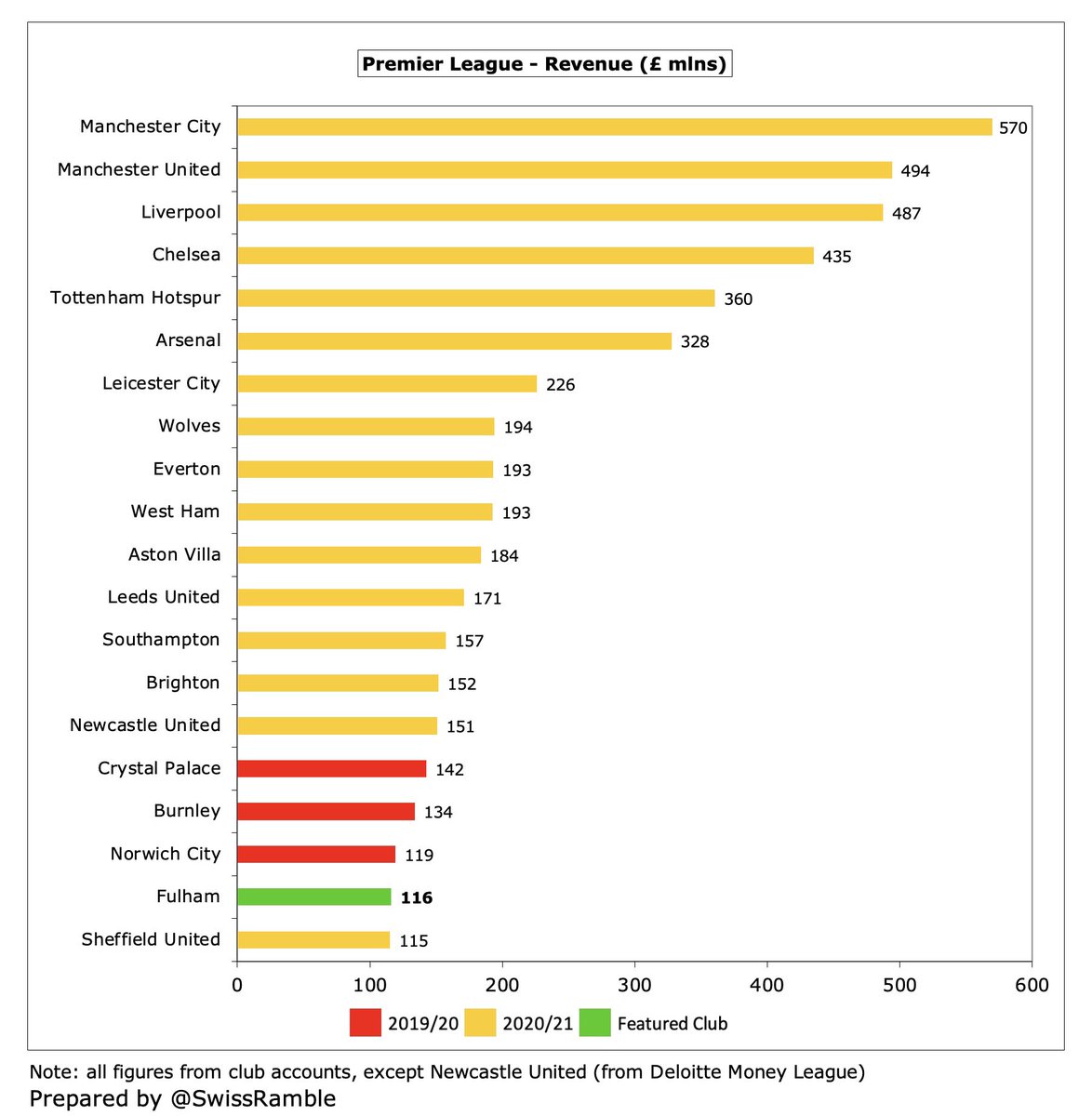

Despite revenue doubling after promotion, #FFC £116m revenue was second lowest in the Premier League, only above #SUFC £115m. For context it was around a fifth of #MCFC £570m. This season’s rankings distorted by different amounts of revenue deferred from 2019/20 accounts.

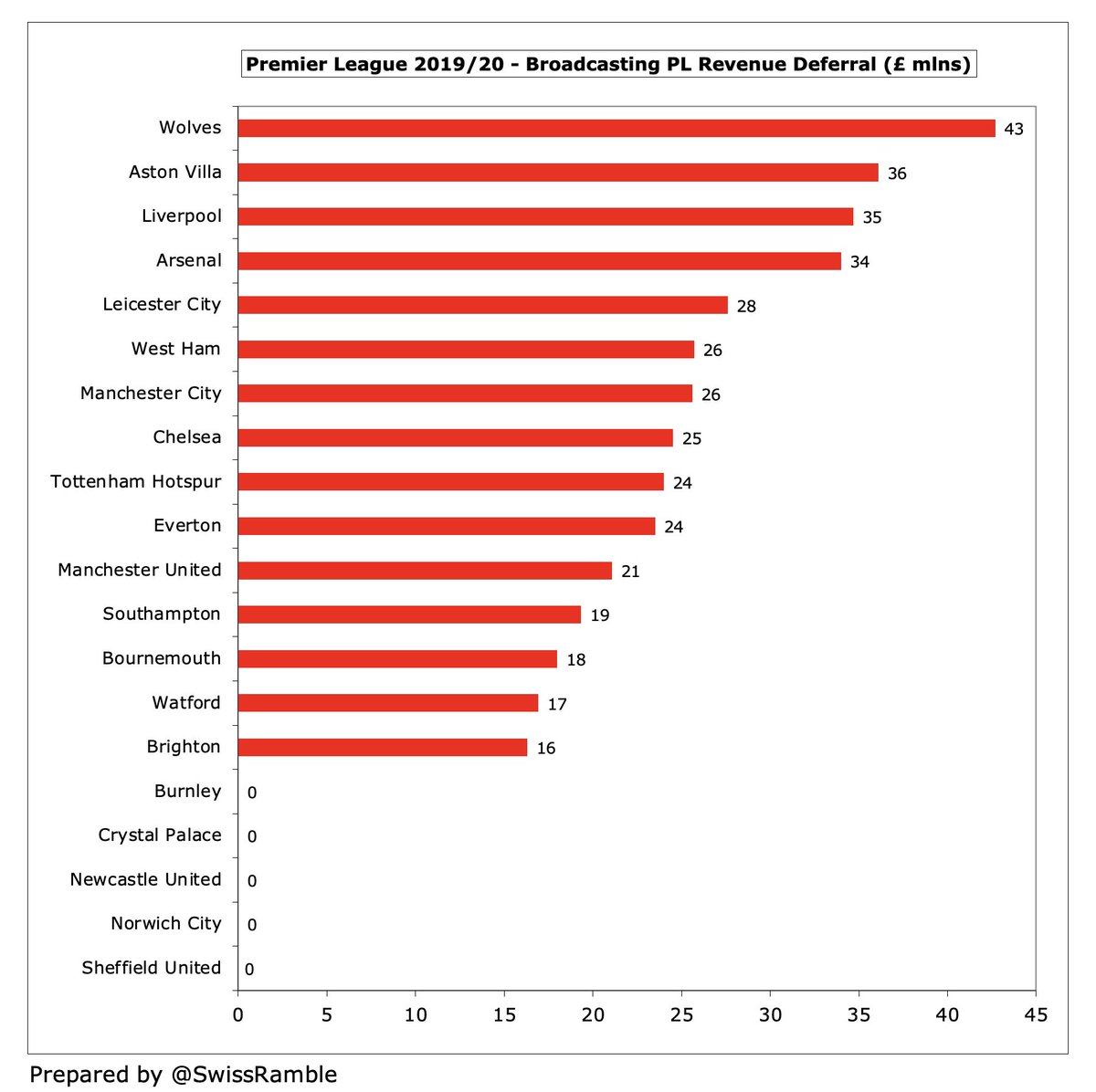

As the 2019/20 season was extended, many clubs deferred revenue into 2020/21 for games played after the accounting close. Those clubs with a May year-end benefited the most with the largest deferrals, while those with a July close deferred nothing. I estimate £6m for #FFC.

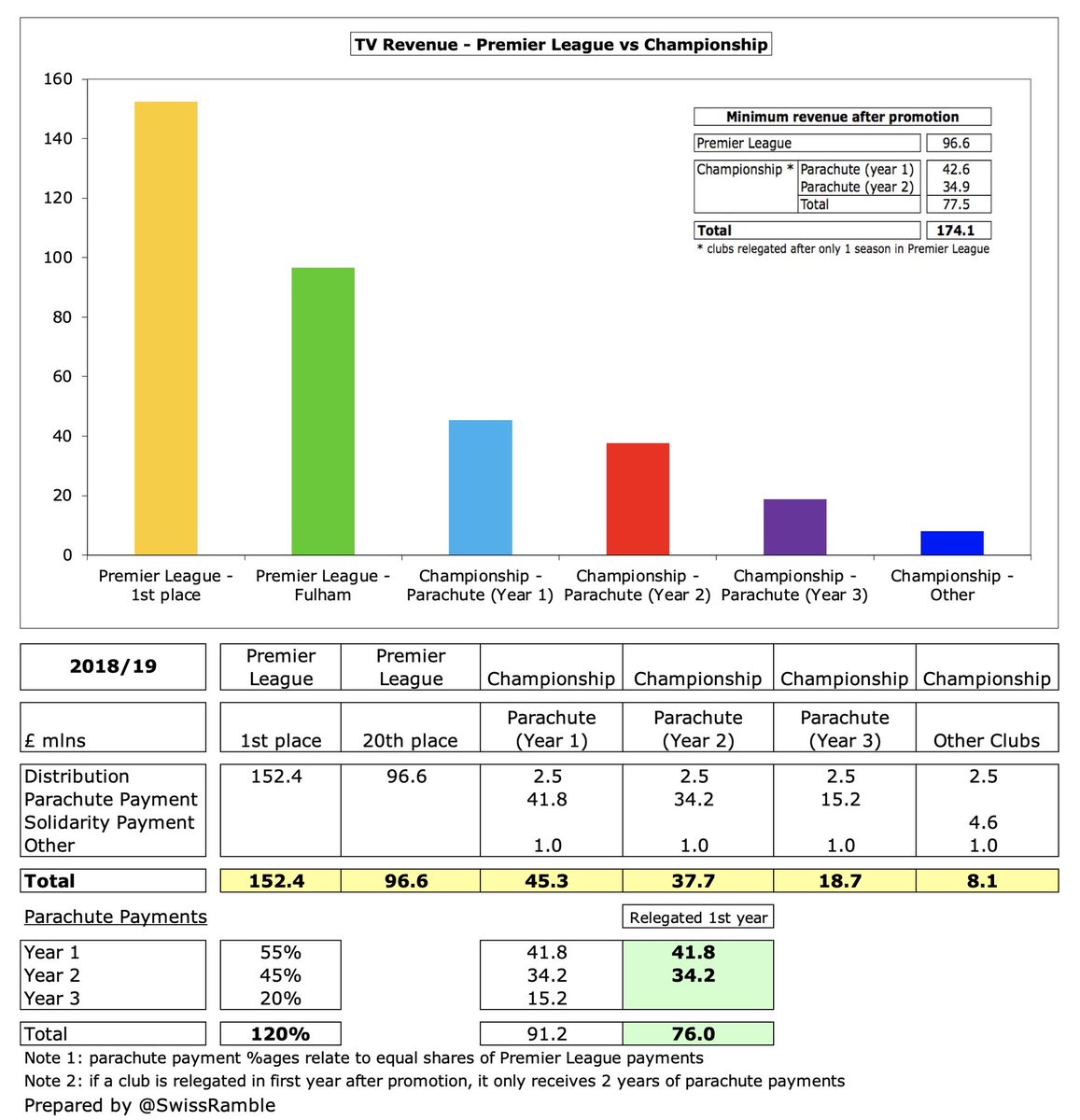

#FFC broadcasting income shot up by £61m from £44m to £105m, the club’s second highest ever from this revenue stream. As Fulham’s 2019/20 income included parachute payments, their growth was smaller than a promoted club without those benefits.

As #FFC were relegated after only one season in the Premier League, they only get 2 years of parachutes (instead of usual 3 years). 2020/21 details not published, but in 2019/20 a relegated club received £42m in year one. If Fulham are promoted, this becomes a moot point.

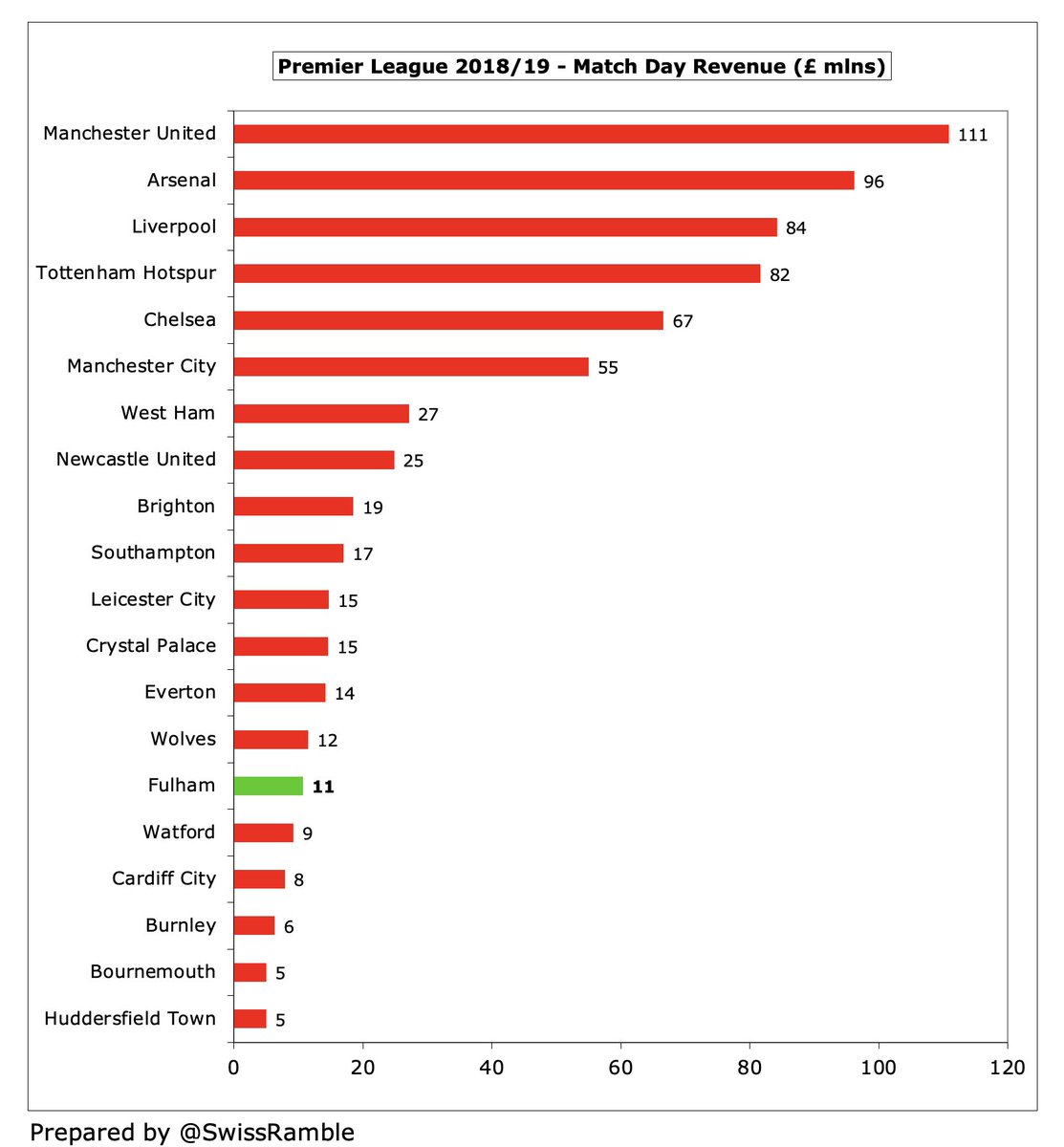

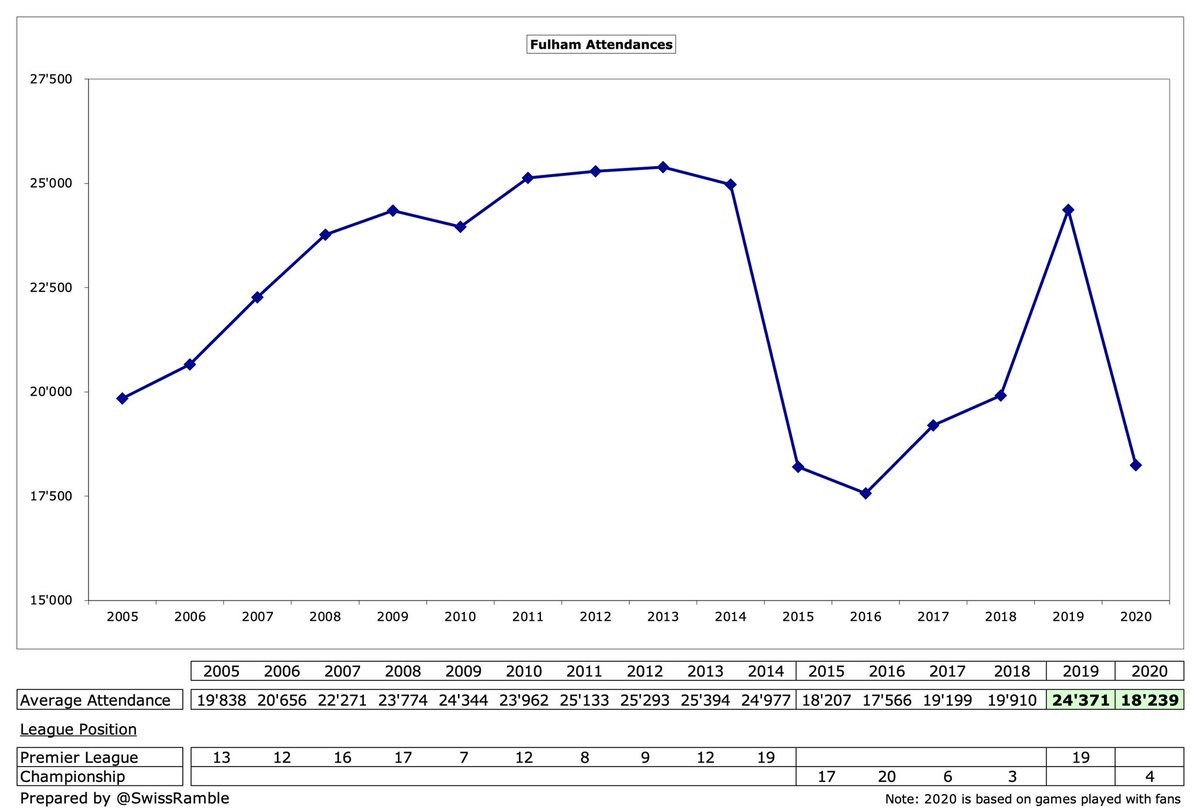

#FFC gate receipts fell £5.3m (96%) to just £231k, as all home games were played behind closed doors (with the exception of two with restricted capacity). Down from £11m pre-pandemic in 2019, but this was firmly in the bottom half of the Premier League.

#FFC 2019/20 average attendance in the Championship of 18,239 (for games played with fans) was around 6,000 (25%) less than the 24,371 they achieved in the 2018/19 Premier League. However, that was still one of the lowest in the top flight.

The expanded Riverside Stand at Craven Cottage will increase capacity from 25,700 to 29,600. #FFC described this as a “game changer”, though fans are unhappy with £1,000 season tickets (£500 for under-18s). Significant funds from the owner required to complete the development.

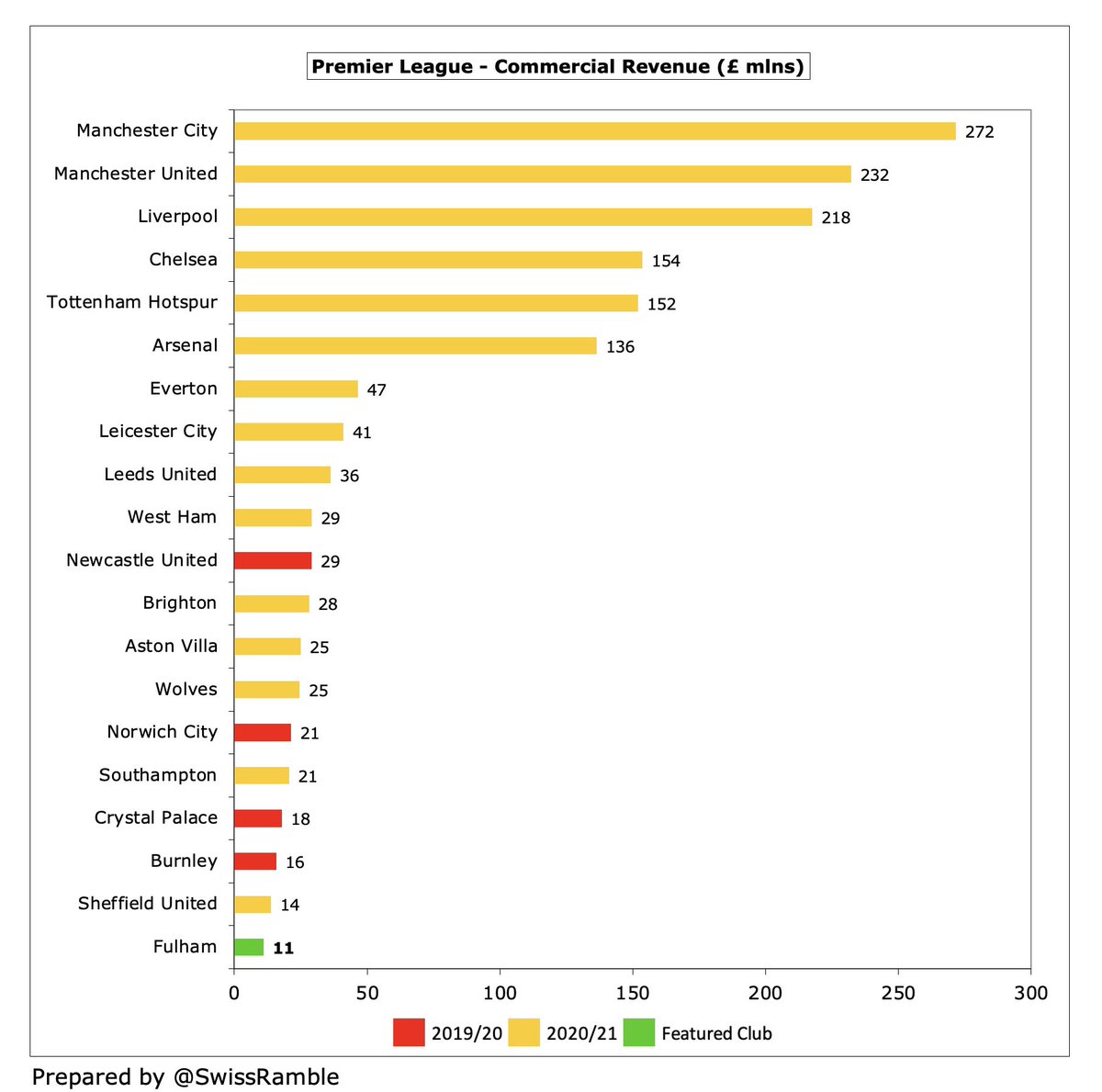

#FFC commercial income rose £2.3m (26%) from £8.7m to £11m, though this was a fair bit lower than the £18m they made the last time they were in the Premier League, partly due to COVID. This was the lowest in the top flight, miles below #MCFC £272m, but also less than #SUFC £14m.

#FFC shirt sponsorship was with BetVictor in 2020/21 (reportedly £3m a year), but has been replaced by blockchain network World Mobile in a 3-year deal from 2021/22. The Adidas kit supplier deal was extended to 2023. New sleeve sponsor, ClearScore, in 2020/21.

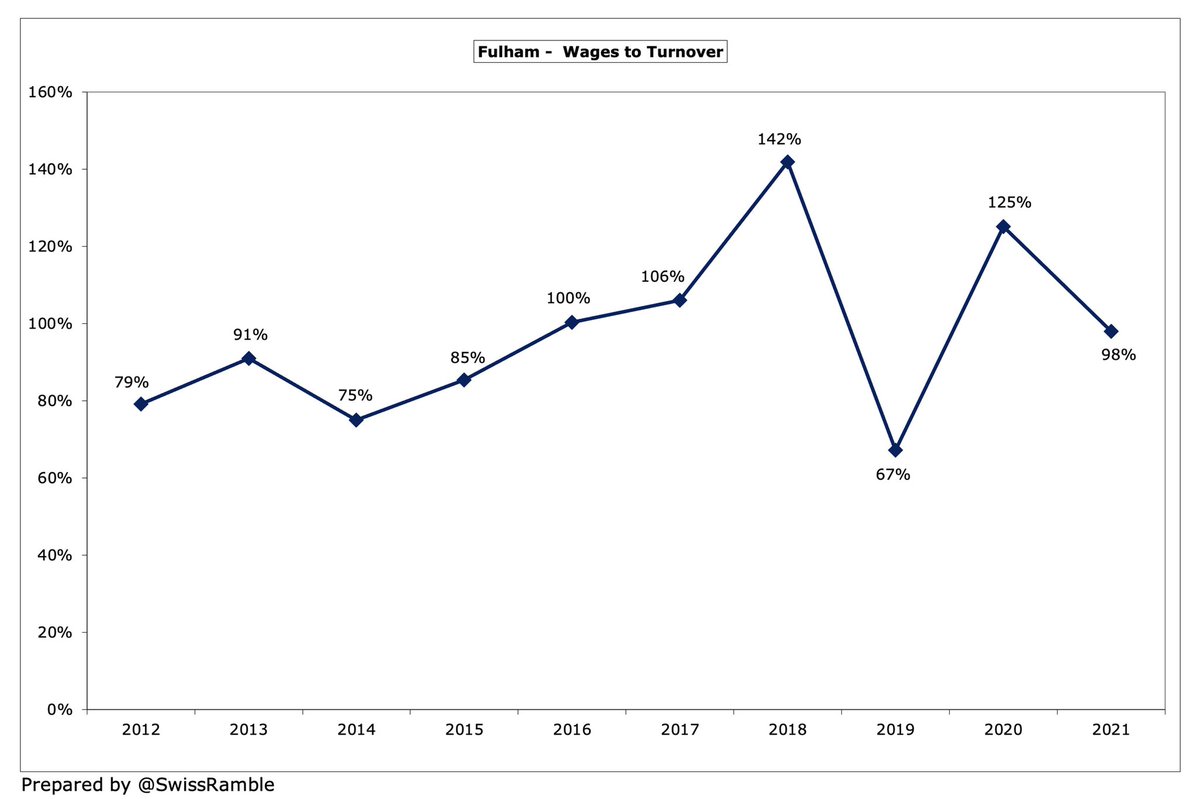

#FFC wages rose significantly by £41m (57%) from £73m (including promotion bonus) to £114m, easily a club record and £21m higher than the last time they were in the Premier League. Would have been higher if they had avoided relegation, as they would have paid a survival bonus.

Even after the increase, #FFC £114m wage bill was firmly in the bottom half of the Premier League, though it was higher than a few clubs that retained their status in the top tier, e.g. #SaintsFC £113m, #BHAFC £109m and #LUFC £108m.

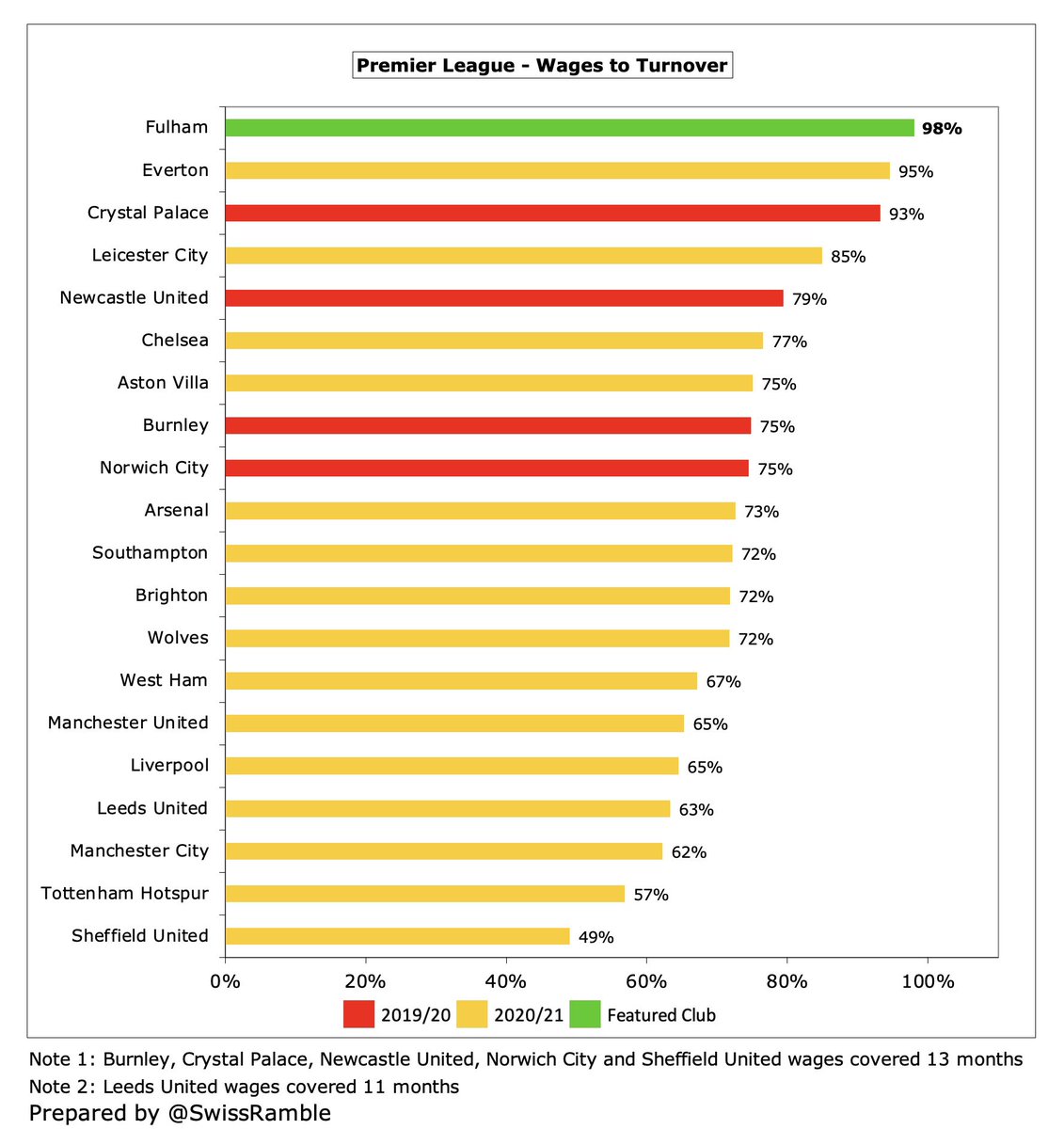

Following promotion #FFC wages to turnover ratio decreased from 125% in the Championship to 98% in the Premier League, though this was the highest (worst) in the division. Even if COVID impact were excluded, I estimate the ratio would still be as high as 86%.

Remuneration for #FFC highest paid director, presumably chief executive Alistair Mackintosh, rose 43% from £948k to £1.4m, similar to last time in the Premier League. This was 7th highest in the top flight, though far below Ed Woodward at #MUFC £2.9m & Daniel Levy at #THFC £2.7m.

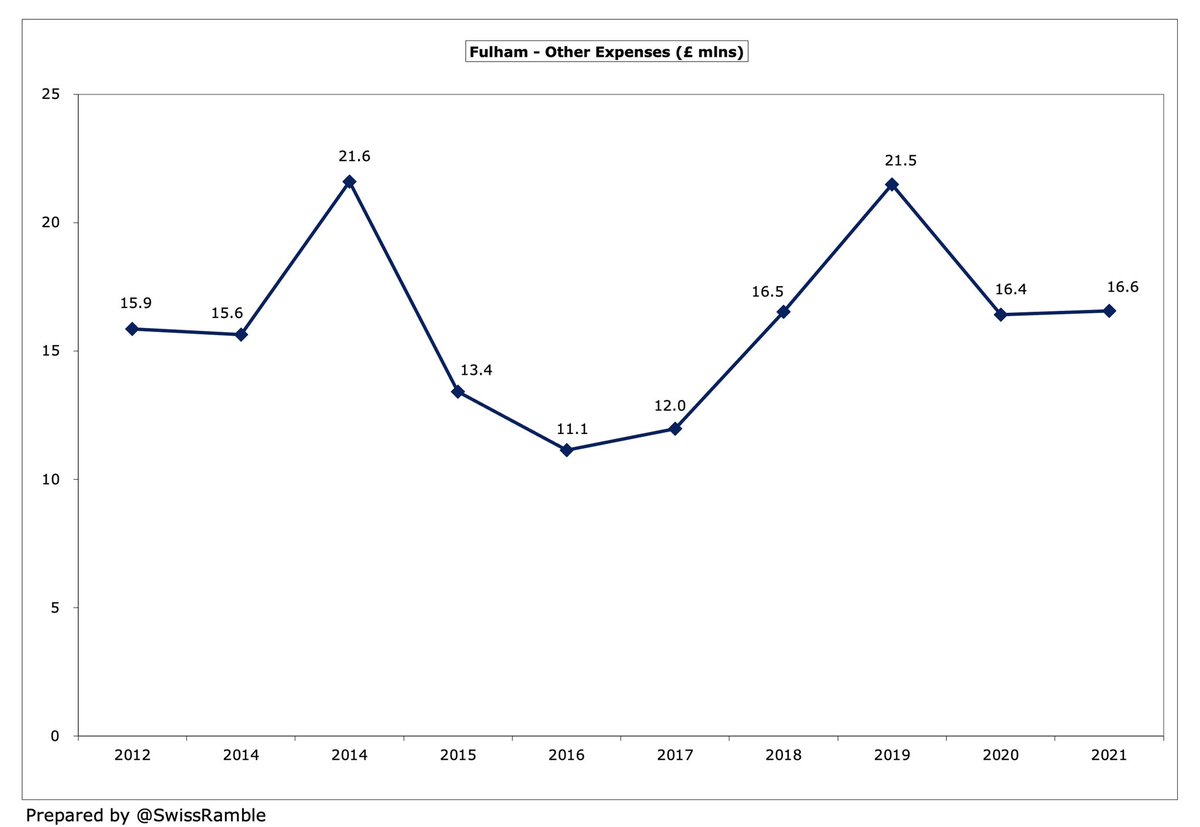

#FFC other expenses were slightly higher at £16.6m, though this was £4.9m lower than the last time they were in the Premier League, partly due to the reduced cost of staging games without fans.

#FFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £16m (41%) from £40m to £56m, a new club record. This was around mid-table in the Premier League, sandwiched between #WHUFC £58m and #AVFC £56m.

In addition, #FFC booked £21m player impairment to reflect lower values in a COVID-impacted transfer market. Over the last two years only #EFC £42m is higher, which is either an indicator of poor recruitment or good financial planning (as this reduces future amortisation).

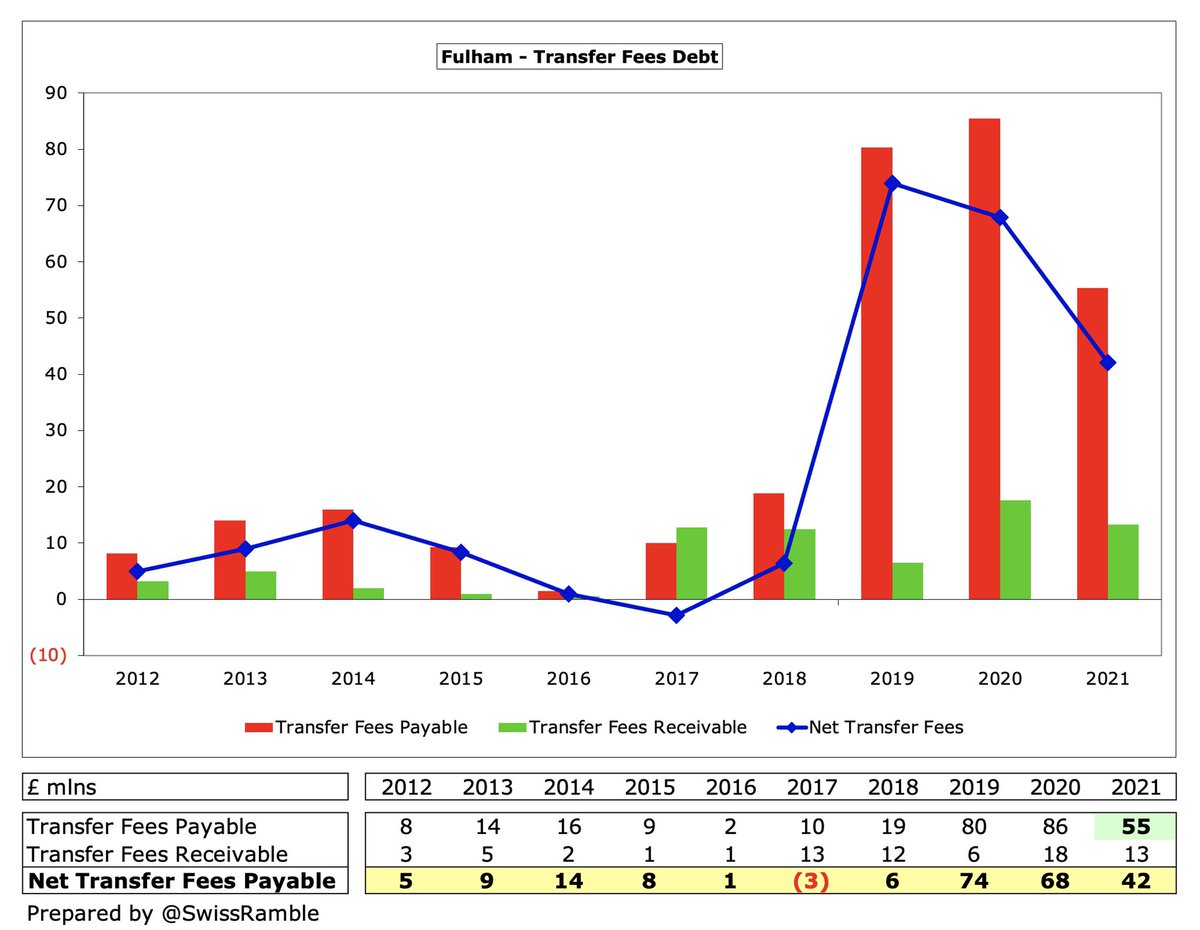

#FFC spent £51m on players, including Anthony Knockaert, Harrison Reed, Terence Kongolo and Kenny Tete. Lower than prior year’s £53m in the Championship and less than half the record £120m outlay two years ago. In the bottom half of the Premier League, just below #WHUFC £54m.

Nevertheless #FFC have spent nearly quarter of a billion (£224m) on player purchases in the last three years, though they have been more frugal since then, as the accounts note that the cost of acquiring new players since year-end was only £18m (Harry Wilson and Rodrigo Muniz).

#FFC gross debt is less than £1m, despite Shahid Khan loaning an additional £151m in 2020, as he converted this into equity. An incredible £653m of debt has now been “written-off” in this way (£441m by Khan plus £212m by former owner Mohamed Al Fayed).

As a result of the significant conversion of loans into capital, #FFC £1m debt is unsurprisingly one of the smallest in the Premier League far below #THFC £854m (stadium), #MUFC £530m (Glazer’s leveraged buy-out), #EFC £379m and #BHAFC £374m (latter two “friendly” owner loans).

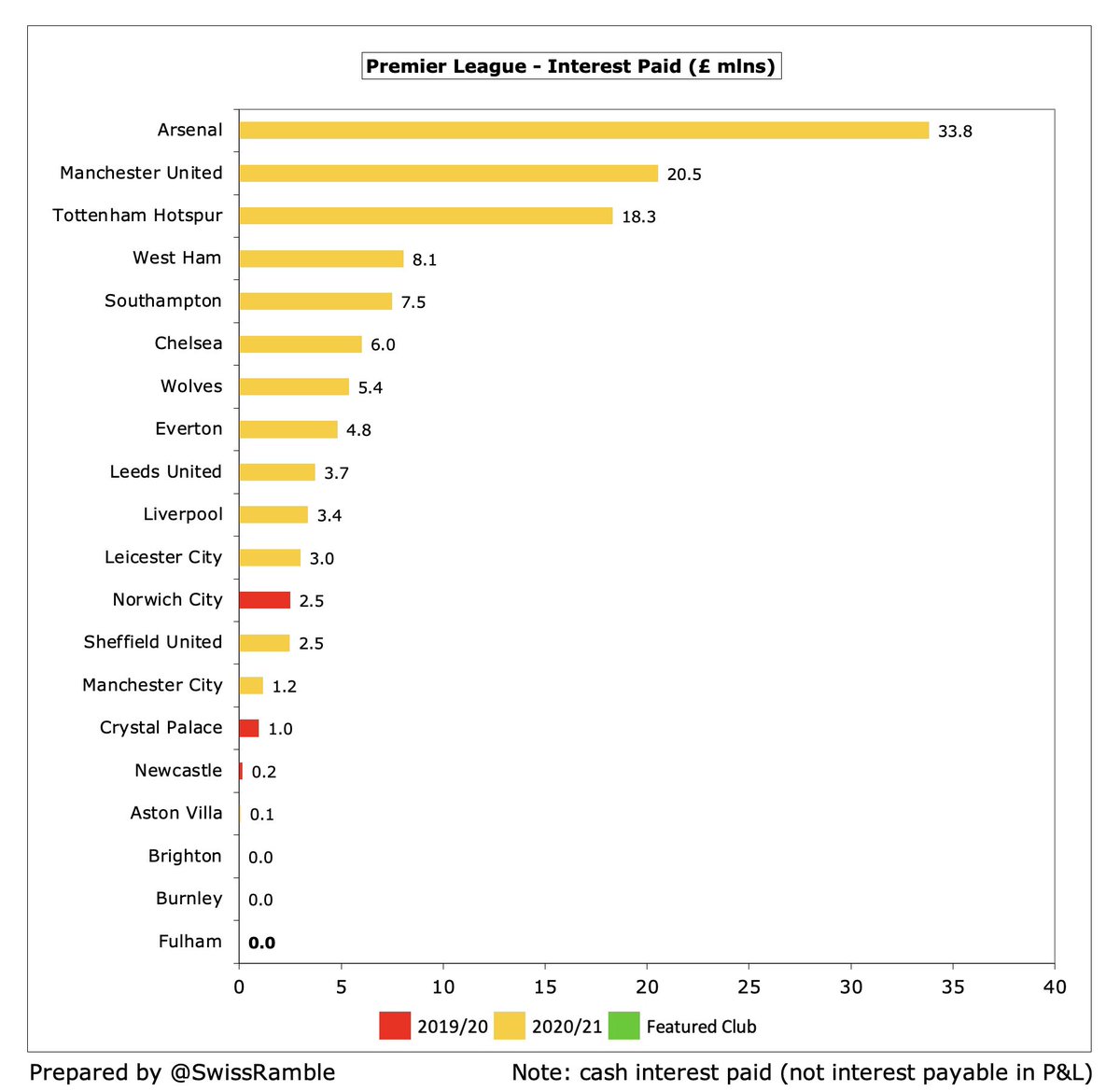

Consequently, #FFC paid no interest, which gives them a competitive advantage against many other clubs who have to pay interest on their loans. Some had very high charges in 2020/21, e.g. #AFC £34m (debt refinancing break fee), #MUFC £21m and #THFC £18m.

#FFC cut their transfer debt from £86m to £55m, though this was just £2m in 2016. This means that much of the player recruitment has been done on credit. On the low side for the Premier League, far below #THFC £170m. Partly offset by £13m owed to Fulham by other clubs.

#FFC £94m operating loss became £18m negative cash flow after adding back £79m amortisation/depreciation less £3m working capital moves, but then spent £76m on players (purchases £82m, sales £6m) and £58m on infrastructure (mainly Riverside Stand). Funded by £151m loan from Khan.

As a result, #FFC cash balance fell £1m to £18m, one of the lowest in the Premier League, e.g. #THFC and #MUFC have £148m and £111m respectively, though Khan has confirmed his support.

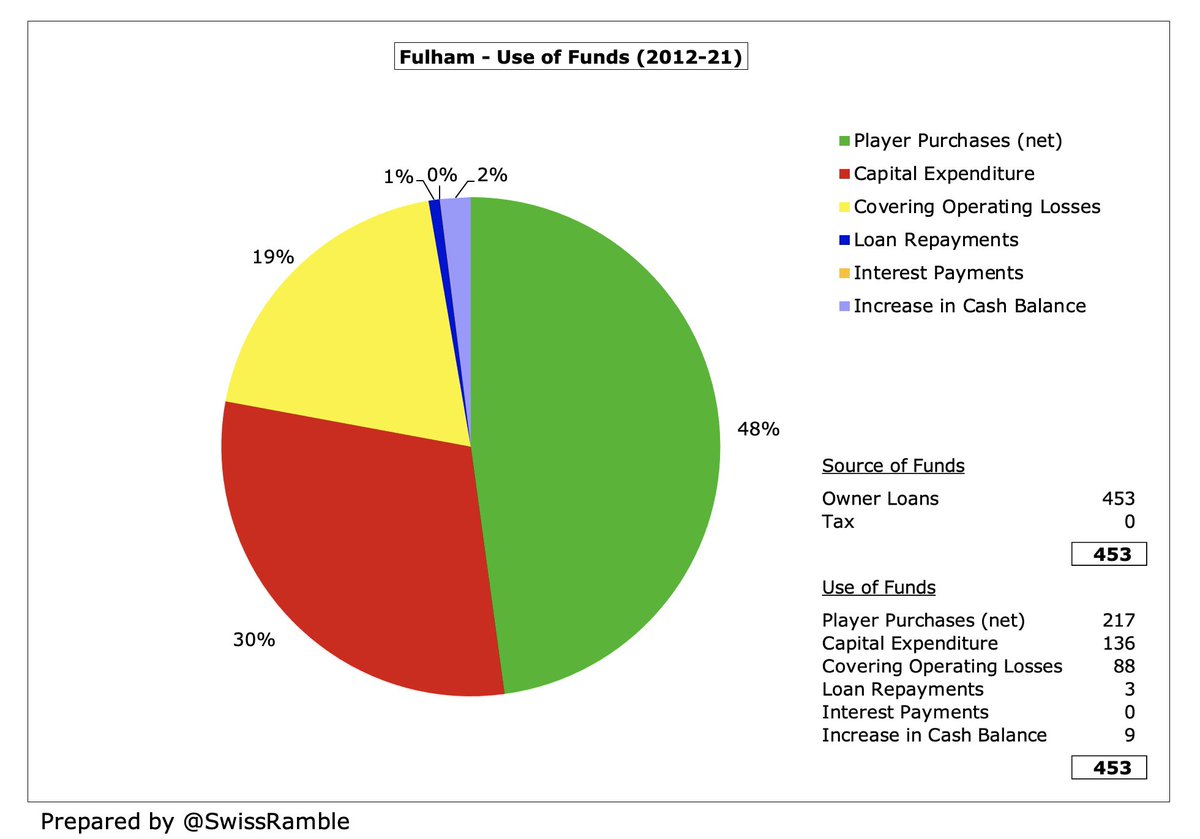

In the last decade all of #FFC £453m available cash has come from the owners’ pockets with £217m used for player purchases (net), £136m on infrastructure, £88m to cover losses and £3m on loan payments. Cash balance increased by £9m.

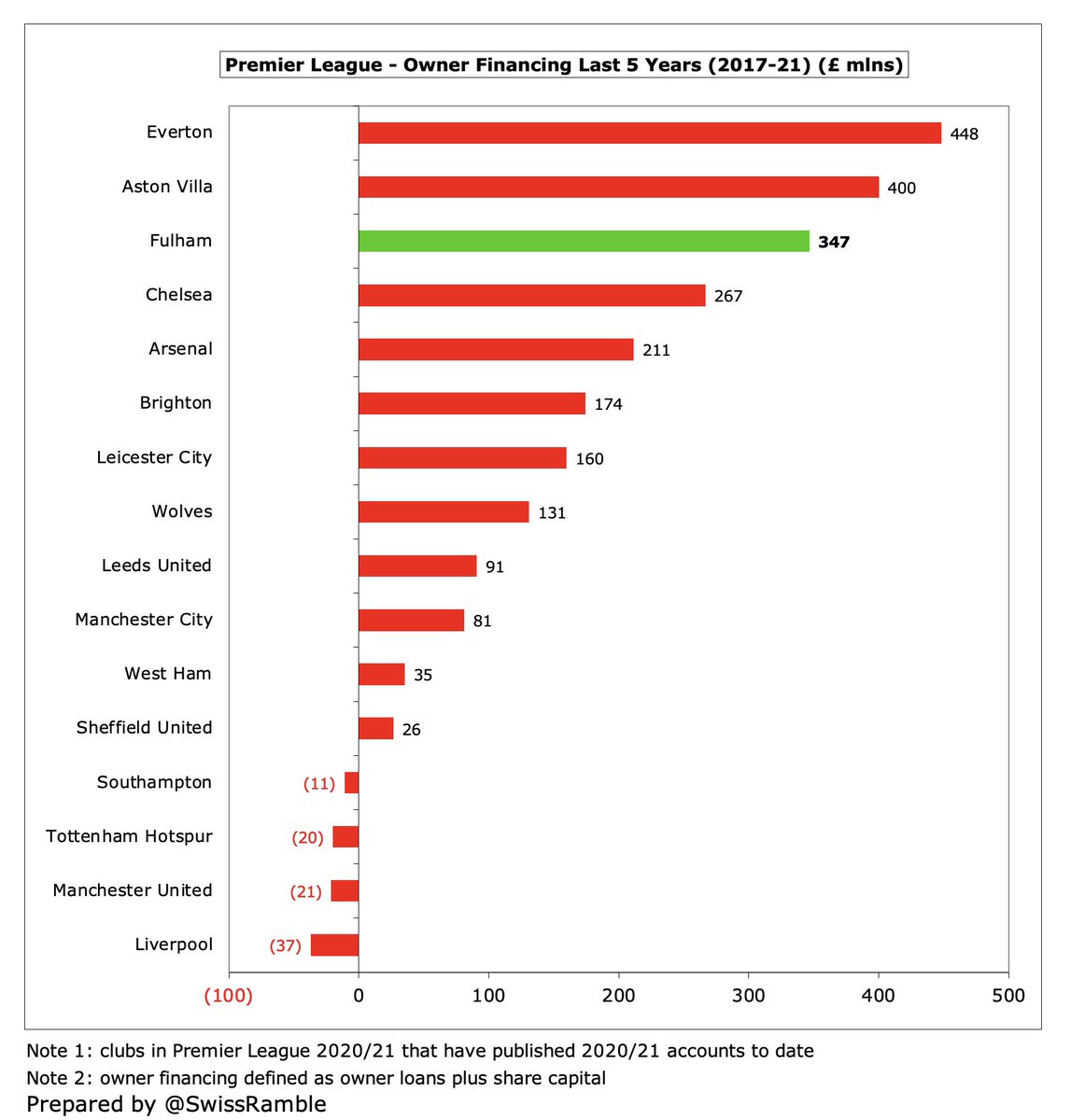

Khan has now provided #FFC with £654m funding, all converted to equity, including £244m in the last 2 years alone (£151m in 2021 and £93m since year-end). For context, only the owners at #EFC and #AVFC have put in more money in the 5 years up to 2021.

Despite the large losses, my model suggests that #FFC were OK with Profitability & Sustainability rules, as they were just about within the limit over the 3-year monitoring period after taking into consideration allowable deductions, promotion bonus and COVID impact.

#FFC again made a huge loss in 2021, partly due to the pandemic, but they are lucky that owner Shahid Khan continues to provide significant financial support. Unfortunately, they were immediately relegated from the Premier League, but do look odds on to bounce back this season.

• • •

Missing some Tweet in this thread? You can try to

force a refresh