Let’s understand if Indian Markets are currently overvalued or undervalued. A Thread 🧵

#macroeconomics #economy #India #MSCI #Nifty #SP500

@SahilKapoor @ankitapathak_ @avasthiniranjan @WeekendInvestng @virtual_kg @564pankaj @JustPunforfun @JustNifty @raggy_k @pprao

#macroeconomics #economy #India #MSCI #Nifty #SP500

@SahilKapoor @ankitapathak_ @avasthiniranjan @WeekendInvestng @virtual_kg @564pankaj @JustPunforfun @JustNifty @raggy_k @pprao

For this we need to understand P/E ratio. It basically tells us the number of years at constant profits it will take to return the investment.

It tends to capture the agony and ecstasy of the market.

It tends to capture the agony and ecstasy of the market.

In bear phase investors are despondent about the future, P/E ratios of companies and indices will contract. Exactly opposite happens in bull phase.

Forward PE Ratio:

It is a version of the P/E ratio that uses forecasted earnings for the P/E calculation.

The earnings used in this formula are just an estimate and not as reliable as current or historical earnings data

It is a version of the P/E ratio that uses forecasted earnings for the P/E calculation.

The earnings used in this formula are just an estimate and not as reliable as current or historical earnings data

Present Nifty PE is 22.2

Forward P/E ratio is 19 - 20x; which is close to its historical average P/E of 19.

The valuations of India's equity market have fallen this year.

Nifty 50 index saw its highest P/E ratio ~ 40x in Feb-Mar’21.

Forward P/E ratio is 19 - 20x; which is close to its historical average P/E of 19.

The valuations of India's equity market have fallen this year.

Nifty 50 index saw its highest P/E ratio ~ 40x in Feb-Mar’21.

Many Fund houses like Goldman Sachs say they prefers EMs like Mexico over India for investments; due to still lofty valuations seen in the Indian markets.

MSCI World's valuation multiple of 17.7 times one-year forward PE

MSCI EM is at 11.91 times.

Infogrpahic @yardeni

MSCI World's valuation multiple of 17.7 times one-year forward PE

MSCI EM is at 11.91 times.

Infogrpahic @yardeni

S&P500, forward 12-month P/E for the index is around 18.5x nearly same as 5Y average of 18.6x and lower than the highs of last year (P/E of 45.89 seen in July 2021)

S&P highest P/E - 123.73 in May 2009; and lowest 5.31 in Dec, 1917.

S&P highest P/E - 123.73 in May 2009; and lowest 5.31 in Dec, 1917.

P/E for two indices: Nifty 50 and S&P 500, the forward PE multiple is extremely similar.

Both have come off from their stretched levels of last year and are now trading closer to their historical averages.

After figure, and end statement from MSCI in next tweet

Both have come off from their stretched levels of last year and are now trading closer to their historical averages.

After figure, and end statement from MSCI in next tweet

Forecasters are trimming their growth expectations amid uncomfortable inflation numbers

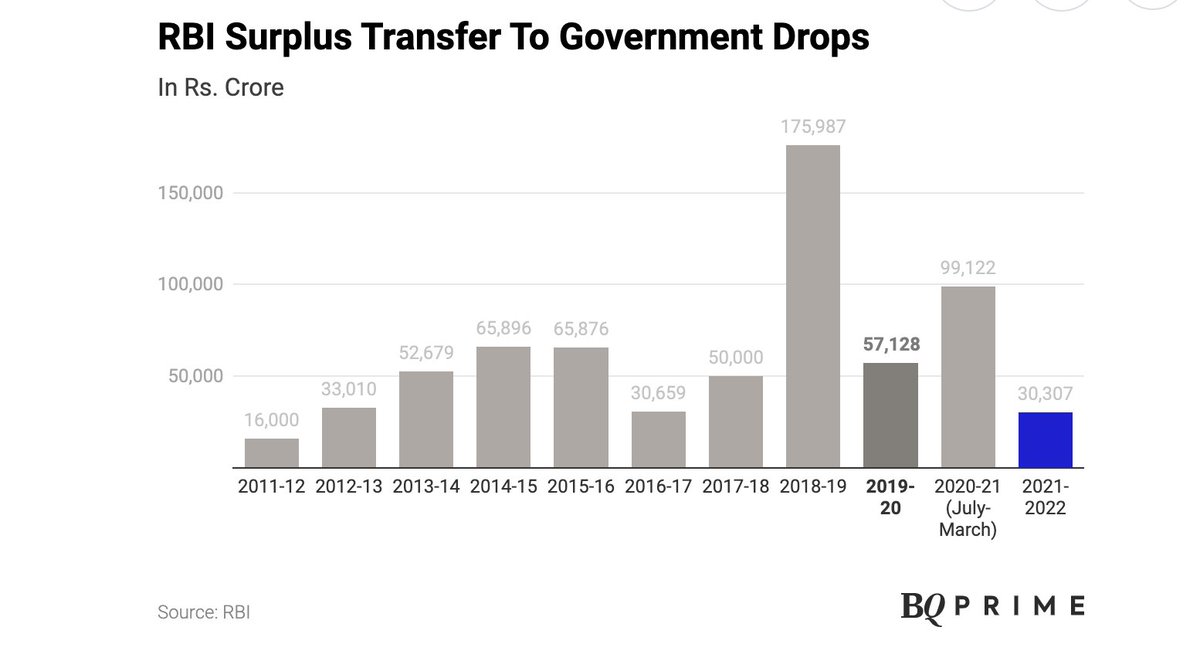

Outlook on exports is unclear; liquidity is expected to reduce as RBI continues on withdrawal track.

Global sentiment is turning hostile from a demand, liquidity and prices standpoint

Outlook on exports is unclear; liquidity is expected to reduce as RBI continues on withdrawal track.

Global sentiment is turning hostile from a demand, liquidity and prices standpoint

Valuations of Indian markets have fallen of late but still trade at a premium to MSCI EM.

Uncertainties exist due to headwinds like war, inflation, interest rates, possibilities of carry trade unwinding (reflected in FII outflow numbers) and supply disruption.

End

RT/Like/Fwd

Uncertainties exist due to headwinds like war, inflation, interest rates, possibilities of carry trade unwinding (reflected in FII outflow numbers) and supply disruption.

End

RT/Like/Fwd

This may be considered a good time to invest for long term goals over next 2 years, if you are ready to bear short term pain. Keep on doing SIP and buying your fav blue chip stocks.

For short term / medium term goals I would not advise to invest any money in equity

For short term / medium term goals I would not advise to invest any money in equity

• • •

Missing some Tweet in this thread? You can try to

force a refresh