1/ #Bitcoin Supply and Demand🧐

Fiat currencies are a phase-out model and financial repression destroys much wealth. The latest inflation numbers shake up the bond markets. #Fed 2022 hawkishness hit another ATH after Employment Cost Index (ECI).

#BTC the safe haven?

Fiat currencies are a phase-out model and financial repression destroys much wealth. The latest inflation numbers shake up the bond markets. #Fed 2022 hawkishness hit another ATH after Employment Cost Index (ECI).

#BTC the safe haven?

2/ To understand the current stage of crypto development, we can use an analogy and compare the number of cryptousers with that of the Internet. We are in the year 2000 of the Internet👀👀👀

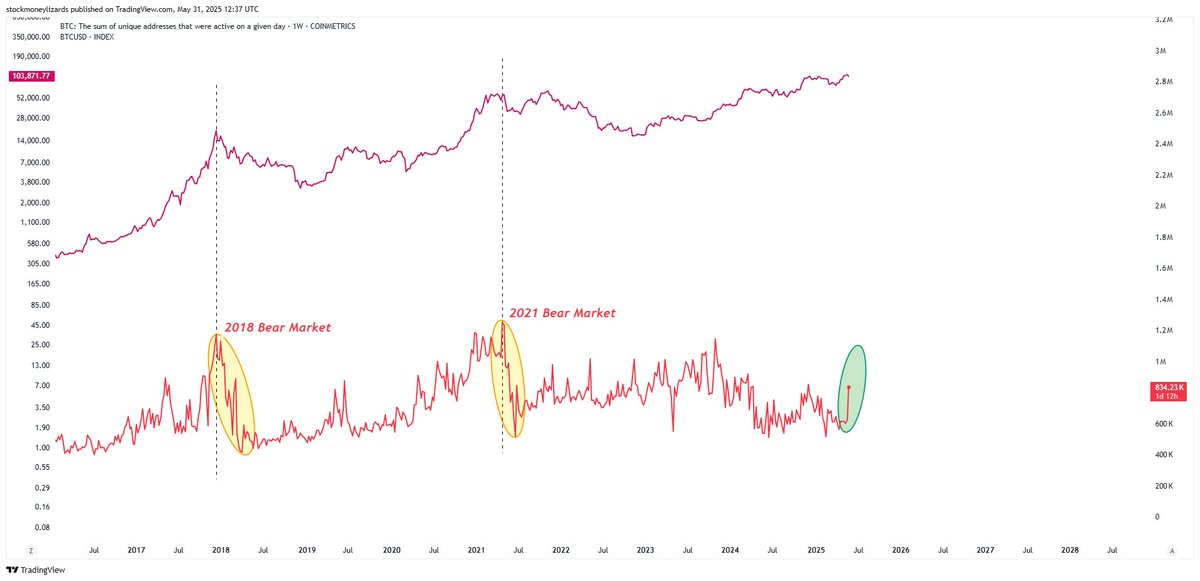

3/ There are a lot of indicators for trading.But the main thing is that more and more people are using crypto (demand/wallets⬆️), although after 3rd halving hardly any #BTC are being mined (supply).

This leads to scarcity and stronger demand than supply.Thus,#Bitcoin price rise!

This leads to scarcity and stronger demand than supply.Thus,#Bitcoin price rise!

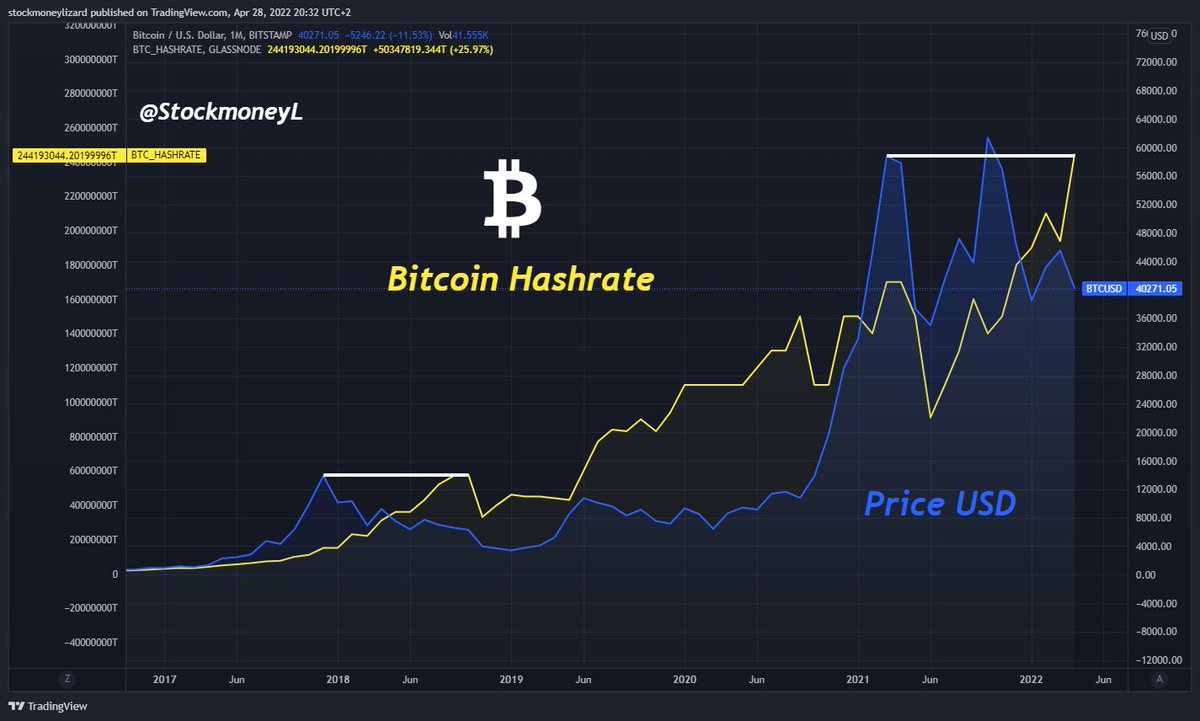

4/ #BTC hashrate hits new all-time high💸

Large sums of money that have been invested in the mining sector. This reflects the "smart money" expectation of price developments in the near future🚀🚀🚀

Large sums of money that have been invested in the mining sector. This reflects the "smart money" expectation of price developments in the near future🚀🚀🚀

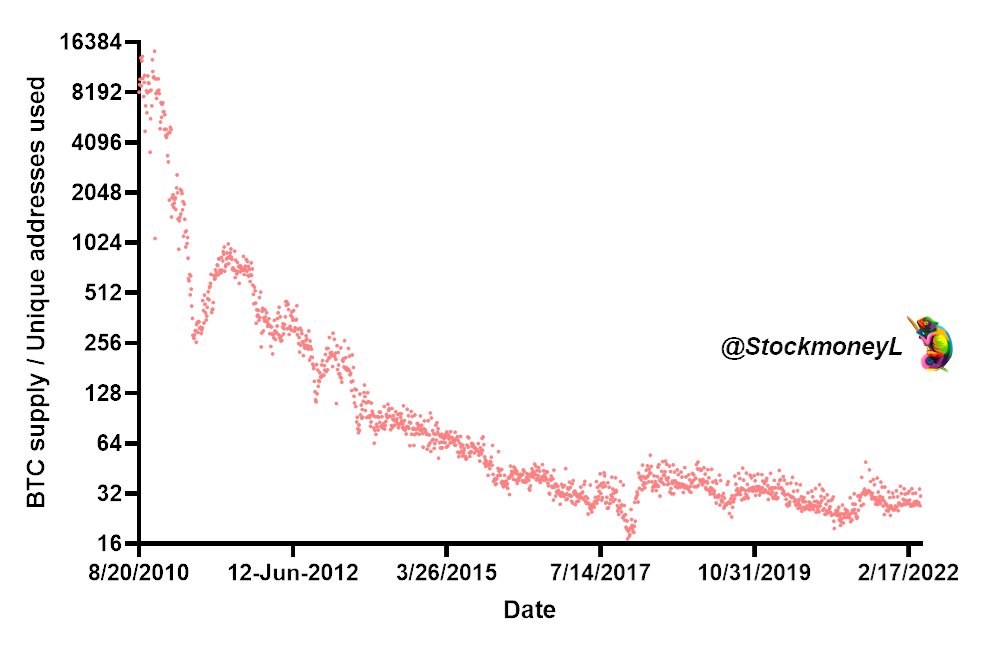

5/ Scarcity increase over time👀

#BTC supply divided by the total number of unique addresses used on the blockchain🔥🔥🔥

It is a matter of time that new users will lift the price even higher, while halving dates will reduce supply🍦

#BTC supply divided by the total number of unique addresses used on the blockchain🔥🔥🔥

It is a matter of time that new users will lift the price even higher, while halving dates will reduce supply🍦

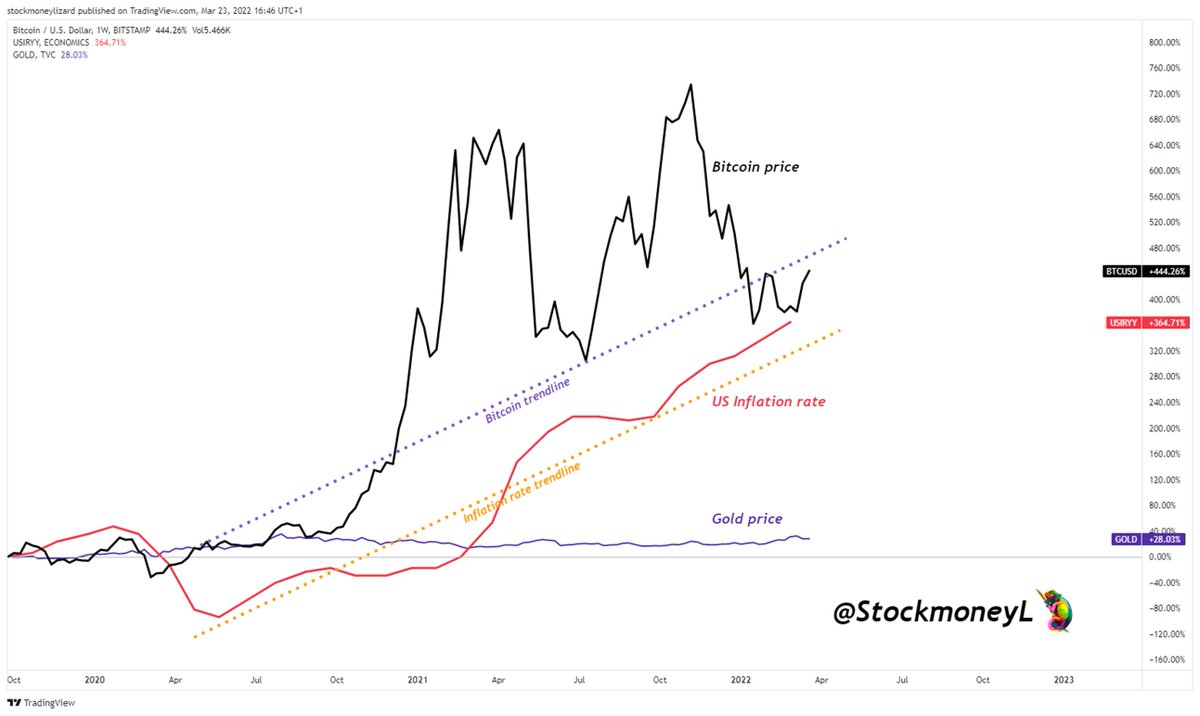

6/ #BTC hedges against inflation while the price is driven by its scarcity and declining supply😍😍😍

#Bitcoin will be the asset in the coming decades👀

A non-logarithmic plot is always good for perspective🌍

#Bitcoin will be the asset in the coming decades👀

A non-logarithmic plot is always good for perspective🌍

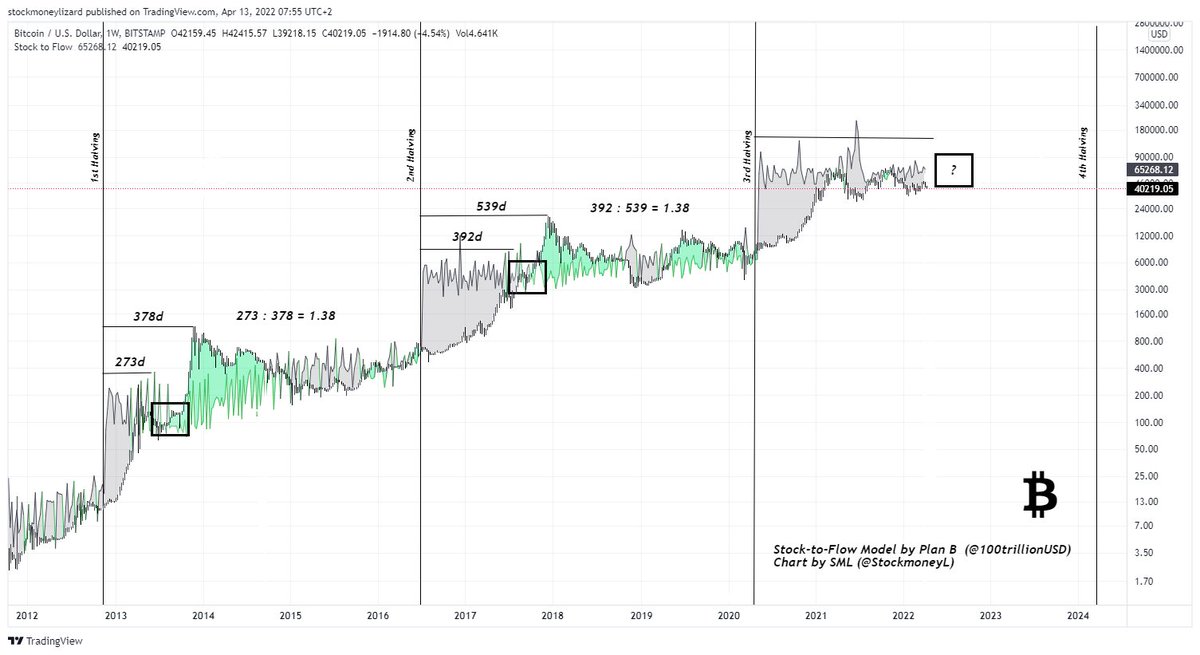

7/ A matter of time for the next bull run🚀 Road to 100k!

Stock-to-flow model from Plan B aka @100trillionUSD

🔥🔥🔥

#Bitcoin bullish!

Stock-to-flow model from Plan B aka @100trillionUSD

🔥🔥🔥

#Bitcoin bullish!

8/ #BTC is very likely to rise at current levels👀

1. TA reasons for bottom and BTC breakout✔️

2. BTC hedges against inflation. Inflation is rising, money is worth less✔️

3. BTC is strongly linked to the stock market✔️

1. TA reasons for bottom and BTC breakout✔️

2. BTC hedges against inflation. Inflation is rising, money is worth less✔️

3. BTC is strongly linked to the stock market✔️

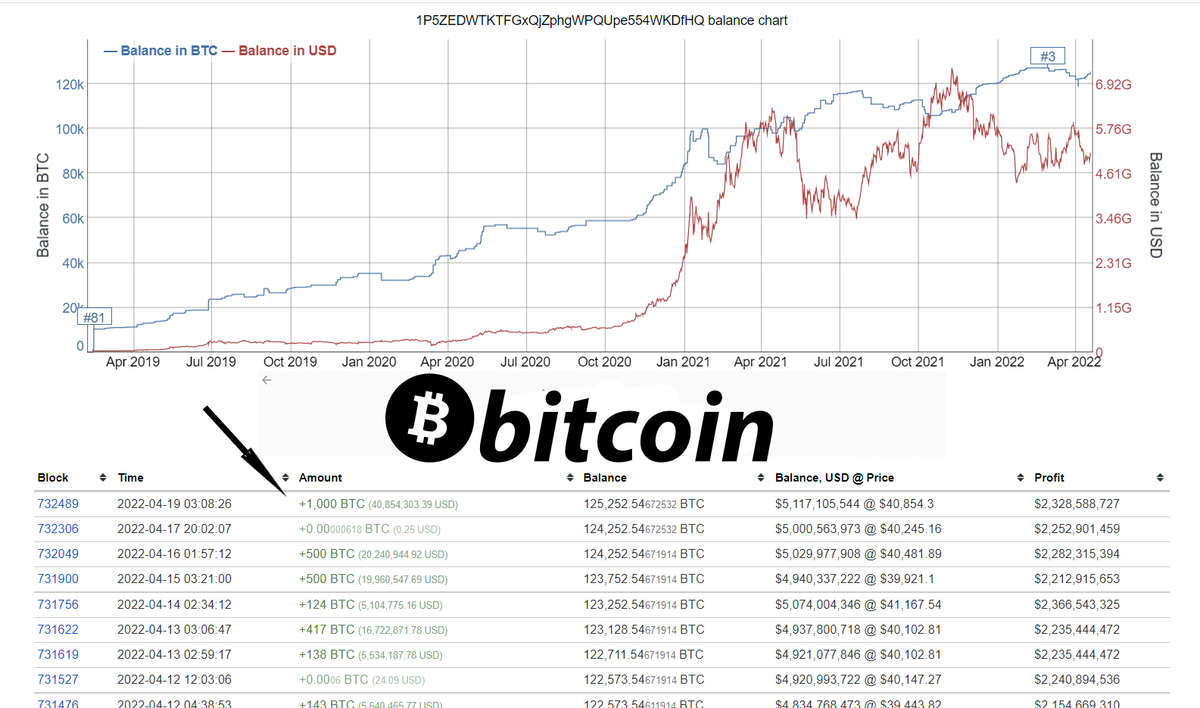

9/ While the retail investor continues to panic, smart money continues to add new #bitcoins at current level. Pointed out by my TA fellow @EtherNasyonaL (a must follow) in a previous post🔥🔥🔥

10/ #Bitcoin addresses are steadily increasing over time. More addresses, more users❤️

At SOPR, we are currently in the twighlight zone 0.07. Using 10-day EMA for the SOPR. Top 2 to 6 (selling zone) and bottom -2 to -4 (buying zone).

#BTC bullish🔥🔥🔥

At SOPR, we are currently in the twighlight zone 0.07. Using 10-day EMA for the SOPR. Top 2 to 6 (selling zone) and bottom -2 to -4 (buying zone).

#BTC bullish🔥🔥🔥

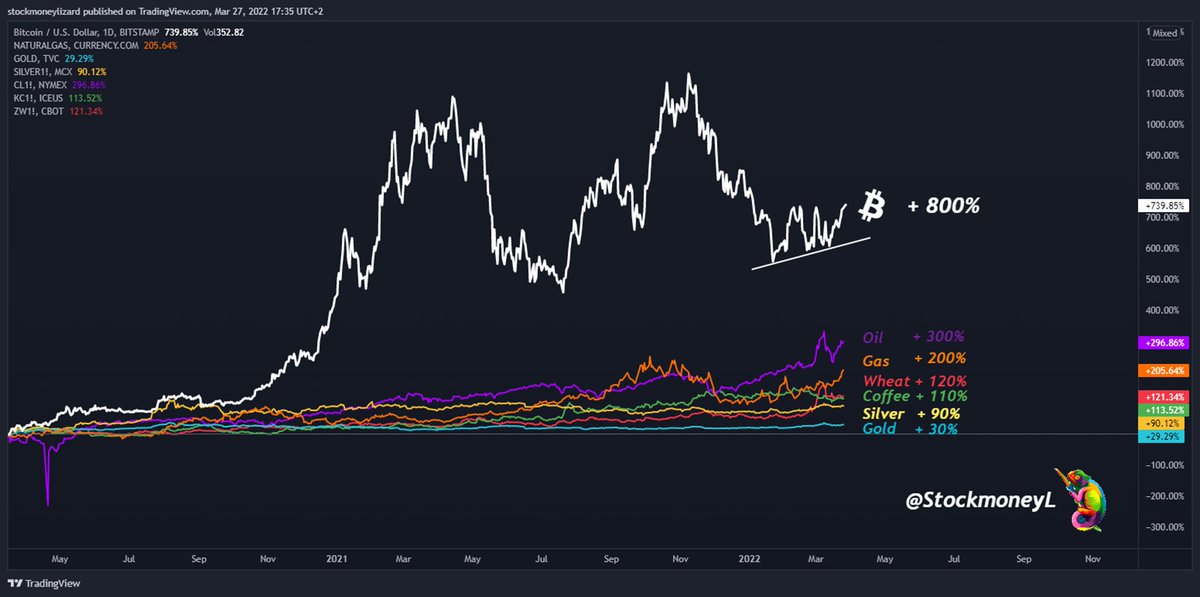

11/ #Bitcoin has "no intrinsic value" but has outperformed all those rare and most traded commodities over the past two years👀.

Interesting🧐 Don´t be fooled by @PeterSchiff or other boomers!

#Bullish. Big time.

Interesting🧐 Don´t be fooled by @PeterSchiff or other boomers!

#Bullish. Big time.

12/ #Bitcoin is replacing #Gold as sound money. So many disadvantages of physical gold... #bitcoin price trendline moves with US #inflation trendline. Geopolitical tensions will continue to exist. Money printing will continue.

13/ We're sticking with it,governments are eliminating the value of fiat currencies. At the same time,we are still in the early stages of crypto. Whether you hit the low on #BTC and trade or HODL will not be decisive in the long run. You just have to be on the right side👐💎

14/ Finally, superb technical analysts you should follow 🔥🔥🔥

@TATrader_Alan

@CryptoBoj

@EmmyMoonie

@AurelienOhayon

@Zima_The_Ape

@el_crypto_prof

@moonshilla

@blaakke

@nihkalowz

@EtherNasyonaL

@ProjectsIco

@FlokitoValhalla

@NZensin

SML🦎

@TATrader_Alan

@CryptoBoj

@EmmyMoonie

@AurelienOhayon

@Zima_The_Ape

@el_crypto_prof

@moonshilla

@blaakke

@nihkalowz

@EtherNasyonaL

@ProjectsIco

@FlokitoValhalla

@NZensin

SML🦎

@nihkalowz @AurelienOhayon @newsforextrader @TATrader_Alan @el_crypto_prof @rickus_trades RT if you like

• • •

Missing some Tweet in this thread? You can try to

force a refresh