A year ago 12 clubs announced a European Super League (ESL) before fan protests led to a humiliating climbdown just days later. However, the factors that drove the 12 clubs to this deeply unpopular move largely remain. It’s still all about money: a combination of fear and greed.

There is little doubt that many of the 12 Super League clubs continue to face serious financial problems. To some extent, this helps explain why the “dirty dozen” would seek more revenue, but that certainly does not excuse their horribly ill-conceived plan.

It is somewhat ironic that these clubs lamented the perilous state of their finances while simultaneously claiming that they had all the answers. Their argument that the Super League would somehow benefit the wider football family should also be taken with a large pinch of salt.

So how have the finances developed at the ESL clubs during the last 12 months? Given the impact of the COVID pandemic, you would expect that matters have not improved – and that is indeed the case. Even where things look better in 2021, this is largely due to technical reasons.

Pre-tax losses for the 12 ESL clubs shot up in the last 2 years, adding up a to a horrific £2.2 bln. In this period, four clubs lost more than a quarter of a billion pounds (#FCBarcelona £604m, #Inter £297m, #Juventus £256m and #Milan £250m) and only one made a (tiny) profit.

In fairness, losses in the last 2 years were clearly driven by the impact of COVID, as the majority of clubs made money before the pandemic struck. That said, the Italian clubs all posted losses in the 8 years up to 2018/19: #Milan £466m, #Inter £312m and #Juventus £12m.

COVID has also depressed the transfer market with profit on player sales for ESL clubs slumping to £348m in 2021, less than half £761m average over previous 3 years. This has also been a factor in the deteriorating bottom line, as player trading has often offset operating losses.

In the last 5 years some of the ESL members have generated very large profits from player sales, especially #Juventus £488m and #CFC £413m, while it has also been an important element for the three Spanish clubs: #RealMadrid £361m, #FCBarcelona £359m and #Atleti £275m.

Excluding profits on player sales (and interest payable), operating losses are enormous, amounting to £4.5 bln since 2012, including £2.8 bln in the last 2 years alone. COVID has obviously bitten hard here, but clubs have consistently lost money on their recurring business.

Half the ESL clubs had operating losses above £200m in last 2 years. #FCBarcelona “led the way” with an awful £602m, while the 3 Italian clubs also posted terrible figures: #Juventus £383m, #Milan £253m and #Inter £236m. #CFC, who are apparently worth £2.5 bln, lost £270m.

On the face of it, ESL clubs were doing fine, as revenue had grown steadily, e.g. by £2.2 bln (65%) in 4 years from £3.4 bln to £5.6 bln in 2019. However, this has fallen to £4.9 bln since then with £1.5m revenue lost in last 2 years, including #FCBarcelona £339m and #MUFC £251m.

Nevertheless, revenue earned by ESL clubs in 2021 is still very impressive with 3 generating over half a billion (#MCFC £571m, #RealMadrid £567m & #FCBarcelona £515m), followed by #MUFC £494m & #LFC £487m. The 3 clubs that rejected the ESL are in top 12 (#FCBayern, #PSG & #BVB).

Match day revenue fell to just £63m in 2021, as almost all games were played behind closed doors, down from £941m pre-pandemic. Comparing the last 2 years against 2019, 4 clubs have lost more than £100m: #FCBarcelona £156m, #RealMadrid £153m, #MUFC £119m and #AFC £110m.

In fact, the real losses are actually higher, due to stadium moves and developments not reaching their full potential, e.g. I estimate that #THFC lost £144m from their new stadium. Clubs with low match day obviously lost least: #Inter £38m and #Milan £39m.

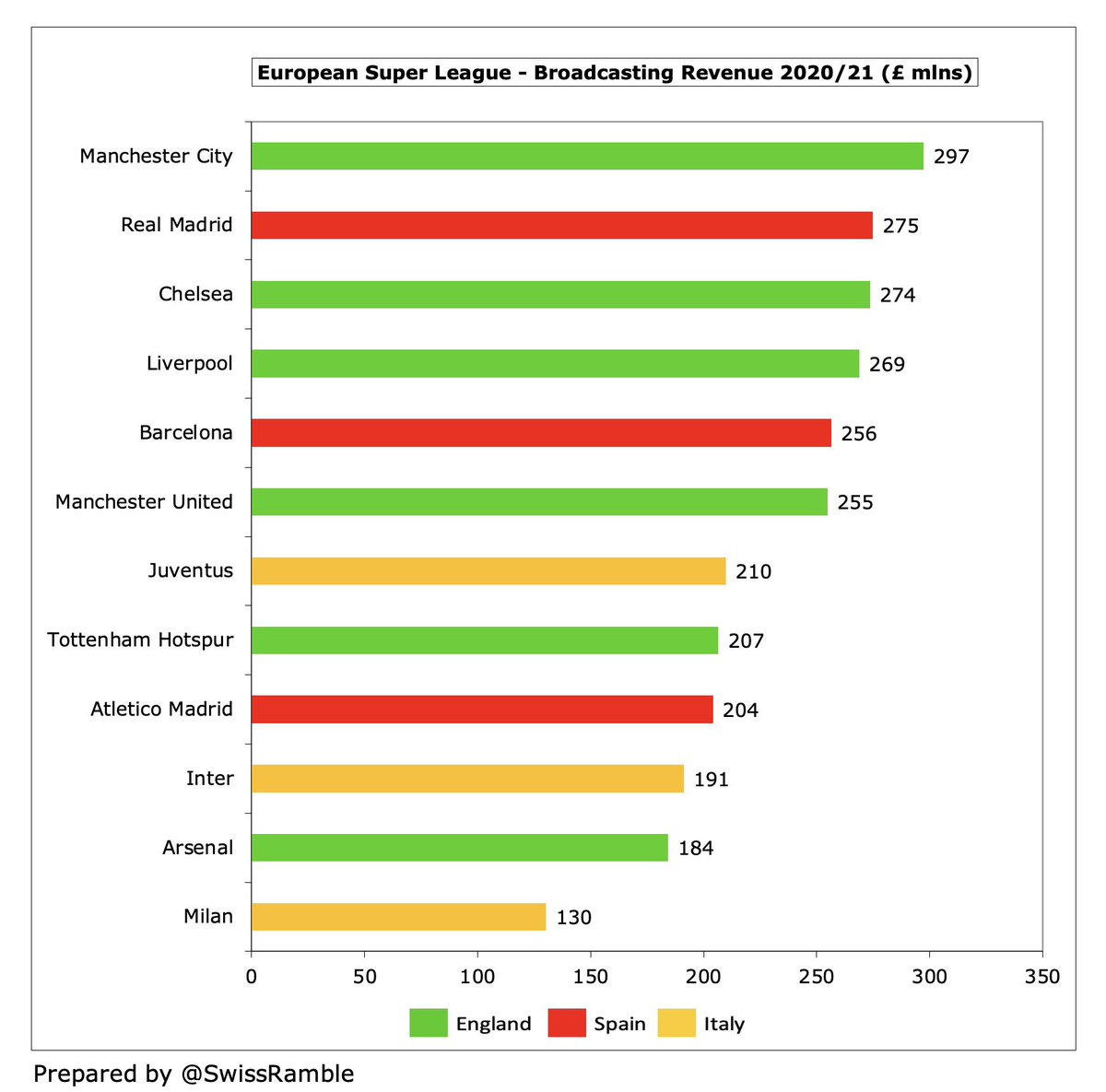

In contrast, broadcasting income shot up in 2021 from £1.9 bln to £2.8 bln, even higher than the previous £2.5 bln peak in 2019, with six clubs over a quarter of a billion: #MCFC £297m, #RealMadrid £275m, #CFC £274m, #LFC £269m, #FCBarcelona £256m and #MUFC £255m.

However, the broadcasting growth was purely technical, as all clubs benefited from revenue deferrals from 2020 for games played after the accounting close, worth an estimated £362m. Year-on-year growth equivalent to reduction in 1st year plus increase in 2nd year, e.g. #LFC £70m.

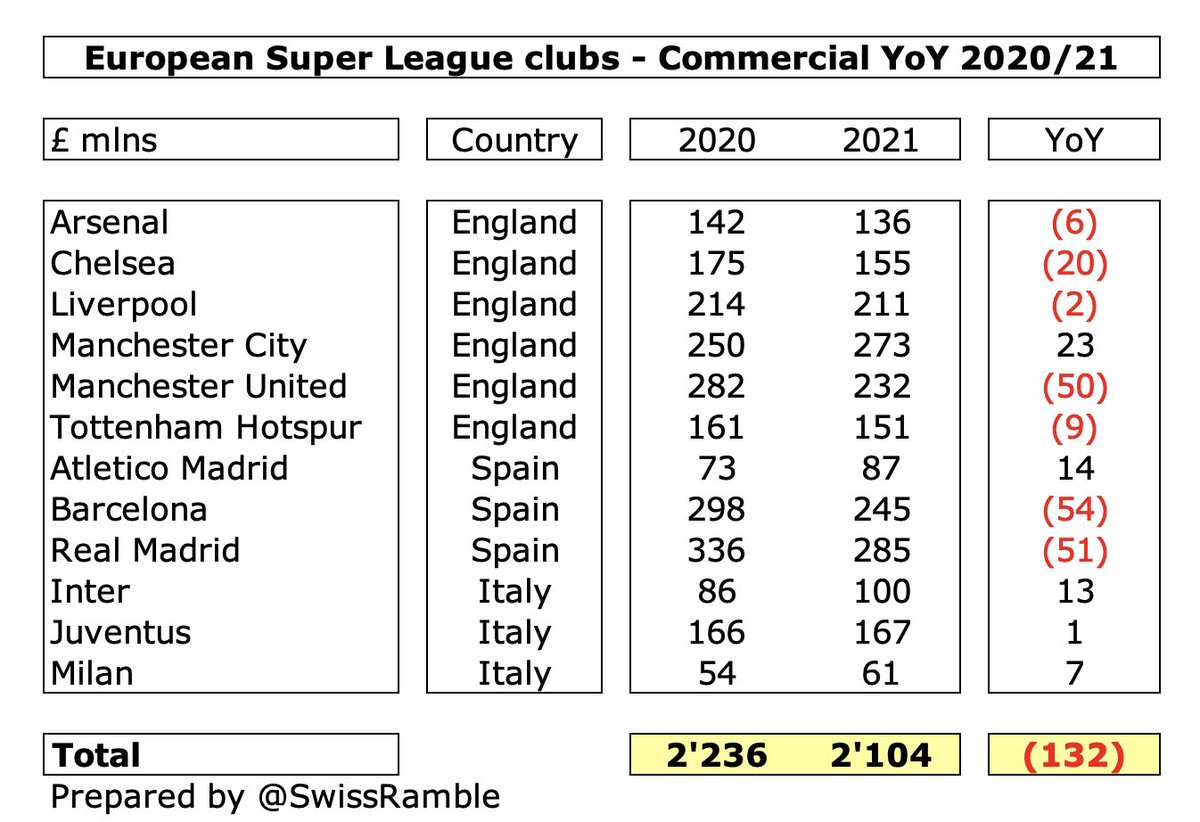

Following years of growth, commercial revenue dropped £132m (6%) to £2.1 bln in 2021, due to lower merchandising and some sponsorship adjustments, though 5 clubs still generated more than £200m: #RealMadrid £285m, #MCFC £273m, #FCBarcelona £245m, #MUFC £232m and #LFC £211m.

The big losers commercially in 2021 were #FCBarcelona, down £54m, #RealMadrid £50m and #MUFC £50m (despite the Glazers’ apparent commercial expertise). On the other hand, #MCFC managed to increase this revenue stream by £23m.

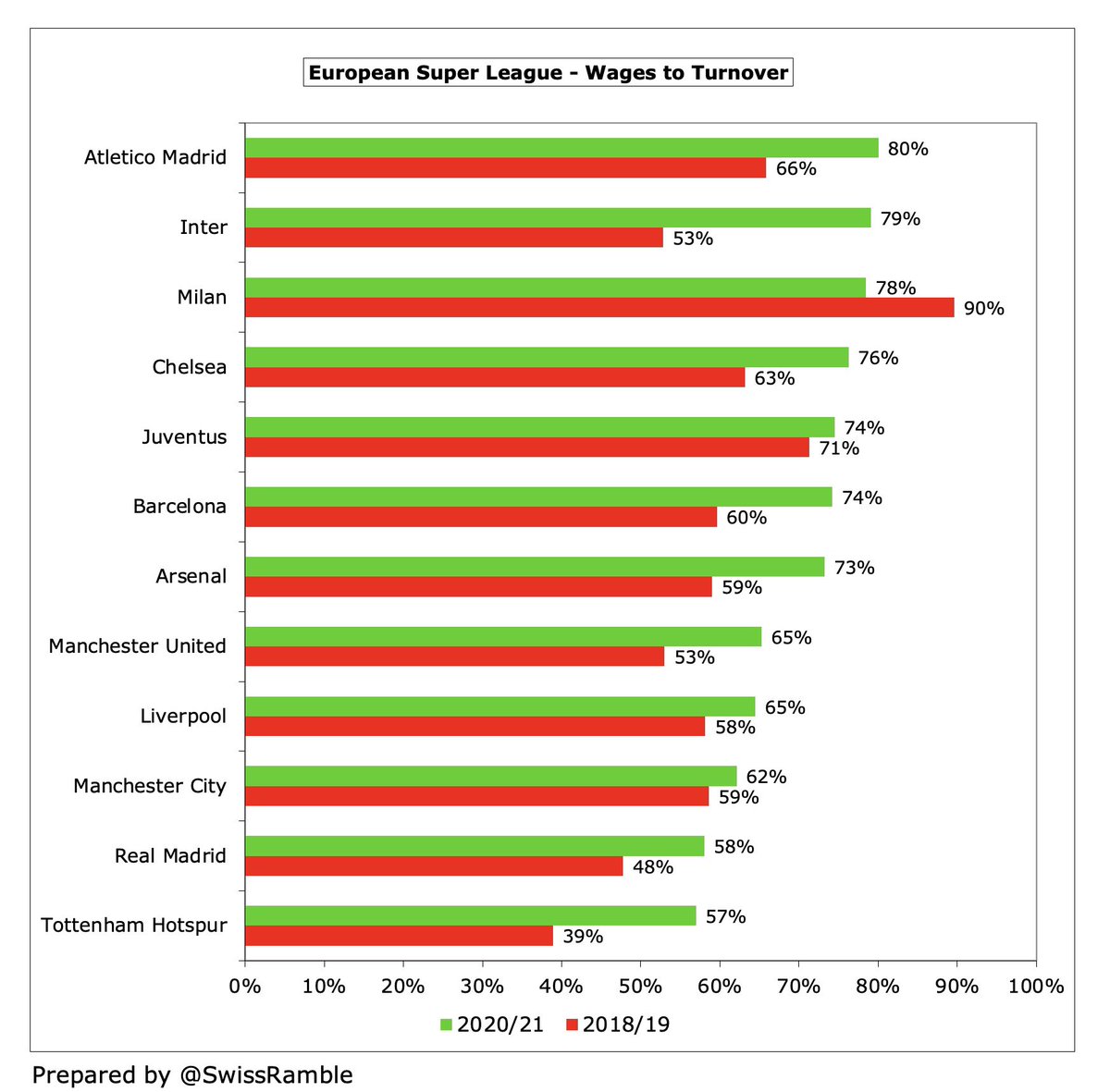

Despite the pressures on revenue, wages at the ESL clubs continued to rise, up £247m (8%) in 2021 to £3.4 bln. The highest wage bills are in Spain and England: #FCBarcelona £383m, #MCFC £355m, #CFC £333m, #RealMadrid £329m, #MUFC £323m and #LFC £314m.

Wages have increased by nearly two-thirds (£1.3 bln) in the last 5 years from £2.1 bln to £3.4 bln with the largest growth at #MCFC £157m, followed by #Inter £139m, #Atleti £133m, #FCBarcelona £130m, #Juventus £120m and #RealMadrid £119m, i.e. only one English club in top 6.

As a result, the wages to turnover ratio has risen to 69% from 58% before the pandemic. This is not too bad, but there is a wide range among the 12 with #Atleti 80% being the worst, followed by #Inter 79% and #Milan 78%. #THFC are at the other end of the spectrum with 57%.

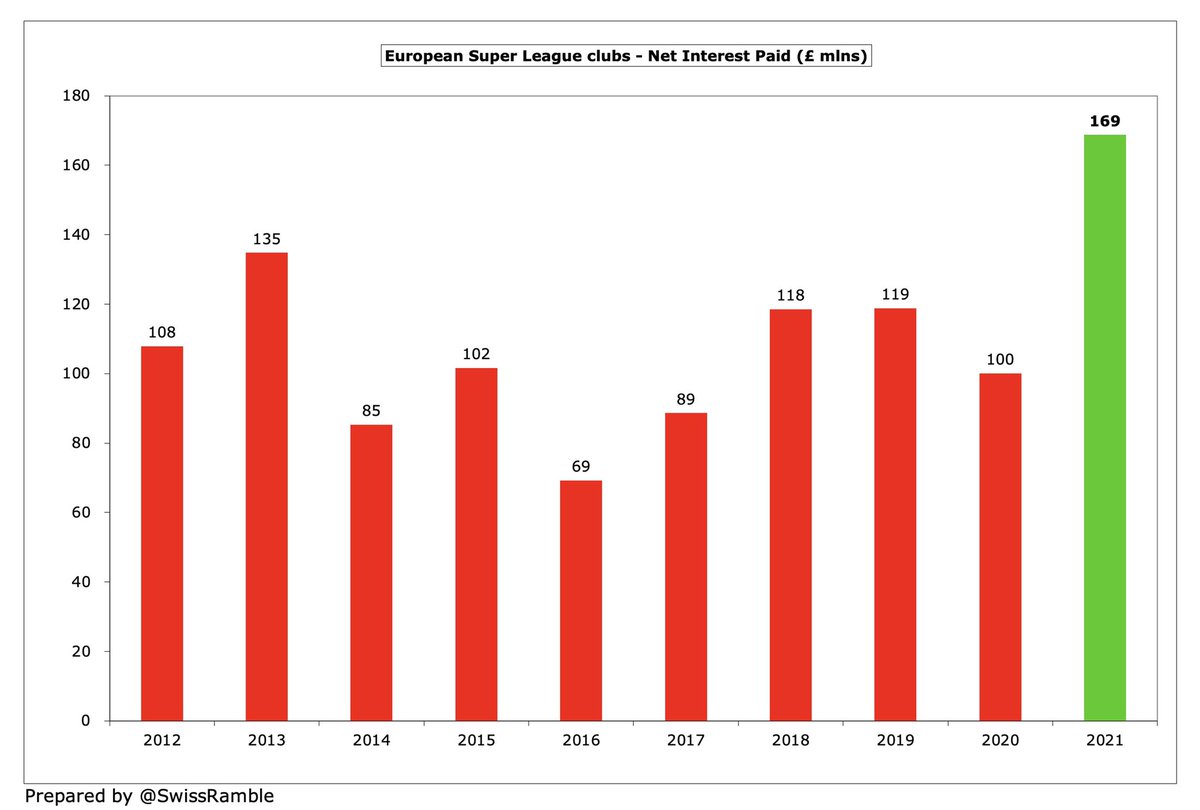

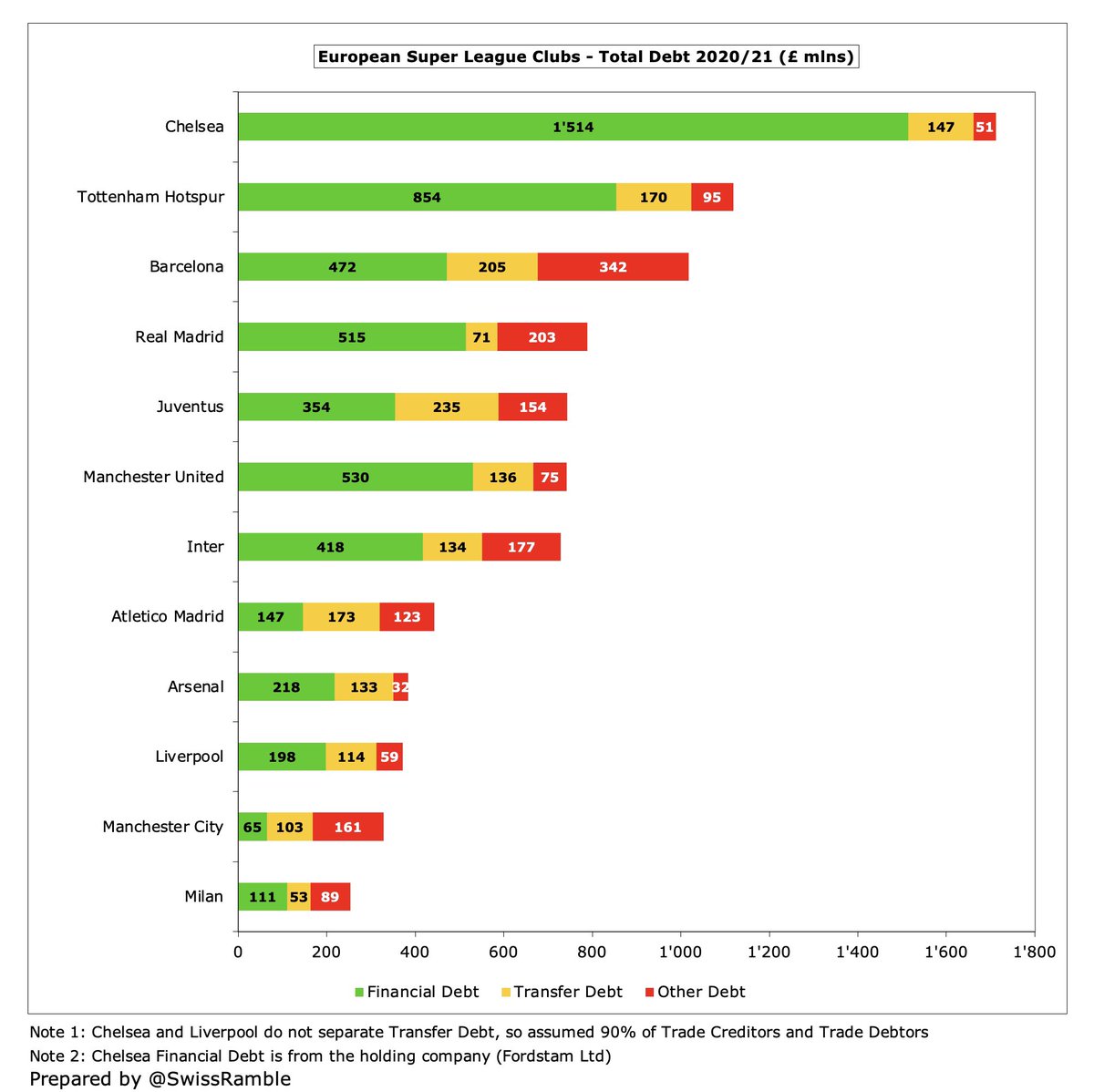

Cost growth has been funded by £5.4 bln of financial debt (bank loans, owner loans, bonds). It might surprise some to see that the English clubs owe the most with #CFC £1.5 bln, #THFC £854m & #MUFC £530m, followed by #RealMadrid £515m and #FCBarcelona £472m.

However, many clubs have kept debt at similar levels with only a few seeing major growth. In the last 5 years the largest increases were at #THFC £729m (to fund new stadium), #FCBarcelona £451m, #RealMadrid £439m, #CFC £374m, #Inter £216m and #Juventus £180m.

As a result, net interest paid has shot up from £100m to £169m. Highest payments in 2021 were #AFC £34m (though this was mainly a once-off debt refinancing fee), #FCBarcelona £33m, #Atleti £26m, #MUFC £21m, #THFC £18m and #Inter £17m.

Another form of financing is transfer debt (outstanding stage payments), though the ESL clubs actually reduced this from £2.0 bln to £1.7 bln in 2021. Highest amounts were owed by #Juventus £235m, #FCBarcelona £205m (down from £283m), #Atleti £173m and #THFC £170m.

If we add other debt (staff, tax, suppliers & other creditors) to financial debt and transfer debt, the total debt is a staggering £8.6 bln. Highest are #CFC £1.7 bln (mostly owed to Roman), #THFC £1.1 bln (new stadium) and #FCBarcelona £1.0 bln (including £213m salaries).

The ESL clubs cut gross transfer spend from £2.2 bln to £1.3 bln in 2021, though their expenditure remains higher than their rivals, e.g. four clubs have spent around a billion pounds in the last 5 years: #Juventus, #FCBarcelona, #MCFC and #CFC. Twice as much as #THFC and #Milan.

Net spend was also lower at £801m, having been over a billion in each of the preceding 3 years. The Manchester clubs are the highest on this basis with #MCFC £656m just ahead of #MUFC £630m, followed by #CFC and #FCBarcelona (both £465m) and, perhaps surprisingly, #AFC £428m.

Some clubs have required substantial funding from their owners to cover losses with an average of half a billion over the last 3 years. The highest funding in the last decade came at #Inter £834m, Milan £771m and #CFC £701m. Almost all of #MCFC £684m funding came before 2016.

It is clear that Super League clubs face tough financial challenges, but it’s largely their own fault. They have enjoyed substantial advantages over others, but decided to go for even more money, rather than address structural issues, their motto seemingly being “greed is good”.

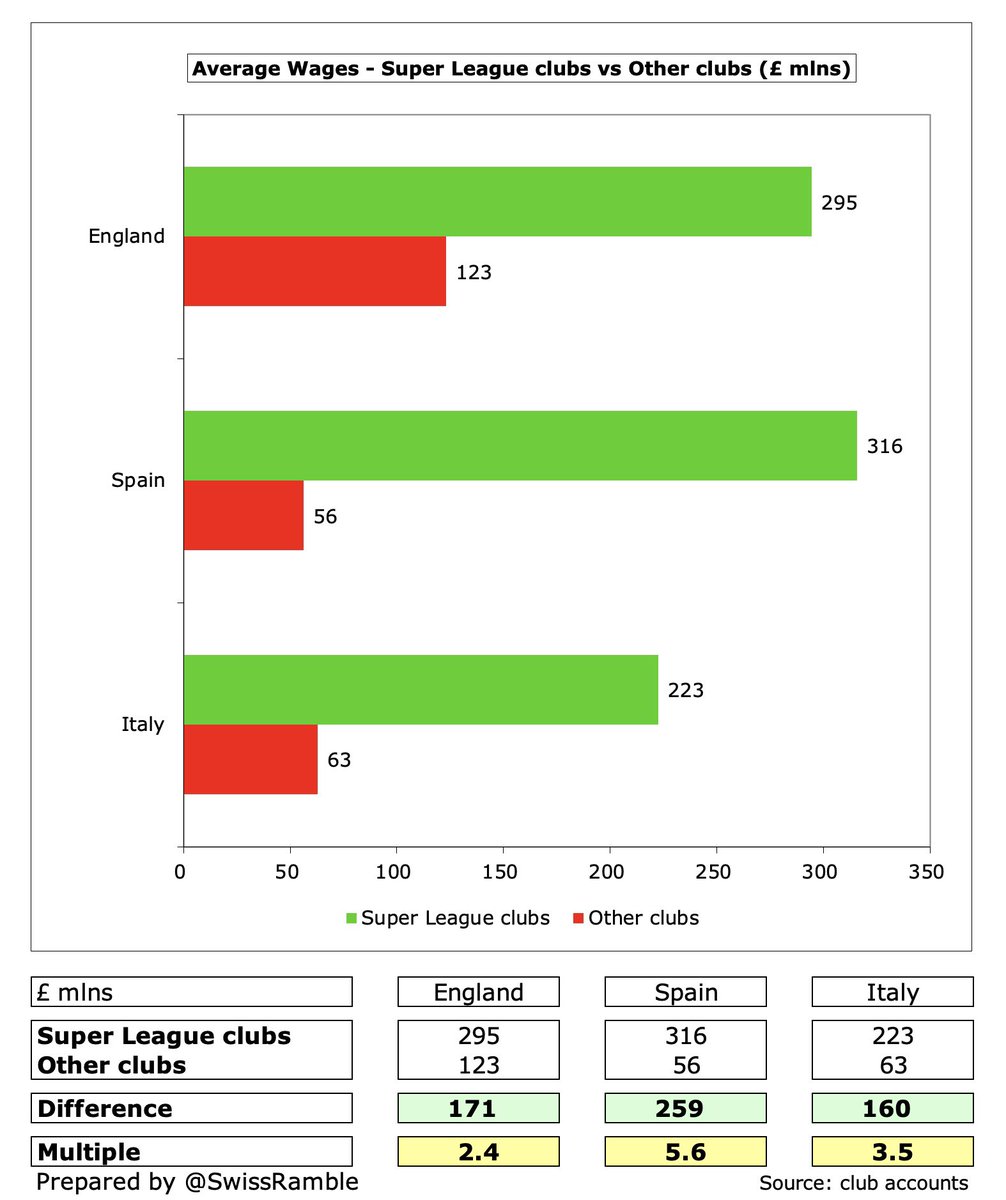

The financial gap between the ESL clubs and others in their domestic leagues is already enormous. For example, average revenue for the “Big Three” in Spain of £467m is 6 times as much as others’ £73m, while it’s 4 times as much in Italy and “only” 3 times as much in England.

It’s pretty much the same story when it comes to wages with a huge disparity between the ESL clubs and domestic rivals. Once again, the wages in Spain and Italy are 6 times and 4 times as much, though the differential in England is down to 2.4 times, but still £295m vs £123m.

If we look at squad cost (amounts paid, rather than market value), the song remains the same, e.g. in England the “Big Six” average squad cost is £762m, which is 3.4 times as much as the “Other 14” £226m. It’s hardly surprising that the same names feature at the top of the league

Some might argue that a super league is effectively already in place in the shape of the Champions League. Indeed, it is evident that European TV money has been extremely important to the ESL clubs, amounting to £5.0 bln in the last decade, including £2.3 bln in last 3 years.

TV Europe money is especially important to clubs in Spain and Italy, as seen by highest earnings in last decade: #Juventus £620m, #RealMadrid £613m, #FCBarcelona £565m, #MCFC £545m, #CFC £476m & #Atleti £457m. However, if clubs don’t qualify for Champions League, it really hurts.

This was at the heart of the ESL proposal with guaranteed places for the 15 Founder Clubs. They said that there was “real frustration” among owners over the unpredictability of the current “unstable system”, much preferring the certainty of a US model.

Europe TV money is a major revenue differentiator, as seen by 2018/19 Premier League (pre-pandemic), where domestic funds are relatively equitable. It’s a vicious cycle where ESL clubs earn more from Champions League, funding investment, making qualification more likely.

Furthermore, football authorities have frequently tried to placate Super League clubs. For example, UEFA introduced a coefficient ranking to distribute Champions League revenue that is a clear benefit, e.g. #RealMadrid and #FCBarcelona received €36m & £34m respectively in 2022.

Although the Champions League share of total revenue distribution fell from 78% to 74% in the current cycle (mainly to fund the new Europa Conference), the gap with the other competitions remains enormous: Champions League €2.0 bln, Europa League €465m and Conference €235m.

The reason that non-English clubs are more enthusiastic about a Super League is the huge advantage the Premier League enjoys with its TV rights. Not only does its €3.3 bln deal dwarf others, but it is still rising (thanks to overseas rights), while they are falling or flat.

The proposed new Champions League format from 2024 will expand number of clubs from 32 to 36, including 2 places based on UEFA coefficient, i.e. historical performance. This looks like a naked attempt to provide a safety net for big clubs that have failed to qualify on the pitch.

The Champions League will adopt the “Swiss model”, whereby there will be 10 games played in the group stage (instead of the current 6 games), so a guaranteed additional 2 home games. For clubs like #RealMadrid, #FCBarcelona, #THFC and #MUFC that could be worth £8-10m match day.

Media reports suggest that the expanded Champions League would deliver an additional 40% revenue in TV and commercial rights. Based on 2020/21, that would increase the income for finalists, #CFC and #MCFC, from around £107m to just under £150m. Again widening the gap to others.

Although fans were delighted to see last year’s collapse of the Super League, the fact is that the financial conditions behind the breakaway still hold true. While the “big bang” approach failed, many of the key elements of the proposal are being added little by little.

While it would be no great surprise if the leading clubs had another go at forming a Super League at some stage, the reality is that they might not need to do so, if it’s effectively being formed by stealth – under the guidance of UEFA.

As #CPFC owner Steve Parish said, “new Champions League proposals look so much like a Super League that you can’t tell the difference.” It’s a bit like Orwell’s Animal Farm, where the pigs came to resemble their human oppressors, so that “it was impossible to say which was which”

• • •

Missing some Tweet in this thread? You can try to

force a refresh