@MikeBurgersburg $CEL under $2 #mikewasright

So I logged on to see if $cel. #celsius had fallen below $1.50…… suprised to see it at $1.06……looks like it will be under $1.00 tomorrow. Down 86% in last 11 months…..#mikewasright Wouldn’t be suprised to see it track back down to issue price $0.30.

So as expected $cel is now below $1.00 - and that's after someone(s) galantly standing in the market buying millions.....not a dead cat bounce......just a sinking bloated corpse.

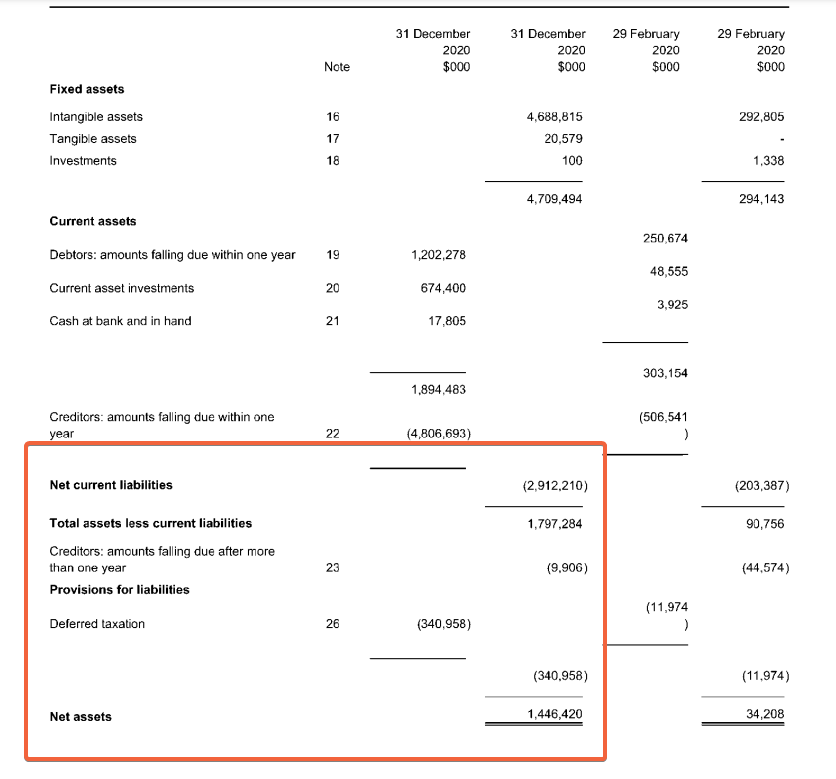

Last year when I first started looking into #celsius I pointed out that their balance sheet was essentially the revaluation of the excess $cel tokens that remained on their books.

There was clearly a rush 31 Dec 2020 to pump $CEL closing at >$4 allowing a massive revaluation on its balance sheet.

As per previous comments...the value of $CEL token underpinned #celsius balance sheet.....

• • •

Missing some Tweet in this thread? You can try to

force a refresh