Hello Friday and the week to date!

$USD +1.15%

$CNY -1.8%

$AUD -3.05%

$GOLD -3.1%

$SILVER -7.15%

$SSEC +1.75%

$DAX +0.5%

$CAC -0.85%

$KOSPI -3.55%

$NIKK -4.65%

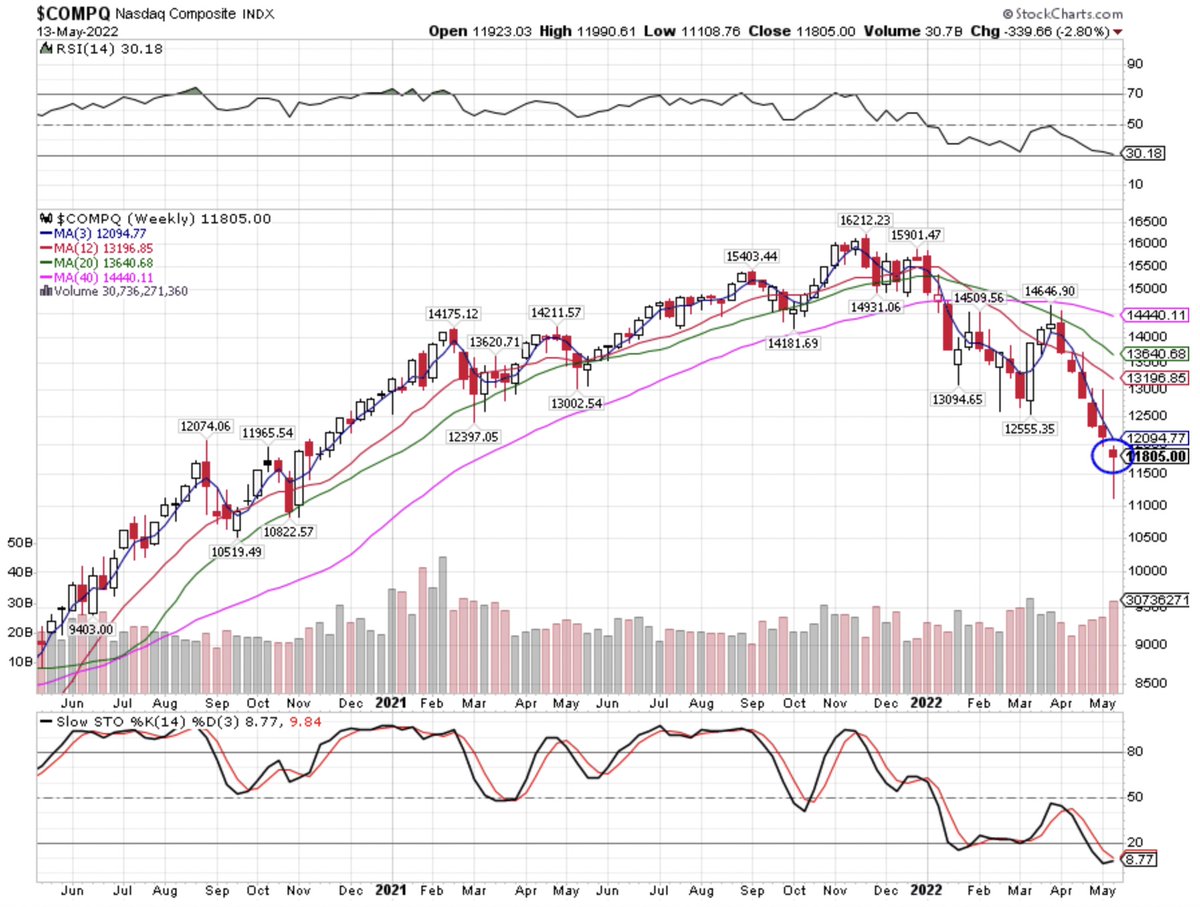

$COMPQ -6.35%

$WTIC -3.3%

$COPPER -3.9%

$COFFEE +2.3%

$WHEAT +6.35%

Let's dig into the 🧮!

$USD +1.15%

$CNY -1.8%

$AUD -3.05%

$GOLD -3.1%

$SILVER -7.15%

$SSEC +1.75%

$DAX +0.5%

$CAC -0.85%

$KOSPI -3.55%

$NIKK -4.65%

$COMPQ -6.35%

$WTIC -3.3%

$COPPER -3.9%

$COFFEE +2.3%

$WHEAT +6.35%

Let's dig into the 🧮!

Asian markets finished on an ↗️ 🎵

$NIKK 26428 +2.65%

$SSEC 3084 +0.95%

$TWII 15832 +1.4%

$HSI 19902 +2.7%

$KOSPI 2604 +2.1%

$IDX 6598 -0.05%

Australia ↗️

7075 +1.95%

India ↗️

$BSE 53664 +1.4%

$NIKK 26428 +2.65%

$SSEC 3084 +0.95%

$TWII 15832 +1.4%

$HSI 19902 +2.7%

$KOSPI 2604 +2.1%

$IDX 6598 -0.05%

Australia ↗️

7075 +1.95%

India ↗️

$BSE 53664 +1.4%

Europe ↗️ at the open

$DAX 13889 +1.1%

$FTSE 7327 +1.3%

$CAC 6276 +1.1%

$AEX 685 +1.6%

$IBEX 8281

$MIB 23800 +1.0%

$SMI 11590 +0.75%

$MOEX 2293 -0.2% 🪆

$VSTOXX 32.40

$DAX 13889 +1.1%

$FTSE 7327 +1.3%

$CAC 6276 +1.1%

$AEX 685 +1.6%

$IBEX 8281

$MIB 23800 +1.0%

$SMI 11590 +0.75%

$MOEX 2293 -0.2% 🪆

$VSTOXX 32.40

🇺🇸 futures rebounding 🏀 ↗️

$ES 3974 +1.1%

$NQ 12152 +1.75%

$RTY 1765 +0.95%

$VIX 30.74 🔻🛗

$ES 3974 +1.1%

$NQ 12152 +1.75%

$RTY 1765 +0.95%

$VIX 30.74 🔻🛗

Metals ↔️ after GOLD broke trend at 1842

$GOLD 1821 -0.15%

$SILVER 20.752 +0.05%

$COPPER 4.088 -0.3%

$PLAT 942 +1.05%

$PALL 1879 +1.0%

$ALU 2746 +0.15%

$ZINC 3493 -1.05%

$GVZ 21.51 🔺

$GOLD 1821 -0.15%

$SILVER 20.752 +0.05%

$COPPER 4.088 -0.3%

$PLAT 942 +1.05%

$PALL 1879 +1.0%

$ALU 2746 +0.15%

$ZINC 3493 -1.05%

$GVZ 21.51 🔺

Hydrocarbons firm ↗️

$WTIC 106.86

$BRENT 108.45 +0.95%

$GASO 3.864 +1.9% ⬅️⛽️ cycle high

$NATGAS 7.819 +1.05%

$OVX 52.71 🔻

$WTIC 106.86

$BRENT 108.45 +0.95%

$GASO 3.864 +1.9% ⬅️⛽️ cycle high

$NATGAS 7.819 +1.05%

$OVX 52.71 🔻

Grains remain ♉️↗️

$WHEAT 1180 +0.2%

$CORN 793 +0.15%

$SOYB 1627 +0.8%

$SUGAR 18.80 +1.1%

$COFFEE 216.33 +0.4% ☕️

🐻 but strong price action 📈

$WHEAT 1180 +0.2%

$CORN 793 +0.15%

$SOYB 1627 +0.8%

$SUGAR 18.80 +1.1%

$COFFEE 216.33 +0.4% ☕️

🐻 but strong price action 📈

After putting in another 20-year high, the $USD takes a break ↘️

$USD 104.675 -0.2%

$EUR 1.04 +0.19%

$GBP 1.22 +0.04%

$AUD 0.689 +0.47%

$USDJPY 128.81 +0.39%

$USDCHF 1.00 -0.25%

$USDCAD 1.301 -0.26%

$USDRUB 63.085 -0.36%🪆

$USD 104.675 -0.2%

$EUR 1.04 +0.19%

$GBP 1.22 +0.04%

$AUD 0.689 +0.47%

$USDJPY 128.81 +0.39%

$USDCHF 1.00 -0.25%

$USDCAD 1.301 -0.26%

$USDRUB 63.085 -0.36%🪆

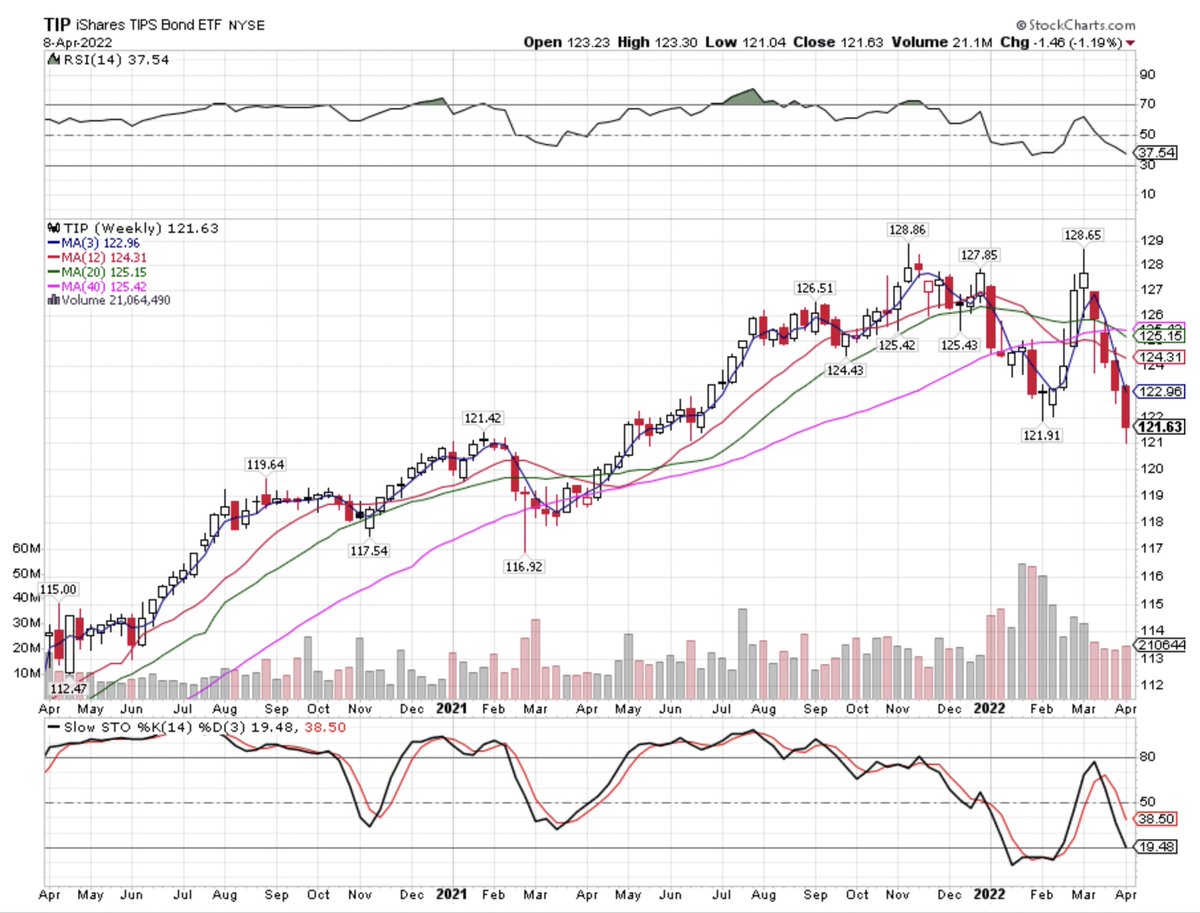

UST yields 🏀 ↗️ after tapping low end of range; expecting retest of 3.2% on the 10Y

10/2s to 31 BPS 🔺

MOVE 118.73

2Y 2.597 +0.075

5Y 2.869 +0.087

10Y 2.911 +0.094

30Y 3.067 +0.096

Global 10Ys mostly ↗️

CAN 2.901 -0.103

10/2s to 31 BPS 🔺

MOVE 118.73

2Y 2.597 +0.075

5Y 2.869 +0.087

10Y 2.911 +0.094

30Y 3.067 +0.096

Global 10Ys mostly ↗️

CAN 2.901 -0.103

30+ vol 🌊 makes for big moves ↕️ providing opportunities at the outer edges of the ranges

Bought $TBT at UST10Y neared 2.82%

Covered SOME $XLK 🩳 near 129

Added $GLD puts as $GOLD broke trend

(protective measure as I am long)

Ride the 🌊🏄 and have a super profitable 💰day!

Bought $TBT at UST10Y neared 2.82%

Covered SOME $XLK 🩳 near 129

Added $GLD puts as $GOLD broke trend

(protective measure as I am long)

Ride the 🌊🏄 and have a super profitable 💰day!

• • •

Missing some Tweet in this thread? You can try to

force a refresh