🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review

5/15/2022

1/10

30 Vol and strong $USD 💣 around the 🌍 with #crypto 💥 and $GOLD breaking Trend (T)

Bond ♉️s finally caught a 🗡️, but equity ♉️s - not so much, though the $DAX, $CAC and $SSEC diverged from $SPX

Let’s dig into the 🧮!

Global Macro Review

5/15/2022

1/10

30 Vol and strong $USD 💣 around the 🌍 with #crypto 💥 and $GOLD breaking Trend (T)

Bond ♉️s finally caught a 🗡️, but equity ♉️s - not so much, though the $DAX, $CAC and $SSEC diverged from $SPX

Let’s dig into the 🧮!

2/10

Equity vol came in for a second week but remains 🛗

$VIX 28.87 with Trend (T) @ 27.75

$VXN 37.71

$RVX 35.66

$VSOTXX 29.11

$VXEEM 28.52

Chart: $VIX - positive flows from weekly #OPEX pushed $SPX 2.4% on Friday.

Equity vol came in for a second week but remains 🛗

$VIX 28.87 with Trend (T) @ 27.75

$VXN 37.71

$RVX 35.66

$VSOTXX 29.11

$VXEEM 28.52

Chart: $VIX - positive flows from weekly #OPEX pushed $SPX 2.4% on Friday.

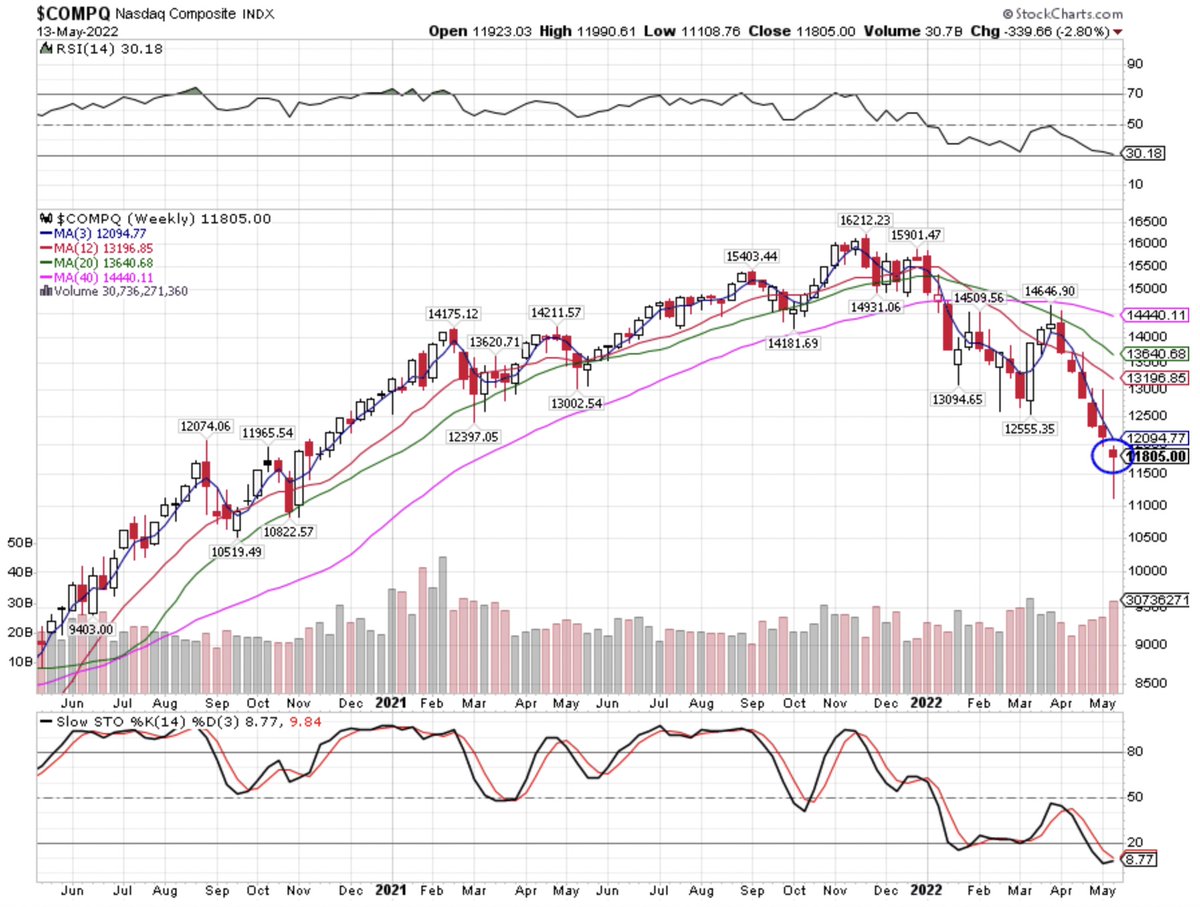

3/10

Were it not for positive #OPEX flows, 🇺🇸 equity prices would have been worse by 2-3% on the week

$SPX 2.4% (w) -8.95% (T)

$IWM -2.45% (w) -11.6% (T)

$COMPQ -2.8% (w) -14.4% (T)

Chart: $COMPQ 🔨 is -11.6% over (t) duration = 1-month

Were it not for positive #OPEX flows, 🇺🇸 equity prices would have been worse by 2-3% on the week

$SPX 2.4% (w) -8.95% (T)

$IWM -2.45% (w) -11.6% (T)

$COMPQ -2.8% (w) -14.4% (T)

Chart: $COMPQ 🔨 is -11.6% over (t) duration = 1-month

3a/10

Nothing but 🤕 in 🇺🇸 equity sectors

(Well, $XLP did manage +0.3% for the week)

$XLRE -3.9% (w) -5.15% (T)

$XLY -3.7% (w) -15.7% (T)

$XLF -3.5% (w) -16.4% (T)

$XLK -3.35% (w) -12.3% (T)

Chart: $XLB -2.4% broke Trend -1.8%

Nothing but 🤕 in 🇺🇸 equity sectors

(Well, $XLP did manage +0.3% for the week)

$XLRE -3.9% (w) -5.15% (T)

$XLY -3.7% (w) -15.7% (T)

$XLF -3.5% (w) -16.4% (T)

$XLK -3.35% (w) -12.3% (T)

Chart: $XLB -2.4% broke Trend -1.8%

4/10

Internat’l indices were a ↔️ 👜

$SSEC +2.7% (w) -10.95% (T)

$DAX +2.6% (w) -9.05% (T)

$CAC +1.65% (w) -9.25% (T)

$HSI -0.5% (w) -20.1% (T)

$KOSPI -2.15% (w) -5.2% (T)

$NIKK -2.15% (w) -4.6% (T)

Chart: $DAX flipped to neutral (t) trade @ -0.95% this week

Internat’l indices were a ↔️ 👜

$SSEC +2.7% (w) -10.95% (T)

$DAX +2.6% (w) -9.05% (T)

$CAC +1.65% (w) -9.25% (T)

$HSI -0.5% (w) -20.1% (T)

$KOSPI -2.15% (w) -5.2% (T)

$NIKK -2.15% (w) -4.6% (T)

Chart: $DAX flipped to neutral (t) trade @ -0.95% this week

4a/10

Nothing but 🐻 markets in Country ETFs

$VNM - 8.3% (w) -22.4% (T)

$IDX -7.55% (w) +0.9% (T) ⚠️🚩

$EDEN -4.25% (w) -9.15% (T)

$EWA -1.9% (w) -0.15% (T)⚠️🚩

Chart: $IDX 🇮🇩 was the last ♉️ 🔫 💥

Nothing but 🐻 markets in Country ETFs

$VNM - 8.3% (w) -22.4% (T)

$IDX -7.55% (w) +0.9% (T) ⚠️🚩

$EDEN -4.25% (w) -9.15% (T)

$EWA -1.9% (w) -0.15% (T)⚠️🚩

Chart: $IDX 🇮🇩 was the last ♉️ 🔫 💥

5/10

Metals 🪓🩸🐻

$SILVER -6.1% (w) -10.15% (T)

$GOLD -3.95% (w) -1.85% (T)

$PLAT -2.65% (w) -8.65% (T)

$COPPER -2.35% (w) -7.5% (T)

Chart: $GOLD broke trend at 1842 this week

So much for this core #quad4 allocation

Metals 🪓🩸🐻

$SILVER -6.1% (w) -10.15% (T)

$GOLD -3.95% (w) -1.85% (T)

$PLAT -2.65% (w) -8.65% (T)

$COPPER -2.35% (w) -7.5% (T)

Chart: $GOLD broke trend at 1842 this week

So much for this core #quad4 allocation

6/10

Grains managed to hang onto ♉️ (T) despite struggling on shorter time frames

$WHEAT +6.2% (w) +47.6% (T)

$SOYB +1.5% (w) +4.0% (T)

$SUGAR +0.0% (w)+5.15% (T)

$CORN -0.45% (w) +20.0% (T)

Chart: $WHEAT with a fresh ♉️ impulse ↗️

Grains managed to hang onto ♉️ (T) despite struggling on shorter time frames

$WHEAT +6.2% (w) +47.6% (T)

$SOYB +1.5% (w) +4.0% (T)

$SUGAR +0.0% (w)+5.15% (T)

$CORN -0.45% (w) +20.0% (T)

Chart: $WHEAT with a fresh ♉️ impulse ↗️

7/10

Hydrocarbons remain ♉️ (T)

$GASO +3.3% (w) +37.95% (T)

$WTIC +0.65% (w) +18.7% (T)

$BRENT -0.85% (w) +43.25% (T)

$NATGAS -4.75% (w) +94.4% (T)

Chart: $GASO 🆕 all-time high 🎈

Hydrocarbons remain ♉️ (T)

$GASO +3.3% (w) +37.95% (T)

$WTIC +0.65% (w) +18.7% (T)

$BRENT -0.85% (w) +43.25% (T)

$NATGAS -4.75% (w) +94.4% (T)

Chart: $GASO 🆕 all-time high 🎈

8/10

After touching 3.2% on Monday, the UST10Y yield ↘️ on the week, providing relief for 🩸 ♉️

10/2s to 34 BPS 🔻 -6.7 BPS

MOVE 114.6 -5.6%

Chart: Is the top in for $TNX or will we 👁️ a re-test of recent highs?

After touching 3.2% on Monday, the UST10Y yield ↘️ on the week, providing relief for 🩸 ♉️

10/2s to 34 BPS 🔻 -6.7 BPS

MOVE 114.6 -5.6%

Chart: Is the top in for $TNX or will we 👁️ a re-test of recent highs?

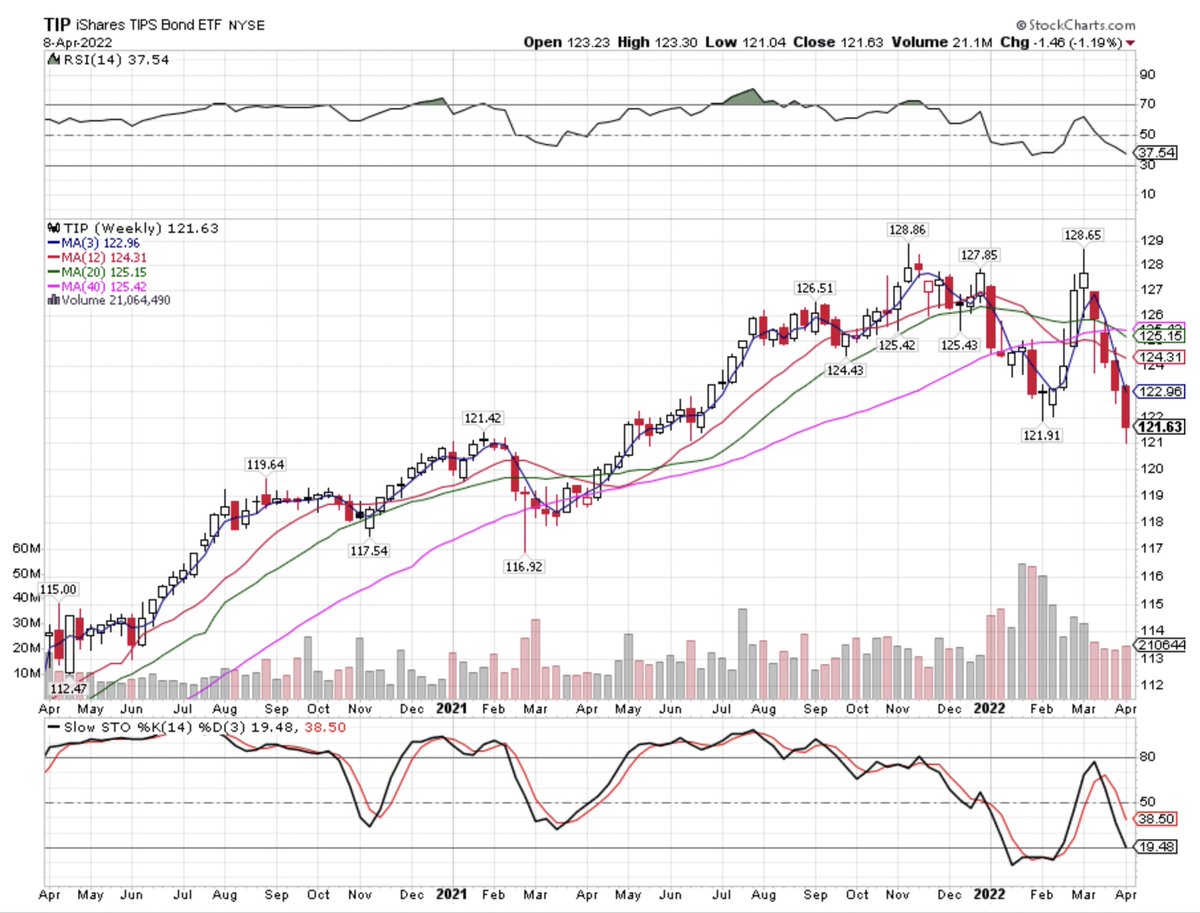

8a/10

Bond ETFs with rare positive returns on the week

$TLT +2.05% (w) -16.1% (T)

$IVOL +1.85% (w) +1.25%% (T) 🆕♉️

$IEF +1.5% (w) -7.7%% (T)

$LQD +0.75% (w) -10.6% (T)

$TIP +0.45% (w) -4.3% (T)

$HYG -1.0% (w) -7.1% (T)

Chart: $IVOL broke to ♉️ (t) + (T) this week

Bond ETFs with rare positive returns on the week

$TLT +2.05% (w) -16.1% (T)

$IVOL +1.85% (w) +1.25%% (T) 🆕♉️

$IEF +1.5% (w) -7.7%% (T)

$LQD +0.75% (w) -10.6% (T)

$TIP +0.45% (w) -4.3% (T)

$HYG -1.0% (w) -7.1% (T)

Chart: $IVOL broke to ♉️ (t) + (T) this week

9/10

The wrecking ball 🎳 known as the $USD put in a 20-year high for the week

$USD +0.9% (w) +8.9% (T)

$AUD -2.0% (w) -2.8% (T) 🐻

$EUR -1.25% (w) -8.3% (T)

$GBP -0.75% (w) -9.65% (T)

Chart: $CNYUSD falling off a cliff

🇨🇳 must need 💰

The wrecking ball 🎳 known as the $USD put in a 20-year high for the week

$USD +0.9% (w) +8.9% (T)

$AUD -2.0% (w) -2.8% (T) 🐻

$EUR -1.25% (w) -8.3% (T)

$GBP -0.75% (w) -9.65% (T)

Chart: $CNYUSD falling off a cliff

🇨🇳 must need 💰

10/10

Even with 💪 $USD, #CPI +8.3% y/y and wages +5.5% in April = -2.8% real buying power. THIS will affect demand ↘️ but Powell reiterated Thursday, “get inflation back under control” is the #1 priority, and it "will also include some pain”

Even with 💪 $USD, #CPI +8.3% y/y and wages +5.5% in April = -2.8% real buying power. THIS will affect demand ↘️ but Powell reiterated Thursday, “get inflation back under control” is the #1 priority, and it "will also include some pain”

10b/10

👊 🥣 removal will include pain

Tighten #FCI = 🔺 rates 🔻 equities

Demand destruction = wealth destruction

🩳 $XLY $XRT $XLK

LONG $TBT $IVOL $DBA $USD

Watch for ♉️ 🍩 into #OPEX, #STFR, and have a super profitable 💰 week!

👊 🥣 removal will include pain

Tighten #FCI = 🔺 rates 🔻 equities

Demand destruction = wealth destruction

🩳 $XLY $XRT $XLK

LONG $TBT $IVOL $DBA $USD

Watch for ♉️ 🍩 into #OPEX, #STFR, and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh