0/It's time for us to bring this topic up for discussion.

This thread will help you understand the difference between USN/NEAR and UST/LUNA

Both are algorithmic stablecoin, but what differentiate USN/NEAR, for them to prevent the same tragic crash that happened to UST and LUNA

This thread will help you understand the difference between USN/NEAR and UST/LUNA

Both are algorithmic stablecoin, but what differentiate USN/NEAR, for them to prevent the same tragic crash that happened to UST and LUNA

TLDR 😅

4 Main reasons why $USN is different from $UST

1/ Smart working mechanism of $USN

2/ $USN owns a more sustainable mechanism than $UST

3/ $USN is just getting started, hasn't fallen into the FOMO phase yet

4/ The stability of the @NEARProtocol ecosystem

4 Main reasons why $USN is different from $UST

1/ Smart working mechanism of $USN

2/ $USN owns a more sustainable mechanism than $UST

3/ $USN is just getting started, hasn't fallen into the FOMO phase yet

4/ The stability of the @NEARProtocol ecosystem

@NEARProtocol 1/ First, to understand how $USN works, you need to re-read this thread

to understand @DcntrlBank‘s price stabilization mechanism, asset collateral strategy and its management approach for $USN

https://twitter.com/NEAR_daily/status/1524706385266712576

to understand @DcntrlBank‘s price stabilization mechanism, asset collateral strategy and its management approach for $USN

@NEARProtocol @DcntrlBank 2/ #USN owns a smarter and more sustainable operating mechanism than #UST:

By combining the price stabilization mechanisms of $UST and Reserve Fund based on $Frax ‘s Currency Board.

🤑

By combining the price stabilization mechanisms of $UST and Reserve Fund based on $Frax ‘s Currency Board.

🤑

@NEARProtocol @DcntrlBank 2.1/ The difference here is that when $1 $LUNA is minted to $1 $UST, that $1 $LUNA will be burned, instead of being deposited into the protocol's Reserve Fund like $NEAR while minting $USN. This $NEAR mechanism partially guarantees USN according to the Currency Board’s principle.

@NEARProtocol @DcntrlBank 2.2/ Accordingly, USN is considered as one of the most effective ways to accelerate liquidity in the NEAR ecosystem, as well as increase the utility of the NEAR token while maintaining its stability. USN's smart contracts and Reserve Funds are managed by the Decentral Bank #DAO🚀

@NEARProtocol @DcntrlBank 2.3/ The staking interest rate of $USN is floating, as determining by the self-adjusting mechanism. When $NEAR price increases, the $USN ‘s staking interest rate will also increase, and vice versa

@NEARProtocol @DcntrlBank 2.3.1/ This maintains the stabilization of USN's exchange rate, avoiding any crisis and perhaps, a complete collapse like $UST when trying to keep the interest rates at a constant 18-20%.

@NEARProtocol @DcntrlBank 3/ USN is just getting started and hasn't entered the FOMO phase yet, even so, every worst case scenario should be carefully taken into consider by $NEAR

@NEARProtocol @DcntrlBank 3.1/ Reserve Fund of $USN was built from scratch as a dual collateral (2:1) – 100% of $USN is available as NEAR and other Stablecoins. In the initial stage, this supported USN to acquire better liquidity and stability compared to UST.

@NEARProtocol @DcntrlBank 3.2/In addition, after the failure of the UST,and with the information that Terra plans to fork a new Terra with a new UST coin, a collateralized mechanism like DAI is going to be implemented with the purpose of transferring and restoring their focus from scalability to stability

@NEARProtocol @DcntrlBank 3.2.1/ It’s very likely that $Near might pick up and apply this mechanism to strengthen its stability after the recent stablecoin crisis.

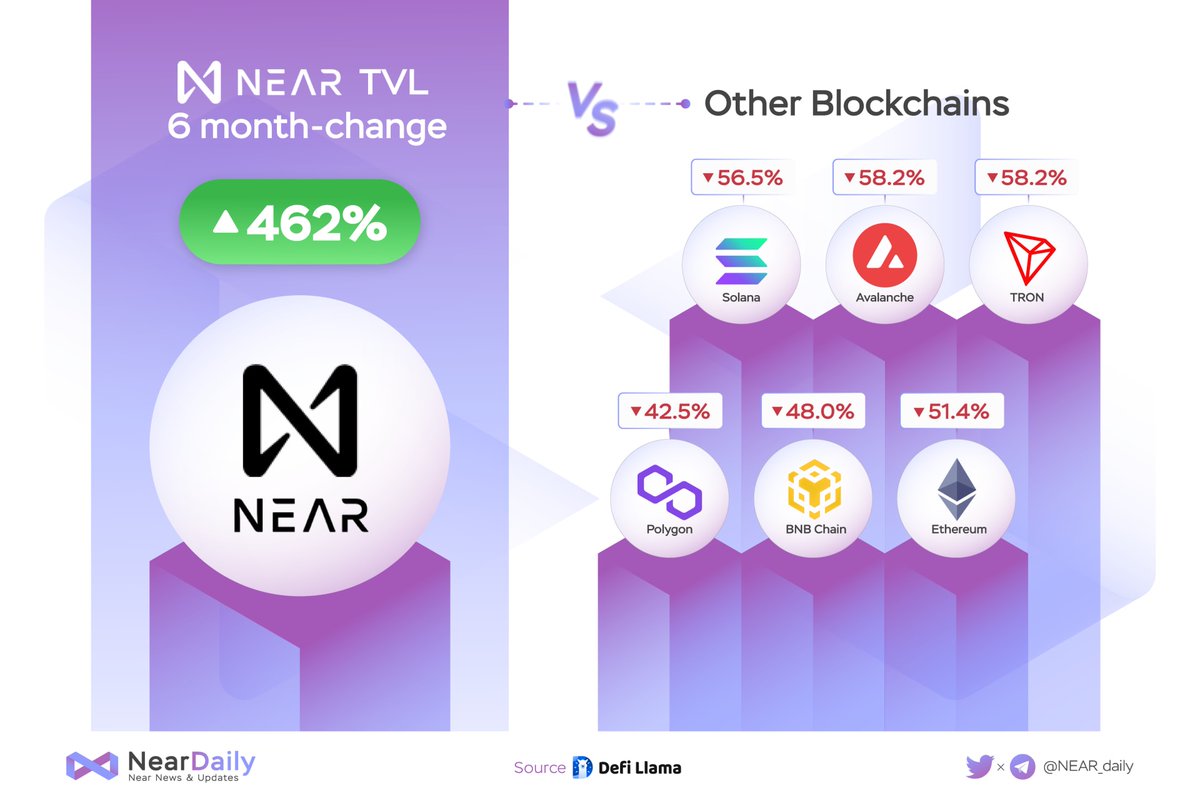

@NEARProtocol @DcntrlBank 4/ The stability of $NEAR ecosystem

@NEARProtocol @DcntrlBank 4.1/ For Terra – a non-EVM Blockchain, the process of developing and migrating dApps from other ecosystems is fairly difficult, since key products on dApps focus mainly around DeFi with the idea of having UST as a core.

@NEARProtocol @DcntrlBank 4.2/ For NEAR, the success of Aurora - NEAR system's EVM project, has attracted talented teams of developers to enter NEAR.

@NEARProtocol @DcntrlBank 4.2.1/ Thereby, the NEAR ecosystem has had a flourishing development of dApps with many different areas of services, which contributes to making NEAR's ecosystem more sustainable with many different customer folders.

@NEARProtocol @DcntrlBank 4.3/ At the same time, thanks to EVM, the NEAR ecosystem is easily accessed and supported by stable and large-cap stablecoins such as DAI, USDT, USDC

@NEARProtocol @DcntrlBank 4.3.1/ In addition, NEAR by nature is the first Blockchain platform to apply a new technology that no one has succeeded in yet, Sharding technology. This is the main reason for the growth of NEAR's value!

@NEARProtocol @DcntrlBank 5/ To sum up,

USN and NEAR have not reached their bubble state yet, everything about USN is still in its infancy. Many mechanisms and improvement opportunities are guaranteed to deliver great development and potential.

USN and NEAR have not reached their bubble state yet, everything about USN is still in its infancy. Many mechanisms and improvement opportunities are guaranteed to deliver great development and potential.

@NEARProtocol @DcntrlBank 5.1/ In particular, with EVM’s assistance, it's definitely easier to get support from outside resources.

Please look forward to tomorrow's thread on "Why Terra projects should come to Near's ecosystem"

#NEAR #UST #USN #TERRA #LUNA

Please look forward to tomorrow's thread on "Why Terra projects should come to Near's ecosystem"

#NEAR #UST #USN #TERRA #LUNA

• • •

Missing some Tweet in this thread? You can try to

force a refresh