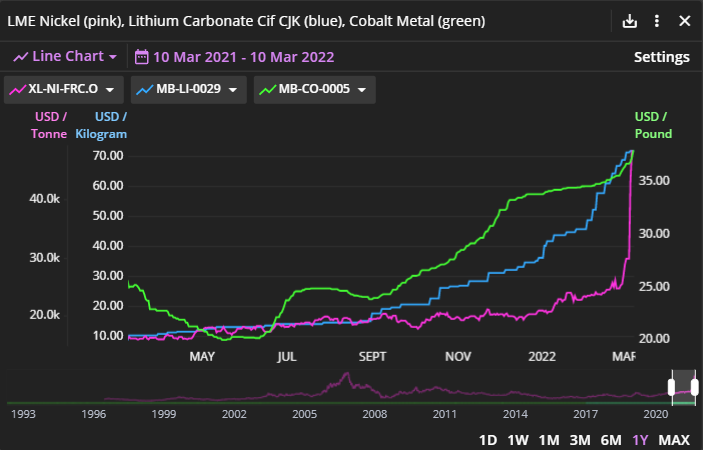

Quick #lithium update from @Fastmarkets...

CIF #hydroxide slightly firmer on the week, #carbonate flat. Domestic #China market also sideways for both compounds but sentiment more bullish. Looking ominous for consumer restocking hopes if this is the extent of the spot 'pullback'.

CIF #hydroxide slightly firmer on the week, #carbonate flat. Domestic #China market also sideways for both compounds but sentiment more bullish. Looking ominous for consumer restocking hopes if this is the extent of the spot 'pullback'.

A few key quotes from the market:

Intl consumer: “Demand for lithium hydroxide remains strong in the seaborne market, while spot supply is tight. Lithium consumers in Japan and South Korea are sending many inquiries to Chinese sellers.”

Intl consumer: “Demand for lithium hydroxide remains strong in the seaborne market, while spot supply is tight. Lithium consumers in Japan and South Korea are sending many inquiries to Chinese sellers.”

Chinese producer: “Chinese sellers are not lowering their offers for lithium hydroxide amid expectations of a price rise in the near term, when the Chinese market recovers from the most recent outbreaks of Covid-19.”

Japanese trader: “Due to Russia’s invasion of Ukraine, the supply of Russian material in Japan has been cut off. This exacerbates the tightness in the supply of lithium hydroxide in the seaborne market”.

Several participants noted a slight recovery of domestic demand for lithium carbonate from the LFP battery sector, citing a gradual resumption of downstream EV production, though some played down its extent calling it "too subtle."

• • •

Missing some Tweet in this thread? You can try to

force a refresh