How to get URL link on X (Twitter) App

A few key quotes from the market:

A few key quotes from the market:

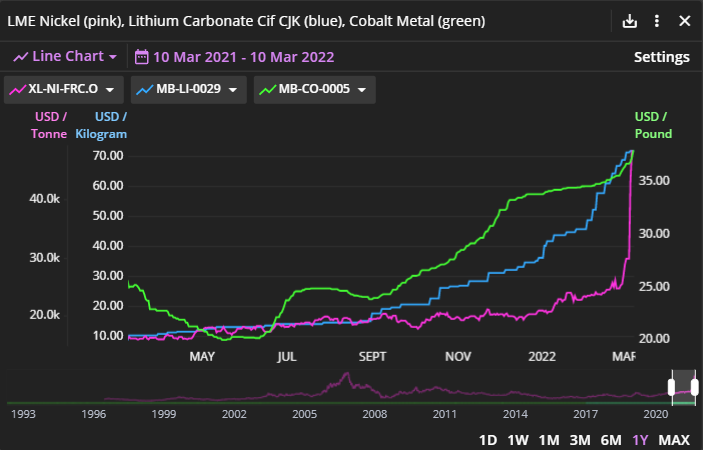

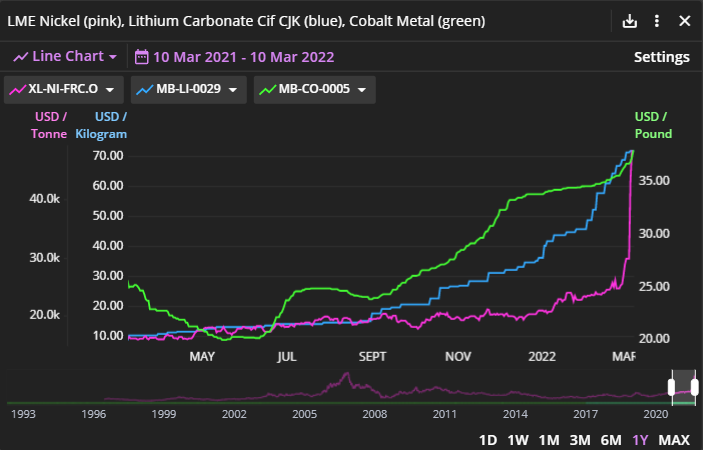

2/ The key distinction is between physically-settled & cash-settled futures. The meme move on Ni was the result of a short squeeze on a contract requiring physical delivery of expiring positions - "he who sells what is'n his'n must pay the price or go to prisn" as they say

2/ The key distinction is between physically-settled & cash-settled futures. The meme move on Ni was the result of a short squeeze on a contract requiring physical delivery of expiring positions - "he who sells what is'n his'n must pay the price or go to prisn" as they say