Now you can buy property at just Rs. 10,000🤯

Don't believe it? Find out how in this thread😎⤵️

(1/8)

#StockMarket #realestate

Don't believe it? Find out how in this thread😎⤵️

(1/8)

#StockMarket #realestate

You don't need lakhs, you can start with as low as Rs. 10,000!

Introducing: RIET(Real Estate Investment Trust)

Let's understand what actually REIT is

(2/8)

Introducing: RIET(Real Estate Investment Trust)

Let's understand what actually REIT is

(2/8)

REITs, just like Mutual funds, pool investors' wealth & invest it in real estate properties.

It is a hybrid product serving dual purposes:

1. Capital Appreciation(rise in value of property)

2. Income Generation(rent from property lent-out)

(3/8)

#investing #mutualfunds

It is a hybrid product serving dual purposes:

1. Capital Appreciation(rise in value of property)

2. Income Generation(rent from property lent-out)

(3/8)

#investing #mutualfunds

Why is REIT better than a direct investment in property?

Here are major 4 reasons:

1. More accessible: Less investment is required & more liquidity as they are listed in stock market

(4/8)

Here are major 4 reasons:

1. More accessible: Less investment is required & more liquidity as they are listed in stock market

(4/8)

2. REITs grow faster: Reports claim REITs grow dividend at >5% pa while pvt real estate at <2% pa

3. Substantial cost savings: Due to bettr netwrk & bigger deals, REIT ensure better price negotiation & fetches loan at low intrst rate. Many exp lyk brokerage r eliminated. (5/8)

3. Substantial cost savings: Due to bettr netwrk & bigger deals, REIT ensure better price negotiation & fetches loan at low intrst rate. Many exp lyk brokerage r eliminated. (5/8)

4. REITs are safer: There could be portfolio concentration risk in physical real estate, which is lesser in REIT as it invests in multiple properties.

(6/8)

(6/8)

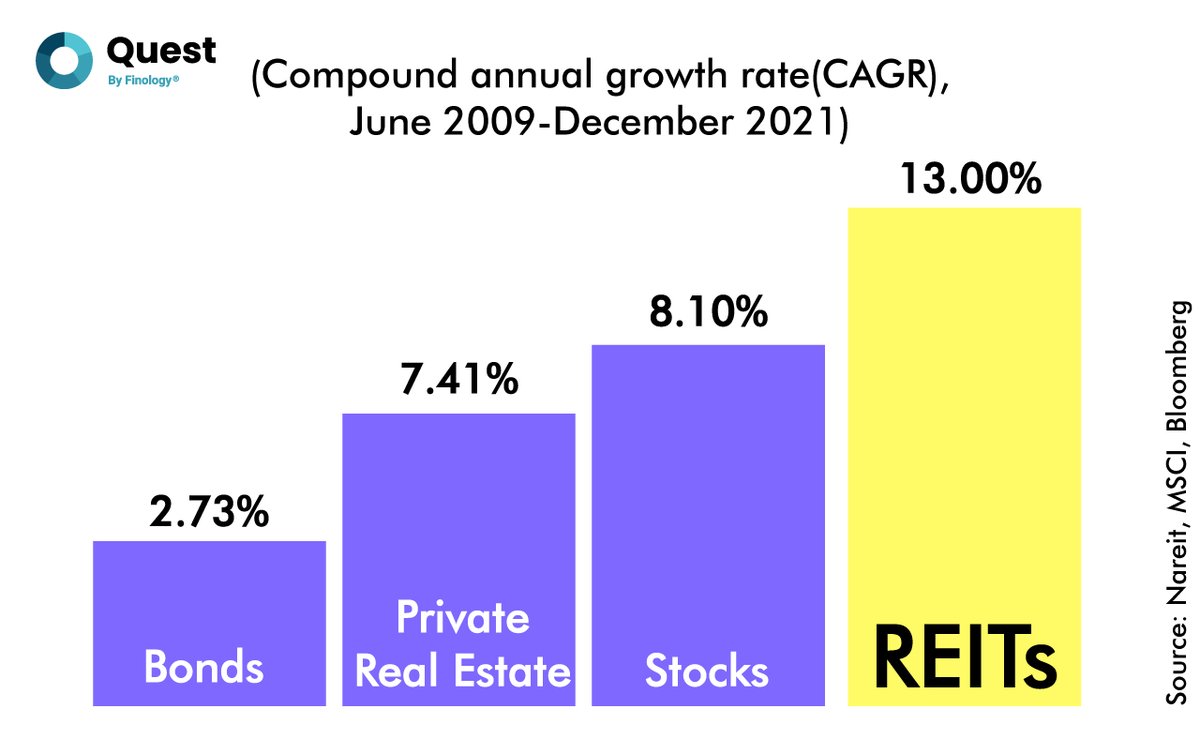

If you look at 12-years historical returns, REITs have outperformed international stocks, bonds & physical real estate too!

(7/8)

(7/8)

There are no. of factors u need to consider while analyzing REITs. So, here is our detailed video course on Quest by one of our expert Mr. HarshVardhan Dawar, Founder of @WealthCafeFin

Course link - bit.ly/quest-realesta…

Please hit retweet🔁so it reaches max #investor

(8/8)

Course link - bit.ly/quest-realesta…

Please hit retweet🔁so it reaches max #investor

(8/8)

• • •

Missing some Tweet in this thread? You can try to

force a refresh