Manchester United have announced financial results for Q3 of 2021/22, incorporating the first 9 months of the season (July 2021 to March 2022), so these are boosted by the return of fans to the stadium. Some thoughts in the following thread #MUFC

#MUFC swung from £18m pre-tax profit to £58m loss (£45m after tax), despite revenue increasing £65m (16%) from £400m to £465m and profit on player sales rising from £0.3m to £18m, as expenses were up £109m (27%) and net interest went from £18m recoverable to £31m payable.

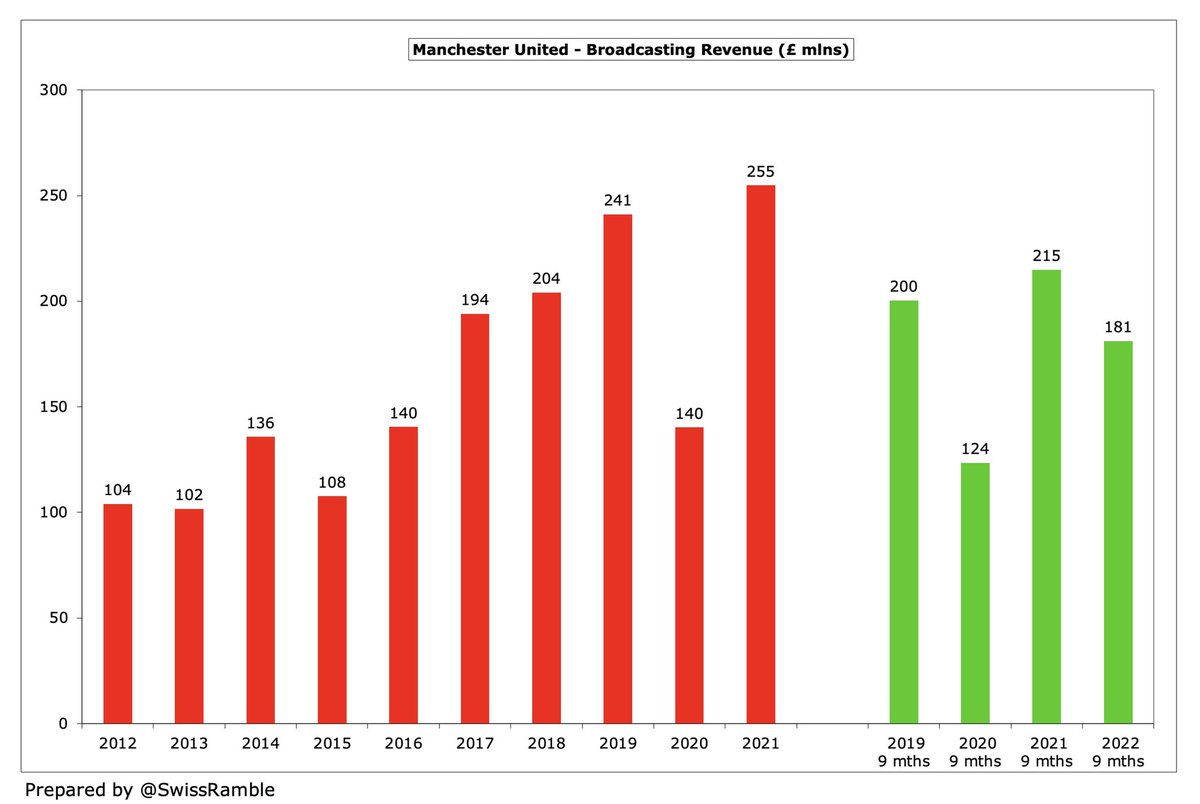

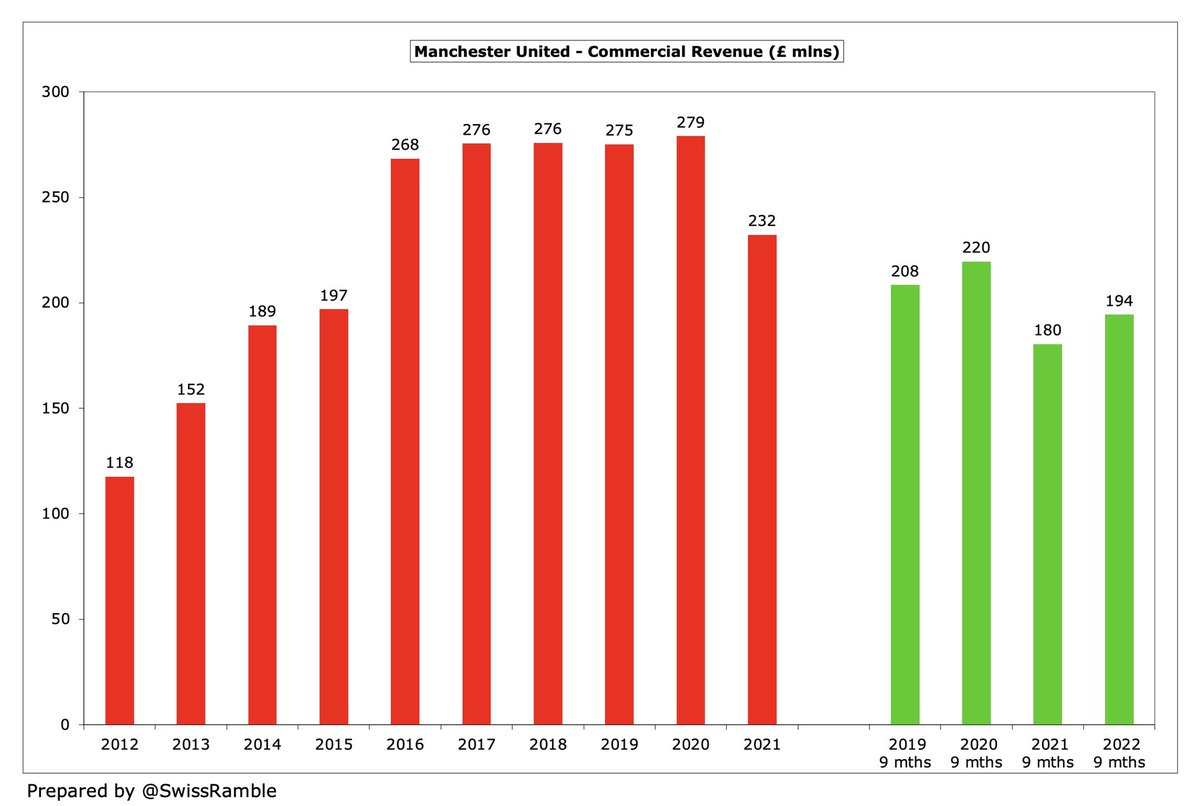

The main driver of the #MUFC £65m revenue increase was match day, which rose £84m from £5m to £89m, as games no longer played behind closed doors, though commercial was also up £14m (8%) from £180m to £194m. In contrast, broadcasting fell £34m (16%) from £215m to £181m.

#MUFC wages shot up £49m (21%) from £239m to £288m, while player amortisation also grew £19m (20%) from £91m to £110m. Increased business activity, due to home games being played with fans and Old Trafford Megastore re-opening, meant £41m (74%) higher other expenses.

#MUFC interest went from went from £18m receivable in 2021 to £31m payable in 2022, an adverse movement of £49m, largely due to an unfavourable swing in unrealised foreign exchange movements on the club’s debt, which is denominated in USD, compared to prior year favourable swing.

It’s interesting that #MUFC have reported a £58m pre-tax loss in the first 9 months of 2021/22, despite the return of fans to the stadium post-COVID. Also worth noting that last season’s £18m profit in the comparable period ultimately became a £24m loss for the full year.

#MUFC profit from player sales rose from just £259k to £18m, thanks to the sale of Dan James to #LUFC and a sell-on fee from Romelu Lukaku’s transfer from Inter to #CFC. This is not that big by Premier League standards, but is more than twice as much as the 2020/21 full year £7m.

#MUFC have reported operating losses for the past two seasons, so it is no huge surprise to see another deficit in the first 9 months of 2021/22. That said, the £44m operating loss is significantly more than the £0.5m lost in the same period last season.

Although it is clearly good news that #MUFC revenue increased from £400m to £465m, it has still not returned to the £496m pre-pandemic level for the first 9 months. This suggests that United are unlikely to reach the club’s 2019 revenue peak of £627m this season.

#MUFC match day revenue increased from just £5m to £89m, as all home games were played in front of a full capacity crowd, while they were behind closed doors in the prior year. As annual income is usually above £110m, United lost more than most from COVID restrictions.

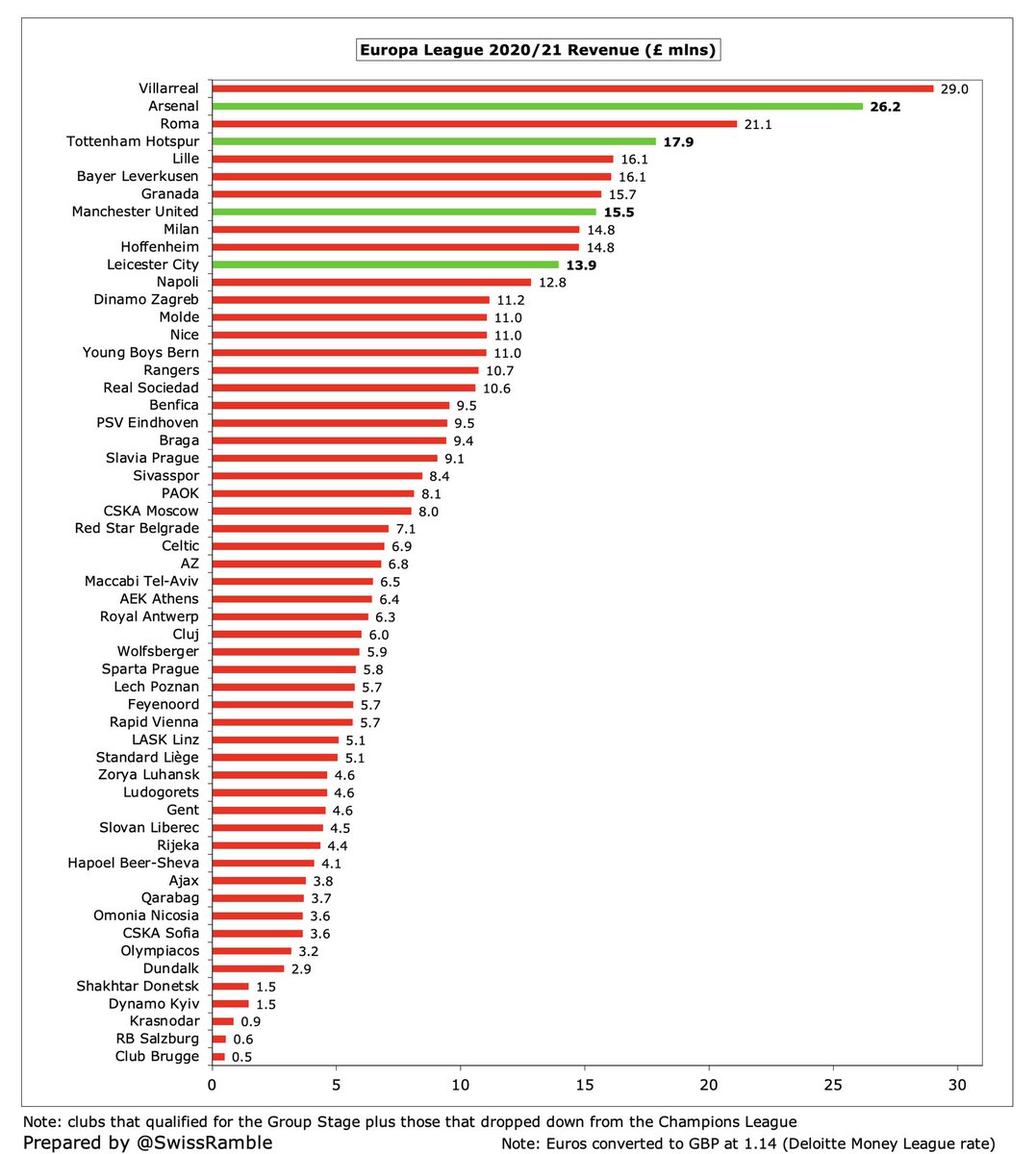

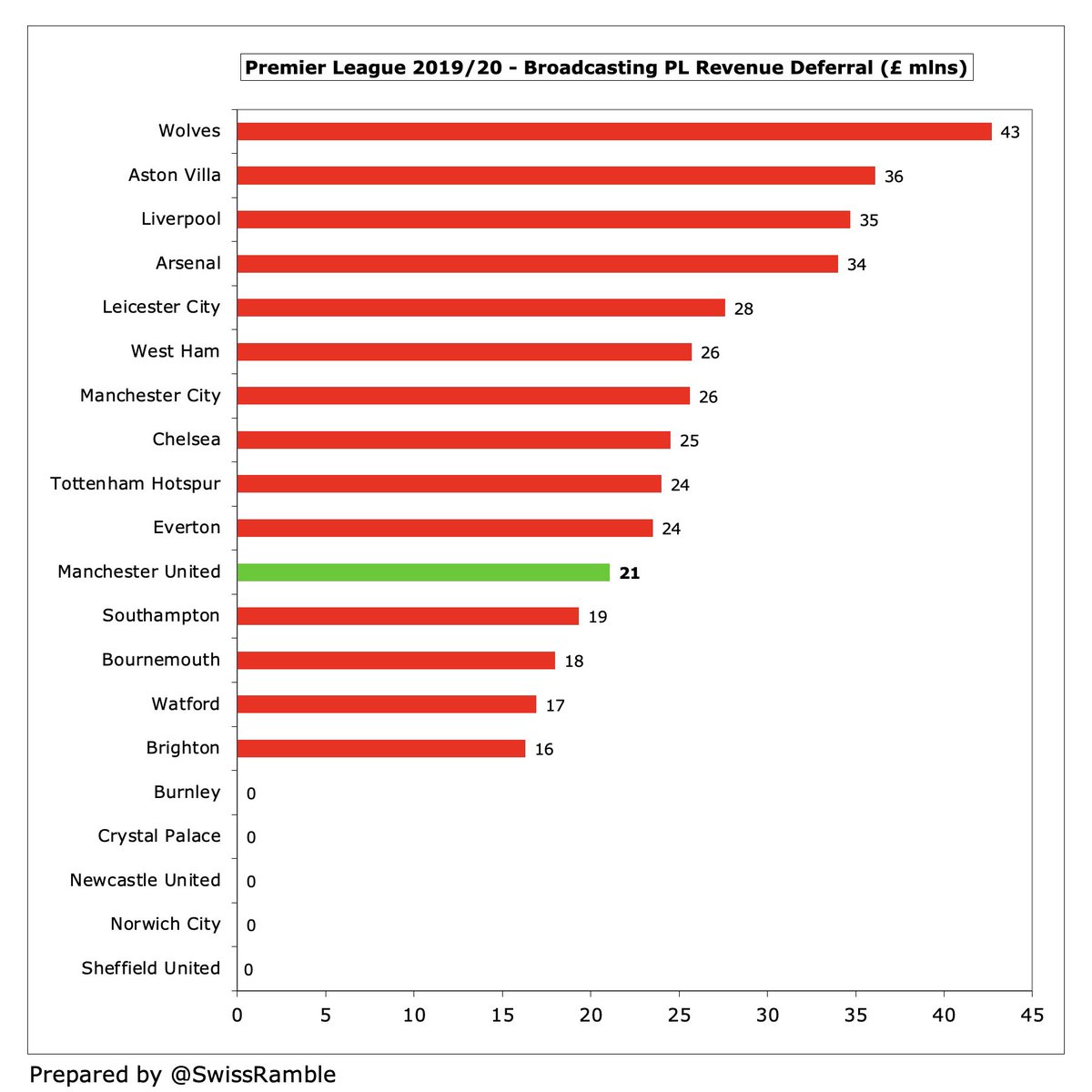

#MUFC broadcasting revenue fell £34m (16%) from £215m to £181m, as prior year accounts benefited from revenue deferred from 2019/20 for games played after end-June accounting close, plus there were fewer European games this season and a lower Premier League merit payment.

On a full year basis I estimate that #MUFC will receive slightly less money from Europe this season, with £67m for reaching the Champions League last 16 compared to £70m in 2020/21 (Champions League group stage £54m plus Europa League finalists £16m).

#MUFC commercial income rose £14m (8%) from £180m to £194m, due to merchandising rising by £13m (19%) to £84m, thanks to “increased Megastore footfall” (aided by the Ronaldo factor), with sponsorship up slightly to £111m. No pre-season tour possible. Still below 2020 £220m peak.

#MUFC figures still include revenue from the lucrative £64m Chevrolet shirt sponsorship, as the contract was extended by 6 months to December 2021. This was replaced in January by TeamViewer’s much lower £47m, though the new Tezos £20m training kit deal is higher than AON £15m.

#MUFC wages shot up £49m (21%) from £239m to £288m, as a result of signing Ronaldo, Varane and Sancho, which works out to £384m on an annualised basis. This is in line with the club’s estimate of a 20% year-on-year increase to £387m, which would be the highest ever in England.

#MUFC wages to turnover for first 9 months of 2021/22 was 62%, which is lower (better) than 65% in full year 2020/21, though still the second worst ratio that United have reported (and significantly higher than 45% in 2017), driven by higher wages and low revenue growth.

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, also rose £19m (20%) from £91m to £110m in the first 9 months. Had been steadily declining since the £137m annual high in 2018, but now on track for £147m.

#MUFC net debt has increased by £76m in the last 9 months to around half a billion, as gross debt rose £62m to £592m and cash fell £15m to £96m. Took out new £40m loan, while US Dollar denominated borrowings were higher in GBP terms, due to foreign exchange movements.

#MUFC Q3 cash balance of £96m is £9m higher than prior year’s £87m. Although this has reduced from (very high) £308m in 2019, it is still pretty good compared to most other Premier League clubs.

After adding back non-cash items and working capital movements, #MUFC had £78m operating cash flow, but then spent £80m on players (purchases £101m, sales £20m), £22m dividends and £18m interest payments. Funded by £39m loan. Net cash outflow was £15m.

In the first 9 months of 2021/22 #MUFC paid £18m interest, around the same as in recent years. United have now paid an amazing three-quarters of a billion pounds in interest since the Glazers leveraged buy-out, while the debt owed is virtually unchanged at around £600m.

Although it has fallen from its peak, #MUFC annual interest payment of about £20m is still a lot higher than every other Premier League club except #AFC £34m (£32m break fee for debt refinancing) and #THFC £18m (new stadium).

#MUFC have found enough cash to pay shareholders (mainly the Glazers) a £22m dividend, including £11m delayed from 2020/21. Another £11m semi-annual dividend will be paid on 24 June, taking year to £33m. United are the only Premier League club to pay dividends (£155m since 2016).

Chief executive Richard Arnold described this as “a disappointing season”, though pointed to revenues continuing to recover from the pandemic. This is clearly true, though the debt remains high and wages are shooting up. New manager Erik ten Hag has much on his “to do” list.

• • •

Missing some Tweet in this thread? You can try to

force a refresh