Hello Friday and the week to date!

Week to date

$NATGAS +10.05%

$COFFEE +5.0%

$WTIC +3.45%

$GASO +2.8%

$LUMBER +2.35%

$COPPER -0.35%

$WHEAT -2.2%

$EUR +1.6%

$GOLD +0.3%

$USD -1.25%

$BTC -4.1%

$SPX +4.0%

$CAC +2.0%

$SSEC -0.75%

$KOSPI -1.0%

$TLT +0.25%

Let's dig into the🧮!

Week to date

$NATGAS +10.05%

$COFFEE +5.0%

$WTIC +3.45%

$GASO +2.8%

$LUMBER +2.35%

$COPPER -0.35%

$WHEAT -2.2%

$EUR +1.6%

$GOLD +0.3%

$USD -1.25%

$BTC -4.1%

$SPX +4.0%

$CAC +2.0%

$SSEC -0.75%

$KOSPI -1.0%

$TLT +0.25%

Let's dig into the🧮!

Asia finished the week on an ↗️🎵

$NIKK 26782 +0.65%

$SSEC 3130 +0.25%

$TWII 15266 +1.85%

$HIS 20683 +2.8%

$KOPSI 2638 +1.0%

$IDX 7026 +2.05%

Australia ↗️

$ASX 7183 +1.1%

India ↗️

$BSE 54865 +1.15%

$NIKK 26782 +0.65%

$SSEC 3130 +0.25%

$TWII 15266 +1.85%

$HIS 20683 +2.8%

$KOPSI 2638 +1.0%

$IDX 7026 +2.05%

Australia ↗️

$ASX 7183 +1.1%

India ↗️

$BSE 54865 +1.15%

Europe building on weekly gains ↗️ at the open

$DAX 14332 +0.7%

$FTSE 7573 +0.1%

$CAC 6472 +0.95%

$AEX 697 +0.65%

$IBEX 8909 +0.25%

$MIB 34575 +0.1%

$SMI 11555 +0.55%

$MOEX 2431 +0.75% 🪆

$VSTOXX 25.66🔻

$DAX 14332 +0.7%

$FTSE 7573 +0.1%

$CAC 6472 +0.95%

$AEX 697 +0.65%

$IBEX 8909 +0.25%

$MIB 34575 +0.1%

$SMI 11555 +0.55%

$MOEX 2431 +0.75% 🪆

$VSTOXX 25.66🔻

🇺🇸 futures ↗️ as the 🌊 of 🌊 ↘️

$VVIX 96.25 a multi-year low

$ES 4070 +0.3%

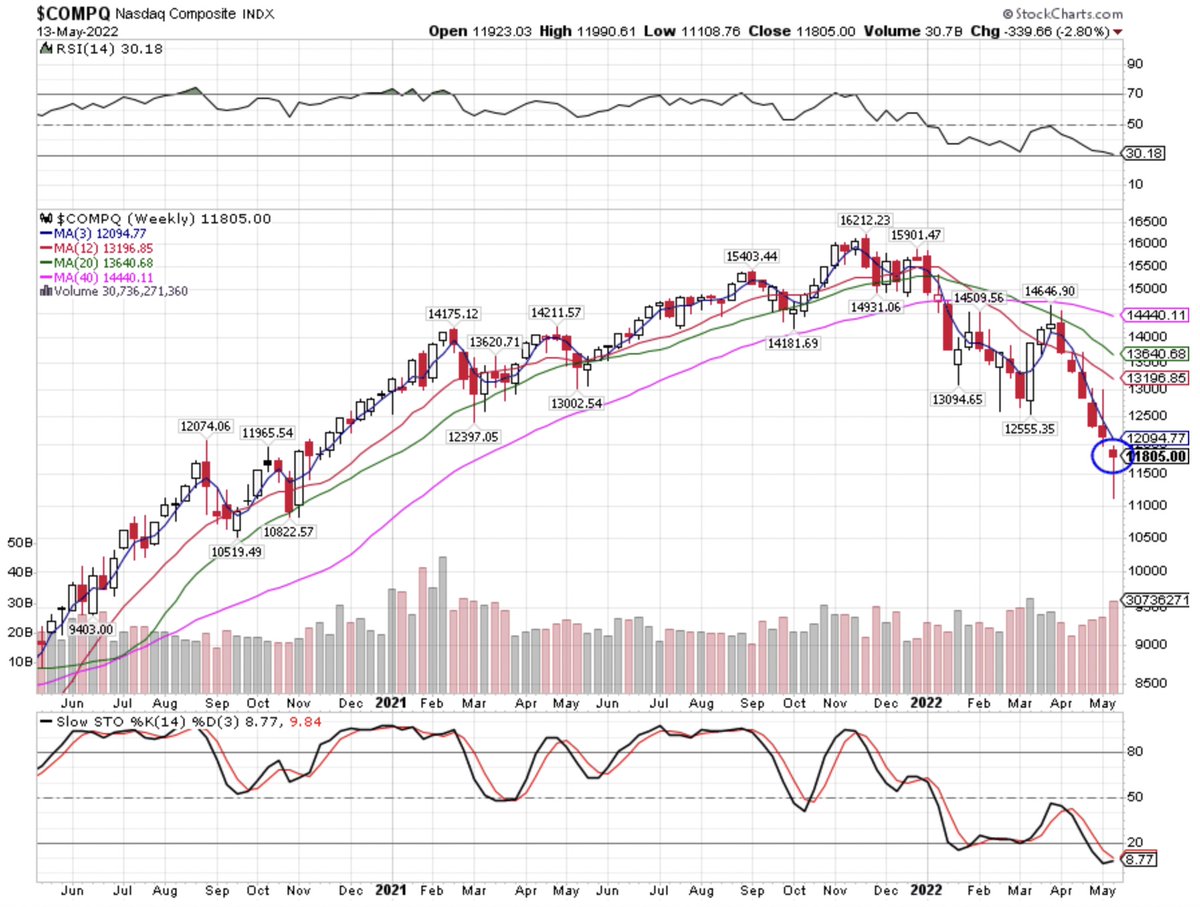

$NQ 12338 +0.5%

$RTY 1842 +0.2%

$VIX 27.16 🔻

$VVIX 96.25 a multi-year low

$ES 4070 +0.3%

$NQ 12338 +0.5%

$RTY 1842 +0.2%

$VIX 27.16 🔻

GOLD and metals trading ↗️

$GOLD 1857 +0.5%

$SILVER 22.28 +1.45%

$COPPER 4.31 +1.1%

$PLAT 943.55 +0.65%

$PALL 2020 +1.35%

$ALI 2894 +1.0%

$ZINC 3812 +2.05%

$GVZ 17.81 🔻

$GOLD 1857 +0.5%

$SILVER 22.28 +1.45%

$COPPER 4.31 +1.1%

$PLAT 943.55 +0.65%

$PALL 2020 +1.35%

$ALI 2894 +1.0%

$ZINC 3812 +2.05%

$GVZ 17.81 🔻

Hydrocarbons firm ↗️

$WTIC 114.42 +0.3%

$BRENT 114,67 +0.45%

$GASO 3.89 +0.3%

$NATGAS 8.814 -0.9%

$OVX 46.03 🔻

$WTIC 114.42 +0.3%

$BRENT 114,67 +0.45%

$GASO 3.89 +0.3%

$NATGAS 8.814 -0.9%

$OVX 46.03 🔻

Grains ↗️ small

$WHEAT 1145 +0.2%

$CORN 764 +0.05%

$SOYB 1729 +0.15%

$SUGAR 19.57 +0.15%

$COFFEE 225.23 -0.25% ☕️

$WHEAT 1145 +0.2%

$CORN 764 +0.05%

$SOYB 1729 +0.15%

$SUGAR 19.57 +0.15%

$COFFEE 225.23 -0.25% ☕️

Continued $USD weakness ↘️

$USD 101.69 -0.16%

$EUR 1.0735 +0.1%

$GBP 1.272 +0.18%

$AUD 0.7144 +0.65%

$USDJPY 127.03 -0.07%

$USDCHF 0.9586 -0.07%

$USDCAD 1.275 -0.2%

$USDRUB 67.267 +3.07% 🪆

$USD 101.69 -0.16%

$EUR 1.0735 +0.1%

$GBP 1.272 +0.18%

$AUD 0.7144 +0.65%

$USDJPY 127.03 -0.07%

$USDCHF 0.9586 -0.07%

$USDCAD 1.275 -0.2%

$USDRUB 67.267 +3.07% 🪆

UST bond yields ↔️

10/2s to 27 BPS

MOVE 102.49🔻

2Y 2.476

5Y 2.717

10Y 2.76

30Y 2.978

Global 10Ys mostly ↘️

CAN 2.794 +0.02

10/2s to 27 BPS

MOVE 102.49🔻

2Y 2.476

5Y 2.717

10Y 2.76

30Y 2.978

Global 10Ys mostly ↘️

CAN 2.794 +0.02

Volatility 🌊↘️ across asset classes is giving investors some reprieve even as the $CRB +2.% as in #inflation is not abating. #NotQuad4

Good spot to start adding back equity 🩳

Vol 🌊 cheaper, complacency ↗️

Have a super profitable 💰 day and an awesome long weekend!

Good spot to start adding back equity 🩳

Vol 🌊 cheaper, complacency ↗️

Have a super profitable 💰 day and an awesome long weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh