1/ #USDD is NOT a stablecoin! WHAT? 😲

Here's my review of the USDD cryptocurrency on #Tron network. #TRX

Read the above again. This is the label they used for USDD in their whitepaper!

A clear red flag & there are more.

You asked & I delivered. A thread. 🧵

👇👇👇

Here's my review of the USDD cryptocurrency on #Tron network. #TRX

Read the above again. This is the label they used for USDD in their whitepaper!

A clear red flag & there are more.

You asked & I delivered. A thread. 🧵

👇👇👇

2/ What is #USDD?

USDD is a cryptocurrency native to #Tron network.

This is nothing big on its own.

However, if you thought USDD was a regular stablecoin, I got a surprise for you. 👇

USDD is a cryptocurrency native to #Tron network.

This is nothing big on its own.

However, if you thought USDD was a regular stablecoin, I got a surprise for you. 👇

3/ Check out this abstract from the USDD whitepaper.

Highlights are mine.

Let me dissect that for you in more detail below.

There is a reason the whitepaper is so... vague.

It's pretty obvious what's going on. 👇

Highlights are mine.

Let me dissect that for you in more detail below.

There is a reason the whitepaper is so... vague.

It's pretty obvious what's going on. 👇

4/ "a cryptocurrency issued by Tron DAO Reserve"

This means it is centralized, full stop. Don't be fooled.

Look at Terra/Luna if you are in doubt (see link).

The Tron DAO has some clear members calling the shots.

Let's check them out. 👇

This means it is centralized, full stop. Don't be fooled.

Look at Terra/Luna if you are in doubt (see link).

The Tron DAO has some clear members calling the shots.

Let's check them out. 👇

https://twitter.com/DU09BTC/status/1523693970395901953?s=20&t=LCczv4qDYaTTQuZzQo9Ljw

5/ Whenever you read USDD is decentralized it means these "members" are in charge of it (see pics).

The Tron DAO Reserve is controlled by them and so is USDD issuance & burn.

If you hold USDD, you in effect trust these entities with your money.

Not convinced? 👇

The Tron DAO Reserve is controlled by them and so is USDD issuance & burn.

If you hold USDD, you in effect trust these entities with your money.

Not convinced? 👇

6/ The only thing decentralized about USDD is the Tron network.

The rest is about the above members sitting down & deciding "monetary policy" for USDD.

That is their whitepaper language, not mine! 🤣

Let us check the peg mechanism next... now we get to the juicy stuff. 👇

The rest is about the above members sitting down & deciding "monetary policy" for USDD.

That is their whitepaper language, not mine! 🤣

Let us check the peg mechanism next... now we get to the juicy stuff. 👇

7/ "a cryptocurrency [...] with a stable price"

Nowhere in the whitepaper do they say that #USDD should be pegged to the USD at a 1:1 rate.

NOWHERE!

USDD could very well be "pegged" to the USD at 10 cents in the future & it would still work as intended!

Wait, what? 👇

Nowhere in the whitepaper do they say that #USDD should be pegged to the USD at a 1:1 rate.

NOWHERE!

USDD could very well be "pegged" to the USD at 10 cents in the future & it would still work as intended!

Wait, what? 👇

8/ They do explain how the peg mechanism works, it is similar to Luna. 🤣

But the peg rate could be any: $1, 50 cents, 10 cents... or 0.

Users & arbitrageurs "can" choose to re-peg, or not! 😅

This is where things get fuzzy & funny! 👇

But the peg rate could be any: $1, 50 cents, 10 cents... or 0.

Users & arbitrageurs "can" choose to re-peg, or not! 😅

This is where things get fuzzy & funny! 👇

9/ We have little info on #USDD backing.

The USDD "reserve" did buy some USDT + BTC to "defend" the peg.

Do they have enough in the reserve to back USDD? Probably not.

But this is fine so long TRX market cap > USDD mcap.

If not, see UST. Next 👇

The USDD "reserve" did buy some USDT + BTC to "defend" the peg.

Do they have enough in the reserve to back USDD? Probably not.

But this is fine so long TRX market cap > USDD mcap.

If not, see UST. Next 👇

https://twitter.com/DU09BTC/status/1516653128841576451?s=20&t=nVo_c2QcgfZuavoO5zIwQA

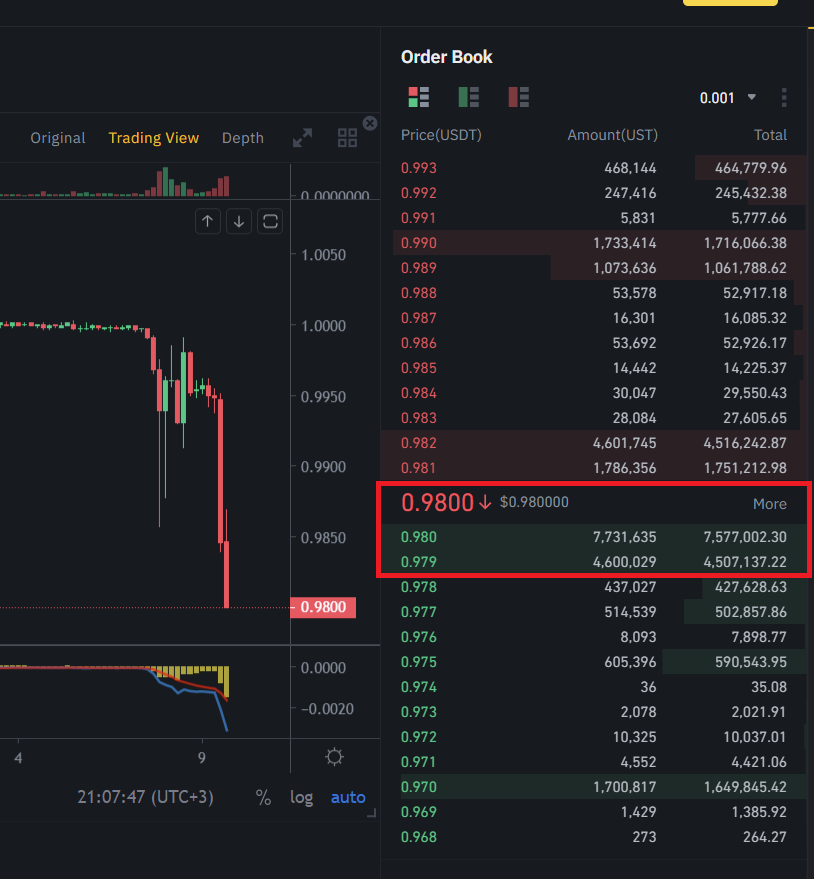

10/ Today's USDD mcap is 0.6 bil vs Tron's 7.7 bil mcap.

Not bad.

But I'd be very careful once USDD mcap is more than half of TRX mcap.

So why even do this, what do those "DAO members" gain? What's the incentive?

Leverage, arbitrage & market share! 👇

Not bad.

But I'd be very careful once USDD mcap is more than half of TRX mcap.

So why even do this, what do those "DAO members" gain? What's the incentive?

Leverage, arbitrage & market share! 👇

11/ First, they can issue USDD against TRX market cap without backing. Yay free money!

This is similar to what Do Kwon did with UST, then bought BTC for free!

But they need to be careful as they can crash USDD/TRX if they leverage too high.

Next 👇

This is similar to what Do Kwon did with UST, then bought BTC for free!

But they need to be careful as they can crash USDD/TRX if they leverage too high.

Next 👇

https://twitter.com/DU09BTC/status/1504862614572179456?s=20&t=iN-bP99ebz2A17rfFO6ANQ

12/ Second, only these DAO members "manage" the peg mechanism & can make a lot of profit from it.

Every time USDD goes above or below $1, they stand to profit.

If it goes too low, will they save the peg? For UST, $3 bil was not enough to save it.

What about the USDD users? 👇

Every time USDD goes above or below $1, they stand to profit.

If it goes too low, will they save the peg? For UST, $3 bil was not enough to save it.

What about the USDD users? 👇

13/ To boost USDD market share (= pump TRX + leverage more), the "Tron DAO" gives incentives to users.

Sun.io USDD & USDT pool has 30% APY at the time of this post.

Not bad, but the risks are clear.

If USDD mcap gets too big = crash. 🤯

What should you do?

Sun.io USDD & USDT pool has 30% APY at the time of this post.

Not bad, but the risks are clear.

If USDD mcap gets too big = crash. 🤯

What should you do?

14/ Understand that USDD market cap is basically a leverage position on the ENTIRE Tron ecosystem!

See Terra / Luna crash for more (video)

If they get greedy, as Lunatics did, it will end in disaster for all involved

Plus, remember the whitepaper? 👇

See Terra / Luna crash for more (video)

If they get greedy, as Lunatics did, it will end in disaster for all involved

Plus, remember the whitepaper? 👇

15/ To me, they have NO OBLIGATION to keep the peg at 1:1 with USD.

Even the title of their whitepaper is "Decentralized Stablecoin Protocol"

That can mean ANYTHING.

Don't be fooled or get too greedy, it may cost you. 👇

Even the title of their whitepaper is "Decentralized Stablecoin Protocol"

That can mean ANYTHING.

Don't be fooled or get too greedy, it may cost you. 👇

16/ USDD is neither decentralized nor a safe stablecoin.

These labels mean little so long there is no transparency on its backing or the "USDD DAO" decisions.

Check out my guide on stablecoins to learn more.

Next 👇

These labels mean little so long there is no transparency on its backing or the "USDD DAO" decisions.

Check out my guide on stablecoins to learn more.

Next 👇

https://twitter.com/DU09BTC/status/1514996987741065223

17/ Do your due diligence!

USDD may offer a juicy +30% yield, but is that worth the risks?

Are you comfortable with losing all your money?

This is exactly what happened to #UST + all token holders across the entire Terra ecosystem!

My risk assessment on USDD is next. 👇

USDD may offer a juicy +30% yield, but is that worth the risks?

Are you comfortable with losing all your money?

This is exactly what happened to #UST + all token holders across the entire Terra ecosystem!

My risk assessment on USDD is next. 👇

18/ Calling #USDD a stablecoin is very misleading & risky!

Calling it a cryptocurrency is much better, as per their whitepaper. 🤣

If you are a degen, you can farm that yield no questions asked.

Just get out early & don't look back once USDD mcap grows too big.

Finally 👇

Calling it a cryptocurrency is much better, as per their whitepaper. 🤣

If you are a degen, you can farm that yield no questions asked.

Just get out early & don't look back once USDD mcap grows too big.

Finally 👇

19/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3MUpkna

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3MUpkna

Retweet for more content like this! 👇👇👇

Thank you!

Thank you!

https://twitter.com/DU09BTC/status/1530582931244294145?s=20&t=EIBDozJMIuqeMnXRiERpLg

• • •

Missing some Tweet in this thread? You can try to

force a refresh