🚨NEW ANALYSIS🚨 The latest #SocialSecurity projections show that the program is only 13 years from insolvency and faces large & rising imbalances. Though finances have improved slightly, they remain perilous, and time is running out to save the program.

crfb.org/papers/analysi….

crfb.org/papers/analysi….

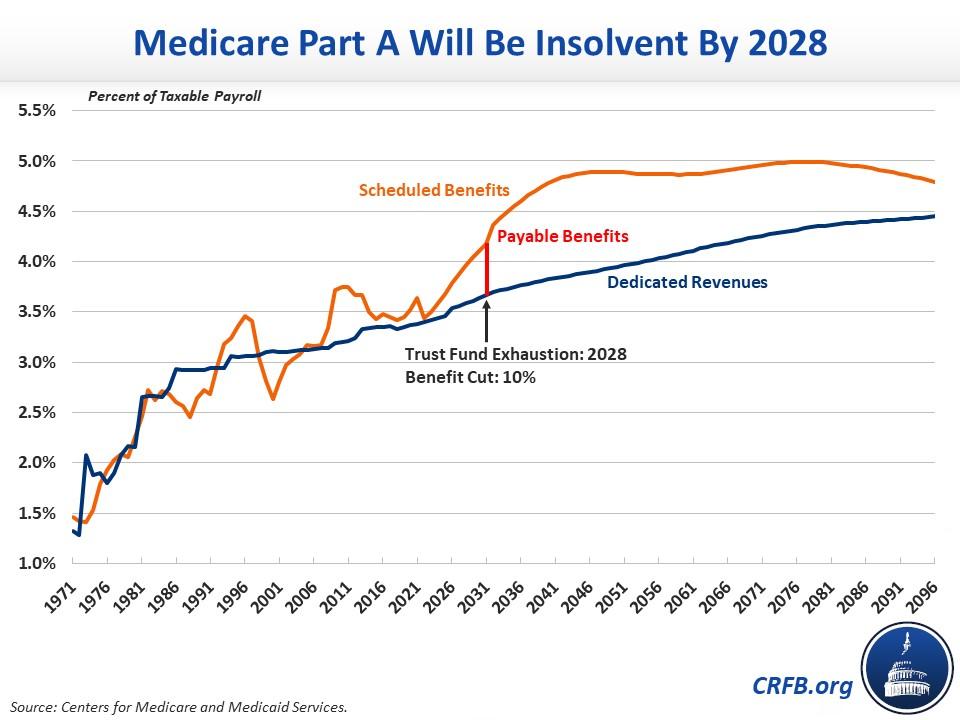

1️⃣ #SocialSecurity is only 𝟭𝟯 𝘆𝗲𝗮𝗿𝘀 from insolvency.

The theoretical combined trust funds comprising #SocialSecurity (OASI+SSDI) will exhaust their reserves by 2035, when today's 54-year-olds reach full retirement age and today's youngest retirees turn 75. ⤵️

The theoretical combined trust funds comprising #SocialSecurity (OASI+SSDI) will exhaust their reserves by 2035, when today's 54-year-olds reach full retirement age and today's youngest retirees turn 75. ⤵️

2️⃣ #SocialSecurity faces large and rising imbalances.

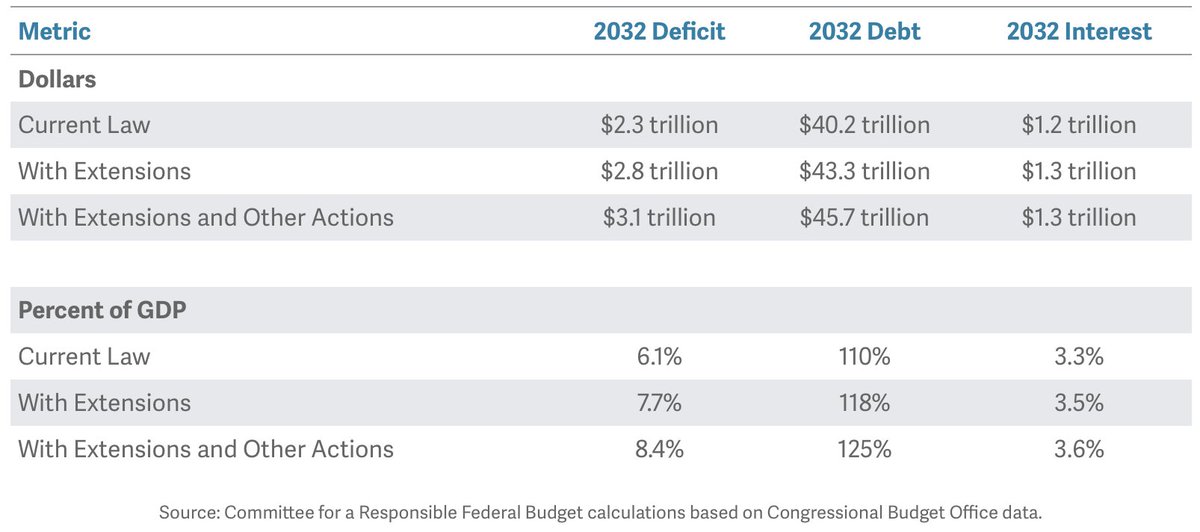

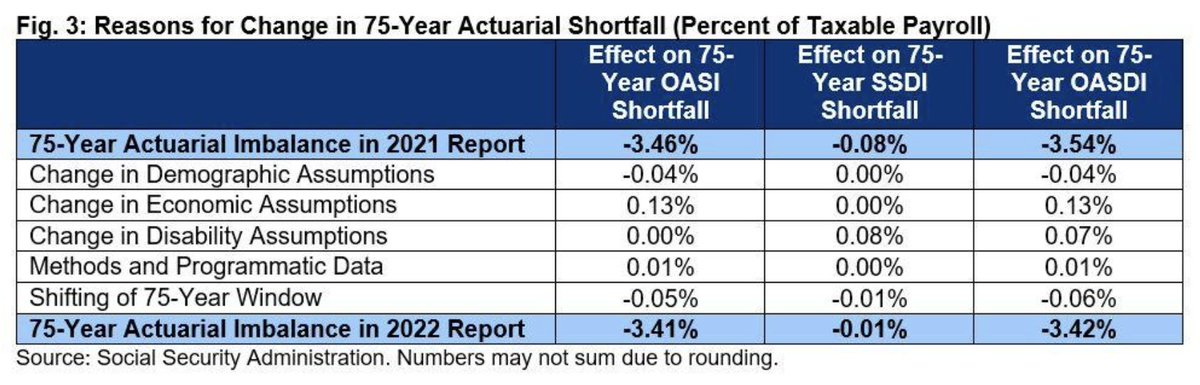

The Trustees project the program will run cash deficits of nearly $2.5 trillion over the next decade – the equivalent of 2.1% taxable payroll or 0.8% of GDP. 75-year actuarial imbalance totals 3.4% of payroll or 1.2% of GDP.

The Trustees project the program will run cash deficits of nearly $2.5 trillion over the next decade – the equivalent of 2.1% taxable payroll or 0.8% of GDP. 75-year actuarial imbalance totals 3.4% of payroll or 1.2% of GDP.

3️⃣ #SocialSecurity's finances remain perilous.

Though finances are slightly better than projected in 2021, the program's 75-year shortfall is the second largest it has been since before reforms in 1983, and the economic assumptions appear outdated relative to current #inflation.

Though finances are slightly better than projected in 2021, the program's 75-year shortfall is the second largest it has been since before reforms in 1983, and the economic assumptions appear outdated relative to current #inflation.

4️⃣ Delaying fixes to #SocialSecurity is costly.

With only a few years left to restore solvency to the program, policymakers should act sooner rather than later to allow more policy options, phase in changes gradually, and provide time for work and savings adjustments.

With only a few years left to restore solvency to the program, policymakers should act sooner rather than later to allow more policy options, phase in changes gradually, and provide time for work and savings adjustments.

➡️Without reforms, #SocialSecurity will not to be able to pay full benefits to many 𝘤𝘶𝘳𝘳𝘦𝘯𝘵 beneficiaries, let alone today’s workers and future generations. Action must be taken soon to avoid a 20% across-the-board cut to all beneficiaries in just 13 years. ⤵️

➡️...Fortunately, many options exist to fix #SocialSecurity's finances and could be enacted+implemented with political will.

Find our full report along with potential #TrustFundSolutions at crfb.org/papers/analysi….

Find our full report along with potential #TrustFundSolutions at crfb.org/papers/analysi….

• • •

Missing some Tweet in this thread? You can try to

force a refresh