#Crypto Investment can be simpler with these tools.

1. Portfolio Management

2. Social Sentiment

3. Bridges

/THREAD

1. Portfolio Management

2. Social Sentiment

3. Bridges

/THREAD

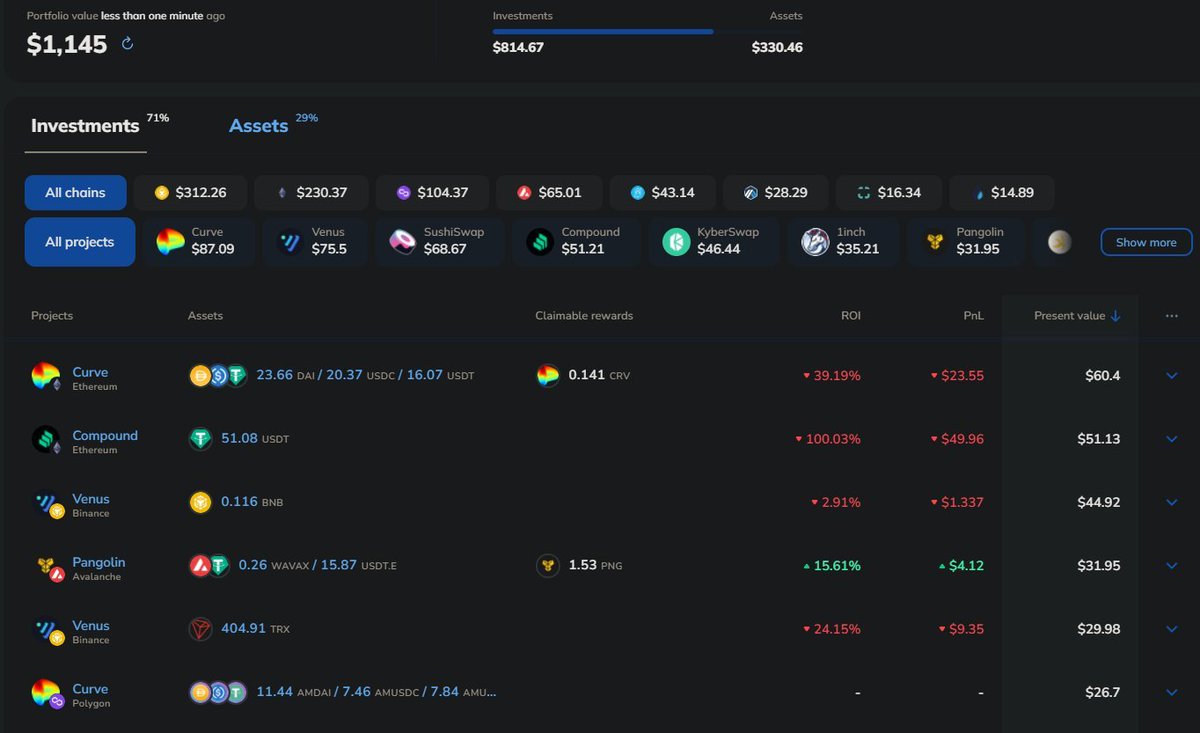

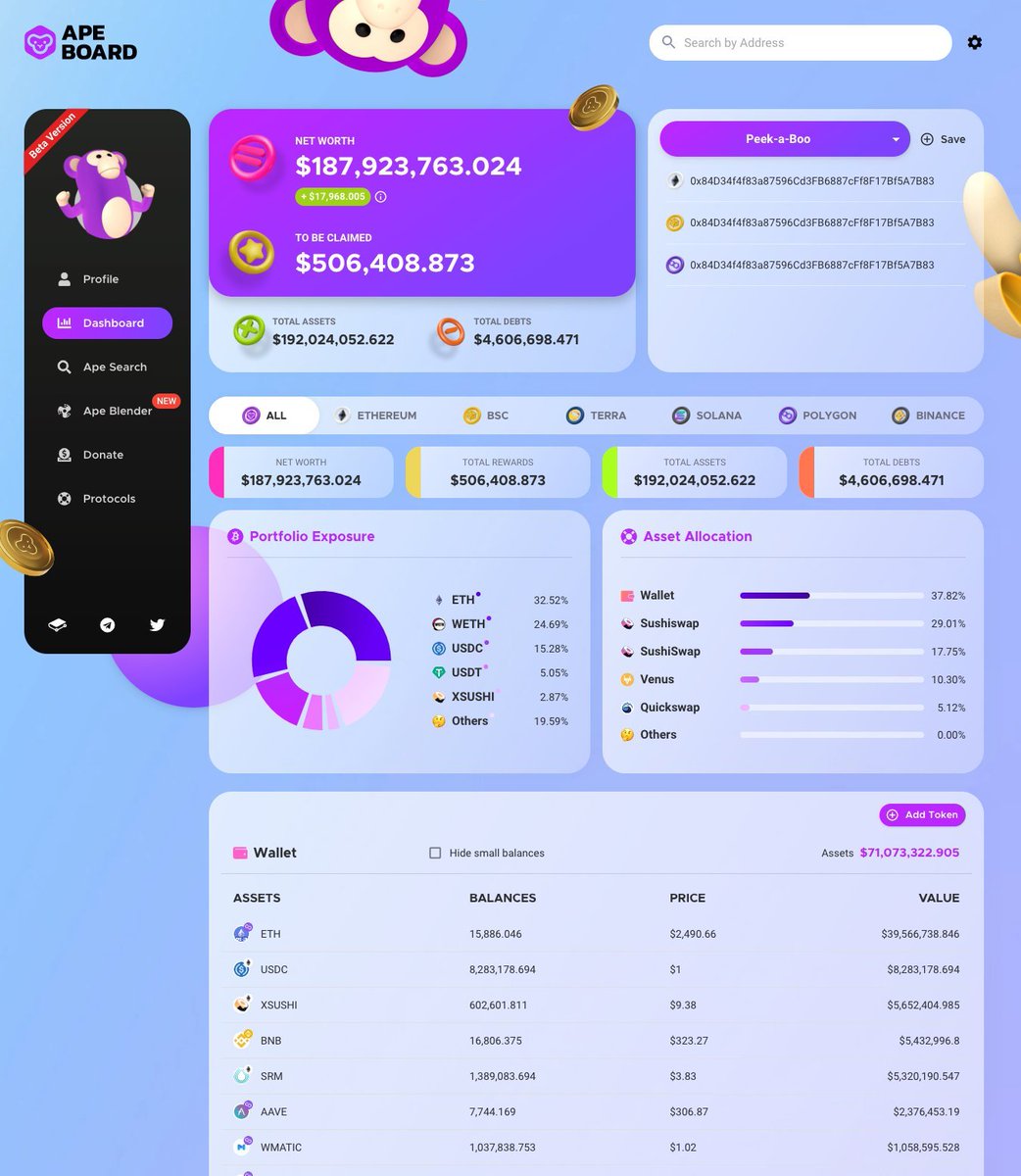

Portfolio Management.

These tools allow you to better manage your cryptocurrency portfolio. You have access to all your tokens and #DeFi applications from one place.

/1

These tools allow you to better manage your cryptocurrency portfolio. You have access to all your tokens and #DeFi applications from one place.

https://twitter.com/CryptosEngineer/status/1523323205192015873

/1

Portfolio Management Tools.

@apyvision

@ape_board

@zapper_fi

@DeBankDeFi

@defiyield_app

@federiconitidi

@yieldwatch

@pacoca_io

@zerion_io

@defi_watch_

@tinnetwork_defi

/2

@apyvision

@ape_board

@zapper_fi

@DeBankDeFi

@defiyield_app

@federiconitidi

@yieldwatch

@pacoca_io

@zerion_io

@defi_watch_

@tinnetwork_defi

/2

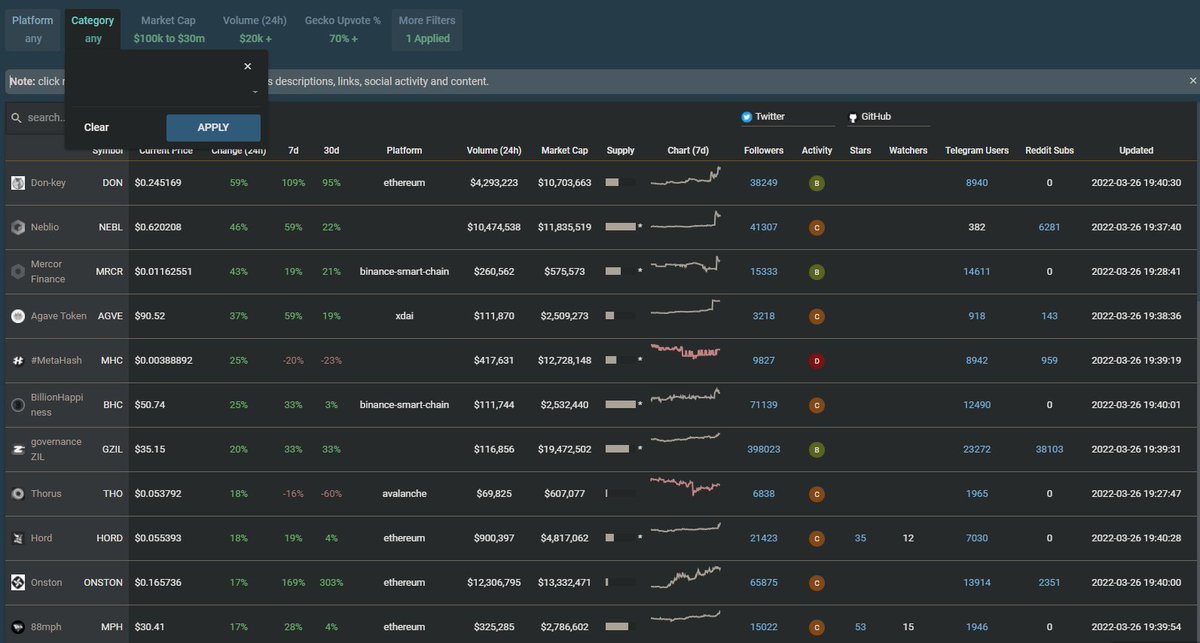

Social Sentiment.

Social sentiment tells us what other people are thinking about the market or specific token.

You can use this to screen new #crypto projects or get the latest updates regarding your projects.

/3

Social sentiment tells us what other people are thinking about the market or specific token.

You can use this to screen new #crypto projects or get the latest updates regarding your projects.

https://twitter.com/CryptosEngineer/status/1507795315851767808

/3

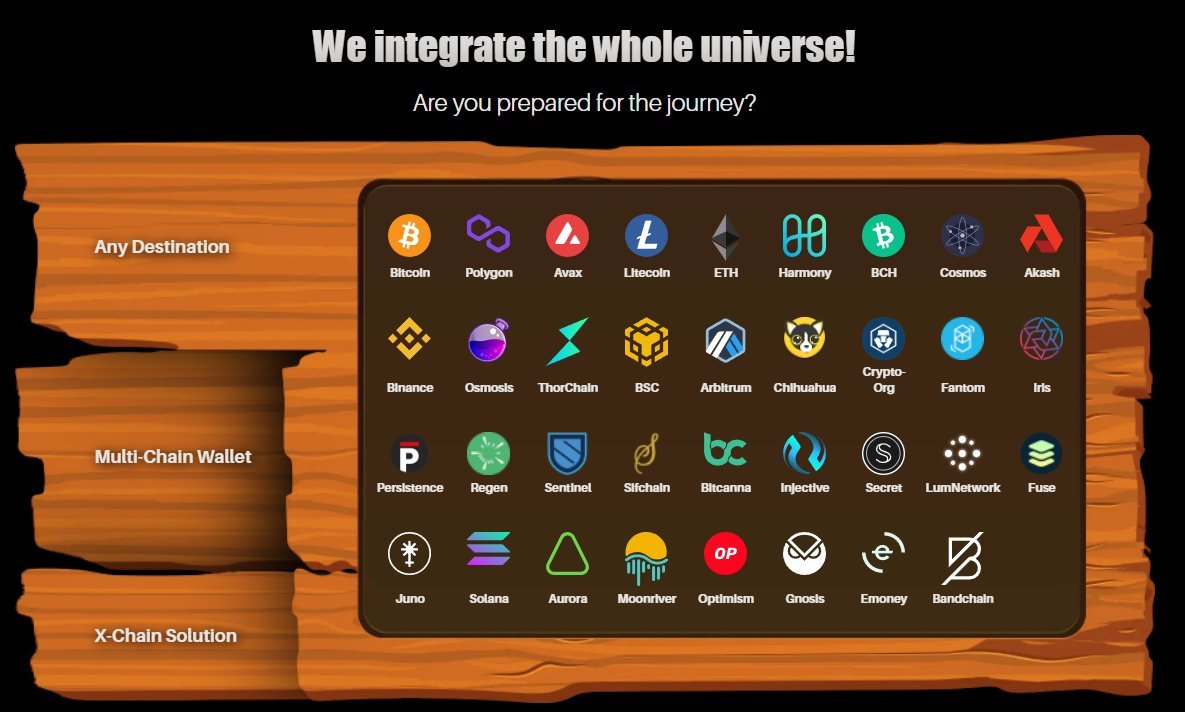

Bridges.

Bridges allow you to move your tokens and #NFTs across different chains to reduce risk and find the best #DeFi yield.

You can also earn on your tokens by providing liquidity to many of these bridges.

/5

Bridges allow you to move your tokens and #NFTs across different chains to reduce risk and find the best #DeFi yield.

You can also earn on your tokens by providing liquidity to many of these bridges.

https://twitter.com/CryptosEngineer/status/1527668922492780546

/5

Bridges Apps.

@multichainxyz

@Orbit_Chain

@wormholecrypto

@Allbridge_io

@HopProtocol

@DarwiniaNetwork

@CelerNetwork

@symbiosis_fi

@CCB_Bridge

@ConnextNetwork

@StargateFinance

@SynapseProtocol

@RangoExchange

@allianceblock

/6

@multichainxyz

@Orbit_Chain

@wormholecrypto

@Allbridge_io

@HopProtocol

@DarwiniaNetwork

@CelerNetwork

@symbiosis_fi

@CCB_Bridge

@ConnextNetwork

@StargateFinance

@SynapseProtocol

@RangoExchange

@allianceblock

/6

Alphas.

Follow these accounts to be up to date with new #crypto tools:

@phtevenstrong

@milesdeutscher

@Route2FI

@PastryEth

@KoroushAK

@shivsakhuja

@Crypto8Fi

@DeFi_Made_Here

@ckaiwu

@danreecer_

@0xmisaka

@puntium

@nateliason

@Gojo_Crypto

@OnChainWizard

/7

Follow these accounts to be up to date with new #crypto tools:

@phtevenstrong

@milesdeutscher

@Route2FI

@PastryEth

@KoroushAK

@shivsakhuja

@Crypto8Fi

@DeFi_Made_Here

@ckaiwu

@danreecer_

@0xmisaka

@puntium

@nateliason

@Gojo_Crypto

@OnChainWizard

/7

If you enjoyed this and want to learn more about #Investing, #Cryptocurrency & #Finance:

✔️ Follow me @cryptosengineer for more threads like this.

✔️ Check out some of my other threads:

/8

✔️ Follow me @cryptosengineer for more threads like this.

✔️ Check out some of my other threads:

https://twitter.com/CryptosEngineer/status/1486395562618503172

/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh