We have entered very rough waters as $BTC got lower than $20,700. Today in #Coin360 Daily Digest 👇

@Tether_to @CelsiusNetwork @trondaoreserve @trondao @usddio @nftport_xyz @TAGHeuer @filecoingreen @FilFoundation @nansen_ai @chainlink @MoonbeamNetwork @ElrondNetwork

@Tether_to @CelsiusNetwork @trondaoreserve @trondao @usddio @nftport_xyz @TAGHeuer @filecoingreen @FilFoundation @nansen_ai @chainlink @MoonbeamNetwork @ElrondNetwork

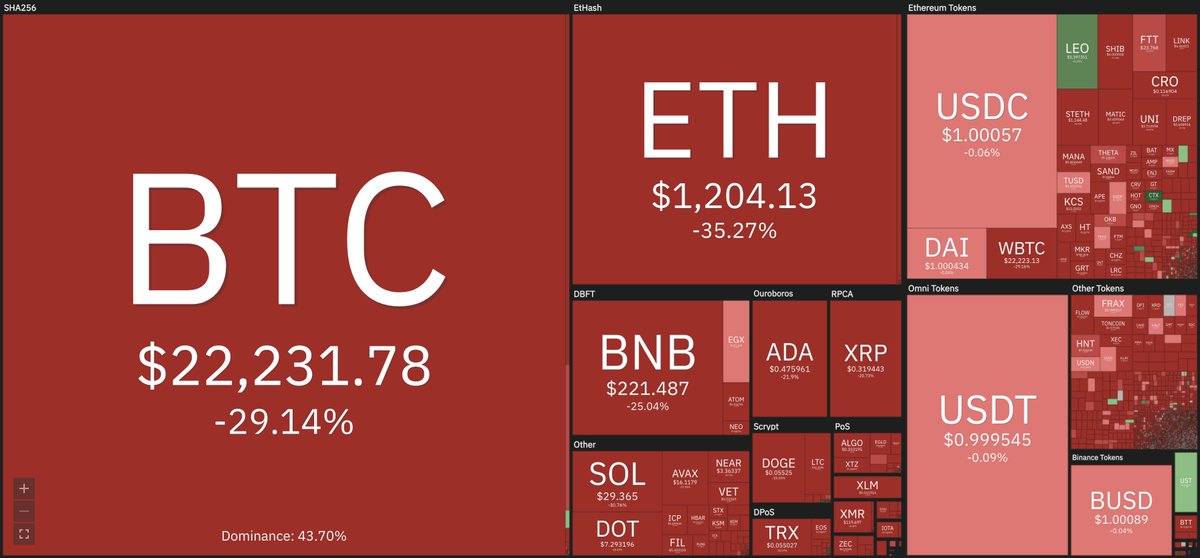

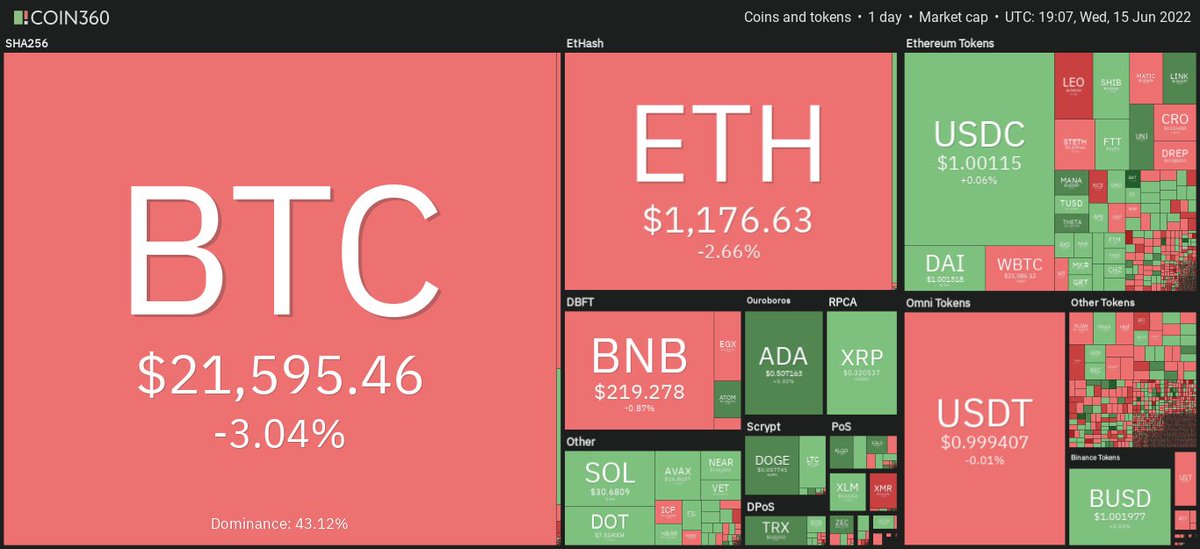

1/ $BTC marked an 8%+ drop in the past 24h and dropped to below $20,700 at the time of writing. With the price action, many analysts doubted #BTC's ability to sustain the low $20,000 zone for long.

$BTC number of addresses in loss (7d MA) reached an ATH:

$BTC number of addresses in loss (7d MA) reached an ATH:

https://twitter.com/glassnodealerts/status/1537121665662042113?s=20&t=Dh6YMpy_f1lwoyELZJUGhQ

2/ $ETH was bleeding to under $1.1k following $BTC's plunge. The percentage of @ethereum addresses in profit has dropped to the lowest level since April 2020, as per @intotheblock:

https://twitter.com/intotheblock/status/1537088175440543744?s=20&t=Dh6YMpy_f1lwoyELZJUGhQ

3/ Three Arrows Capital grabbed the headlines today after a so-called $400M liquidation leading to its potential insolvency. @zhusu also confirmed that the company was struggling.

cointelegraph.com/news/su-zhu-s-…

cointelegraph.com/news/su-zhu-s-…

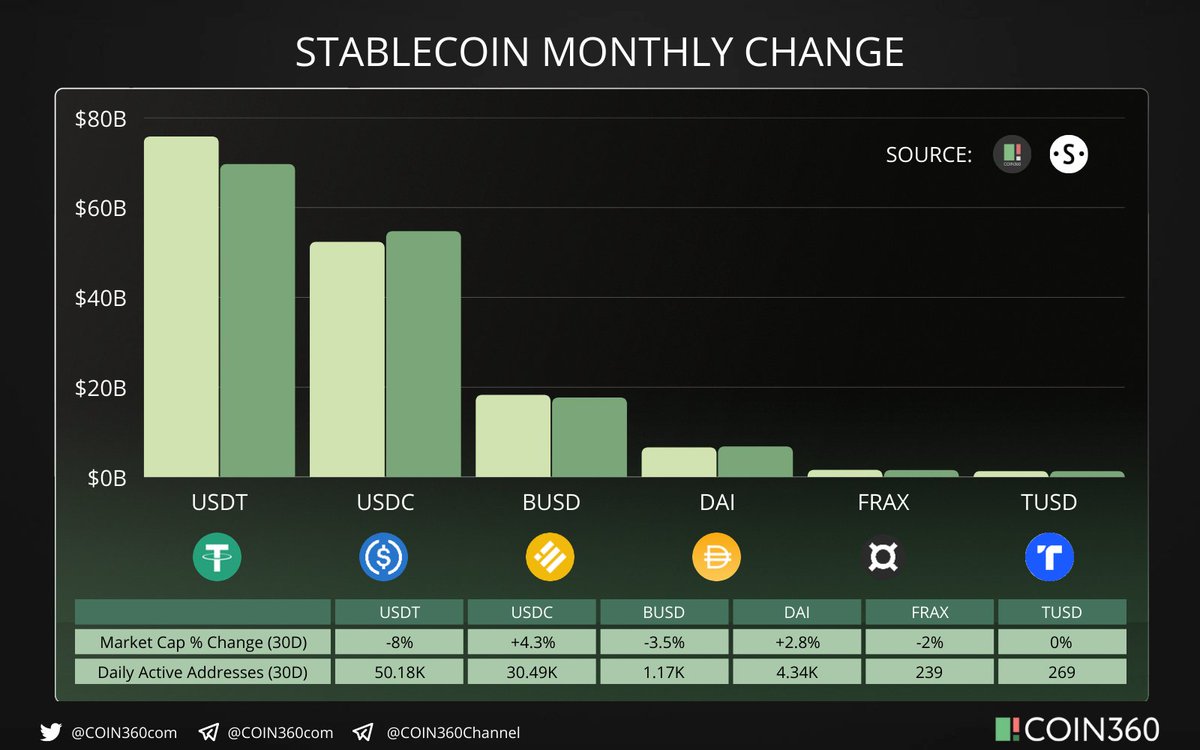

4/ As it denied the claims of Asian commercial paper backing & exposure to 3AC, @Tether_to was said to expect to reduce $USDT commercial paper backing to $8.4B, then completely remove it.

u.today/tether-denies-…

@Nexo was the next to reject 3AC exposure:

u.today/tether-denies-…

@Nexo was the next to reject 3AC exposure:

https://twitter.com/Nexo/status/1536957253634375680?s=20&t=Dh6YMpy_f1lwoyELZJUGhQ

5/ Meanwhile, @CelsiusNetwork was trying to find solutions by hiring restructuring lawyers: en.ethereumworldnews.com/celsius-networ…

Following its freeze, US policymakers were on high alert for #crypto systemic contagion: theblock.co/post/152262/fo…

Following its freeze, US policymakers were on high alert for #crypto systemic contagion: theblock.co/post/152262/fo…

6/ @trondaoreserve pulled 2.5B $TRX from @binance as $USDD has been losing its peg for three days in a row.

cryptoslate.com/usdd-depeg-con…

cryptoslate.com/usdd-depeg-con…

7/ @nftport_xyz raised $26M in a Series A round co-led by Taavet+Sten and @atomico to build its #NFT infrastructure platform for developers.

https://twitter.com/nftport_xyz/status/1536990410966450176?s=20&t=A3UI8U0oF11E4_MWldpIbw

8/ The Swiss luxury watchmaker @TAGHeuer continued its #web3 journey by rolling out a smartwatch feature for users to show #NFTs.

finbold.com/tag-heuer-laun…

finbold.com/tag-heuer-laun…

9/ @filecoingreen & @FilFoundation have recently joined hands to launch a $1M grants program to support climate positive #ReFi initiatives.

filecoin.io/blog/posts/fil…

filecoin.io/blog/posts/fil…

10/ The analytics platform @nansen_ai has introduced a new messaging app for #NFT projects and others.

https://twitter.com/nansen_ai/status/1537050071115542528?s=20&t=UjPnGUi5dp9sCOjMeQU2CQ

11/ As @chainlink Price Feeds are live on @MoonbeamNetwork, developers can leverage its oracle network for #DeFi app building.

moonbeam.network/announcements/…

moonbeam.network/announcements/…

12/ @ElrondNetwork was chosen as the #blockchain to build ICI Bucharest's #NFT marketplace and #DNS. $EGLD has been listed on @krakenfx.

cointelegraph.com/news/ici-bucha…

cointelegraph.com/news/ici-bucha…

13/ Other news:

SEC Opens Investigation Into Insider Trading on Crypto Exchanges: decrypt.co/102969/sec-ope…

@saylor Clarifies Concerns Over @MicroStrategy Bitcoin Loan Margin Call: beincrypto.com/michael-saylor…

Bill Gates criticizes the intangible value of NFTs: cointelegraph.com/news/a-fool-s-…

SEC Opens Investigation Into Insider Trading on Crypto Exchanges: decrypt.co/102969/sec-ope…

@saylor Clarifies Concerns Over @MicroStrategy Bitcoin Loan Margin Call: beincrypto.com/michael-saylor…

Bill Gates criticizes the intangible value of NFTs: cointelegraph.com/news/a-fool-s-…

14/ @binance, @krakenfx & @0xPolygon Accelerate Hiring in Response to Industry-Wide Job Cuts: coindesk.com/business/2022/…

@MetaMask, @phantom and Other Browser Wallets Patch Security Vulnerability: coindesk.com/tech/2022/06/1…

@MetaMask, @phantom and Other Browser Wallets Patch Security Vulnerability: coindesk.com/tech/2022/06/1…

15/ Liking our daily digests? Like, retweet and join us on Twitter & Telegram!

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

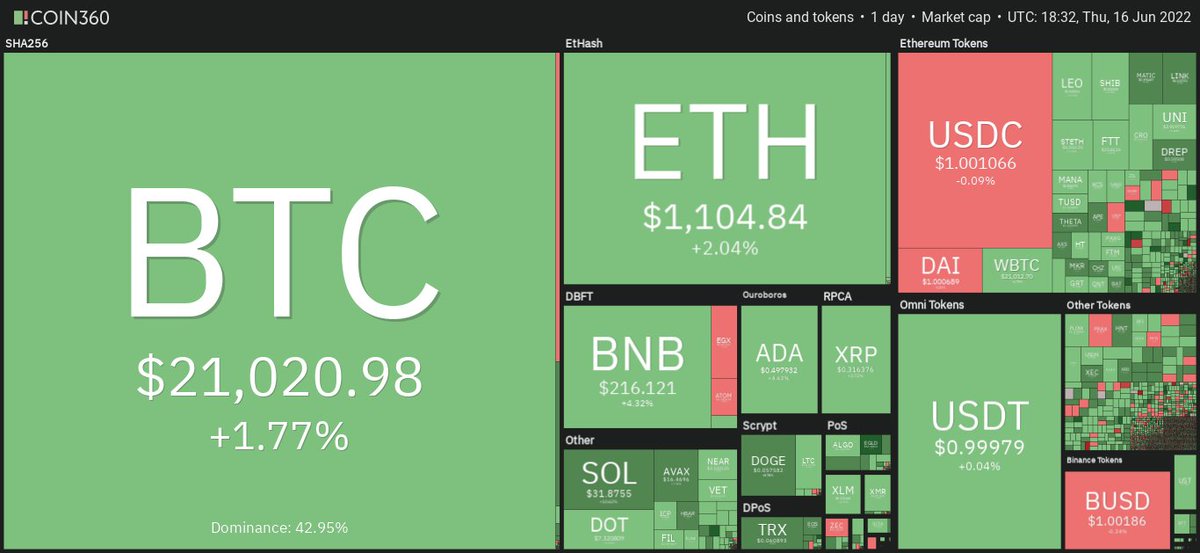

@Tether_to @CelsiusNetwork @trondaoreserve @trondao @usddio @nftport_xyz @TAGHeuer @filecoingreen @FilFoundation @nansen_ai @chainlink @MoonbeamNetwork @ElrondNetwork Updated: $BTC has crossed $21,500 and $ETH reached $1,175. Head over to our website for more: coin360.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh