@investvoyager looks like its headed for #deathspiral because of its exposure to #3AC.

tweets about locked funds coming fast and furious right now.

coindesk.com/business/2022/…

tweets about locked funds coming fast and furious right now.

coindesk.com/business/2022/…

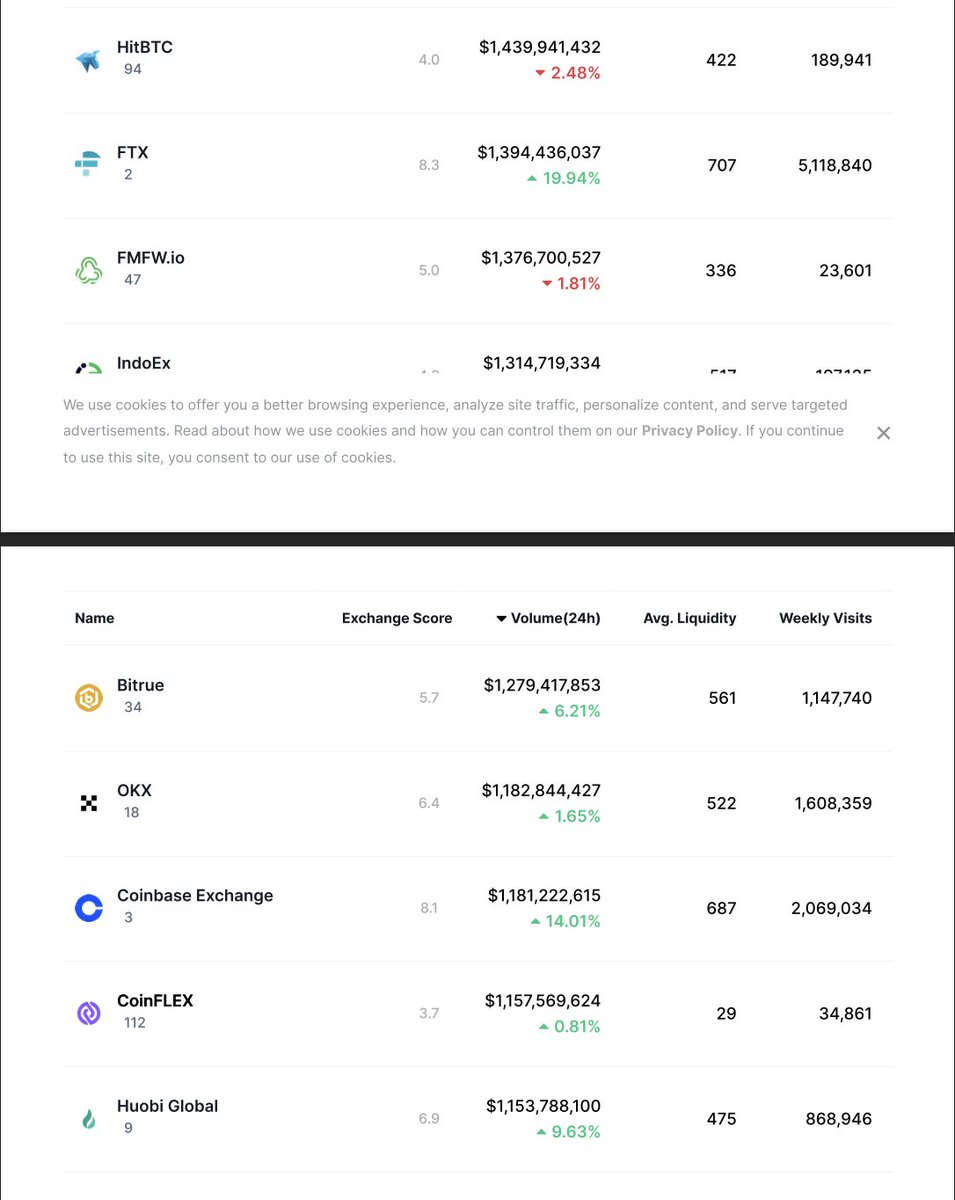

@investvoyager Looks like @investvoyager, another #DeFi (#CeFi?) "bank" like #BlockFi, has halted customer withdrawals and Twitter is freaking out. $VGX token has crashed.

https://twitter.com/hulsy51/status/1539607771490000896

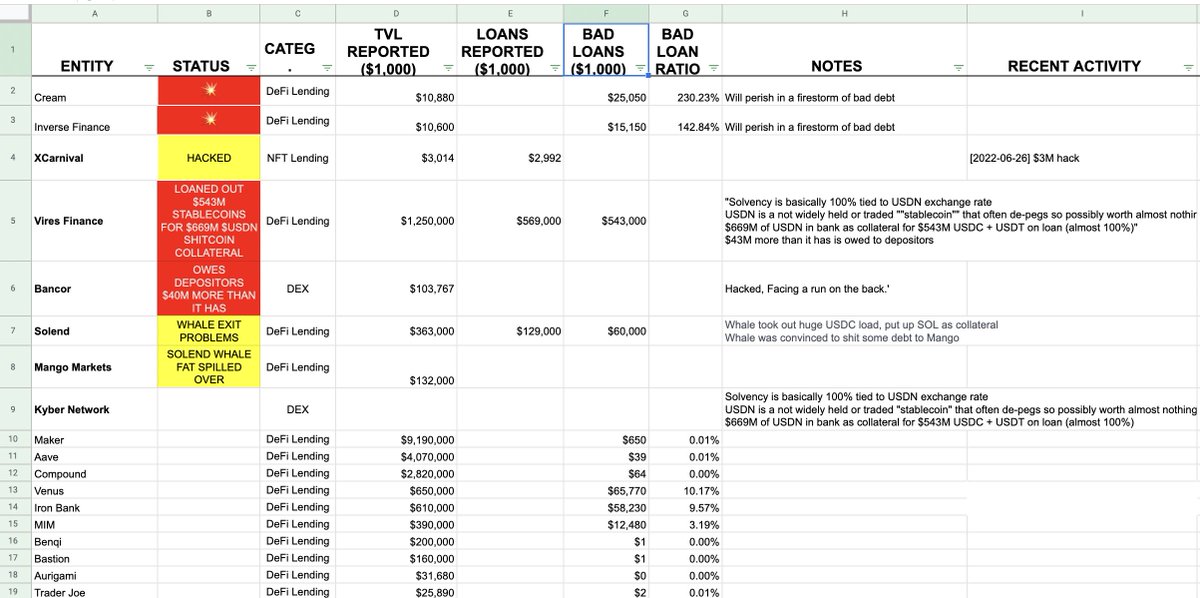

more details w/r/t Voyager (@investvoyager) loan book, another crypto "bank" circling the drain because of the #3AC situation.

#VGX $VGTX

#VGX $VGTX

https://twitter.com/angusdav/status/1539610104563105798

@TheDeepDive_ca does a deep dive on #Voyager / $VOYG / $VGX

As of March 31...Voyager had loaned out 53,840 $BTC, $633M $USDC. #3AC represents 28.3% of $BTC, 55.3% of $USDC currently loaned out.

But what if another major creditor implodes?

thedeepdive.ca/voyager-digita…

As of March 31...Voyager had loaned out 53,840 $BTC, $633M $USDC. #3AC represents 28.3% of $BTC, 55.3% of $USDC currently loaned out.

But what if another major creditor implodes?

thedeepdive.ca/voyager-digita…

What #Voyager says: "straightforward, low-risk approach to asset management"

What #Voyager means: we gave half a billion dollars to the crypto bro morons running #3AC and we just realized it's never coming back

$VGX #Voyagerheroes #deathspiral $VYGVF

What #Voyager means: we gave half a billion dollars to the crypto bro morons running #3AC and we just realized it's never coming back

$VGX #Voyagerheroes #deathspiral $VYGVF

@TheDeepDive_ca says #Voyager's #3AC exposure is roughly $305M in $BTC and $350M in $USDC. That's $655M in bad debt.

Voyager's filings on 2022-03-31 declare equity of $257M.

SBF bailout is $200M cash, $300M in $BTC. enough to cover the hole...

if there are no other problems

Voyager's filings on 2022-03-31 declare equity of $257M.

SBF bailout is $200M cash, $300M in $BTC. enough to cover the hole...

if there are no other problems

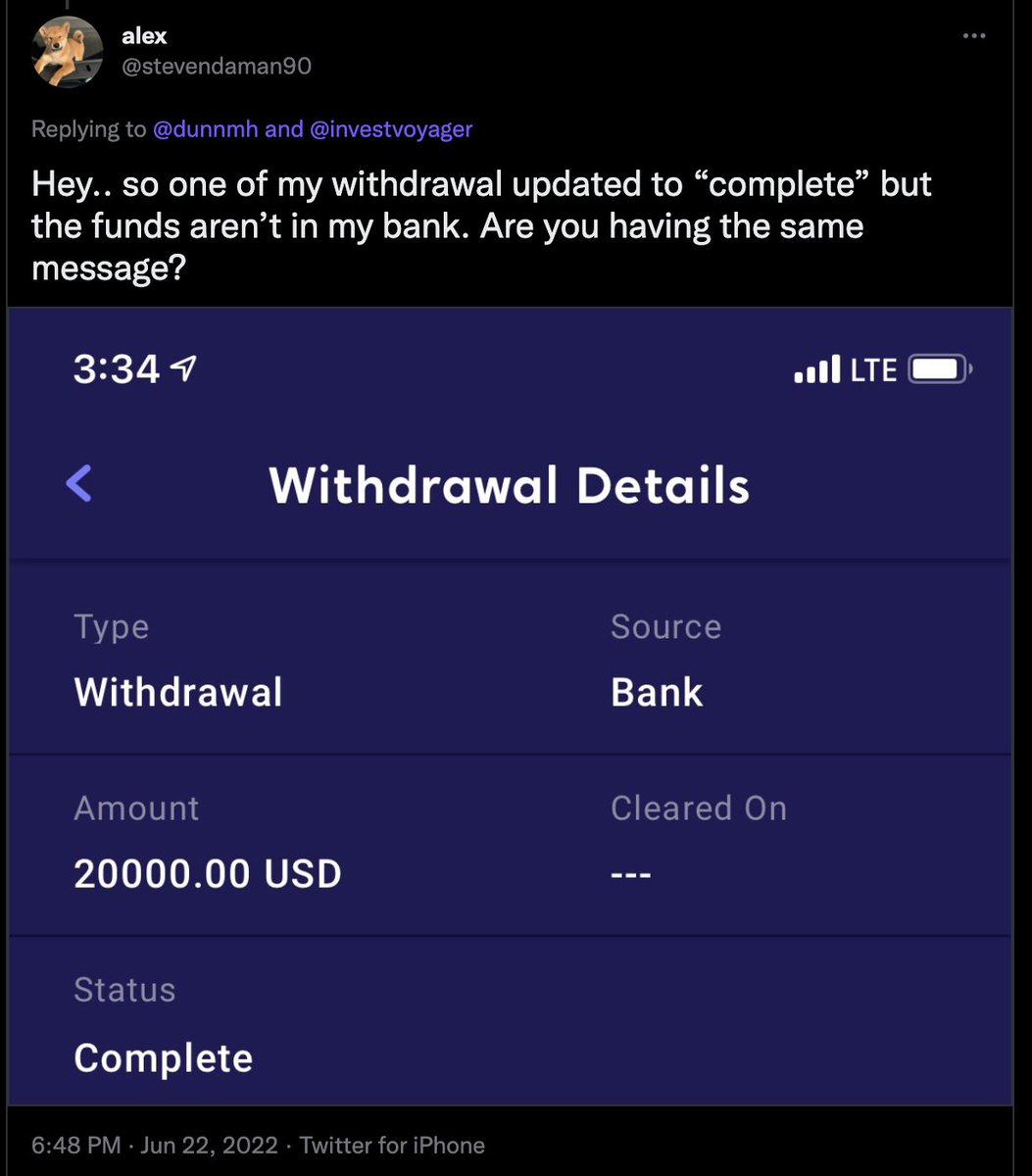

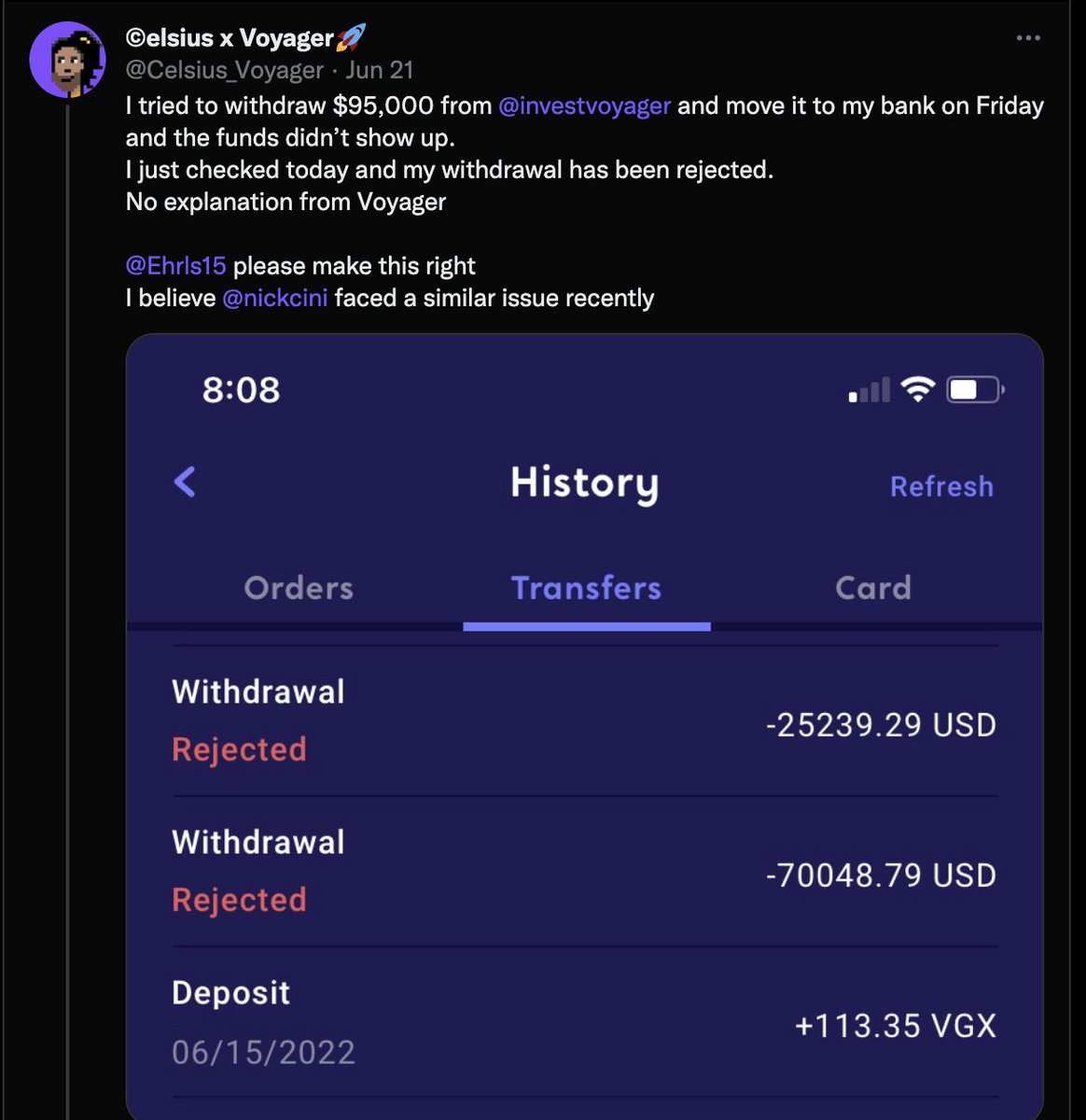

tl;dr: @investvoyager's customers seem to be getting very, very upset on social media... it this keeps it will cause a #bankrun and whoever is late to the party will not get their money.

live look at latest tweets on the subject: twitter.com/search?q=inves…

$VGX #Voyager $VYGVF

live look at latest tweets on the subject: twitter.com/search?q=inves…

$VGX #Voyager $VYGVF

Not looking good for @investvoyager ... looking an awful lot like a #cryptocurrency #bankrun if this tweet is correct that they have limited withdrawals even further.

$BTC $ETH $VGX #Bitcoin #Ethereum #cryptocurrencies

$BTC $ETH $VGX #Bitcoin #Ethereum #cryptocurrencies

https://twitter.com/AbrodolfLinkler/status/1539660191733411840

some customers are seeing "Internal Server Error" when they go to withdraw funds from #Voyager exchange (@investvoyager)...

i'm sure this is good for #Bitcoin. and also good for #Etherum. oh, and $VYGVF stock. $BTC $ETH #cryptocurrency

i'm sure this is good for #Bitcoin. and also good for #Etherum. oh, and $VYGVF stock. $BTC $ETH #cryptocurrency

https://twitter.com/stonklesner/status/1539687226979876866

if @epichedge is correct and this is real then it appears @investvoyager accounts may not actually be #FDIC insured after all... especially if there is any kind of malfeasance at #Voyager.

https://twitter.com/epichedge/status/1539693438194655235

not a lawyer but it seems to me that this is likely the correct take w/r/t @investvoyager customer deposits, esp. given the #Voyager user agreement specifically says that customer funds are NOT protected if Voyager fails (see screenshot of UA upthread)

https://twitter.com/SirOpsALot/status/1539720100630208512

tweet claims even a $100 withdrawal from @investvoyager was rejected...

https://twitter.com/ItzHLK/status/1539731299006660611

@investvoyager @investvoyager withdrawal limits tweeted by @1512222a:

- yesterday: $700K

- 2:27PM today: $700K

- 3:51PM: $10K

- yesterday: $700K

- 2:27PM today: $700K

- 3:51PM: $10K

https://twitter.com/1512222a/status/1539723465317548035

a redditor took a closer look at the @investvoyager user agreement's legal language to see how well depositors' money would be protected in the face of a #Voyager bankruptcy.

tl;dr: money in #Voyager seems not as #FDIC insured as people seem to think

reddit.com/r/Buttcoin/com…

tl;dr: money in #Voyager seems not as #FDIC insured as people seem to think

reddit.com/r/Buttcoin/com…

slightly more specific info about @investvoyager's loans to @3arrowscap / #3AC.

ps this thread is impressively long for one about a company i barely knew existed yesterday...

ps this thread is impressively long for one about a company i barely knew existed yesterday...

https://twitter.com/alyssachoo_/status/1539685155685957632

people are having trouble getting money out of @investvoyager

not exactly surprising if you read this whole thread (👆), but here's some concrete examples.

not exactly surprising if you read this whole thread (👆), but here's some concrete examples.

• • •

Missing some Tweet in this thread? You can try to

force a refresh