and there goes another exchange. @CoinFLEXdotcom has not just limited withdrawals, they have shut them off altogether.

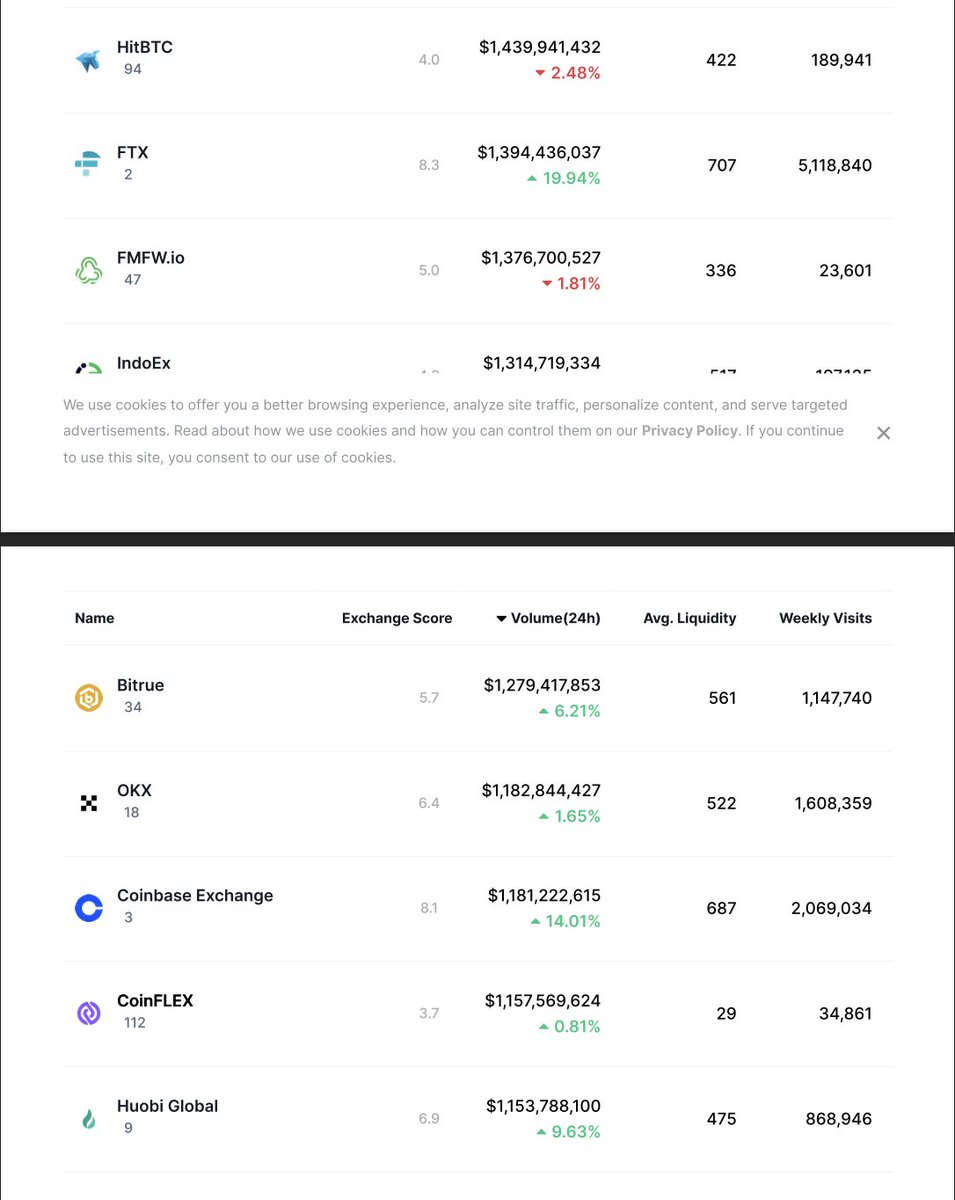

@coingecko puts #Coinflex as ~30th largest by vol.

@CoinMarketCap has it at #3 (!!)

exchanges are really falling like dominoes now

coinflex.com/blog/coinflex-…

@coingecko puts #Coinflex as ~30th largest by vol.

@CoinMarketCap has it at #3 (!!)

exchanges are really falling like dominoes now

coinflex.com/blog/coinflex-…

@CoinFLEXdotcom @coingecko @CoinMarketCap here's what @CoinMarketCap and @coingecko have to say about size of #CoinFlex / @CoinFLEXdotcom / @CoinFLEX_US.

tl;dr coingecko says it's roughly the size of @krakenfx, coinmarketcap says it's way bigger than #FTX.

all numbers in this market are fake... but this is huge

tl;dr coingecko says it's roughly the size of @krakenfx, coinmarketcap says it's way bigger than #FTX.

all numbers in this market are fake... but this is huge

kind of a serious LOL at those @CoinMarketCap / @coingecko rankings of the size of @CoinFLEXdotcom / @CoinFLEX_US though.

the ratio of trading volume to weekly visits (AKA "the one un-fakeable number") CMC/CG are showing is... kind of hard to believe/bordering on preposterous

the ratio of trading volume to weekly visits (AKA "the one un-fakeable number") CMC/CG are showing is... kind of hard to believe/bordering on preposterous

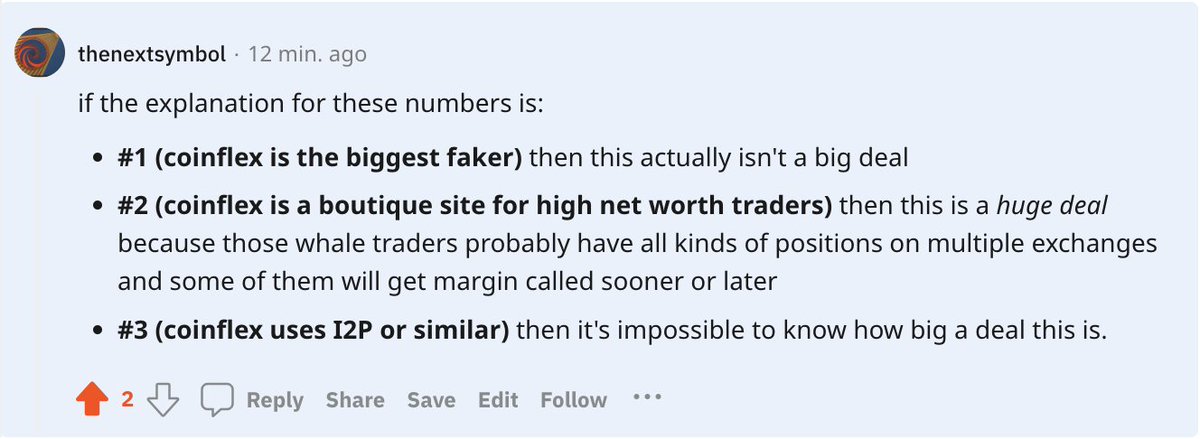

did slightly more in depth look at the #Coinflex's mad sus numbers currently showing on @coingecko.

(link is to reddit or see screenshot)

reddit.com/r/Buttcoin/com…

(link is to reddit or see screenshot)

reddit.com/r/Buttcoin/com…

some notes on what the possible explanations for #coinflex's weird numbers would imply...

(link and screenshot are the same)

reddit.com/r/Buttcoin/com…

(link and screenshot are the same)

reddit.com/r/Buttcoin/com…

@Bitfinexed took a look at the... let's call it "the recent sudden course correction" of @CoinFLEXdotcom's marketing

https://twitter.com/Bitfinexed/status/1540064709134766080

tl;dr at founding, @CoinFLEXdotcom intended to serve asian retail AND large institutions with $BTC futures

if the @coingecko numbers aren't a total lie it would imply they moved in the institutional direction.

if that is so, halting withdrawals/not settling trades could be bad

if the @coingecko numbers aren't a total lie it would imply they moved in the institutional direction.

if that is so, halting withdrawals/not settling trades could be bad

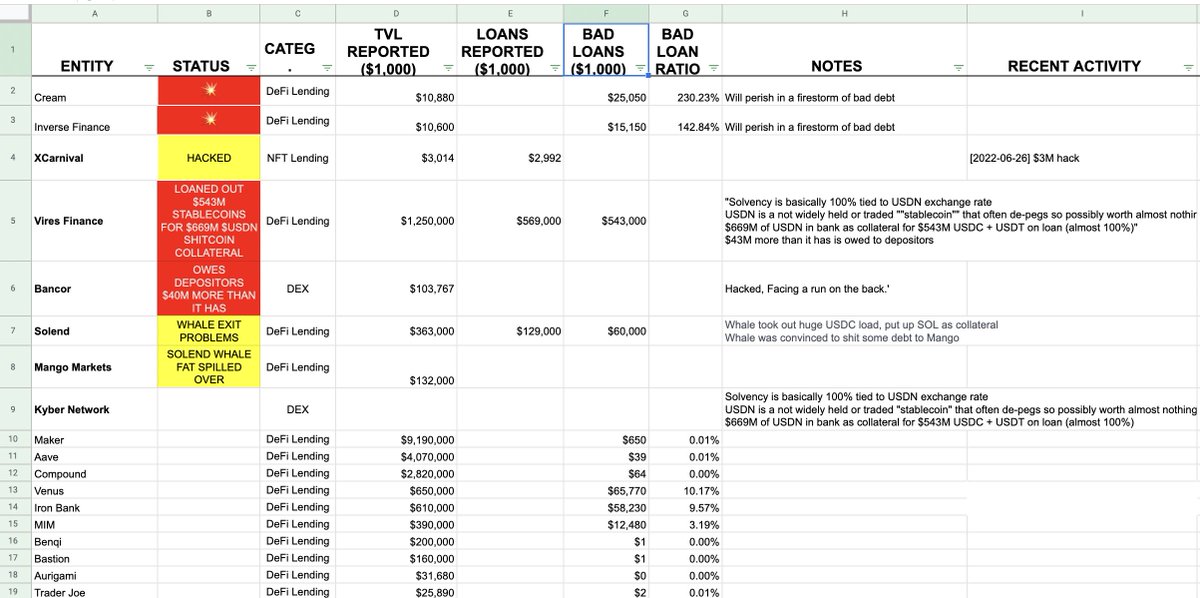

oh look, #FlexUSD - apparently a stablecoin associated with #Coinflex and backed by $USDC (?) seems to be headed into some kind of death spiral...

$0.83 and falling fast.

$200M explosion incoming... @CoinFLEXdotcom

$0.83 and falling fast.

$200M explosion incoming... @CoinFLEXdotcom

rumors on reddit: whale used a circular arbitrage between $FLEX, $USDC, and other coins to loot @CoinFLEXdotcom's $BCH w/market value ca. $90M

that pile of $BCH has been slowly sold on the open market for a while now.

2 links:

reddit.com/r/btc/comments…

reddit.com/r/btc/comments…

that pile of $BCH has been slowly sold on the open market for a while now.

2 links:

reddit.com/r/btc/comments…

reddit.com/r/btc/comments…

#CoinFlex, it turns out, wasn't much of an exchange.

It was however at some point a major broker - maybe even an inventor - of many (most?) of the of illegal-on-NYSE-but-OK-in-crypto derivatives that exchanges like #Binance use to manipulate the markets and skin retail sheep

It was however at some point a major broker - maybe even an inventor - of many (most?) of the of illegal-on-NYSE-but-OK-in-crypto derivatives that exchanges like #Binance use to manipulate the markets and skin retail sheep

• • •

Missing some Tweet in this thread? You can try to

force a refresh