News flow remains positive as the #uranium sector started to decouple from broader market headwinds over the past week. Close to $2bn added to the sectoral market cap, and the spot price sitting just below $50/lb mid-week.

- #Canadian regulatory amendments had US-bound EUP stranded in St Petersburg

- Further speculation suggests Germany could be pivoting on their nuclear phaseout strategy

- #Nuclear gets a boost at the #G7 Summit with Biden pledging $14m for #NuScale project in #Romania

- Further speculation suggests Germany could be pivoting on their nuclear phaseout strategy

- #Nuclear gets a boost at the #G7 Summit with Biden pledging $14m for #NuScale project in #Romania

- #KAP sees 40% YoY rise in government payments as supply chain inflation continues to hit #Kazakh nuclear powerhouse and its subsidiaries

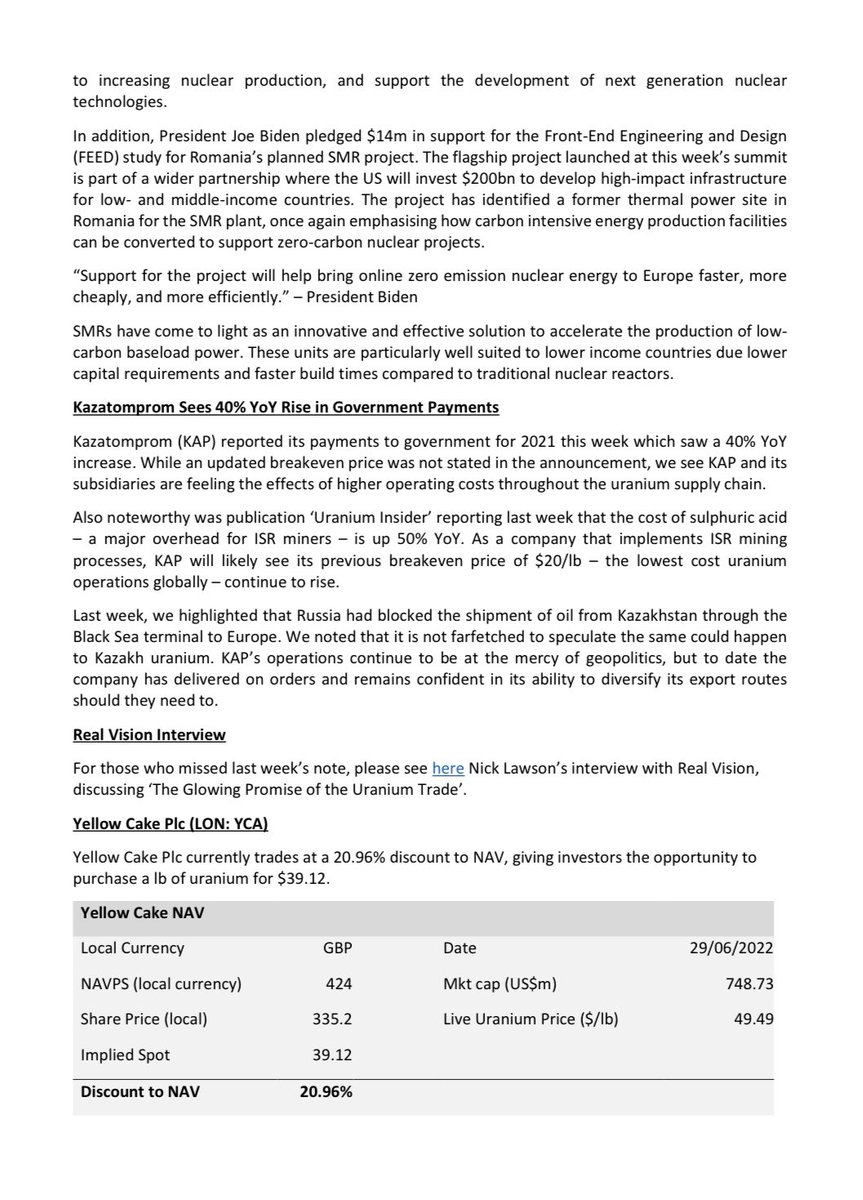

- #YCA trading at a 20.96% discount to NAV, giving investors sub $40/lb uranium exposure

- #YCA trading at a 20.96% discount to NAV, giving investors sub $40/lb uranium exposure

• • •

Missing some Tweet in this thread? You can try to

force a refresh