1/13

According to @dovemetrics, $3.9B was raised in June across 202 funding rounds.

Sharing 10 interesting #CeFi, #DeFi & #NFT projects that just raised from prominent VCs and you might not have heard on CT.

These are the projects to keep an eye during the bear market.

A🧵

According to @dovemetrics, $3.9B was raised in June across 202 funding rounds.

Sharing 10 interesting #CeFi, #DeFi & #NFT projects that just raised from prominent VCs and you might not have heard on CT.

These are the projects to keep an eye during the bear market.

A🧵

2/13

Capricon @capricornfund raised $200M from Malaysia-listed company MQ Technology.

Capricon is a multi-collateral stablecoin #DeFi protocol issuing $CUSD to connect #crypto to the real world.

Learn more -

capricorn.fund

cointelegraph.com/press-releases…

Capricon @capricornfund raised $200M from Malaysia-listed company MQ Technology.

Capricon is a multi-collateral stablecoin #DeFi protocol issuing $CUSD to connect #crypto to the real world.

Learn more -

capricorn.fund

cointelegraph.com/press-releases…

3/13

Unizen @unizen_io is building a #CeDeFi exchange to combine CEXes and DEXes to meet the needs of both retail and institutional traders.

Basically #DEX & #CEX aggregator.

Announced $200m USD capital commitment by Global Emerging Markets.

unizen-io.medium.com/weekly-pulse-1…

Unizen @unizen_io is building a #CeDeFi exchange to combine CEXes and DEXes to meet the needs of both retail and institutional traders.

Basically #DEX & #CEX aggregator.

Announced $200m USD capital commitment by Global Emerging Markets.

unizen-io.medium.com/weekly-pulse-1…

4/13

FalconX @falconxnetwork announced $150M Series D led by GIC and @BCapitalGroup at $8B valuation.

FalconX provides end-to-end insitutional trading services (trade execution, market making etc.)

falconx.io/media-press-re…

FalconX @falconxnetwork announced $150M Series D led by GIC and @BCapitalGroup at $8B valuation.

FalconX provides end-to-end insitutional trading services (trade execution, market making etc.)

falconx.io/media-press-re…

5/13

@AstraProtocol raised $100M Series A from @joinrepublic at $500M valuation.

Its mission is to equip all DeFi with a decentralized compliance layer, including KYC & AML capabilities.

Regulation coming for #DeFi and investors are getting ready.

accesswire.com/703394/Tier-1-…

@AstraProtocol raised $100M Series A from @joinrepublic at $500M valuation.

Its mission is to equip all DeFi with a decentralized compliance layer, including KYC & AML capabilities.

Regulation coming for #DeFi and investors are getting ready.

accesswire.com/703394/Tier-1-…

6/13

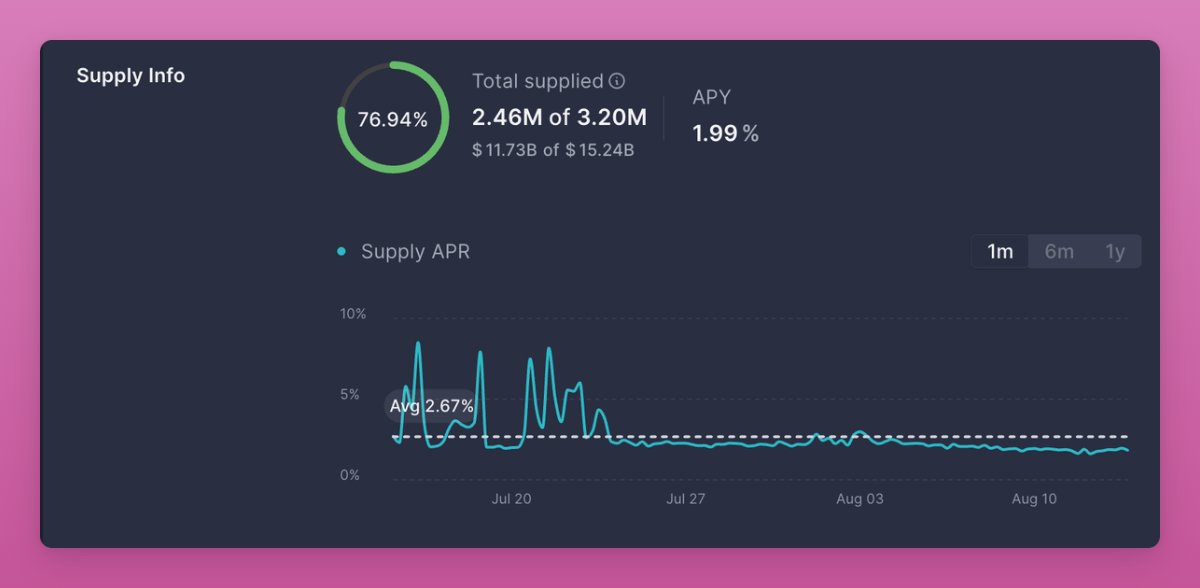

@eulerfinance raised $32M led by @HaunVentures

Jump, FTX, Coinbase, Uniswap Labs have also invested.

Euler is a #DeFi lending and borrowing protocol on #Ethereum.

👀Euler has a token $EUL that trades at $78M FDV on Huobi and MEXC exchanges.

@eulerfinance raised $32M led by @HaunVentures

Jump, FTX, Coinbase, Uniswap Labs have also invested.

Euler is a #DeFi lending and borrowing protocol on #Ethereum.

👀Euler has a token $EUL that trades at $78M FDV on Huobi and MEXC exchanges.

https://twitter.com/eulerfinance/status/1534163279349592064

7/13

NFTPort @nftport_xyz is Stripe for #NFTs - bring your #NFT application to market in hours instead of months w/developer-first NFT APIs

Estonia based company raised $26M Series A by Atomico and Taavet+Sten.

coindesk.com/business/2022/…

NFTPort @nftport_xyz is Stripe for #NFTs - bring your #NFT application to market in hours instead of months w/developer-first NFT APIs

Estonia based company raised $26M Series A by Atomico and Taavet+Sten.

coindesk.com/business/2022/…

8/13

Entropy @entropydotxyz is the first truly trustless protocol for #DeFi asset custody.

Raised $25M seed, led by @a16z.

Joined by Dragonfly Capital, Ethereal Ventures, Variant, Coinbase Ventures, Robot Ventures, Inflection, and the Komerabi Fund.

mirror.xyz/entropy.eth/mZ…

Entropy @entropydotxyz is the first truly trustless protocol for #DeFi asset custody.

Raised $25M seed, led by @a16z.

Joined by Dragonfly Capital, Ethereal Ventures, Variant, Coinbase Ventures, Robot Ventures, Inflection, and the Komerabi Fund.

mirror.xyz/entropy.eth/mZ…

9/13

Skolem institutional-grade infra for #DeFi trading raised $20 million in Series A.

The round was led by Galaxy Digital.

Joined by Point72 Ventures, Jump Crypto, Fenwick and West, Morpheus Ventures, and Dragonfly Capital.

skolem.tech

businesswire.com/news/home/2022…

Skolem institutional-grade infra for #DeFi trading raised $20 million in Series A.

The round was led by Galaxy Digital.

Joined by Point72 Ventures, Jump Crypto, Fenwick and West, Morpheus Ventures, and Dragonfly Capital.

skolem.tech

businesswire.com/news/home/2022…

10/13

PartyDAO 🥳 @prtyDAO is a fun one.

Cannot afford to buy a #BAYC? PartyDAO allows to invest in #NFTs as a team.

Fundraised $16.4M seedround led by @a16z.

Definately a project to keep an 👁 on.

PartyDAO 🥳 @prtyDAO is a fun one.

Cannot afford to buy a #BAYC? PartyDAO allows to invest in #NFTs as a team.

Fundraised $16.4M seedround led by @a16z.

Definately a project to keep an 👁 on.

https://twitter.com/prtyDAO/status/1534936108156571648

11/13

Earth From Another Sun (@PlayEFAS) is a science fiction action-oriented strategy role-playing game.

Raised $4.5M seed from @SolanaVentures , @AlamedaResearch and Lightspeed Ventures.

venturebeat.com/2022/06/16/ear…

Earth From Another Sun (@PlayEFAS) is a science fiction action-oriented strategy role-playing game.

Raised $4.5M seed from @SolanaVentures , @AlamedaResearch and Lightspeed Ventures.

venturebeat.com/2022/06/16/ear…

12/13

These are just 10 out of 202 deals announced in June.

According to the BoE, crypto crash survivers will rise to become the technology companies of the future, like Amazon and eBay.

So, following well funded startups could be a good Alpha to prepare for the next bull run.

These are just 10 out of 202 deals announced in June.

According to the BoE, crypto crash survivers will rise to become the technology companies of the future, like Amazon and eBay.

So, following well funded startups could be a good Alpha to prepare for the next bull run.

13/13

You can see all the publicly announced fundraising data on @dovemetrics website dovemetrics.com

Can sort deals by date, category like #DeFi, #CeFi, #NGT, #Web3 etc.

Or check active fund portfolios.

You can see all the publicly announced fundraising data on @dovemetrics website dovemetrics.com

Can sort deals by date, category like #DeFi, #CeFi, #NGT, #Web3 etc.

Or check active fund portfolios.

• • •

Missing some Tweet in this thread? You can try to

force a refresh