Huddersfield Town’s 2020/21 accounts cover a season when they finished 20th in the Championship, thus narrowly avoiding relegation. However, matters on the pitch were much better last season, when Carlos Corberan’s team reached the play-off final. Some thoughts follow #HTAFC

Since these accounts, it has been reported that former owner Dean Hoyle has almost completed a takeover of #HTAFC by acquiring the 75% controlling stake he sold to Phil Hodgkinson in 2019. As Hoyle had kept 25%, he would have full ownership if the deal is finalised.

Hodgkinson’s main company had been placed into administration in November 2021, so there was concern that this would cause problems for #HTAFC, though the club was not directly affected. So, there has been much change, but the 2020/21 accounts are still of interest.

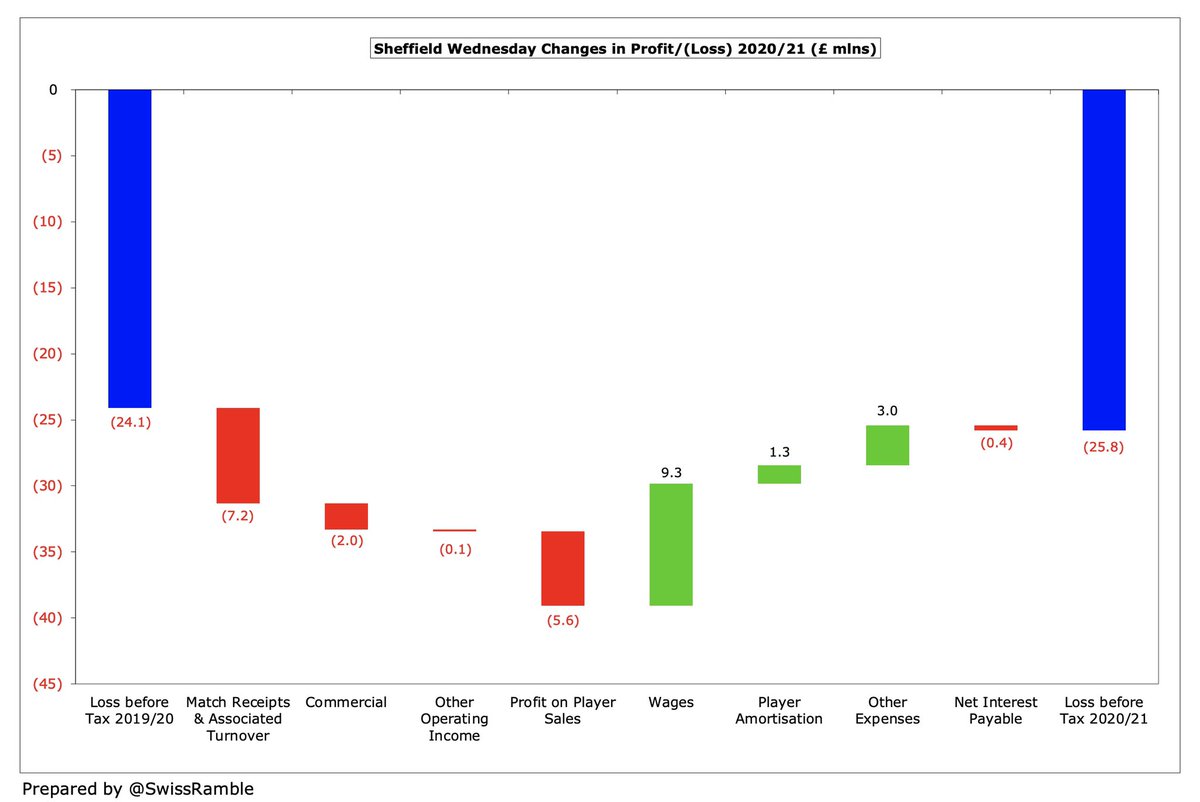

#HTAFC swung from £8.5m pre-tax loss to £2.6m profit, despite revenue falling £8m (16%) from £53m to £45m, exacerbated by decreases in profit on player sales (from £18m to £10m) and player loans (from £5.7m to £0.6m). This was thanks to a huge £33m (38%) cut in expenses.

Main reason for #HTAFC £8m revenue decrease was COVID, which drove reductions in match day, down £2.4m (58%) to £1.7m, and commercial, down £1.6m (41%) to £2.3m. Broadcasting fell £4.3m (10%) to £40.4m, as lower parachute payment were partly offset by deferred 2019/20 revenue.

To compensate for the revenue decline, #HTAFC cut the wage bill by £5.6m (19%) from £30m to £25m, player amortisation by £13m (46%) from £28m to £15m and other expenses by £6m (42%) to £9m. No repeat of prior year’s £6m player impairment. Interest payable almost halved to £2m.

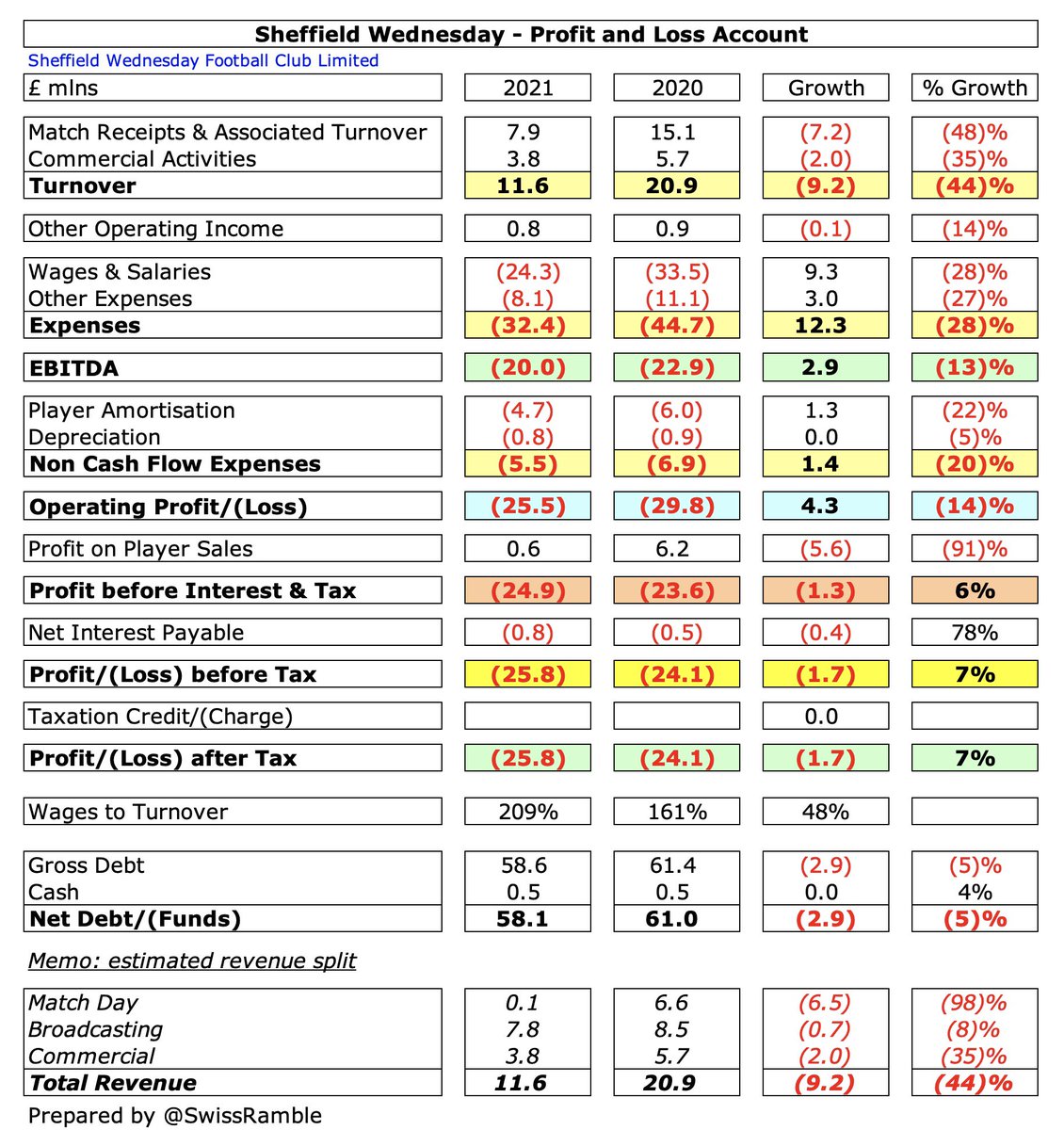

#HTAFC were one of only four clubs to post a pre-tax profit in the 2020/21 Championship, though their £2.6m was outpaced by two clubs relegated from the Premier League the prior season: #NCFC £21m and #AFCB £17m. No fewer than five clubs had losses above £20m.

#HTAFC did not quantify the effect of COVID-19, though many revenue streams fell because of the pandemic, as the entire season was played behind closed doors. The impact was not only on gate receipts, but also other match day spend such as retail, hospitality and catering.

#HTAFC profit on player sales fell £8m from £18m to £10m, mainly Karlan Grant to WBA, Ramadhan Sobhi to Pyramids FC (Egypt) and Terence Kongolo to #FFC. Town said that transfer market was depressed by COVID, but clubs relegated from the Premier League made between £56m and £60m.

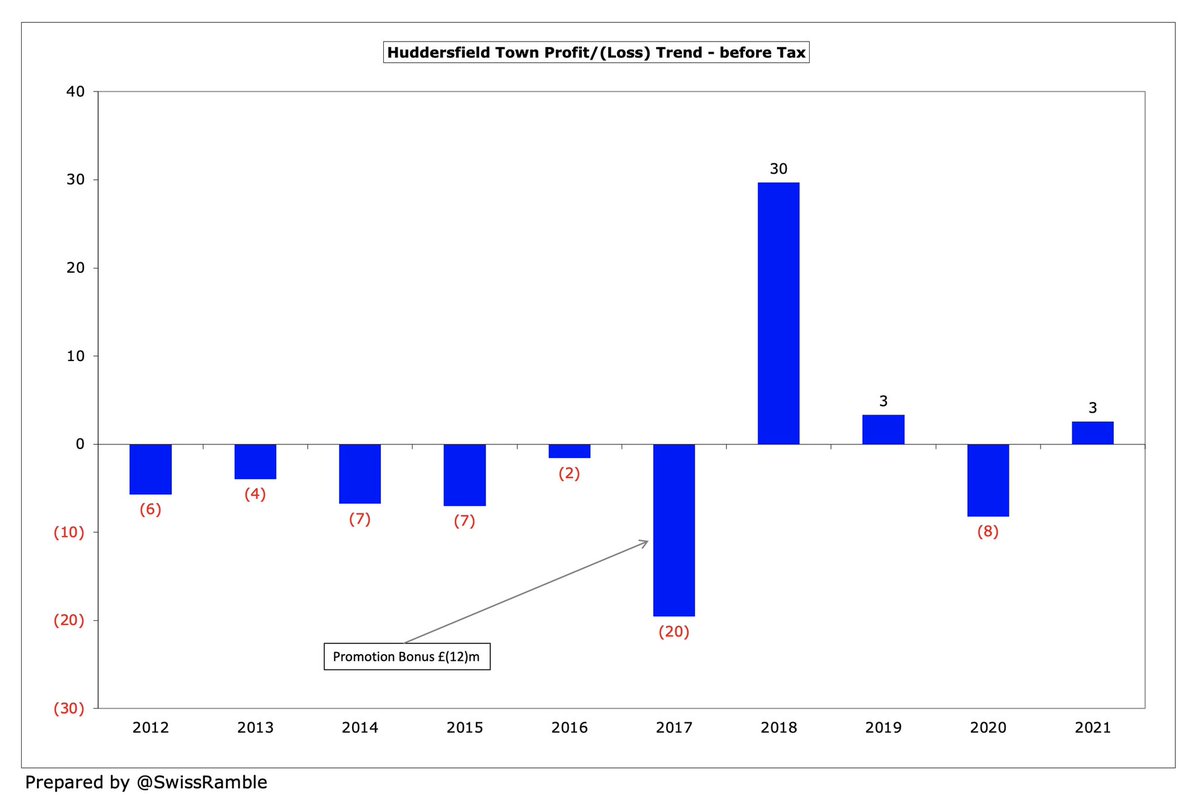

#HTAFC have made money in three of the last four years, boosted by two seasons in the Premier League (including a hefty £30m profit in 2018). Before that, they generally posted small losses with the £20m reported in 2017 adversely impacted by estimated £12m promotion bonuses.

The £28m profit #HTAFC have made from player sales in the last 2 years is as much as previous 7 years combined. Since these accounts, many players have left, but very largely on free transfers (to get them off the wage bill), with only Juninho Bacuna to Rangers attracting a fee.

#HTAFC operating loss (excluding player sales and interest) improved from £23m to £5m, one of the best results in the Championship, where almost every club has substantial operating losses, i.e. nearly half of them are above £30m. Generated £23m profit in Premier League in 2018.

Since relegation from the Premier League, #HTAFC revenue has dropped by £75m (63%) from £119m in 2019 to £44m, very largely due to less TV money in the Championship (£64m decrease), though commercial and match day are also down £7m and £3m respectively.

#HTAFC revenue decrease has been cushioned by Premier League parachute payments (£42m in 2020 and £34m in 2021), though this will have fallen to £15m in 2022. That was the final year, so next season Town will have to make do without a parachute.

Even after the decrease, #HTAFC £44m revenue was still 5th highest in the 2020/21 Championship, though a fair way below the clubs receiving the largest parachute payments, namely #AFCB £72m, #NCFC £57m and Watford £57m. Likely to have been in the bottom half in 2021/22.

#HTAFC broadcasting income fell £4.3m (10%) from £44.7m to £40.4m, as lower parachute payment was partly offset by revenue deferred from 2019/20 for games played after 30 June close. Most Championship clubs receive £8-10m TV money, but huge gap to clubs receiving parachutes.

#HTAFC match day income dropped £2.4m (58%) to £1.7m, as all home games were played behind closed doors, though presumably some fans donated their season ticket money (maybe also includes iFollow streaming revenue). Never been a significant revenue stream (PL peak only £5m).

#HTAFC average attendance (for games played with fans) was 21,748 in 2019/20, so has fallen over 2,000 since the 2018 Premier League peak of 24,032. However, this was still 9th highest in the Championship and also more than the 2017 promotion season.

#HTAFC commercial income fell £1.6m (41%) to £2.3m, mainly due to COVID. This is the club’s lowest since 2011 and significantly down from £10.6m in top flight. One of the smallest in the Championship, only ahead of Luton Town, Barnsley and (probably) Wycombe.

#HTAFC launched an innovative shirt sponsor scheme with different local businesses on a weekly basis in 2020/1, but have since signed a 3-year deal with Utilita Energy. The Umbro kit supplier deal has been extended to June 2025. Back-of-shirt deal with SportsBroker also extended.

#HTAFC other operating income decreased from £6,3m to £1.0m, mainly due to lower player loans, down from £5.7m to £0.6m (prior year included Aaron Mooy to #BHAFC and Ramadan Sobhi to Al-Ahly). Some clubs included COVID business interruption insurance claims here.

#HTAFC wage bill fell £5.6m (19%) from £30m to £25m, as the club “continued to balance reducing the football wages cost while maintaining a competitive squad.” This means that wages have been cut by £39m (61%) since relegation from the Premier League.

Following the decrease, #HTAFC £25m wage bill was firmly in the bottom half of the Championship, the lowest of all clubs with parachute payments. For more perspective, this was over £40m below Watford £68m and #NCFC £67m, though they both included promotion bonuses.

Thanks to a combination of parachute payment and wage reductions, #HTAFC had by far the lowest wages to turnover ratio in the Championship with 55%, only slightly higher than 53% in the Premier League. Vast majority of clubs in this division have ratios well over 100%.

#HTAFC said that “football wages will decrease as the squad is remodelled”, as seen by last summer’s departure of some of the expensive players signed in the Premier League. The last time the club was in the Championship, the wage bill was around £13m (excluding promotion bonus).

#HTAFC total directors’ remuneration was reduced by around a third from £585k to £403k, around mid-table in the Championship, far below #AFCB £2.1m and Watford £934k. Highest paid director cut from £188k to £110k.

#HTAFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, almost halved from £28m to £15m. This was still 4th highest in the Championship, but less than half of #AFCB £36m and Watford £33m. Reduction helped by previous player impairment.

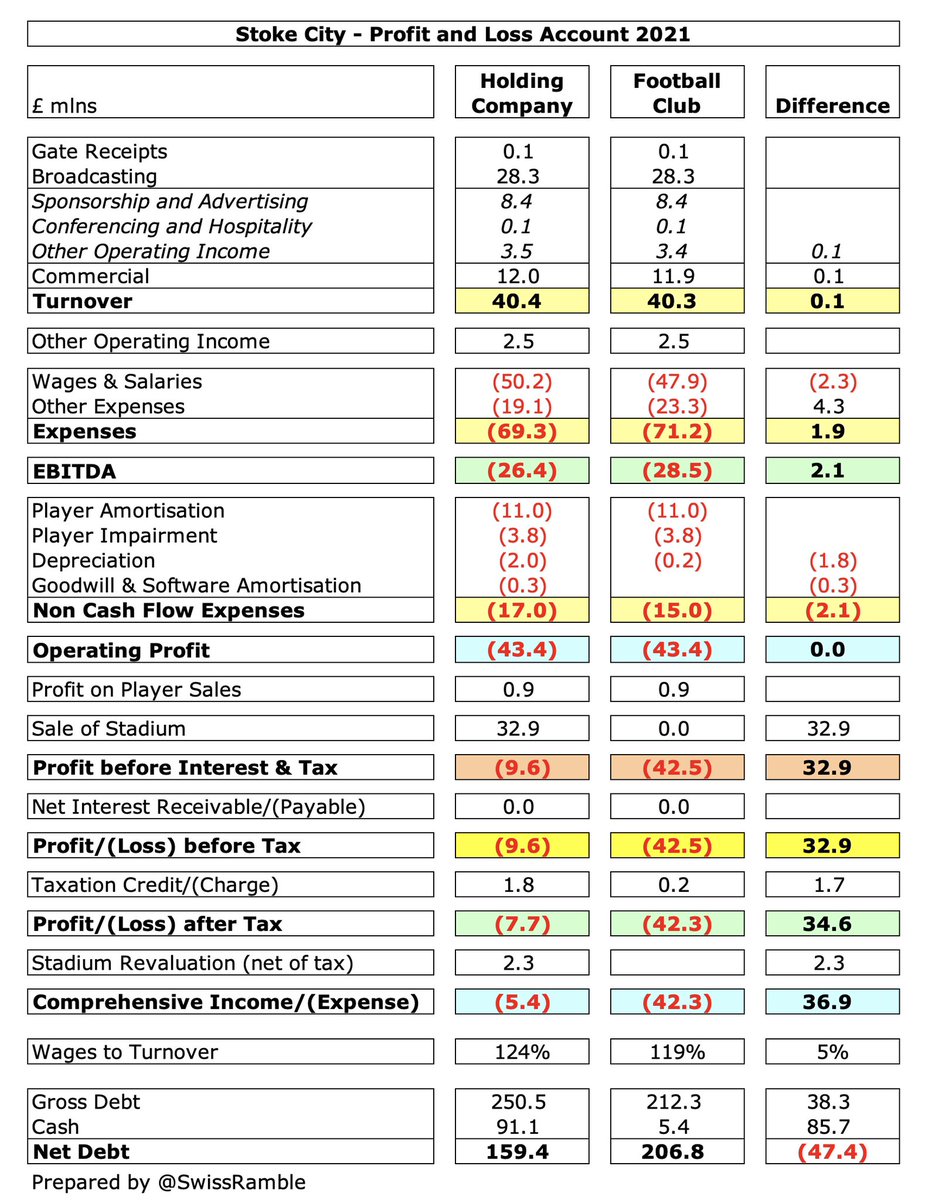

#HTAFC booked £6m impairment charge in 2019/20 to reduce the value of players in the accounts, partly due to the termination of certain players’ contracts. They had the second highest in the Championship over the past two years, though much lower than Stoke City £43m.

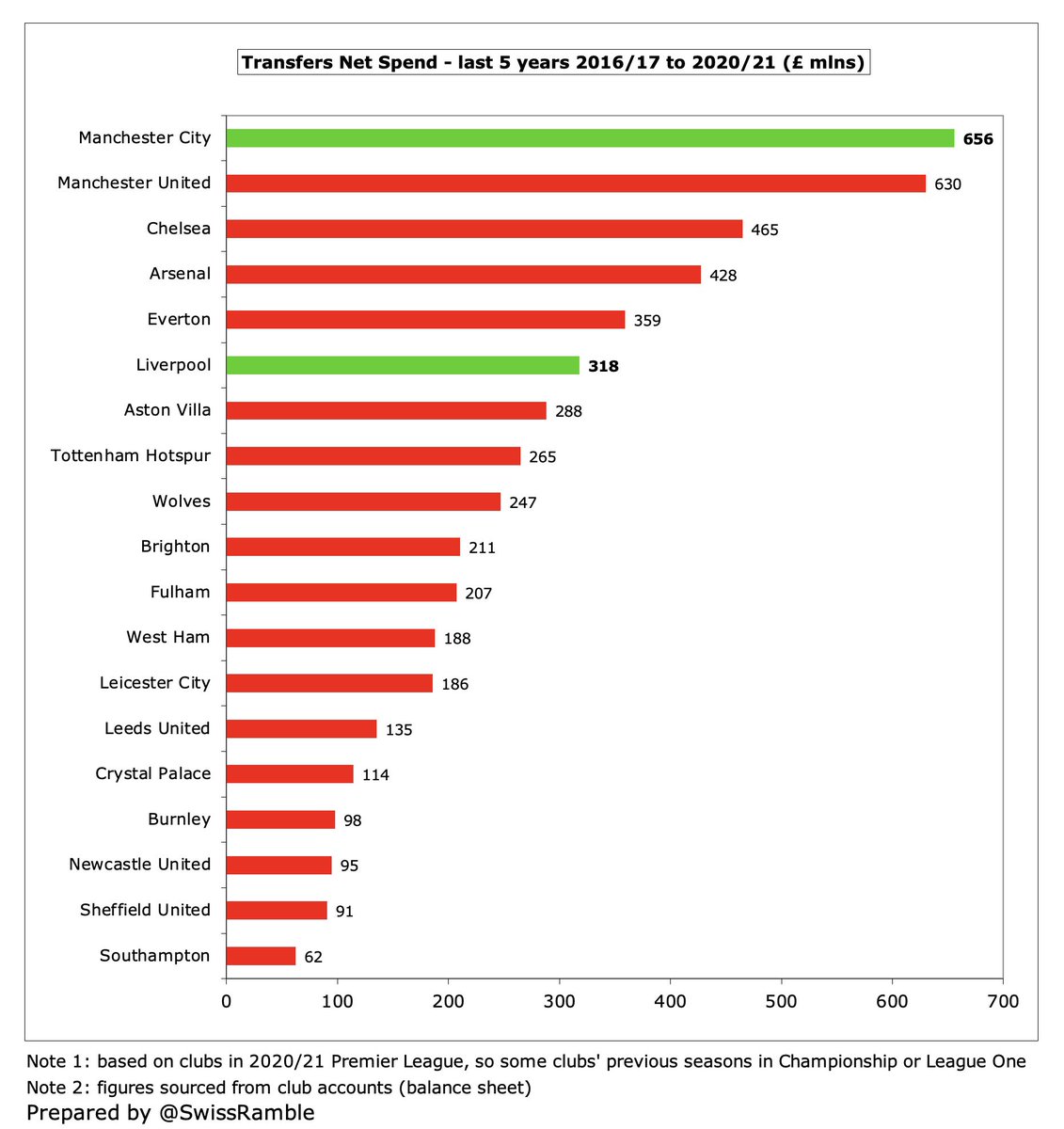

#HTAFC said they “continued to invest heavily in the squad”, but they actually only spent £2m on players, mainly Pipa, Duane Holmes and Sorba Thomas, which was one of the lowest in the Championship. Less than 10% of Brentford, #NCFC and Watford (all between £21m and £22m)

#HTAFC have spent £128m on players in the last 5 years, compared to just £11m in preceding 5-year period. Unsurprisingly, expenditure was much higher in the Premier League. Down 3 years in a row since then. Very little spent this season with many arrivals being on free transfers.

#HTAFC gross debt decreased £14m from £58m to £44m, so down £31m in 2 years. The amount owed to former owner Dean Hoyle was £34m (discounted at 5.5% in accounts to £30m) with the former owner rescheduling repayment to help the club. The remaining balance is a bank loan.

#HTAFC £44m debt is on the low side for the Championship, far below Stoke City £212m, #AFCB £165m, #BRFC £152m and Watford £139m, though it has grown from just £11m in 2010.

Hoyle’s loans are interest-free, but #HTAFC had to pay £3.4m interest on the bank loan in 2020/21, up from prior year’s £3.1m. This was only below Watford £6.2m in the Championship, where most debt is provided by club owners, so is usually interest-free.

#HTAFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this has been slashed from £25m in 2019 to £4m, as much of the PL player recruitment was done on credit. Also reduced transfer receivables from £30m to £20m, so net amount owed to club is £15m.

#HTAFC £5m operating loss became £2m cash flow after adding back non-cash movements, boosted by £5m from player trading (sales £17m, purchases £12m). Spent £3m on interest and £1m on infrastructure. Related party £500k loan (probably Hodgkinson), but £13m repayment of bank loan.

As a result, #HTAFC cash balance fell £9.3m from £10.6m to £1.3m. This was on the low side, but in fairness most Championship clubs have less than £3m cash in the bank.

In the last decade, #HTAFC had £94m available cash with £51m from operations plus £43m funding (£27m from owners & £16m from banks). Most of this went on players £68m, while £18m has been invested into infrastructure, mainly the training ground at PPG Canalside, and £6m interest.

#HTAFC owners, almost entirely Dean Hoyle, have provided £27m of funding in the last 10 years, though this is after £18m of loan repayments between 2018 and 2020, using some of the money made in the Premier League.

In fact, #HTAFC £27m owner funding in the last 10 years was actually in the bottom half of the Championship, far below the likes of QPR £283m, Stoke City £195m and Cardiff City £194m, though money has clearly not always been a guarantee of success.

That said, Hoyle had to find £2m to pay October wages for players and staff. He advised fans, “I have subsequently provided millions more to meet cash requirements of the club. The alternative would have been administration.” #HTAFC are fortunate to have his backing.

#HTAFC had no issues with Financial Fair Play (FFP) regulations, as they are profitable over the 3-year monitoring period, even before allowable deductions for academy, community and infrastructure. Annual limit is £13m a year in the Championship and £35m in the Premier League.

Since these accounts #HTAFC made considerable progress on the pitch and were unfortunate to lose the play-off final (and miss out on more Premier League millions), but the club did prove that it is possible to do well in the Championship even on a limited budget.

• • •

Missing some Tweet in this thread? You can try to

force a refresh