Hello Friday!

China reporting -2.6% Q/Q growth on the back of Q2 🦠🔒🔻 and US retail sales 🛍️ on tap.

Let's dig into the 🧮!

China reporting -2.6% Q/Q growth on the back of Q2 🦠🔒🔻 and US retail sales 🛍️ on tap.

Let's dig into the 🧮!

Asian equities closed the week ↔️ with 🇨🇳↘️

$NIKK 26788 +0.55%

$SSEC 3228 -1.65% 🇨🇳

$TWII 14551 +0.8%

$HSI 20304 -2.15%

$KOSPI 2331 +0.35%

$IDX 6652 -0.55%

Australia ↘️

$ASX 6606 -0.7%

India ↗️

$BSE 53517 +0.2%

$NIKK 26788 +0.55%

$SSEC 3228 -1.65% 🇨🇳

$TWII 14551 +0.8%

$HSI 20304 -2.15%

$KOSPI 2331 +0.35%

$IDX 6652 -0.55%

Australia ↘️

$ASX 6606 -0.7%

India ↗️

$BSE 53517 +0.2%

Europe opens ↗️

$DAX 12738 +1.75%

$FTSE 7120 +1.15%

$CAC 5968 +0.9%

$AEX 669 +1.35%

$IBEX 7909 +1.35%

$MIB 20882 +1.6%

$SMI 10860 +0.55%

$MOEX 2057 -0.3% 🪆

$VTSOXX 31.01 🛗

$DAX range 12425 - 12925 🐻

$DAX 12738 +1.75%

$FTSE 7120 +1.15%

$CAC 5968 +0.9%

$AEX 669 +1.35%

$IBEX 7909 +1.35%

$MIB 20882 +1.6%

$SMI 10860 +0.55%

$MOEX 2057 -0.3% 🪆

$VTSOXX 31.01 🛗

$DAX range 12425 - 12925 🐻

🇺🇸 futures trading ↗️ into #opex

$XLX showing 💪 into yesterday's close

$ES 3803 +0.35%

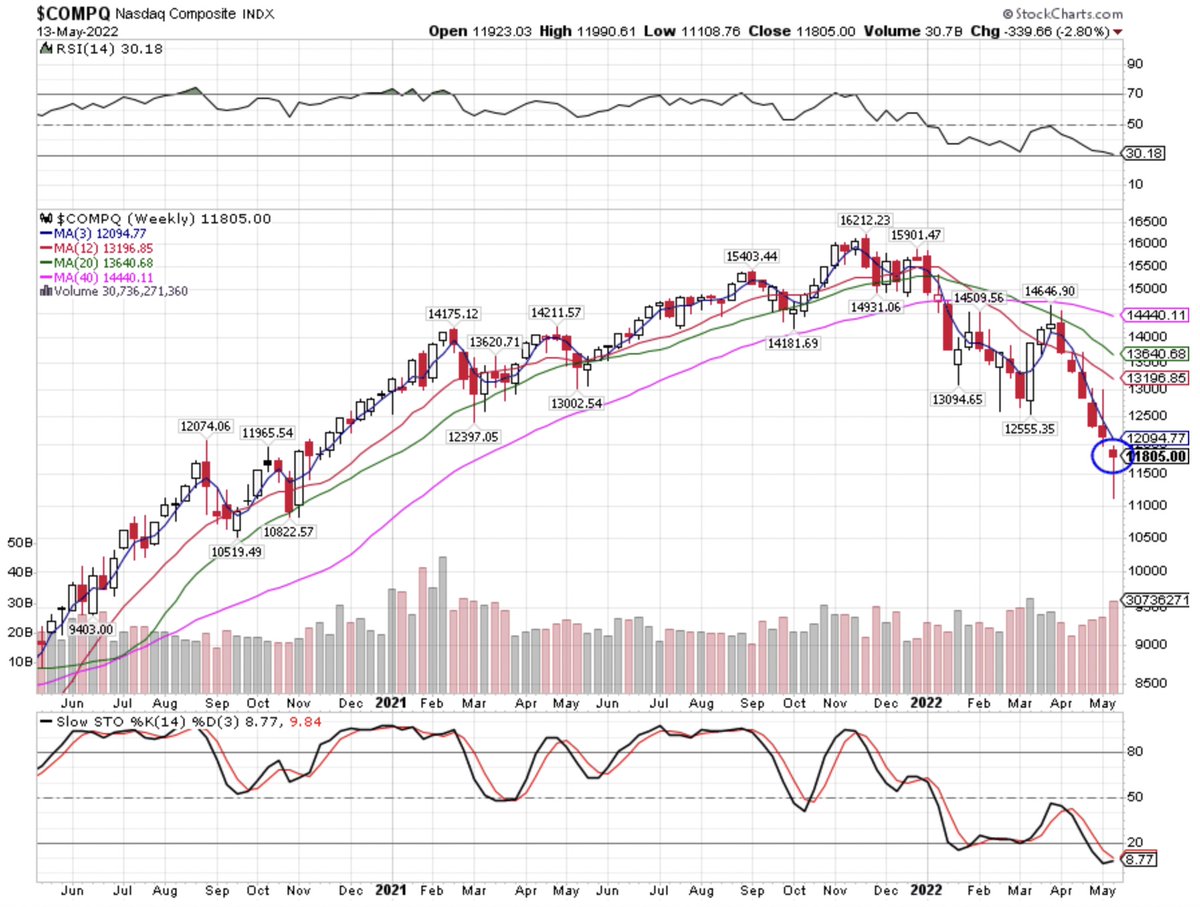

$NQ 11817 +0.4%

$RTY 1712 +0.25%

$VIX 26.33 🪓🪣

$SPX range = 3685 - 3945 🐻

$VIX range = 24.20 - 31.80♉️

$XLX showing 💪 into yesterday's close

$ES 3803 +0.35%

$NQ 11817 +0.4%

$RTY 1712 +0.25%

$VIX 26.33 🪓🪣

$SPX range = 3685 - 3945 🐻

$VIX range = 24.20 - 31.80♉️

GOLD and metals continue to get 🔨↘️

$GOLD 1700 -0.35%

$SILVER 18.17 -0.3%

$COPPER 3.17 -1.35%

$PLAT 819 +0.2%

$PALL 1884 -0.5%

$ALI 2322 -0.25%

$ZINC 2846 -0.7%

$GVZ 19.60 🔺

$GOLD range = 1677 - 1790 🐻

$COPPER range = 3.13 - 3.68 🐻

$GOLD 1700 -0.35%

$SILVER 18.17 -0.3%

$COPPER 3.17 -1.35%

$PLAT 819 +0.2%

$PALL 1884 -0.5%

$ALI 2322 -0.25%

$ZINC 2846 -0.7%

$GVZ 19.60 🔺

$GOLD range = 1677 - 1790 🐻

$COPPER range = 3.13 - 3.68 🐻

Hydrocarbons bouncing around break ↔️

$WTIC 96.11 +0.35%

$BRENT 99.84 +0.85%

$NATGAS 6.601 unch

$GASO 3.192 +0.15%

$OVX 53.03

$WTIC range = 90 - 105.45 🐻

$WTIC 96.11 +0.35%

$BRENT 99.84 +0.85%

$NATGAS 6.601 unch

$GASO 3.192 +0.15%

$OVX 53.03

$WTIC range = 90 - 105.45 🐻

Grains ↔️

$WHEAT 798 +0.4%

$CORN 608 +0.45%

$SOYB 1470 -0.05%

$SUGAR 19.00 +0.05%

$COFFEE 196.90 +0.65% after getting ground -5.8% yesterday

$DBA range 19.01 - 20.53 🐻

$WHEAT 798 +0.4%

$CORN 608 +0.45%

$SOYB 1470 -0.05%

$SUGAR 19.00 +0.05%

$COFFEE 196.90 +0.65% after getting ground -5.8% yesterday

$DBA range 19.01 - 20.53 🐻

EUR holding onto parity

$EUR 1.003 +0.15%

$GBP 1.182 +0.03%

$AUD 0.6737 -0.15%

$USD 108.40 -0.01%

$USDJPY 138.82 -0.05%

$USDCHF 0.9803 -0.36%

$USDCAD 1.3115 -0.02%

$USDRUB 58.12 -0.31% 🪆

$USD range = 105.51 - 109.40 ♉️

$EUR 1.003 +0.15%

$GBP 1.182 +0.03%

$AUD 0.6737 -0.15%

$USD 108.40 -0.01%

$USDJPY 138.82 -0.05%

$USDCHF 0.9803 -0.36%

$USDCAD 1.3115 -0.02%

$USDRUB 58.12 -0.31% 🪆

$USD range = 105.51 - 109.40 ♉️

UST yields ↘️

10/2s @ -19 BPS

MOVE 137.76 🛗

$TLT range = 113.50 - 117.30 🐻 (T) ♉️ (t)

Global 10Ys ↘️

10/2s @ -19 BPS

MOVE 137.76 🛗

$TLT range = 113.50 - 117.30 🐻 (T) ♉️ (t)

Global 10Ys ↘️

$SPX closed well off intraday lows yesterday and $XLK and $BTC showed particular strength

Covered my $XLK short and took off some of my $KBA. Continuing to 👁🗨 $TLT long

Flows dictate today into #OPEX

Watch for possible head fake, have a super profitable 💰 day, and great w/e!

Covered my $XLK short and took off some of my $KBA. Continuing to 👁🗨 $TLT long

Flows dictate today into #OPEX

Watch for possible head fake, have a super profitable 💰 day, and great w/e!

• • •

Missing some Tweet in this thread? You can try to

force a refresh