Worldwide PMIs to provide guidance on recession risks and inflation trends. Read our free preview of what to look out for in Friday's flash releases ihsmarkit.com/research-analy…

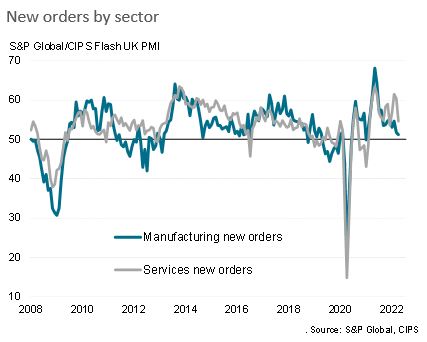

The key data will be the new orders indices, and what they are telling us about the environment in which central banks are hiking interest rates. It's not been looking great up to June ...

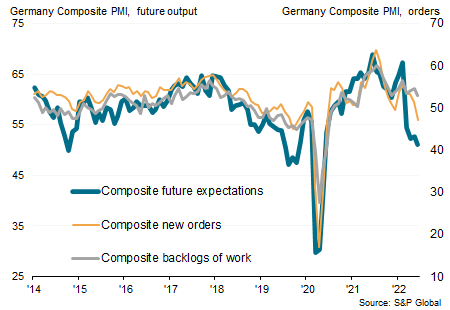

With forward-looking #PMI indicators such as business expectations, new orders and backlogs of work signalling worse is yet to come, euro area #GDP looks set to contract in the third quarter

Excluding the initial COVID-19 lockdowns, the eurozone's #manufacturing sector is entering a period of decline of a nature not witnessed since 2012, with the new-orders-to-inventory ratio in fact now down to its lowest since 2008-9

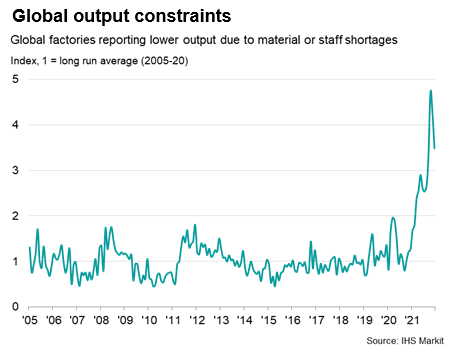

One positive from the recent slumping of demand, and a concomitant build-up of excess inventories, is a significant easing of supply chain pressures in the eurozone, which has brought industrial price pressures down considerably

Although gas/energy is the wildcard, a cooling of input cost pressures across manufacturing and services in the eurozone July flash #PMI numbers hints at a further cooling of core #inflation in the months ahead

• • •

Missing some Tweet in this thread? You can try to

force a refresh