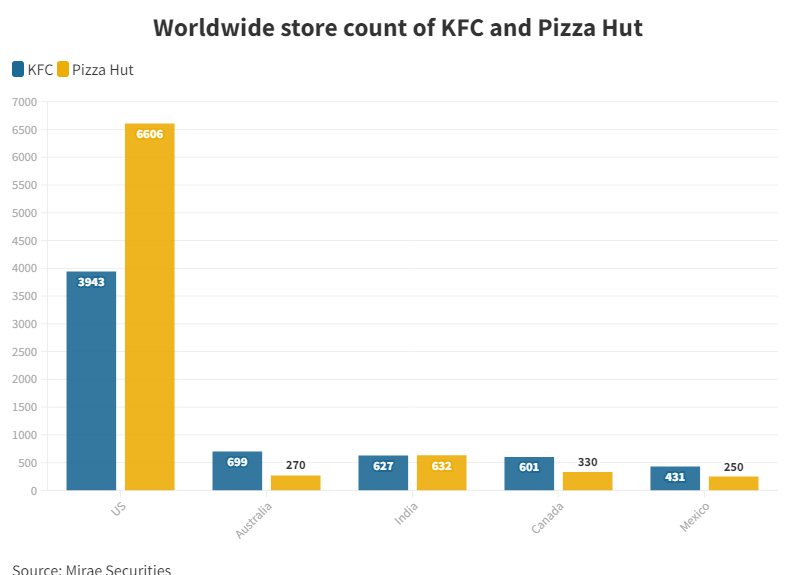

India has more KFCs and Pizza Huts than Canada or Mexico, and they’re customized too

@KFC_India @PizzaHutIN

businessinsider.in/business/news/…

By @KatyaNaidu

@KFC_India @PizzaHutIN

businessinsider.in/business/news/…

By @KatyaNaidu

One would think that American fast food brands like #KFC and #PizzaHut would be more popular on home turf than outside – like in Canada and Mexico. But they are spreading their wings in countries like China and #India.

While #China has a higher number of these stores outside the US, India has more #PizzaHut outlets than Australia. It also ranks very close to Australia in terms of the number of KFCs– proving that Colonel’s chicken and pizzas have found favour with the Indian palate.

#KFC

#KFC

India has 400 million #millennials – 120 million of them in urban areas – who prefer quick service restaurants or QSRs. The country has 2.8 million QSR outlets, accounting for a 34% market share in food outlets and twice as many full-service restaurants.

#KFC #PizzaHut

#KFC #PizzaHut

Quick-service restaurants – be it those serving pizza, burgers or fried chicken – have seen growth. Along with trends and macroeconomic factors, the industry has recognized this opportunity and improved the affordability and availability of their products.

#KFC #PizzaHut

#KFC #PizzaHut

Most of these stores are operating at a 20% margin, implying payback in less than three years, as per a report. Some of these stores are delivery-focussed – a business that boomed during the pandemic and yields results – making stores smaller and paybacks better.

#KFC #PizzaHut

#KFC #PizzaHut

The franchise operators also revised their menus to suit Indian needs. Interestingly, they converted its rice bowl into a #Biryani bucket, as the former never took off. This is the most favourite product in the south, and has also become a hit in the north and the west.

#KFC

#KFC

It looks like, when it comes to food, most young Indians prefer it quick, fast, tasty and affordable – which is why they’re flocking to QSRs – a sweet spot that these American brands have managed to hit.

#KFC #PizzaHut

#KFC #PizzaHut

• • •

Missing some Tweet in this thread? You can try to

force a refresh