1/ What's next for #DeFi?🤔

I researched roadmaps of 25 major protocols to find out.

A lot is coming up: protocol-owned-stablecoins, new tokenomics, decentralization plans, The End Game for Maker and more.

These are the top 7 trends coming for DeFi 🧵

I researched roadmaps of 25 major protocols to find out.

A lot is coming up: protocol-owned-stablecoins, new tokenomics, decentralization plans, The End Game for Maker and more.

These are the top 7 trends coming for DeFi 🧵

2/ First of all, the past year for #DeFi was brutal.

DeFi tokens have been sinking against #ETH since at least October 2020.

DeFi Pulse Index, which tracks major DeFi tokens, has dropped 69% against $ETH just in the past year alone.

DeFi tokens have been sinking against #ETH since at least October 2020.

DeFi Pulse Index, which tracks major DeFi tokens, has dropped 69% against $ETH just in the past year alone.

3/ Why?

• Inflationary design of DeFi tokenomics

• Lack of protocol revenue redistribution to the token holders.

• Attractive #ETH staking APY

For example, the only use case for Uniswap's $UNI is to vote and 0% of its generated fees are distributed to the UNI holders.

• Inflationary design of DeFi tokenomics

• Lack of protocol revenue redistribution to the token holders.

• Attractive #ETH staking APY

For example, the only use case for Uniswap's $UNI is to vote and 0% of its generated fees are distributed to the UNI holders.

3/ Why?

• Inflationary design of DeFi tokenomics

• Lack of protocol revenue redistribution to the token holders.

• Attractive #ETH staking APY

For example, the only use case for Uniswap's $UNI is voting and 0% of its generated fees are distributed to the UNI holders.

• Inflationary design of DeFi tokenomics

• Lack of protocol revenue redistribution to the token holders.

• Attractive #ETH staking APY

For example, the only use case for Uniswap's $UNI is voting and 0% of its generated fees are distributed to the UNI holders.

4/ In light of this, I ventured to analyze the roadmaps of the 25 major #DeFi protocols to see what's next in the pipeline.

You can check the full list of projects, roadmap details, timeline and the information source.

Link to Notion table: bit.ly/3J49Mwg

You can check the full list of projects, roadmap details, timeline and the information source.

Link to Notion table: bit.ly/3J49Mwg

5/

So, what's coming for DeFi?

1⃣ Growth of Protocol-owned-stablecoins

Following recent launches of #NEAR, #Tron, #Waves blockchain stablecoins, #DeFi protocols Aave and Curve are planning to launch their own stablecoins too.

Even $SHIB is building its own stablecoin $SHI

So, what's coming for DeFi?

1⃣ Growth of Protocol-owned-stablecoins

Following recent launches of #NEAR, #Tron, #Waves blockchain stablecoins, #DeFi protocols Aave and Curve are planning to launch their own stablecoins too.

Even $SHIB is building its own stablecoin $SHI

6/ While not much official info is available crvUSD, Aave revealed its $GHO stablecoin mechanics.

The advatanges:

• Add a new source of revenue

• Brings additional use cases for the token

• Increases its demand and boosts generated yield to liquidity providers.

The advatanges:

• Add a new source of revenue

• Brings additional use cases for the token

• Increases its demand and boosts generated yield to liquidity providers.

7/

2️⃣ Increased adoption of veTokenomics:

• Yearn Finance is expected to launch $veYFI with a 4-year locking in mid August

• Synthetix will use $veSNX gauges for inflation weighting

• Pancakeswap too will roll out $vCAKE for rewards weight voting 'soon'.

2️⃣ Increased adoption of veTokenomics:

• Yearn Finance is expected to launch $veYFI with a 4-year locking in mid August

• Synthetix will use $veSNX gauges for inflation weighting

• Pancakeswap too will roll out $vCAKE for rewards weight voting 'soon'.

8/ The model creates skin in the game and discourages mercenary farming when liquidity mining token rewards are instantly sold.

I wouldn't be surprised if $COMP transitioned to veTokenomics as well in the future, as they stopped liquidity mining altogether

I wouldn't be surprised if $COMP transitioned to veTokenomics as well in the future, as they stopped liquidity mining altogether

9/

3️⃣Focus on Progressive decentralization

As projects establish PMF, financial sustainability, a community and regulatory compliance, they seek to reduce their single point of failure - centralization.

$DYDX, $GRT, $REN, $LDO and $MKR is moving towards full decentralization

3️⃣Focus on Progressive decentralization

As projects establish PMF, financial sustainability, a community and regulatory compliance, they seek to reduce their single point of failure - centralization.

$DYDX, $GRT, $REN, $LDO and $MKR is moving towards full decentralization

10/

4️⃣Launching new iteration protocols

#Crypto and DeFi moves fast.

In order to keep up with the fast pace market, many protocols will completely overhall how the protocols work.

Soon to launch:

• Synthetix V3

• Compound III

• Nexus V2

• dYdX V4

• Yearn V3

• GMX X4

4️⃣Launching new iteration protocols

#Crypto and DeFi moves fast.

In order to keep up with the fast pace market, many protocols will completely overhall how the protocols work.

Soon to launch:

• Synthetix V3

• Compound III

• Nexus V2

• dYdX V4

• Yearn V3

• GMX X4

11/

5⃣ Future is multichain

This one is so obvious, that even Compound has a multichain strategy for its Compound III.

Also:

• $SUSHI launched SushiXSwap DEX

• $REN is working in partnership with @catalogfi for a Metaversal exchange

• MakerDAO's End Game has Maker Teleport

5⃣ Future is multichain

This one is so obvious, that even Compound has a multichain strategy for its Compound III.

Also:

• $SUSHI launched SushiXSwap DEX

• $REN is working in partnership with @catalogfi for a Metaversal exchange

• MakerDAO's End Game has Maker Teleport

12/

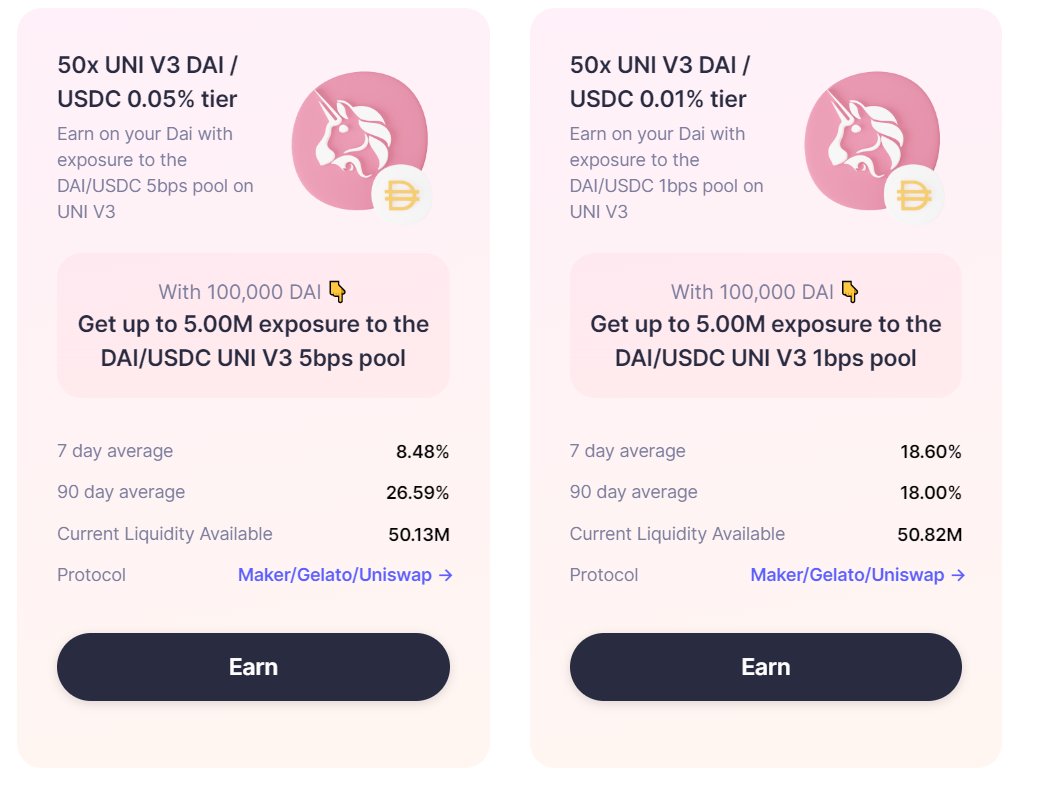

6⃣Increasing influence of Uniswap V3

V3 introduced concentrated liquidity and recently @KyberNetwork launched KyberSwap elastic with concentrated the same feature + 5 fee tiers for LPs.

@osmosiszone is building CL too.

6⃣Increasing influence of Uniswap V3

V3 introduced concentrated liquidity and recently @KyberNetwork launched KyberSwap elastic with concentrated the same feature + 5 fee tiers for LPs.

@osmosiszone is building CL too.

13/

7⃣Expanding token use cases:

• @chainlink announced Economics 2.0 for $LINK staking

• @PancakeSwap V2 tokenomics caps $CAKE at 750M tokens, boosts yields, IFO benefits and weight voting

• Maker will launch liquidity mining for $MKR and even $DAI holders for its End Game

7⃣Expanding token use cases:

• @chainlink announced Economics 2.0 for $LINK staking

• @PancakeSwap V2 tokenomics caps $CAKE at 750M tokens, boosts yields, IFO benefits and weight voting

• Maker will launch liquidity mining for $MKR and even $DAI holders for its End Game

14/ one more thing…

The transparency in which teams are building is very different even among the top DeFi projects.

$YFI, $SNX and $MKR have very clear roadmaps and details on implementation and great communication while $UNI is the most closed off.

The transparency in which teams are building is very different even among the top DeFi projects.

$YFI, $SNX and $MKR have very clear roadmaps and details on implementation and great communication while $UNI is the most closed off.

15/ Will these protocol upgrades suffice for #DeFi to recover?

Would love to get your take on it @DeFiSurfer808 @thedefiedge @Dynamo_Patrick @DeFi_Dad @DegenSpartan @xangle_intern @milesdeutscher and @intocryptoast

Would love to get your take on it @DeFiSurfer808 @thedefiedge @Dynamo_Patrick @DeFi_Dad @DegenSpartan @xangle_intern @milesdeutscher and @intocryptoast

16/Feel free to reach out if I missed something important or you want contribute to the table.

I will be following the progress of these roadmaps so make sure to follow me!

medium.com/@Ignas_defi_re…

I will be following the progress of these roadmaps so make sure to follow me!

medium.com/@Ignas_defi_re…

• • •

Missing some Tweet in this thread? You can try to

force a refresh