1/ n

#ETH #Ethereum

This thread is about

1. The upcoming UPGRADE to the #Ethereum blockchain🚀

2. Triple halvening this september (roughly equivalent to three Bitcoin halvenings) 👀 and

3. Possible implications for #ETH price movements📈📉

#ETH #Ethereum

This thread is about

1. The upcoming UPGRADE to the #Ethereum blockchain🚀

2. Triple halvening this september (roughly equivalent to three Bitcoin halvenings) 👀 and

3. Possible implications for #ETH price movements📈📉

2/n

The Upgrade!

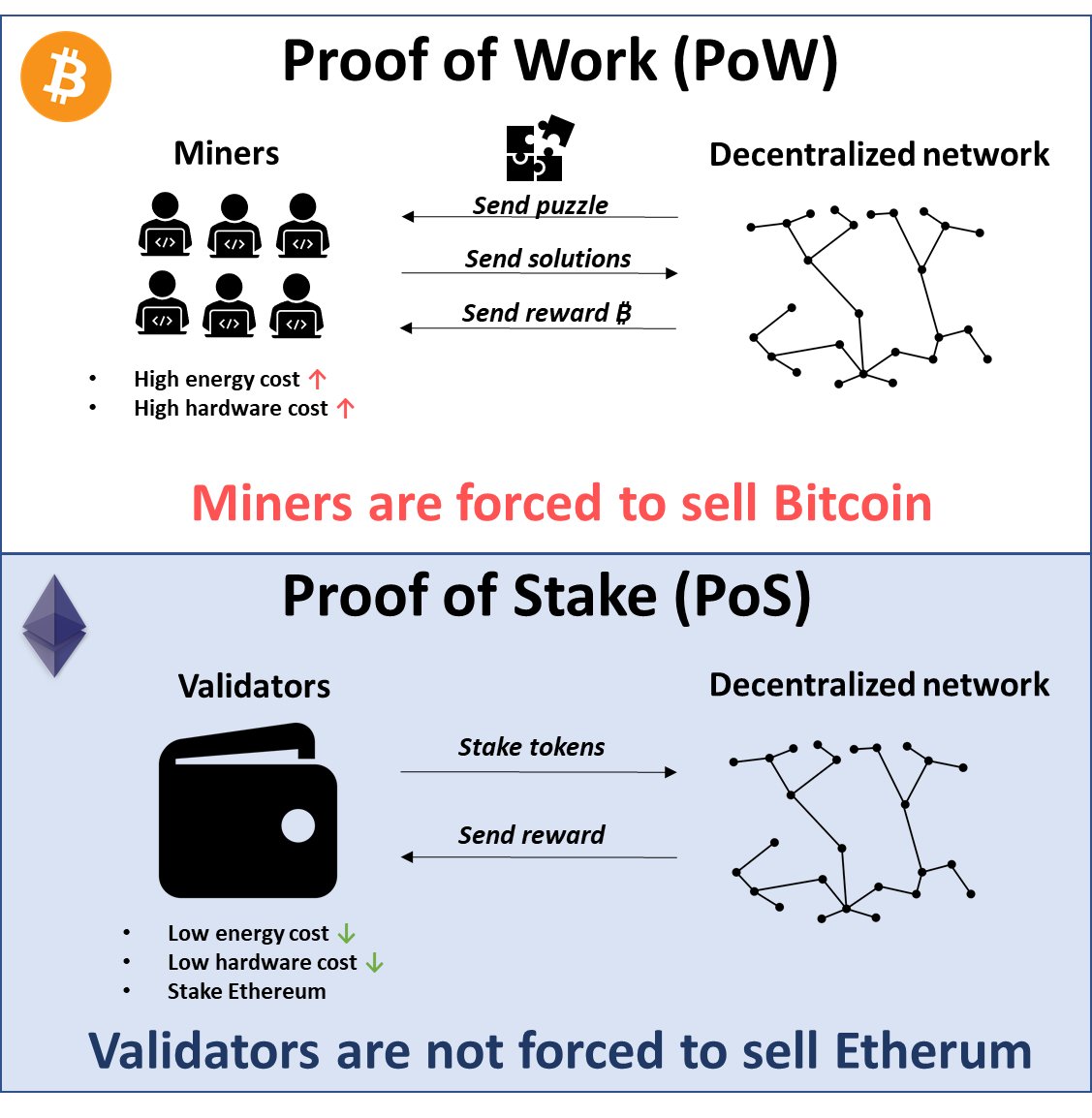

#Ethereum is expected to move to proof-of-stake! First, a Bellatrix upgrade will take place in the Beacon Chain on September 6, 2022. Once a certain difficulty value is reached, the proof-of-work chain will transition to proof-of-stake (10. - 20. Sept. 2022).

The Upgrade!

#Ethereum is expected to move to proof-of-stake! First, a Bellatrix upgrade will take place in the Beacon Chain on September 6, 2022. Once a certain difficulty value is reached, the proof-of-work chain will transition to proof-of-stake (10. - 20. Sept. 2022).

3/n

Implications of the upgrade - Inflation for #ETH will decrease!

- Currently inflating at ~4.13% (4.93M per year/119.3M total)

- After merge at ~ 0.49% (584K per year/119.3M total)

The triple halvening is an issuance cliff roughly equivalent to three #Bitcoin halvenings👀

Implications of the upgrade - Inflation for #ETH will decrease!

- Currently inflating at ~4.13% (4.93M per year/119.3M total)

- After merge at ~ 0.49% (584K per year/119.3M total)

The triple halvening is an issuance cliff roughly equivalent to three #Bitcoin halvenings👀

4/n

- #ETH issuance after The Merge is decreasing by ~90%

- Staking reward (APR) is expected to increase after Merge

- More #ETH will be staked

- Newly issued #ETH, at least 6-12 months following the Merge, will be locked

- Demand will surge after The Merge

- #ETH issuance after The Merge is decreasing by ~90%

- Staking reward (APR) is expected to increase after Merge

- More #ETH will be staked

- Newly issued #ETH, at least 6-12 months following the Merge, will be locked

- Demand will surge after The Merge

5/n

Supply decreases due to

- Triple Halvening

- Increased incentive for staking

- Locked #ETH

- Fee burn (EIP-1559)

The technically leads to deflation🤤

Supply decreases due to

- Triple Halvening

- Increased incentive for staking

- Locked #ETH

- Fee burn (EIP-1559)

The technically leads to deflation🤤

6/n

Demand will increase due to

- decreased inflation

- The Merge will reduce #Ethereum's energy consumption by ~99.95%

- Staking reward (APR)↑

- Institutional demand

Demand will increase due to

- decreased inflation

- The Merge will reduce #Ethereum's energy consumption by ~99.95%

- Staking reward (APR)↑

- Institutional demand

7/n

#Bitcoin currently issues 900 #BTC per day - an annual issuance ~ 1.7%. The next two "halvenings" will reduce Bitcoin issuance to about 0.8% in 2024 and 0.4% in 2028. Bitcoin issuance will not come close to #ETH issuance again until 2028.

#ETH MERGE ~ 3 #BTC halvenings

#Bitcoin currently issues 900 #BTC per day - an annual issuance ~ 1.7%. The next two "halvenings" will reduce Bitcoin issuance to about 0.8% in 2024 and 0.4% in 2028. Bitcoin issuance will not come close to #ETH issuance again until 2028.

#ETH MERGE ~ 3 #BTC halvenings

8/n

When "The Triple Halvening" is combined with the BASEFEE combustion mechanism of EIP-1559 (operational as of August 2021), it is very likely that Ethereum will become deflationary👀👀👀

When "The Triple Halvening" is combined with the BASEFEE combustion mechanism of EIP-1559 (operational as of August 2021), it is very likely that Ethereum will become deflationary👀👀👀

9/n

With PoS, the network is no longer validated by hardware, but by long-term holders. These validators have minimal costs! and thus are not forced to sell #ETH. This is what currently happend with #Bitcoin

With PoS, the network is no longer validated by hardware, but by long-term holders. These validators have minimal costs! and thus are not forced to sell #ETH. This is what currently happend with #Bitcoin

10/n

If you stake #ETH, you currently earn 4.5%/year.

APR for staking will increase by 50% after Merge!

If you stake #ETH, you currently earn 4.5%/year.

APR for staking will increase by 50% after Merge!

11/n

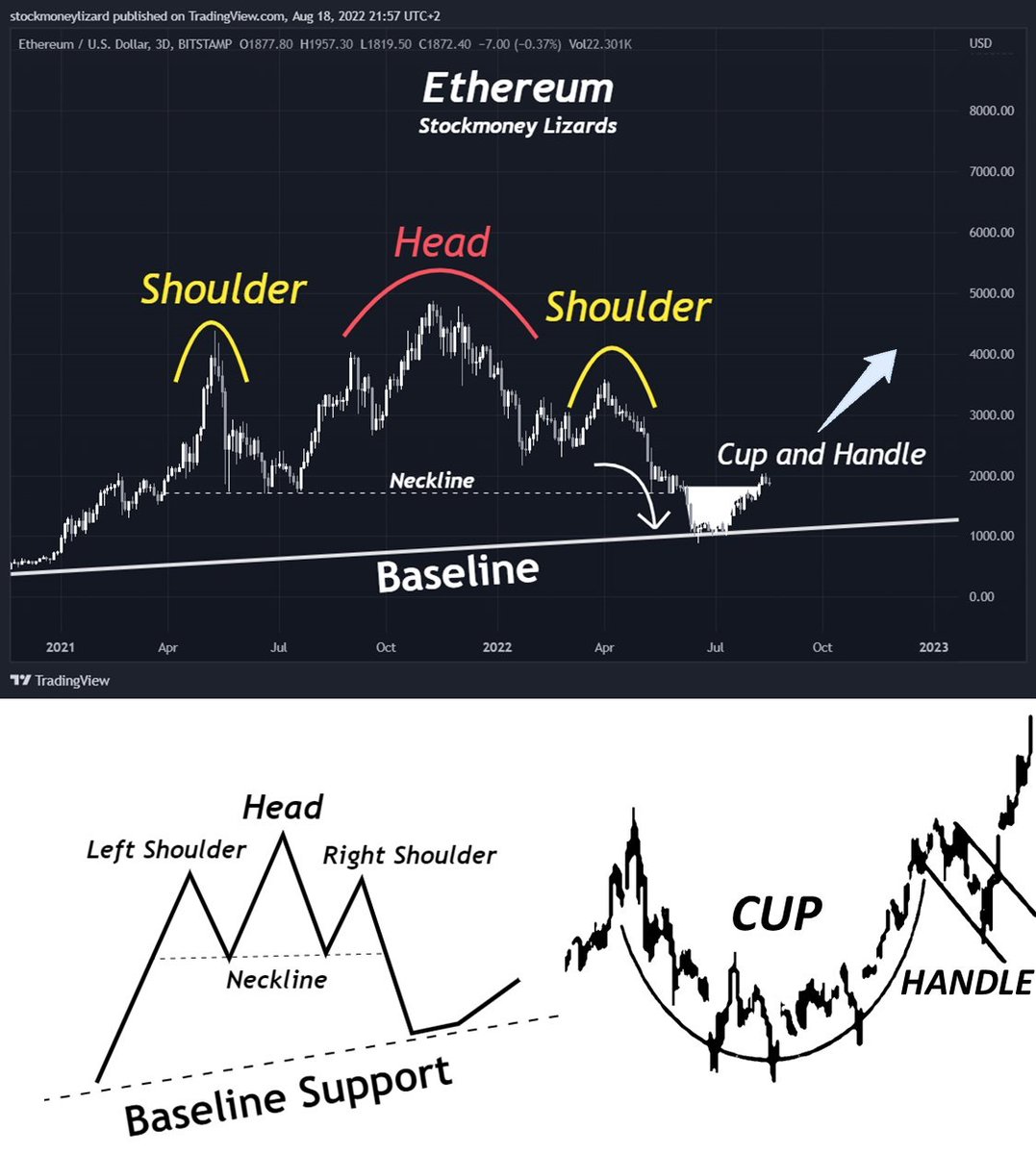

Current chart setup of #ETH🍦

After the bearish H&S was complete and $ETH chart returned to the baseline, we saw a bullish cup and handle forming. #Bullish

Current chart setup of #ETH🍦

After the bearish H&S was complete and $ETH chart returned to the baseline, we saw a bullish cup and handle forming. #Bullish

12/n

Are halvenings (or a triple halvening) important for price movements?

We would definitely say yes looking at the #Bitcoin chart.

Are halvenings (or a triple halvening) important for price movements?

We would definitely say yes looking at the #Bitcoin chart.

13/n

Halvening = scarcity🚀🚀🚀

#Bitcoin impact of the following halvening

1st H = + 11500%

2nd H = + 2900%

3rd H = + 800%

The upcomin super halvening event will be a corner stone for #ETH.

Halvening = scarcity🚀🚀🚀

#Bitcoin impact of the following halvening

1st H = + 11500%

2nd H = + 2900%

3rd H = + 800%

The upcomin super halvening event will be a corner stone for #ETH.

14/n

The merge in september 2022 will increase scarcity of #ETH and will impact the price. Moreover the demand will increase.

The merge in september 2022 will increase scarcity of #ETH and will impact the price. Moreover the demand will increase.

15/n

#Etherum #ETH

I believe that after MERGE/ triple halvening we will see a longer upward phase, of course mixed with smaller corrections.

Feel free to follow me on twitter:

@StockmoneyL

#Etherum #ETH

I believe that after MERGE/ triple halvening we will see a longer upward phase, of course mixed with smaller corrections.

Feel free to follow me on twitter:

@StockmoneyL

• • •

Missing some Tweet in this thread? You can try to

force a refresh