Let us look at the state of the European gas market.

We have worked hard to collect real time data where possible and are convinced to have a worldclass database by now.

What did we find out?

Thread 1/n

#TTF #LNG

We have worked hard to collect real time data where possible and are convinced to have a worldclass database by now.

What did we find out?

Thread 1/n

#TTF #LNG

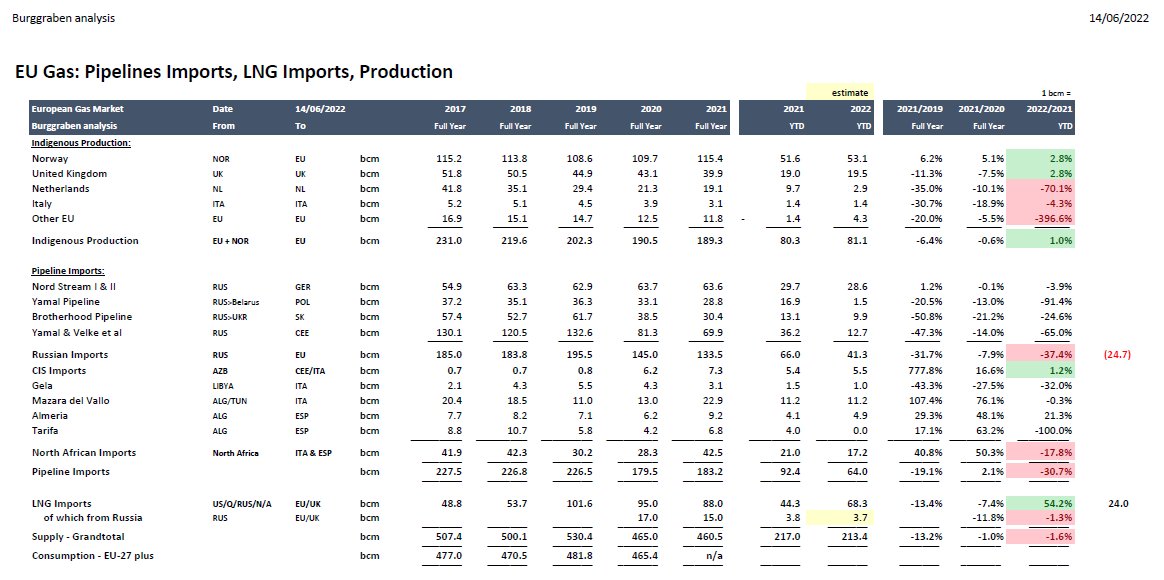

Big picture first:

- Consumption: -12.2% yoy;

- RUS pipe imports: -48% yoy (inc. RUS LNG imports -42%);

- Local Production: +0.6% (Groningen could increase EU production by 10% alone within weeks);

- LNG imports: +70%.

- Net storage build: 45bcm!

2/n #Netherlands

- Consumption: -12.2% yoy;

- RUS pipe imports: -48% yoy (inc. RUS LNG imports -42%);

- Local Production: +0.6% (Groningen could increase EU production by 10% alone within weeks);

- LNG imports: +70%.

- Net storage build: 45bcm!

2/n #Netherlands

Storage:

- ITA, FRA, GER, POL or CZE have done a great job saving gas to fill salt cavities et al "whatever it takes style".

- UK cannot b/c it lacks storage;

- EE struggles to access more flows;

- EU covers 51 of 180 winter days (<2 months).

So it needs flows!

3/n

- ITA, FRA, GER, POL or CZE have done a great job saving gas to fill salt cavities et al "whatever it takes style".

- UK cannot b/c it lacks storage;

- EE struggles to access more flows;

- EU covers 51 of 180 winter days (<2 months).

So it needs flows!

3/n

Put differently, the EU now lost 180bcm (on 470) of annulised RUS gas! Storage 100% filled won't be enough without SAVING gas.

Subj to weather, the EU needs to save up to 20%, some countries more, some less (ESP/PT does not need savings).

4/n EU fill level in % @vonderleyen

Subj to weather, the EU needs to save up to 20%, some countries more, some less (ESP/PT does not need savings).

4/n EU fill level in % @vonderleyen

In fact, savings is 3x more important than storing gas (both matters).

Take GER: it can storage max 2 months of gas (24bcm). Without flows, that will take it to Dec.

GER has flows from NOR & NL/BEL LNG re-imports & saved 16% YTD. Issue is..

5/n

Take GER: it can storage max 2 months of gas (24bcm). Without flows, that will take it to Dec.

GER has flows from NOR & NL/BEL LNG re-imports & saved 16% YTD. Issue is..

5/n

https://twitter.com/BurggrabenH/status/1564002145359339522?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

Bundesnetzagentur reports >9bcm imports in Aug (3.3 TWh/d) which does NOT match real time reported 3.3bcm consump. + 3.3 builds - 0.5bcm prod.

Either BNA missed 3bcm of exports, some industrial consumption is unreported or both. Either way, it needs 6-9bcm/month flow.

6/n

Either BNA missed 3bcm of exports, some industrial consumption is unreported or both. Either way, it needs 6-9bcm/month flow.

6/n

VVP knows that which is why I explained countless times to study the LEADERS instead of theorising about what makes economic sense.

VVP does not care about the RUS economy at this stage. Instead, he & Patrushev dream about an empire. Accept.

7/n

VVP does not care about the RUS economy at this stage. Instead, he & Patrushev dream about an empire. Accept.

7/n

https://twitter.com/BurggrabenH/status/1546116223397765127?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

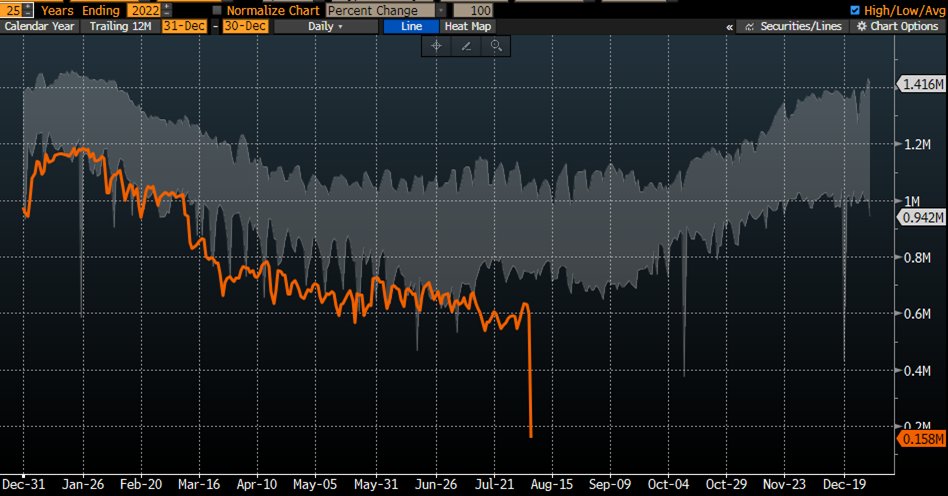

Hence, it did not come as a surprise to us that Nord Stream 1 flows have stopped yesterday too (Yamal and Brotherhood - ironic name, isn't it - flows aready ceases to exist). These are the facts, the rest is noise.

8/n

8/n

More precisely, we predicted this back in July and explained its potential consequences for the European gas market and its economy at some length in an interview below on Real Vision.

Turns out we were in the money.

9/n @AndreasSteno

Turns out we were in the money.

9/n @AndreasSteno

https://twitter.com/JulianMI2/status/1549170460759302147?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

Now it's all about LNG.

VVP reduced flows by the exact same amout as EU increased LNG (42bcm YTD) and finally cut it to zero. Consequently, the EU will have to import 200bcm of LNG in 2023 to compensate the loss if consumption remains 12% reduced yoy. Can it?

10/n @OKalleklev

VVP reduced flows by the exact same amout as EU increased LNG (42bcm YTD) and finally cut it to zero. Consequently, the EU will have to import 200bcm of LNG in 2023 to compensate the loss if consumption remains 12% reduced yoy. Can it?

10/n @OKalleklev

We think it can, but only if politicans don't mess it up.

It needs to conditions:

a) A price that outbids Asia for LNG; and

b) Enough re-gas capacity.

The EU has capacity, but at the wrong places. At 60% utilisation (150bcm pa), it is effectively maxed out for now.

11/n

It needs to conditions:

a) A price that outbids Asia for LNG; and

b) Enough re-gas capacity.

The EU has capacity, but at the wrong places. At 60% utilisation (150bcm pa), it is effectively maxed out for now.

11/n

If you want to read up on the European gas market or LNG bottlenecks, here is some material.

Part I (25 tweets)

12/n

Part I (25 tweets)

12/n

https://twitter.com/BurggrabenH/status/1519135040868962305?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

Part II (another 25 tweets)

13/n

13/n

https://twitter.com/BurggrabenH/status/1519174995741712385?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

Part III (another 25 tweets)

14/n

14/n

https://twitter.com/BurggrabenH/status/1522281598988820481?s=20&t=068ee8Q2cZNLEZqtkD_8Vw

Anyway, we explained what can improve and improving it does.

We identified 150bcm (!) of #LNG regasification terminal or FSRU projects, of which 20bcm are under construction for delivery in Q4 22 or Q1 23 & another 130bcm soon to be started - worldclass!

15/n

We identified 150bcm (!) of #LNG regasification terminal or FSRU projects, of which 20bcm are under construction for delivery in Q4 22 or Q1 23 & another 130bcm soon to be started - worldclass!

15/n

That is a lot of #LNG.

Adding it up & assuming ESP/FRA will debottle (STEP project), Europe ends up having 390bcm pa of re-gasification capacity by 2025.

Our view: it will be more. Everybody & their brother is sick & tired of #Gazprom (VVP) as a supplier.

16/n @OKalleklev

Adding it up & assuming ESP/FRA will debottle (STEP project), Europe ends up having 390bcm pa of re-gasification capacity by 2025.

Our view: it will be more. Everybody & their brother is sick & tired of #Gazprom (VVP) as a supplier.

16/n @OKalleklev

As for price, TTF trades at a $20/MMBtu premium to JKM. That is plenty to redirect LNG away from Asia and into Europe.

But if the EU Commission caps TTF (not just its price for power gen), it will mean Europe must save 30-50bcm more in 2023 & til production increases.

17/n End

But if the EU Commission caps TTF (not just its price for power gen), it will mean Europe must save 30-50bcm more in 2023 & til production increases.

17/n End

• • •

Missing some Tweet in this thread? You can try to

force a refresh