1/ On the #oil price cap: After listening to this excellent Brookings discussion, I am more optimistic it could work, but I also believe it may need to be postponed by 8-12 weeks. Here is why...

2/ First on the cost of delaying #sanctions: The sooner, the more, the better. But this is just a small delay, and the goal - depriving Russia of FX and budget revenues - is a multi-year goal that will be gradually achieved, because Russia still has considerable buffers in both.

3/ The key question is of course Russia's reaction: Russia could reduce its exports, causing oil market prices to rise. From Russia's perspective, compliance would show weakness. Russia has shown it can reduce some production in 2020, and it is willing to bear costs (eg: gas...).

4/ There are also risks for Russia: Using the gas weapon is already costly to Russia itself, and adding the "oil weapon" could backfire, in a very difficult economic situation. Non-sanctioning countries would also suffer from Russia's cut (India), but may blame it on the West.

5/ Russia could still sell cheap oil to China via pipeline to keep Xi happy if it chooses to cut oil supply. But Moscow also needs to consider that its partners in OPEC+ may not be a fan of huge market disruption, even if it increases their own revenue in the short term.

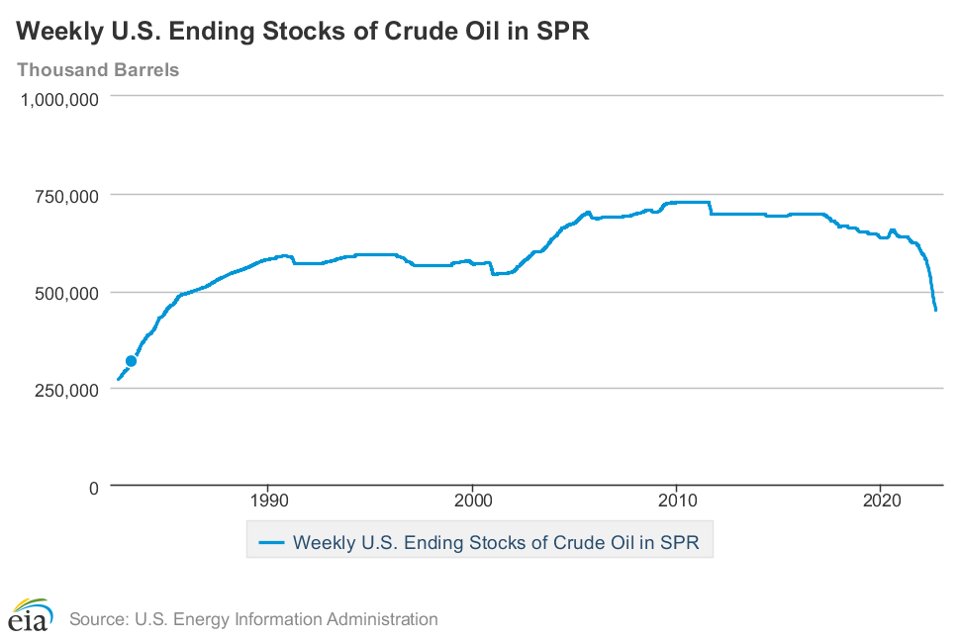

6/ The timing in early winter is not great for the West. For the EU it could increase energy costs even more, at a time when gas uncertainty is still high and some parts of the population are unhappy. In addition to that, strategic oil reserves are relatively low right now.

7/ If Russia refuses to export under the cap, these reserves may be needed to stabilize the market. It is probably politically difficult to rebuild them before the US midterm elections, so some time is needed afterwards to prepare for a possible standoff with Russia.

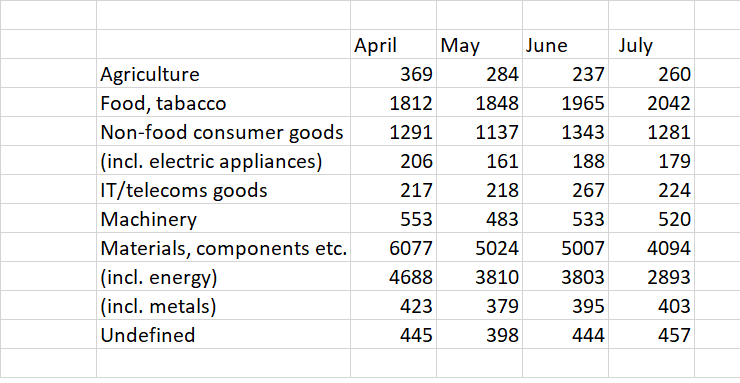

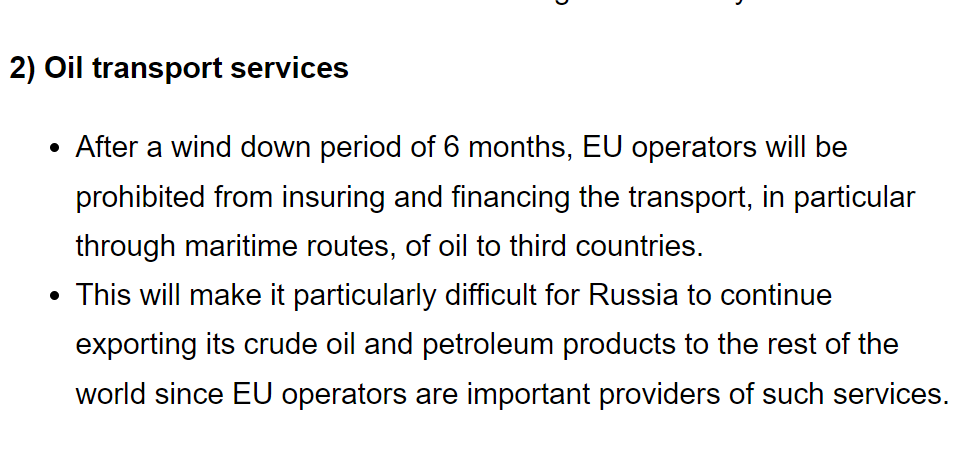

8/ What are the options: Essentially, the oil price cap is not an additional restriction, but an exception to a measure the EU has already decided on in June (banning EU companies from offering maritime services to Russian oil shipments starting Dec. 6th).

9/ Many currently believe that this measure cannot come into effect without such an exception, as it would shut in too much Russian oil, causing the oil price to skyrocket. So a revision to the EU's 6th sanction package is probably necessary either way. ec.europa.eu/commission/pre…

10/ Postponing the measure and adding an oil price cap until, e.g., March 1st, would significantly reduce the risks for the West and give it more time to prepare. The downside: It also gives Russia more time to prepare. But there is not that much Russia can do as preparation.

11/ Russia is vulnerable because it will need to export 85% of its oil via ship and neither Russia, nor its non-sanctioning customers have enough ships to do that. It is unlikely that Western firms will go along with Russian circumvention schemes, risk/reward will not work out.

12/ An alternative to postpoining the cap until March is introducing it, but starting with a non-binding (high) cap. This makes Russia retaliation a bit less likely and gives the West time to test its tool. Then, the screws could be tightened in spring.

13/ I believe the oil price cap is very promising. I have the impression it is not just a "wild idea", but is thought out carefully. It could be a great solution for the next ~3-5 years, even if it is "leaky", i.e. if Russia finds ways to circumvent it partially.

14/14 In the long run, if Russia continues its war on Ukraine, the goal should still be Iran-style sanctions on Russian oil, i.e. minimizing export volumes as much as possible through secondary sanctions on buyers. But that needs huge alternative supply, which takes time to grow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh