1/ #Sanctions are hitting #Russia's economy in many ways, but two goals are key:

1.) Diminish Putin's ability to redistribute rubles within Russia (depends mostly on #budget).

2.) Diminish Russia's ability to #import (depends on availability of foreign exchange AND restrictions).

1.) Diminish Putin's ability to redistribute rubles within Russia (depends mostly on #budget).

2.) Diminish Russia's ability to #import (depends on availability of foreign exchange AND restrictions).

2/ It all boils down to these two things. If the budget is doing fine and imports are doing fine, then the regime can compensate for any sanctions damage with transfers. If there is problem with either one, the government faces difficult foreign/domestic policy tradeoffs.

3/ The budget and the ability to import are the "transmission belts" through which economic effecs of #sanctions become political. The budget is the pie that Putin can share among military/elites/population. The imports are decisive for the size of the pie and how tasty it is.

4/ #Sanctions have affected both the Russian #budget and Russia's ability to #import. The budget is under pressure because revenue is shrinking due to lower economic activity, the war is costly, and sanctions create social costs that need to be compensated with transfers.

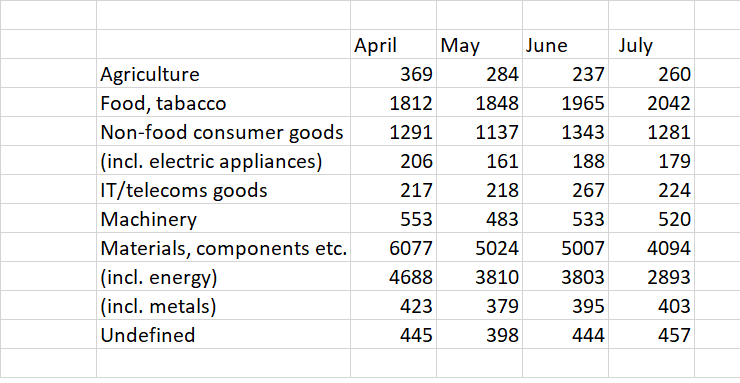

5/ Russia's imports are under pressure because of a technology embargo, disruption of logistics and payment channels and the retreat of international companies. The availability of FX in Russia has NOT been the problem, and due to a structural trade surplus it won't be very soon.

6/ It is important to stress that the only reason Russia exports is because it wants to import. When we focus on the development of export revenues, what we actually have in mind is the ability to import goods and technologies.

7/ This has led some to the conclusion that export embargoes on Russian oil and gas are pointless if Russia has more FX than it can spend. This is wrong: An oil&gas embargo serves _both_ goals at the same time: It diminishes budget revenues (1) AND diminishes FX revenues (2).

8/ The budget revenues from oil&gas are of great value to Putin, because it is not politically costly to generate them. The alternative: Raising taxes or austerity policies - are politically costly. That's how oil sanctions create problems for the Kremlin, despite abundant FX.

9/ Also, the current situation, in which restrictions are the only bottleneck for Russian imports and FX is abundant, is unlikely to stay forever. If oil sanctions are tightened over time, Russia could very well slide into a trade deficit, at least in times of lower oil prices.

10/ This is why embargoes on Russian exports make a lot of sense even under the current condition of abundant FX in Russia. In addition to that, they should be seen as a step-by-step process towards a Russian trade deficit, which will materialize at some point in the future.

11/ PS: The budget is not the only mechanism for redistribution of resources in Russia, there are also shadow budgets (such as Gazprom), and Putin can order businesses directly to spend or take risks for the regime. But the budget is by far the biggest piece of the puzzle.

12/ PS2: Some will claim that Putin can just print as much rubles as he wants and that the budget is no limitation. Printing rubles may work for a limited time, but a.) it is incompatible with the mindset of the current econ technocrats and b.) it is limited by economic fallout.

• • •

Missing some Tweet in this thread? You can try to

force a refresh